Evaluating RATIONAL (XTRA:RAA) Valuation Following Q3 Earnings Growth and Renewed Investor Interest

Reviewed by Simply Wall St

RATIONAL (XTRA:RAA) just released its third quarter and nine-month earnings, highlighting year-over-year growth in both sales and net income. This performance has garnered fresh attention from investors who are tracking the company’s momentum.

See our latest analysis for RATIONAL.

RATIONAL’s consistent business performance hasn’t fully translated to strength in its shares just yet, with the stock trading at €652.5 and posting a year-to-date share price return of -21.24%. While its third quarter results and recent conference appearance have sparked renewed investor interest, the company’s long-term outlook remains promising, supported by a three-year total shareholder return of 14.47%. However, recent price momentum is still subdued.

If you’re curious about what other fast-moving companies could be out there, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares down so far in 2025 despite healthy earnings growth, is RATIONAL offering investors a rare bargain, or is the current price already reflecting all expected gains ahead?

Most Popular Narrative: 12.4% Undervalued

With RATIONAL’s last close at €652.5 and the most-followed fair value estimate at €744.93, the narrative is that the current share price understates the company's medium-term earnings and market potential. The gap between these figures points to bullish assumptions about growth and profitability compared to what the market is currently pricing in.

Resource-efficient kitchen technology is gaining traction as rising energy and water costs, paired with new sustainability priorities, compel the foodservice industry to modernize. RATIONAL's proven ability to deliver significant energy and water savings, as validated by independent studies, positions it to outperform as customers upgrade equipment, driving revenue growth and improving gross margins.

Want to know the numbers behind this optimism? Analysts are forecasting a level of earnings and margins that defy industry trends. What bold assumptions make that lofty valuation add up? Dive in to uncover the projections that have captivated investors.

Result: Fair Value of €744.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks such as persistent margin pressure or unexpectedly weak sales in Asia could disrupt these bullish forecasts and challenge RATIONAL's growth story.

Find out about the key risks to this RATIONAL narrative.

Another View: Is the Market Setting a High Bar?

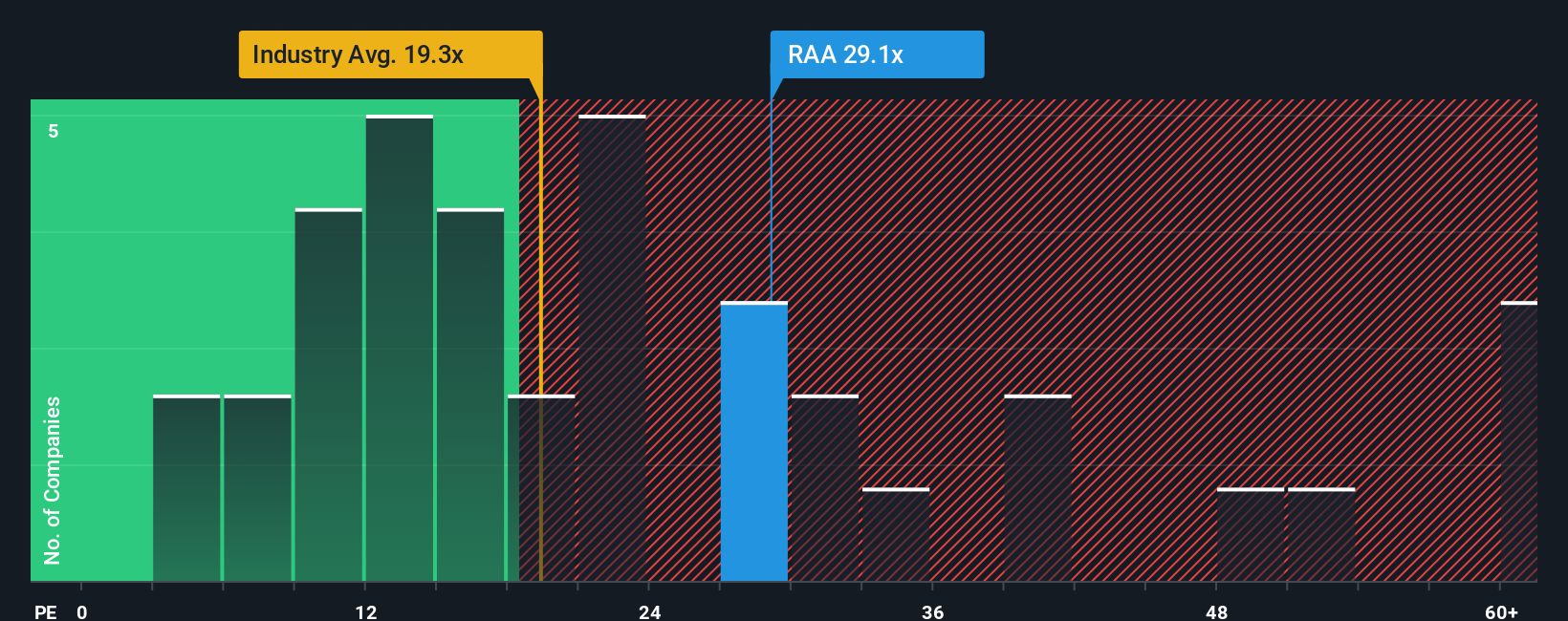

Looking from a different angle, the company trades on a price-to-earnings ratio of 29.1x, which is well above both the German Machinery industry average of 19.5x and the fair ratio implied by deeper analysis, which stands at just 16.8x. This premium suggests investors are already paying up for expected growth. This raises the question: What happens if expectations slip?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own RATIONAL Narrative

If you want to dig into the details and reach your own conclusions rather than rely on consensus, you can craft your own story from the data in just minutes. Do it your way

A great starting point for your RATIONAL research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Take charge of your financial future and check out high-potential opportunities using the Simply Wall Street Screener before these trends get picked over by the crowd.

- Unlock reliable future income and see which companies are offering strong yields by browsing these 15 dividend stocks with yields > 3%.

- Spot tomorrow’s leaders at compelling prices and get ahead of the curve with these 872 undervalued stocks based on cash flows.

- Step into the frontier of artificial intelligence and back innovation with these 26 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:RAA

RATIONAL

Engages in the development, production, and sale of professional cooking systems for industrial kitchens in Germany, rest of Europe, North America, Latin America, Asia, Australia, New Zealand, the Middle East, and Africa.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives