- Italy

- /

- Medical Equipment

- /

- BIT:ELN

Discovering Europe's Undiscovered Gems This June 2025

Reviewed by Simply Wall St

As June 2025 unfolds, European markets are navigating a landscape marked by geopolitical tensions and economic shifts, with the STOXX Europe 600 Index experiencing a decline amid concerns over Middle Eastern conflicts. Despite these challenges, opportunities may arise in the small-cap sector as central banks across Europe maintain steady interest rates and inflation pressures show signs of easing. In this environment, identifying promising stocks requires an eye for companies that demonstrate resilience and adaptability to changing market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Sparta | NA | -9.54% | -15.40% | ★★★★★☆ |

| Dekpol | 63.20% | 11.06% | 13.37% | ★★★★★☆ |

| Viohalco | 93.48% | 11.98% | 14.19% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

EL.En (BIT:ELN)

Simply Wall St Value Rating: ★★★★★★

Overview: EL.En. S.p.A. is involved in the research, development, production, sale, and distribution of laser solutions across Italy and internationally with a market capitalization of approximately €874.10 million.

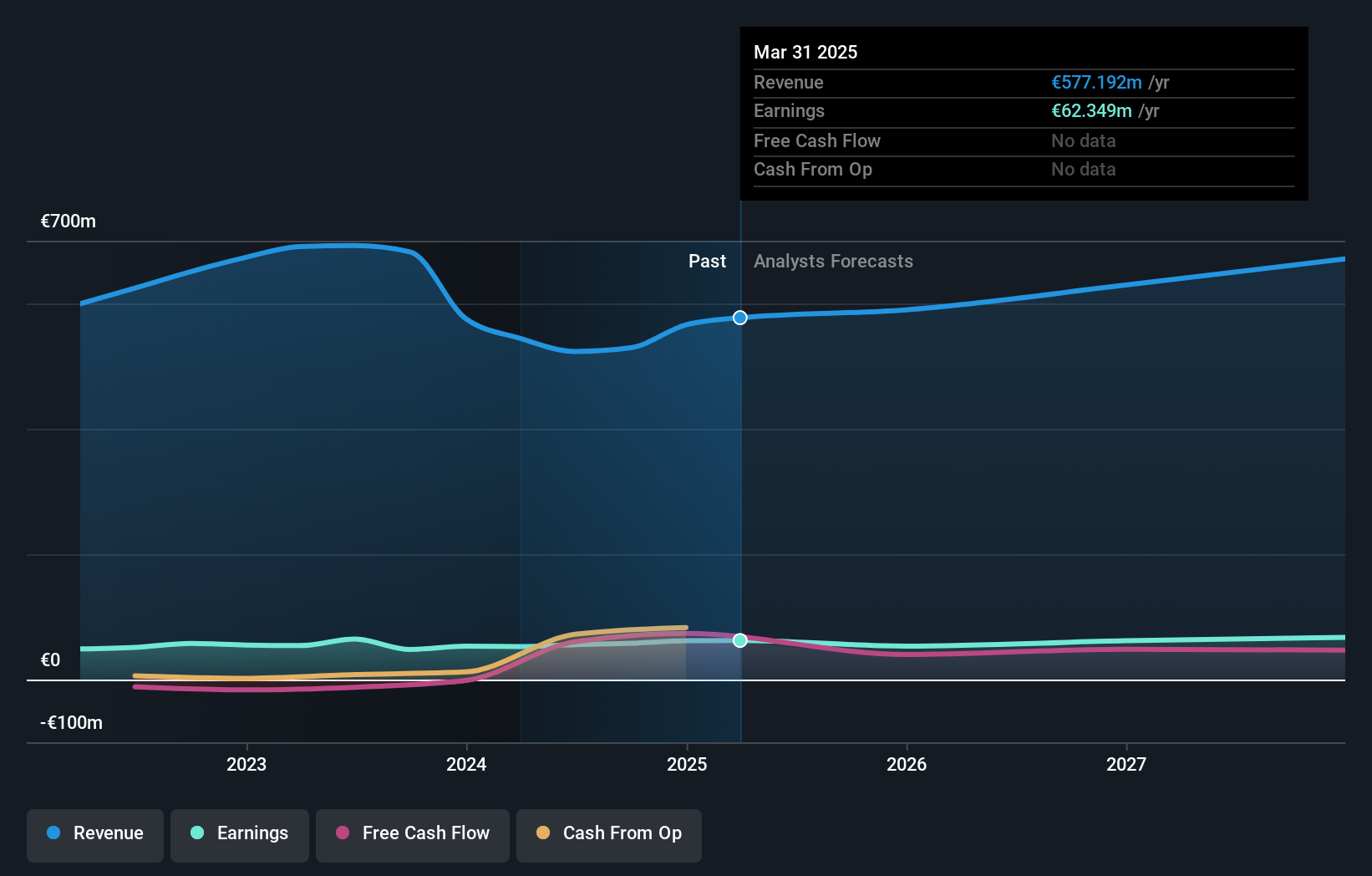

Operations: EL.En. S.p.A. generates revenue primarily from its medical and industrial laser solutions, with the medical segment contributing €417.90 million and the industrial segment adding €160.70 million.

EL.En, a nimble player in the medical equipment sector, has recently reported robust earnings growth of 18.2%, outpacing the industry average of 14.7%. The company is strategically pivoting towards high-margin medical products after divesting non-core laser metal cutting operations, aiming to bolster its financial stability and operational efficiency. Despite challenges like legal disputes and market issues in China, EL.En remains profitable with a debt-to-equity ratio reduced to 11.4% over five years. With first-quarter sales rising to €140.9 million from €129.56 million last year, EL.En's future seems promising yet uncertain amidst varying analyst opinions and market volatility.

Placoplatre (ENXTPA:MLPLC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Placoplatre SA specializes in manufacturing and supplying insulation solutions for both professionals and individuals, with a market cap of €692.01 million.

Operations: Placoplatre SA generates its revenue primarily from the construction materials segment, amounting to €595.90 million.

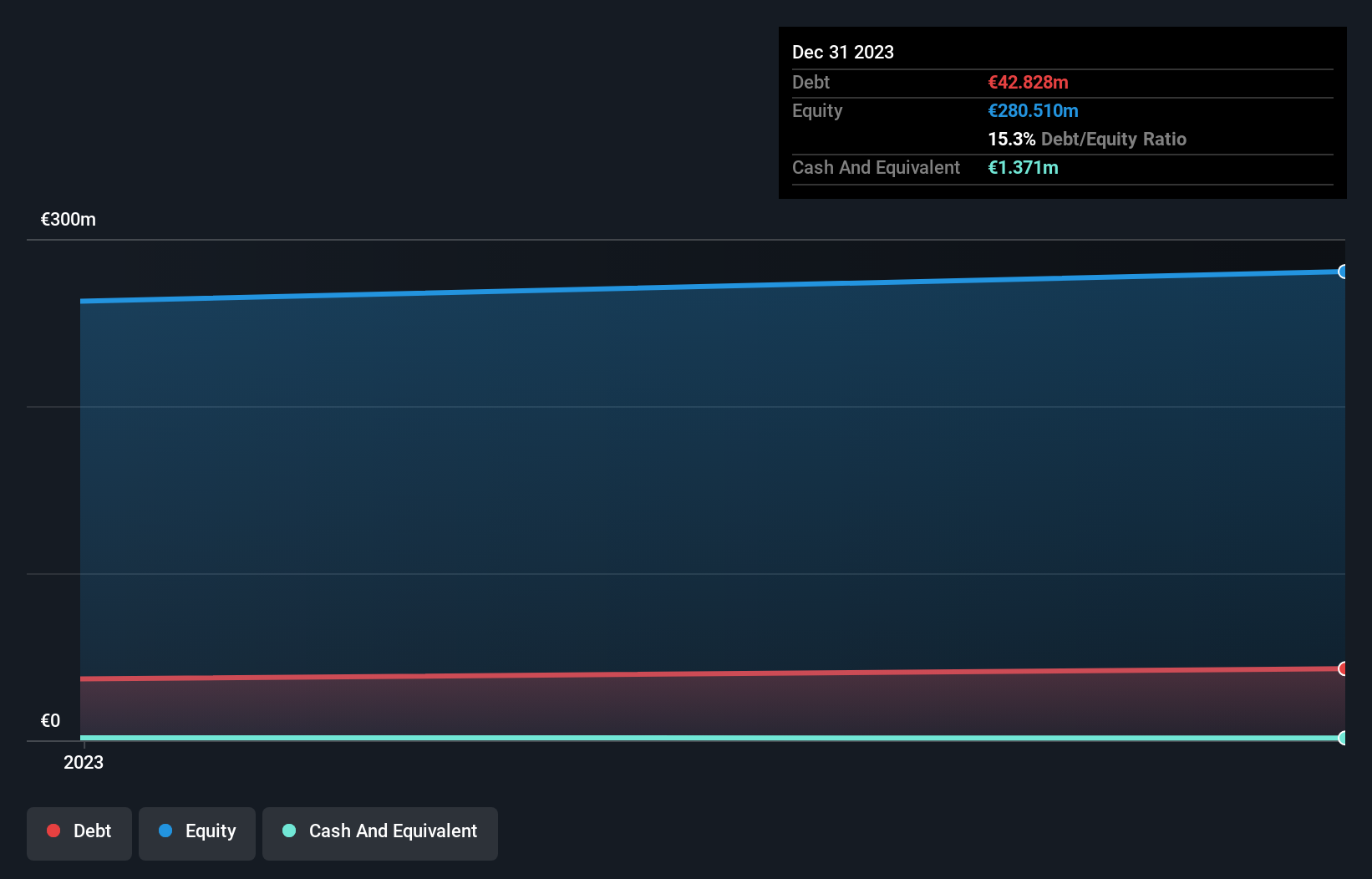

Placoplatre stands out with its impressive earnings growth of 227% over the past year, significantly outperforming the building industry average of -5.8%. The company has high-quality earnings and a satisfactory net debt to equity ratio at 14.8%, indicating sound financial health. Despite the lack of recent free cash flow data, Placoplatre's ability to cover interest payments comfortably suggests strong operational efficiency. Recent events include a notable dividend increase, offering €24.48 per share, reflecting confidence in future performance and shareholder value enhancement through consistent returns. This small cap's robust fundamentals position it well for potential growth ahead in its sector.

- Dive into the specifics of Placoplatre here with our thorough health report.

Assess Placoplatre's past performance with our detailed historical performance reports.

PFISTERER Holding (XTRA:PFSE)

Simply Wall St Value Rating: ★★★★★☆

Overview: PFISTERER Holding SE specializes in manufacturing cable fittings, insulators for overhead lines, and components for energy networks and renewable energy generation, with a market capitalization of €736.67 million.

Operations: PFISTERER Holding SE generates revenue primarily through its High Voltage Cable Accessories segment, which contributes €149.68 million, followed by Components at €100.70 million. The Overhead Lines and Medium Voltage Cable Accessories segments contribute €78.59 million and €52.72 million, respectively.

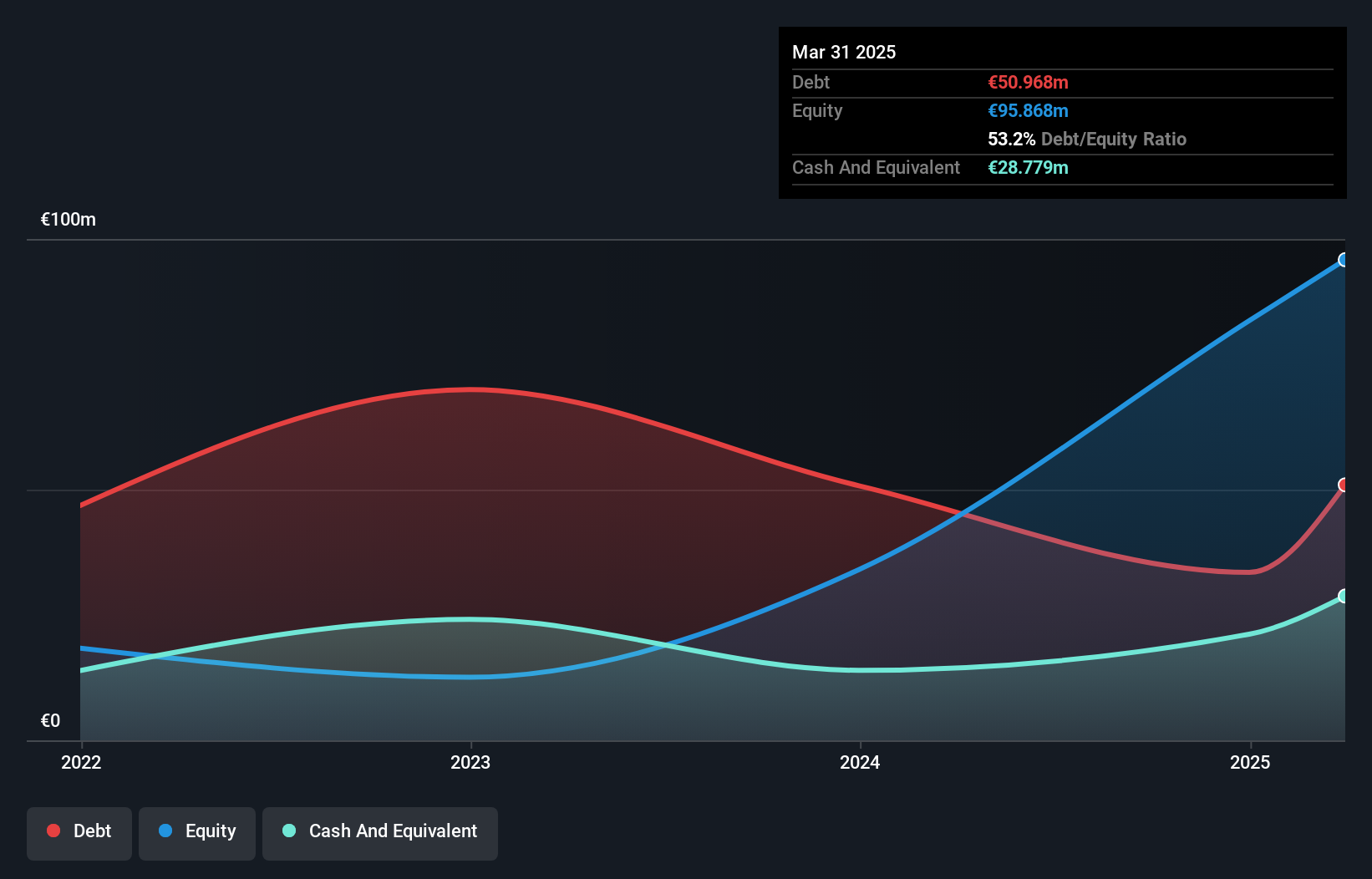

Pfisterer Holding, a German manufacturer of high-voltage cable insulators, recently completed an IPO raising €167.1 million with shares priced at €27 each. The company is trading 48% below its estimated fair value, indicating potential upside for investors. Its earnings growth of 32% over the past year outpaced the electrical industry average of 8%. With a net debt to equity ratio at a satisfactory 23%, Pfisterer's interest payments are well-covered by EBIT at 15.8 times coverage. The firm plans to invest €215 million in expanding manufacturing and developing new products while seeking strategic M&A opportunities.

- Get an in-depth perspective on PFISTERER Holding's performance by reading our health report here.

Understand PFISTERER Holding's track record by examining our Past report.

Next Steps

- Unlock more gems! Our European Undiscovered Gems With Strong Fundamentals screener has unearthed 332 more companies for you to explore.Click here to unveil our expertly curated list of 335 European Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EL.En might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ELN

EL.En

Engages in the production, research and development, distribution, and sale of laser systems in Italy, rest of Europe, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives