- Germany

- /

- Aerospace & Defense

- /

- XTRA:OHB

OHB (XTRA:OHB) Valuation Spotlight as New European Spaceport Subsidiary Marks Strategic Expansion

Reviewed by Simply Wall St

OHB (XTRA:OHB) has launched a new subsidiary, the European Spaceport Company. The company is consolidating its launch infrastructure projects with a plan to develop an offshore European spaceport and expand operations at Kourou in French Guiana.

See our latest analysis for OHB.

Momentum has been on OHB’s side this year, with the 1-year total shareholder return reaching an impressive 135.67%, and the share price up over 126% year to date. While recent weeks saw a pullback, excitement around the new spaceport subsidiary and expanded launch ambitions seems to have reignited investor optimism, as reflected in the stock’s strong 90-day share price return of nearly 60%.

If OHB’s ambitions got you thinking bigger, this could be the perfect chance to take the next step and discover See the full list for free.

The question now is whether all this momentum means OHB’s future growth is already reflected in its soaring share price, or if there is still an opportunity for investors to buy in before the next significant increase.

Price-to-Sales of 1.9x: Is it justified?

OHB’s shares trade at a price-to-sales multiple of 1.9x, a level that appears attractive when compared to industry averages and peers. At a last close of €108.5, this suggests the market is not fully pricing in OHB’s sales relative to competitors.

The price-to-sales ratio measures what investors are willing to pay per euro of revenue. In aerospace and defense, where high capital costs and unpredictable earnings can complicate profit figures, this multiple offers a clearer perspective on core business activity.

OHB’s current ratio of 1.9x sits below both the European Aerospace & Defense industry average of 2.3x and the peer average of 3.5x. That makes OHB appear undervalued on this metric compared to its main rivals and could indicate potential upside if the market moves toward the group average.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales of 1.9x (UNDERVALUED)

However, recent share price gains may stall if ambitious spaceport projects face delays or if OHB struggles to turn revenue growth into stronger profits.

Find out about the key risks to this OHB narrative.

Another View: The SWS DCF Model

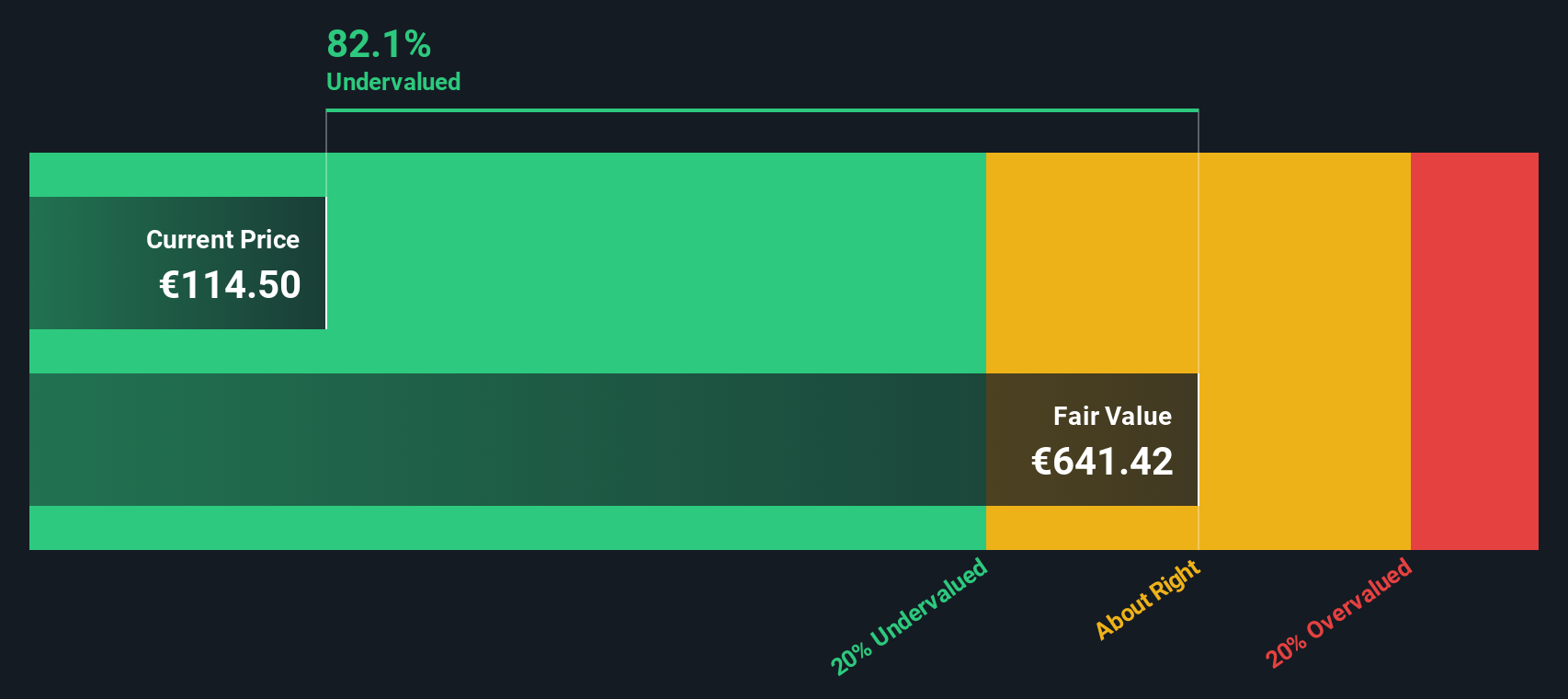

While the price-to-sales multiple paints OHB as undervalued, our DCF model offers another perspective by estimating the company's intrinsic worth based on projected cash flows. Interestingly, this model suggests the shares are trading at a striking 84.1% discount to fair value. Is the market overlooking something, or is it simply cautious for good reason?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out OHB for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 856 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own OHB Narrative

If you see things differently or want to dig into the numbers on your own, you can craft your own perspective in just a few minutes with Do it your way.

A great starting point for your OHB research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Make your portfolio stand out by regularly tapping into fresh investment themes and strong opportunities, hand-picked for their growth, innovation, or income potential.

- Capture income potential by reviewing these 15 dividend stocks with yields > 3% that offer attractive yields above 3% and could strengthen your passive returns.

- Uncover future industry leaders by checking out these 25 AI penny stocks, featuring companies advancing artificial intelligence and setting the pace for tomorrow’s technology.

- Take advantage of value opportunities by searching for these 856 undervalued stocks based on cash flows with prices that may not yet reflect their robust fundamentals and cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:OHB

OHB

Operates as a space and technology company in Germany, rest of Europe, and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives