KION GROUP (XTRA:KGX): Assessing Valuation After Mixed Q3 Results and Lowered 2025 Guidance

Reviewed by Simply Wall St

KION GROUP (XTRA:KGX) just released its third-quarter results, offering investors a mixed picture. Quarterly net income increased while nine-month earnings dropped compared to last year. The company also lowered its revenue guidance for 2025.

See our latest analysis for KION GROUP.

After these updates, KION GROUP’s shares have surged, with a year-to-date price return of nearly 98% and a one-year total shareholder return of 82%. The recent rally suggests growing optimism; however, the cautious revenue outlook could heighten volatility in the short term.

If this kind of momentum has you curious about what other opportunities are out there, consider exploring fast growing stocks with high insider ownership.

With shares nearly doubling this year while growth forecasts are being reduced, investors now face a key question: is the recent surge in KION GROUP’s stock justified, or is the market already pricing in future gains?

Most Popular Narrative: Fairly Valued

With the most popular narrative now pegging KION GROUP’s fair value at €62.57, nearly matching the last close of €62.70, market and narrative are tightly aligned. This consensus sets the stage for an in-depth look at what’s really driving the valuation.

Recent record-high order intake in Supply Chain Solutions (SCS), particularly driven by multiple large e-commerce projects, indicates a structural uptick in demand from the ongoing digitalization and automation of warehouses; this supports a strong revenue foundation and points to accelerating revenue growth over the next 18-24 months as these orders convert to sales.

Want to know what’s powering this rare market and narrative alignment? The backbone of this valuation: a surge in industrial automation and expectations for new earnings highs near unprecedented multiples. You might be surprised by the underlying profit and margin assumptions baked into the forecast. Get the story behind these numbers before the next market move.

Result: Fair Value of €62.57 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on e-commerce and intensifying global competition could challenge both the company’s growth narrative and the sector’s recent optimism.

Find out about the key risks to this KION GROUP narrative.

Another View: Cash Flow Model Points to Deep Value

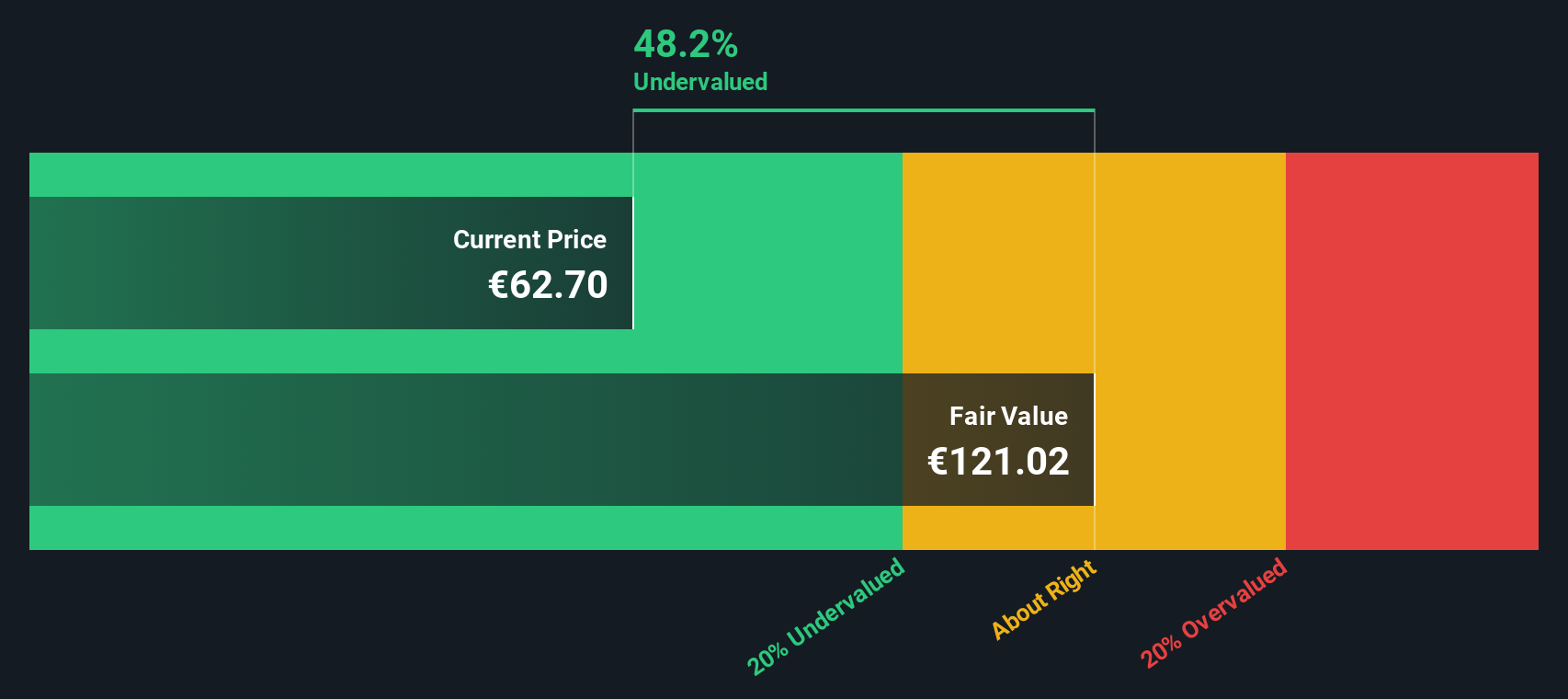

While popular opinion and most ratios suggest KION GROUP is fairly valued, our DCF model tells a different story. The SWS DCF model calculates a fair value of €120.91, which is nearly double the current share price. Could the market be overlooking long-term cash flow potential?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own KION GROUP Narrative

If you want to challenge these conclusions or run your own analysis, the data is open for you to shape your own story in just minutes. Do it your way.

A great starting point for your KION GROUP research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Take charge of your portfolio and get ahead of the crowd by tapping into unique stock opportunities with Simply Wall Street’s powerful screeners.

- Unlock consistent income streams by checking out these 14 dividend stocks with yields > 3%, which yields over 3% for steady long-term growth.

- Pinpoint the market’s hidden gems by evaluating these 880 undervalued stocks based on cash flows to find companies priced below their true worth.

- Ride the next tech revolution and accelerate your returns by tracking these 27 AI penny stocks at the forefront of artificial intelligence advancement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KION GROUP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:KGX

KION GROUP

Provides industrial trucks and supply chain solutions in Western and Eastern Europe, the Middle East, Africa, North America, Central and South America, China, and the rest of the Asia Pacific.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives