Will Knorr-Bremse's (XTRA:KBX) Stable 2025 Outlook Reinforce Faith in Management's Long-Term Strategy?

Reviewed by Sasha Jovanovic

- Knorr-Bremse AG recently reported its earnings for the nine months ended September 30, 2025, with sales and net income showing slight year-on-year declines to €5.91 billion and €418 million, respectively, while also reaffirming its annual revenue and margin guidance for 2025.

- The company's decision to confirm its full-year outlook despite softer results offers investors reassurance about management's confidence in its longer-term targets and operational stability.

- We'll explore how the reaffirmed 2025 guidance and stable performance may influence Knorr-Bremse's investment narrative and outlook.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Knorr-Bremse Investment Narrative Recap

To hold Knorr-Bremse stock, investors need confidence in its capacity to deliver stable earnings from resilient rail and vehicle systems markets, while executing on cost efficiency and digitalization amid sector headwinds. The recent reaffirmation of full-year guidance, even as sales and net income slipped, signals management's commitment to margin improvement, helping offset short-term concerns. However, this announcement does not materially alter the main catalyst, recovery in core end-markets, or lessen persistent risks tied to execution and regional exposure.

The October confirmation of 2025 guidance stands out. By maintaining revenue expectations between €7.8 billion and €8.1 billion, with an operating EBIT margin of 12.5% to 13.5%, the company underscores its focus on cost control and operational reliability, both crucial to supporting the investment case as order books fluctuate. But investors should also consider what happens if supply chain disruptions or integration setbacks materialize...

Read the full narrative on Knorr-Bremse (it's free!)

Knorr-Bremse's outlook forecasts €9.2 billion in revenue and €979.1 million in earnings by 2028. This scenario assumes an annual revenue growth rate of 4.8% and a €557.1 million earnings increase from the current €422.0 million.

Uncover how Knorr-Bremse's forecasts yield a €88.93 fair value, a 6% upside to its current price.

Exploring Other Perspectives

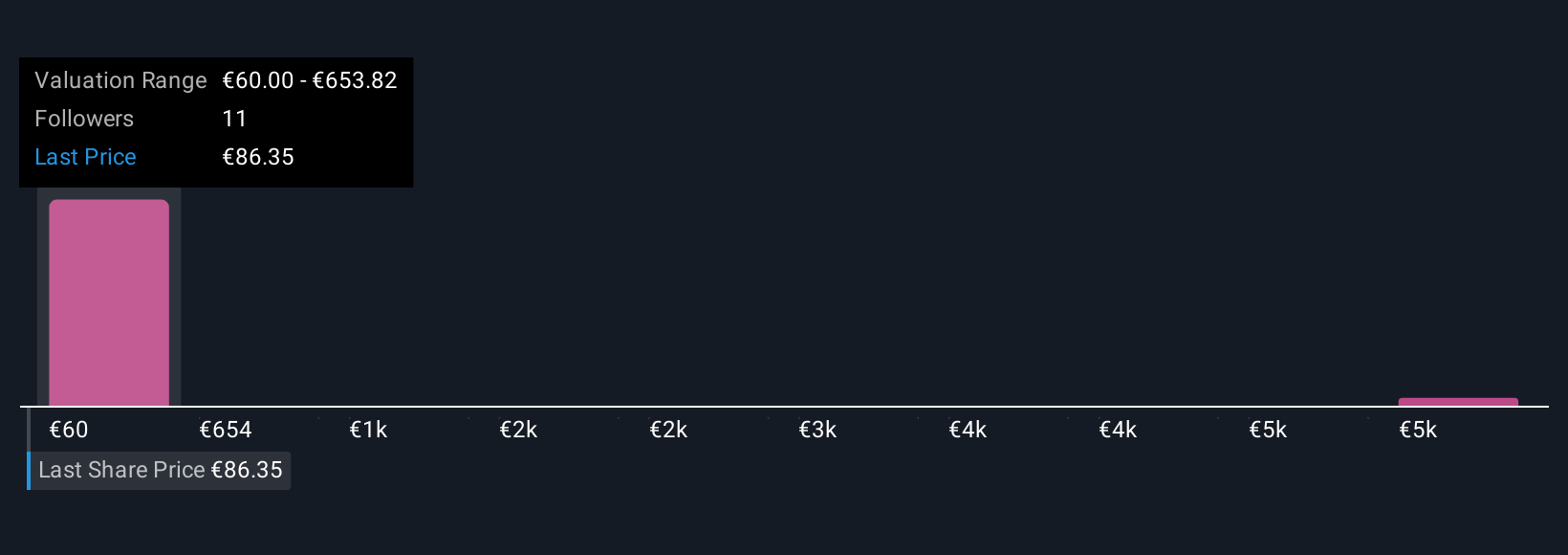

Simply Wall St Community members present fair value estimates for Knorr-Bremse ranging from €60 to €5,998, with five individual perspectives represented. While profit growth is forecast to outpace the broader German market, such a wide range highlights just how much views on future performance can differ, explore these alternative viewpoints for a fuller picture.

Explore 5 other fair value estimates on Knorr-Bremse - why the stock might be worth 29% less than the current price!

Build Your Own Knorr-Bremse Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Knorr-Bremse research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Knorr-Bremse research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Knorr-Bremse's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Knorr-Bremse might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:KBX

Knorr-Bremse

Develops, produces, and markets brake systems for rail and commercial vehicles and other safety-critical systems worldwide.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives