Jungheinrich (XTRA:JUN3): Exploring Valuation After Q3 Profits and Margins Beat Expectations

Reviewed by Simply Wall St

Jungheinrich (XTRA:JUN3) shares climbed after the company posted third-quarter results that easily beat expectations. Orders, revenues, and EBIT all came in higher than consensus forecasts, and profit margins saw clear improvement.

See our latest analysis for Jungheinrich.

Jungheinrich’s upbeat third-quarter performance has given the share price a noticeable boost, with a 10% gain over the past week adding to a robust 12% one-month return. Looking at the bigger picture, momentum has picked up in 2024. The year-to-date share price is up nearly 28%, while the total shareholder return for the past 12 months sits at an impressive 31%.

If you’re keen to see which other manufacturers are showing fresh momentum this quarter, it’s a great moment to discover See the full list for free.

But with shares now trading nearly 26% below analyst price targets, investors may be wondering if this presents a genuine buying opportunity or if the recent surge already reflects all the future growth.

Price-to-Earnings of 11.5x: Is it justified?

Jungheinrich's valuation stands out, trading at a modest price-to-earnings ratio of 11.5x. With peers and the industry averaging much higher P/E ratios, the current share price may not reflect its true underlying earnings power.

The price-to-earnings multiple measures how much investors are willing to pay for a unit of the company’s earnings. In the industrial manufacturing sector, this metric is particularly important because it offers a clear view of how the market values near-term and future profit streams.

For Jungheinrich, the market is currently pricing its shares well below the German Machinery industry average of 19.4x and even further below the peer average of 42.7x. The company's fair price-to-earnings ratio is estimated at 22.2x, which suggests meaningful headroom for a re-rating if earnings momentum is sustained and investor confidence increases.

Explore the SWS fair ratio for Jungheinrich

Result: Price-to-Earnings of 11.5x (UNDERVALUED)

However, slowing revenue growth or weaker profit margins could limit future upside if market conditions become less supportive for manufacturers such as Jungheinrich.

Find out about the key risks to this Jungheinrich narrative.

Another View: What Does the SWS DCF Model Say?

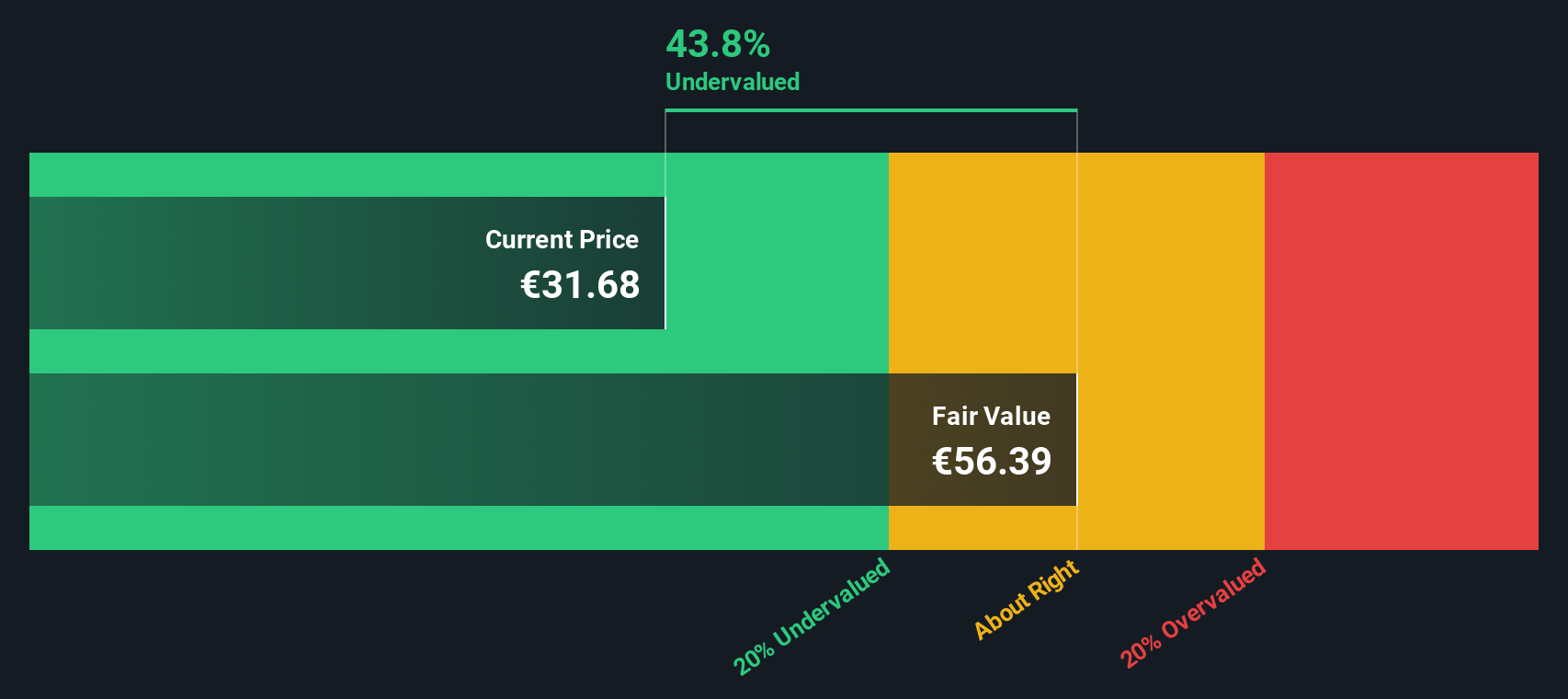

Looking at Jungheinrich through our DCF model gives a strikingly different view. The share price of €32.08 sits about 43% below our estimated fair value of €56.09, which suggests the stock is significantly undervalued if these cash flow assumptions hold true. Which lens offers better insight into the path forward?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Jungheinrich for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 882 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Jungheinrich Narrative

If you think a different perspective might tell a clearer story, you can dive into the data and shape your own outlook in just a few minutes. Do it your way

A great starting point for your Jungheinrich research is our analysis highlighting 6 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Curious what else is moving the markets? You could miss your next big win if you stick with the usual picks. Exciting opportunities are waiting if you know where to look.

- Tap into reliable income by checking out these 14 dividend stocks with yields > 3% delivering strong yields above 3% from established companies paying steady dividends.

- Uncover game-changers in artificial intelligence and gain early exposure to innovation with these 27 AI penny stocks poised for rapid expansion in this thriving sector.

- Find the hidden bargains and snag value buys among these 882 undervalued stocks based on cash flows identified as trading below their true cash flow potential right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:JUN3

Jungheinrich

Through its subsidiaries, provides products and solutions for the intralogistics sector with a portfolio of material handling equipment, automated systems, and warehouse equipment and services worldwide.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives