Can Daimler Truck (XTRA:DTG) Balance Margin Headwinds and Guidance Uncertainty Amid Supplier Challenges?

Reviewed by Sasha Jovanovic

- In early November 2025, Daimler Truck Holding AG issued cautious fourth quarter guidance while announcing that its third quarter sales fell to €9.70 billion and net income declined to €434 million compared to the prior year. Management highlighted ongoing margin headwinds in Trucks North America and outlined that Mercedes-Benz Truck’s full-year profitability would reach the midpoint of its guidance range if supplier issues are quickly resolved.

- Amid a challenging demand and cost environment, Daimler Truck is emphasizing its ability to mitigate additional tariff costs and manage supplier disruptions as it approaches year-end.

- We’ll examine how Daimler Truck’s softer guidance and margin pressures may influence the company’s investment narrative going forward.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Daimler Truck Holding Investment Narrative Recap

At its core, being a shareholder in Daimler Truck means believing in the company’s ability to navigate cyclical truck demand, execute on zero-emission vehicle initiatives, and achieve operational efficiency despite a volatile macro backdrop. The latest guidance, which points to softer profitability in North America and sales headwinds, reinforces that short-term catalysts, such as order recovery and cost containment, remain highly sensitive to persistent margin pressures and tariffs, while weak demand continues as the primary risk. These developments do not fundamentally shift the long-term narrative but do emphasize near-term uncertainty for earnings momentum.

Among recent announcements, the November 2025 Q4 guidance is especially relevant: Daimler Truck expects North American unit sales at the low end of its range and sequentially weaker profitability, while Mercedes-Benz Trucks’ improved Q4 unit outlook hinges on prompt supplier recovery. Investors tracking catalysts like the adoption of zero-emission vehicles and digital fleet solutions will likely see these trends as being closely intertwined with the company’s near-term ability to mitigate supply chain and cost issues.

However, it is important for investors to also recognize that even with management’s confidence on tariffs, persistent structural margin pressure remains a concern if demand softens further…

Read the full narrative on Daimler Truck Holding (it's free!)

Daimler Truck Holding is projected to reach €58.3 billion in revenue and €3.8 billion in earnings by 2028. This outlook implies a 3.6% annual revenue growth rate and a €1.4 billion increase in earnings from the current €2.4 billion.

Uncover how Daimler Truck Holding's forecasts yield a €42.85 fair value, a 19% upside to its current price.

Exploring Other Perspectives

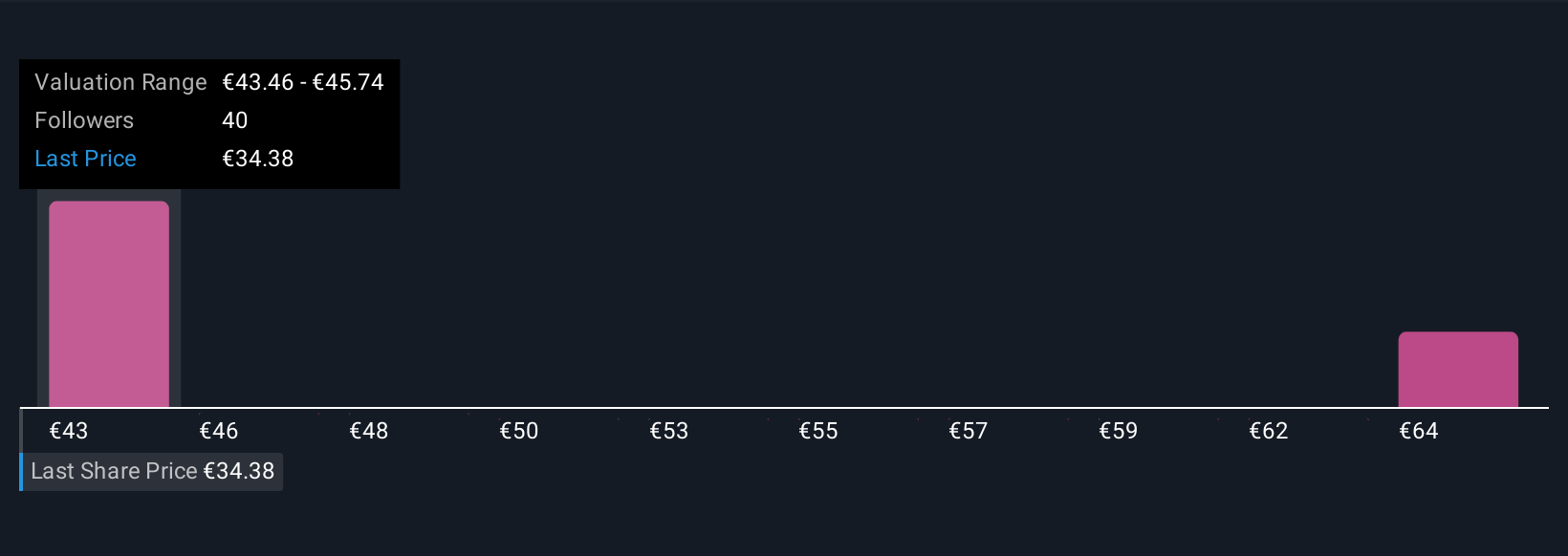

Simply Wall St Community members submitted four fair value estimates for Daimler Truck ranging from €38.44 to €50.20 per share. With margin pressures weighing on North American earnings outlook, you have reason to consider several viewpoints before forming your own expectations.

Explore 4 other fair value estimates on Daimler Truck Holding - why the stock might be worth as much as 40% more than the current price!

Build Your Own Daimler Truck Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Daimler Truck Holding research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Daimler Truck Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Daimler Truck Holding's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:DTG

Daimler Truck Holding

Manufactures and sells light, medium- and heavy-duty trucks and buses in Europe, North America, Asia, Latin America, and internationally.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives