Is There Now an Opportunity in Volkswagen After Recent 11% Share Price Rally?

Reviewed by Simply Wall St

Thinking about what to do with Volkswagen stock? You are not alone. Whether you saw its iconic logo pass you on the Autobahn or just checked the latest ticker, Volkswagen is back in focus for investors, and for several good reasons. The stock has gained 11.4% over the past month, and 15.8% year-to-date. These numbers are tough to ignore in a crowded automobile market. The one-year return sits at 11.8%, suggesting a pattern of steady, if sometimes bumpy, progress. After a slow patch earlier this year, positive earnings surprises and optimism about the company’s electric vehicle push seem to be reshaping sentiment in Volkswagen’s favor.

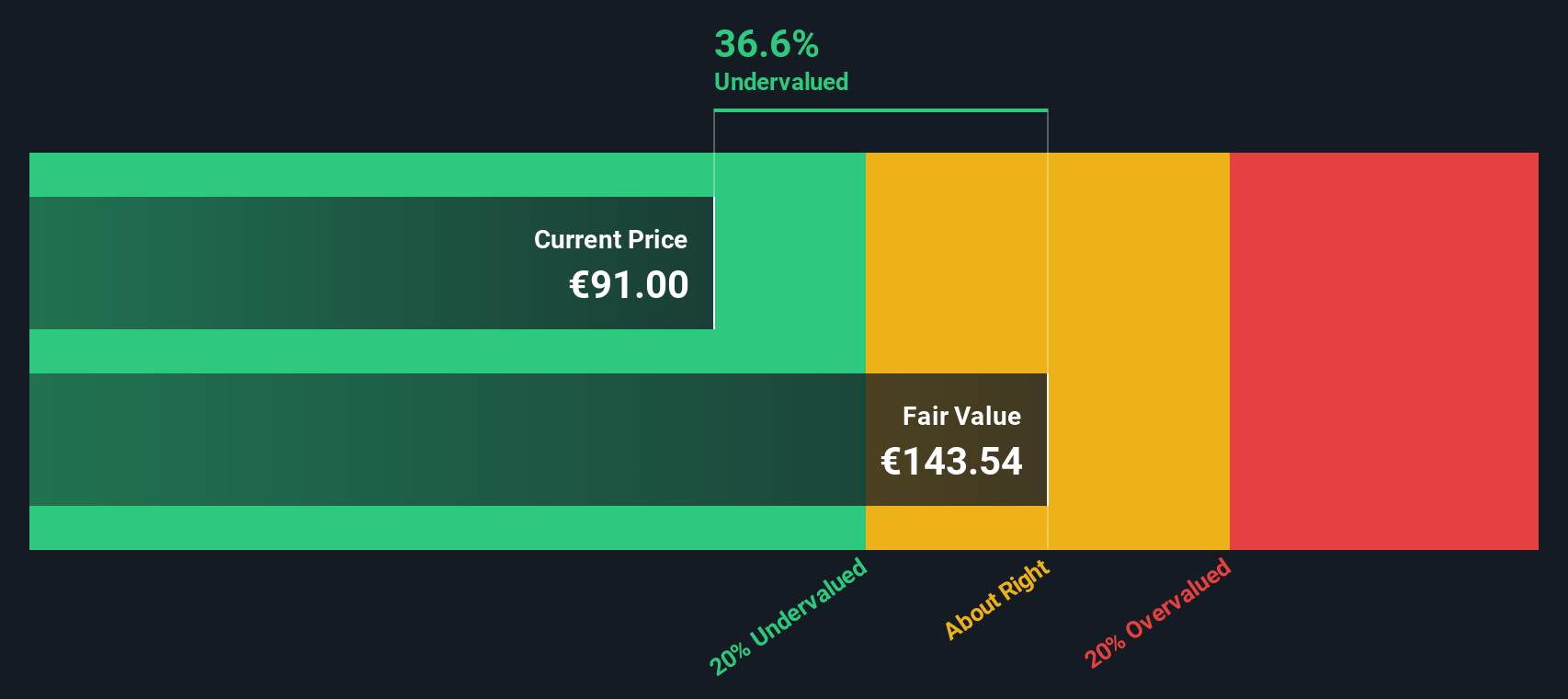

However, momentum alone does not provide a complete picture of whether Volkswagen is a buy, hold, or sell. What really matters, especially with a global brand like this, is the company’s valuation. Right now, Volkswagen scores a robust 5 out of 6 on our value checklist, indicating it is undervalued by five major measures. Considering the current price is at roughly a 46.7% discount to our intrinsic valuation estimate, and the discount to analysts’ targets, there is a real case for upside or at least a floor to the risk.

Before you decide your next move, let’s break down exactly how Volkswagen scores across different valuation benchmarks. And stay tuned, because at the end we will touch on a method of understanding value that most investors overlook.

Volkswagen delivered 11.8% returns over the last year. See how this stacks up to the rest of the Auto industry.Approach 1: Volkswagen Cash Flows

A Discounted Cash Flow (DCF) model estimates what a business is worth today by projecting its future free cash flows and discounting them back to today's value. In essence, it helps investors gauge whether a stock is trading at a discount or premium compared to its underlying value.

For Volkswagen, the latest twelve months have shown free cash flow at negative €10.5 billion, reflecting recent challenges. However, analysts are projecting a turnaround, with free cash flow expected to reach €8.3 billion by 2029 and rising steadily for the following decade. Using a detailed two-stage DCF approach, the model builds out these forecasts to provide a more realistic picture of Volkswagen's potential.

The resulting estimated intrinsic value per share comes out to €190.01. This means that based on projected future cash flows, Volkswagen stock is currently trading at a 46.7% discount to its fair value. This suggests it is significantly undervalued, with almost half of its intrinsic value not reflected in today's market price.

Result: UNDERVALUED

Approach 2: Volkswagen Price vs Earnings

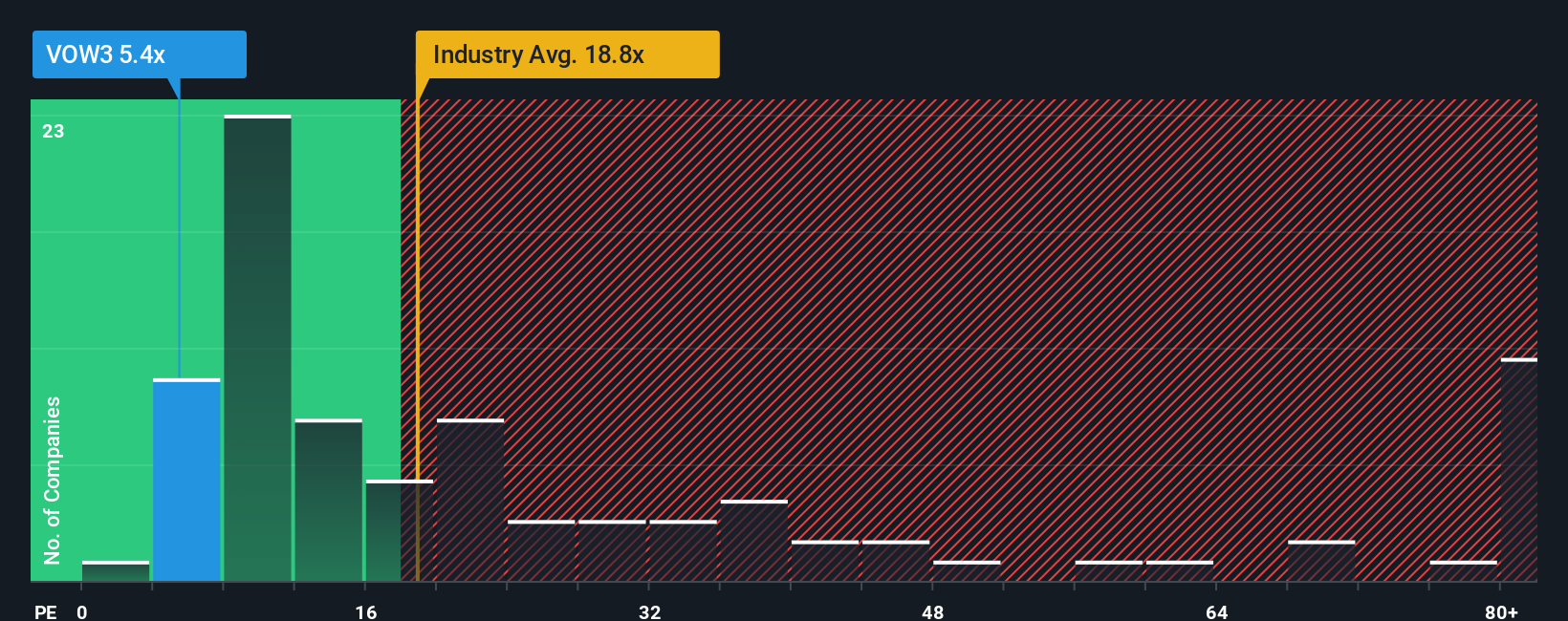

Price-to-Earnings (PE) is a core valuation metric for companies with consistent profits, as it reflects how much investors are willing to pay for each euro of earnings. Since Volkswagen is a profitable automaker, the PE ratio offers a straightforward way to weigh its price against its bottom-line performance.

What counts as a "normal" or "fair" PE ratio is shaped by several factors, including how quickly a company is expected to grow and the level of risk tied to achieving those earnings. Fast-growing or low-risk companies tend to trade with higher PE ratios, while those facing more uncertainty or slower growth tend to trade lower.

Currently, Volkswagen's PE ratio stands at 6.03x, a steep discount compared to the auto industry average of 19.61x and the peer group average of 12.68x. To provide a tailored benchmark, Simply Wall St has calculated a Fair Ratio for Volkswagen at 13.53x, taking into account its growth outlook, margins, and risk profile.

When comparing Volkswagen's current PE of 6.03x to this Fair Ratio of 13.53x, the company appears to be substantially undervalued by this measure. This large gap highlights potential for upside, assuming earnings hold steady or improve.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Volkswagen Narrative

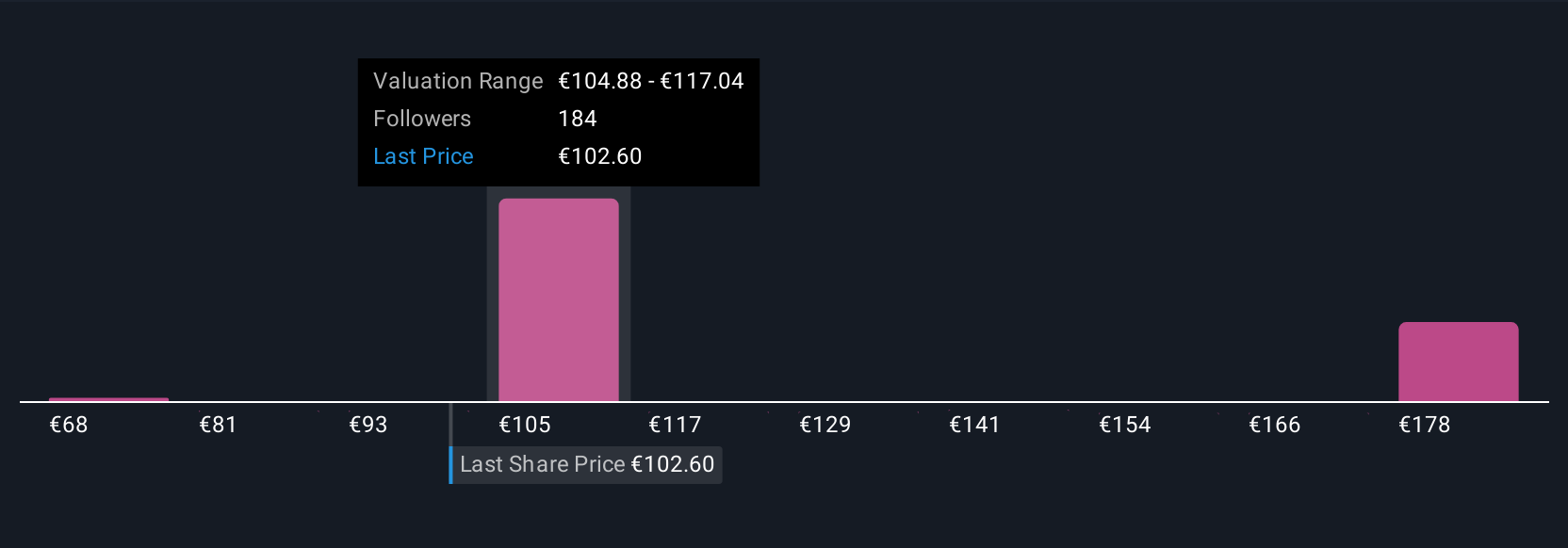

A Narrative is simply your personal story or perspective about a company like Volkswagen. It blends your view of its business prospects with assumptions about future growth, margins, and risks to create your own fair value estimate. Essentially, it connects what you believe about the company to the numbers that matter.

This approach goes beyond static ratios and lets you easily link Volkswagen’s story, such as its push into electric vehicles or challenges with restructuring, to a financial forecast and a clear decision on whether the current share price represents good value. Narratives are both accessible and actionable, especially when using the Simply Wall St platform, where millions of investors build and share their perspectives with the wider community.

Instead of relying on a single "official" number, Narratives help you compare your fair value to the market price in real time. This makes buy or sell decisions more transparent and tailored to your outlook. Because Narratives update automatically with new information, from earnings results to industry news, your investment stance stays relevant as the facts change.

For Volkswagen, bullish investors see fair value as high as €113.25, while those with a more cautious outlook set it much lower at €68.40. This illustrates how Narrative empowers you to make choices that truly fit your expectations.

For Volkswagen, we’ll make it easy for you with previews of two leading Volkswagen Narratives: 🐂 Volkswagen Bull Case Fair value: €113.25

Undervalued by: 10.6%

Expected revenue growth: 2.8%

- Volkswagen’s expansion into electrified vehicles, digital services, and operational restructuring positions it for future growth and higher margins. This is supported by a focus on premium and high-return markets.

- Investments in local production, partnerships, and cost optimization are expected to help reduce geopolitical risks and support margin recovery with more resilient, recurring revenue streams.

- Profitability is anticipated to improve as restructuring costs decrease. However, there are still risks related to trade disputes, battery electric vehicle competition, and the company’s organizational complexity.

Fair value: €68.40

Overvalued by: 48%

Expected revenue growth: 1%

- Volkswagen faces challenges including strategic missteps, an overreliance on the Chinese market, and a slow response to the electric vehicle transition.

- Profits and market share outside Germany are stagnating. Guidance lacks ambition, and management has delayed margin improvement targets.

- Although new value-segment models provide long-term potential, ongoing operational and strategic weaknesses affect the company’s near-term outlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:VOW3

Volkswagen

Manufactures and sells automobiles in Germany, other European countries, North America, South America, the Asia-Pacific, and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026