- China

- /

- Renewable Energy

- /

- SZSE:000600

Jointo Energy Investment Hebei's (SZSE:000600) earnings have declined over three years, contributing to shareholders 16% loss

Jointo Energy Investment Co., Ltd. Hebei (SZSE:000600) shareholders should be happy to see the share price up 10% in the last week. It's not great that the stock is down over the last three years. But on the bright side, its return of -17%, is better than the market, which is down 26%.

Although the past week has been more reassuring for shareholders, they're still in the red over the last three years, so let's see if the underlying business has been responsible for the decline.

See our latest analysis for Jointo Energy Investment Hebei

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

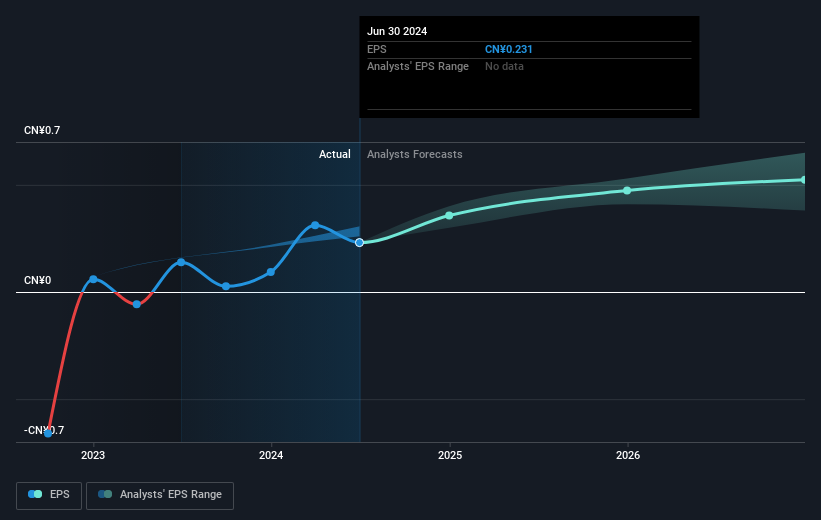

During the three years that the share price fell, Jointo Energy Investment Hebei's earnings per share (EPS) dropped by 10% each year. In comparison the 6% compound annual share price decline isn't as bad as the EPS drop-off. This suggests that the market retains some optimism around long term earnings stability, despite past EPS declines.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Jointo Energy Investment Hebei shareholders are down 15% over twelve months (even including dividends), which isn't far from the market return of -14%. Unfortunately, last year's performance is a deterioration of an already poor long term track record, given the loss of 0.8% per year over the last five years. It will probably take a substantial improvement in the fundamental performance for the company to reverse this trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Jointo Energy Investment Hebei has 3 warning signs (and 1 which shouldn't be ignored) we think you should know about.

Of course Jointo Energy Investment Hebei may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000600

Jointo Energy Investment Hebei

Invests in, constructs, operates, and manages energy projects primarily based on electricity production.

Moderate growth potential with acceptable track record.