In a week marked by economic uncertainties and mixed signals from global markets, major indices like the Nasdaq Composite and S&P MidCap 400 initially hit record highs before retreating, reflecting the complex interplay of earnings reports and economic data. Amidst this backdrop of cautious optimism and volatility, dividend stocks present a compelling option for investors seeking stability through regular income streams.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.72% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.29% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.96% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.21% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.10% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.32% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.94% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.83% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.64% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.03% | ★★★★★★ |

Click here to see the full list of 2023 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

C&D International Investment Group (SEHK:1908)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: C&D International Investment Group Limited is an investment holding company involved in property development, real estate industry chain investment services, and industry investment activities across Mainland China, Hong Kong, Macau, Taiwan, and internationally with a market cap of HK$29.45 billion.

Operations: C&D International Investment Group Limited generates its revenue primarily from Property Development and Property Management and Other Related Services, amounting to CN¥142.82 billion.

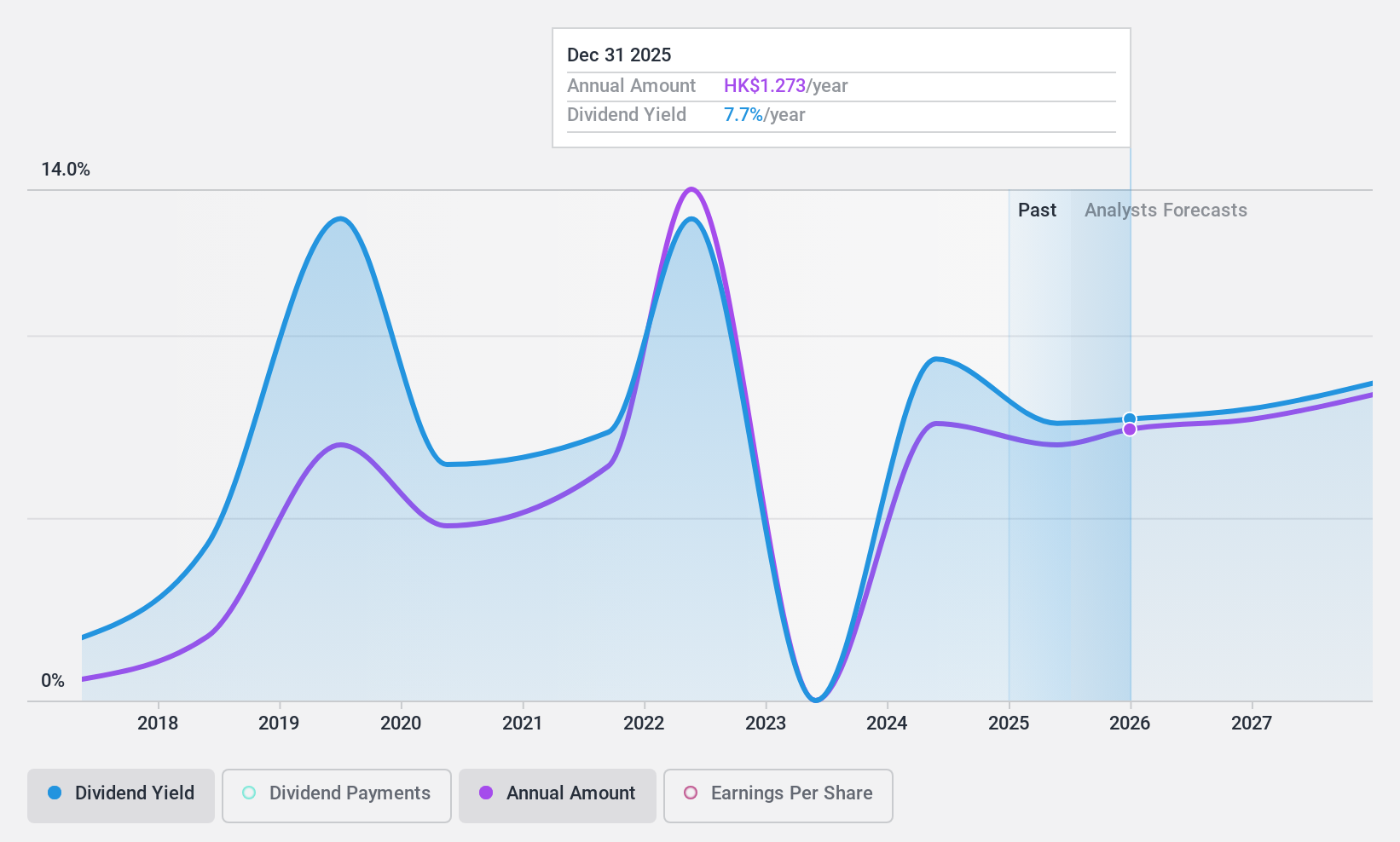

Dividend Yield: 8.4%

C&D International Investment Group offers a high dividend yield of 8.44%, placing it in the top 25% of Hong Kong market payers, yet its dividends have been unreliable and volatile over the past decade. The company's dividends are not covered by free cash flow, though they are supported by earnings with a payout ratio of 52.6%. Recent sales figures show a significant decline, with contracted sales down approximately 34.8% year-on-year as of September 2024.

- Click here and access our complete dividend analysis report to understand the dynamics of C&D International Investment Group.

- Our valuation report here indicates C&D International Investment Group may be undervalued.

Eastern Air Logistics (SHSE:601156)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Eastern Air Logistics Co., Ltd. offers air express, comprehensive ground, and multimodal transport services with a market cap of CN¥27.35 billion.

Operations: Eastern Air Logistics Co., Ltd. generates revenue through its air express, comprehensive ground, and multimodal transport services.

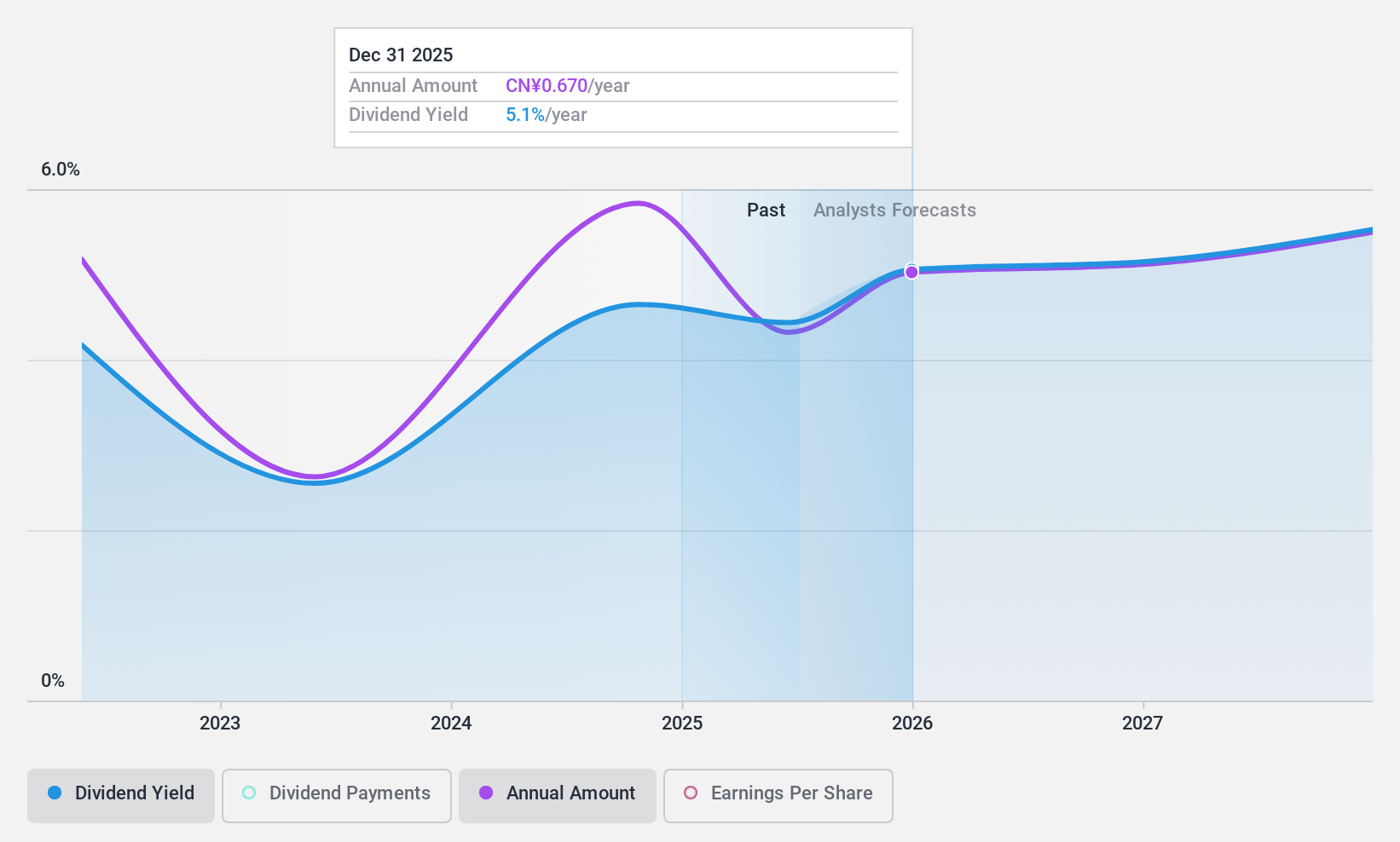

Dividend Yield: 4.4%

Eastern Air Logistics exhibits a strong earnings growth of 22.5% over the past year, with its dividend yield at 4.38%, ranking it in the top 25% of Chinese market payers. Despite being well-covered by earnings and cash flows, with payout ratios of 24.8% and 34.8% respectively, its dividend track record is unstable and has been volatile over the last two years. Recent sales increased to CNY 17.67 billion for nine months ending September 2024 from CNY 14.23 billion a year ago, indicating robust revenue growth amidst an uncertain dividend history.

- Click to explore a detailed breakdown of our findings in Eastern Air Logistics' dividend report.

- According our valuation report, there's an indication that Eastern Air Logistics' share price might be on the cheaper side.

Jinduicheng Molybdenum (SHSE:601958)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Jinduicheng Molybdenum Co., Ltd. is engaged in the production and sale of molybdenum products globally, with a market capitalization of CN¥36.17 billion.

Operations: Jinduicheng Molybdenum Co., Ltd. generates its revenue primarily from the production and sale of molybdenum products across international markets.

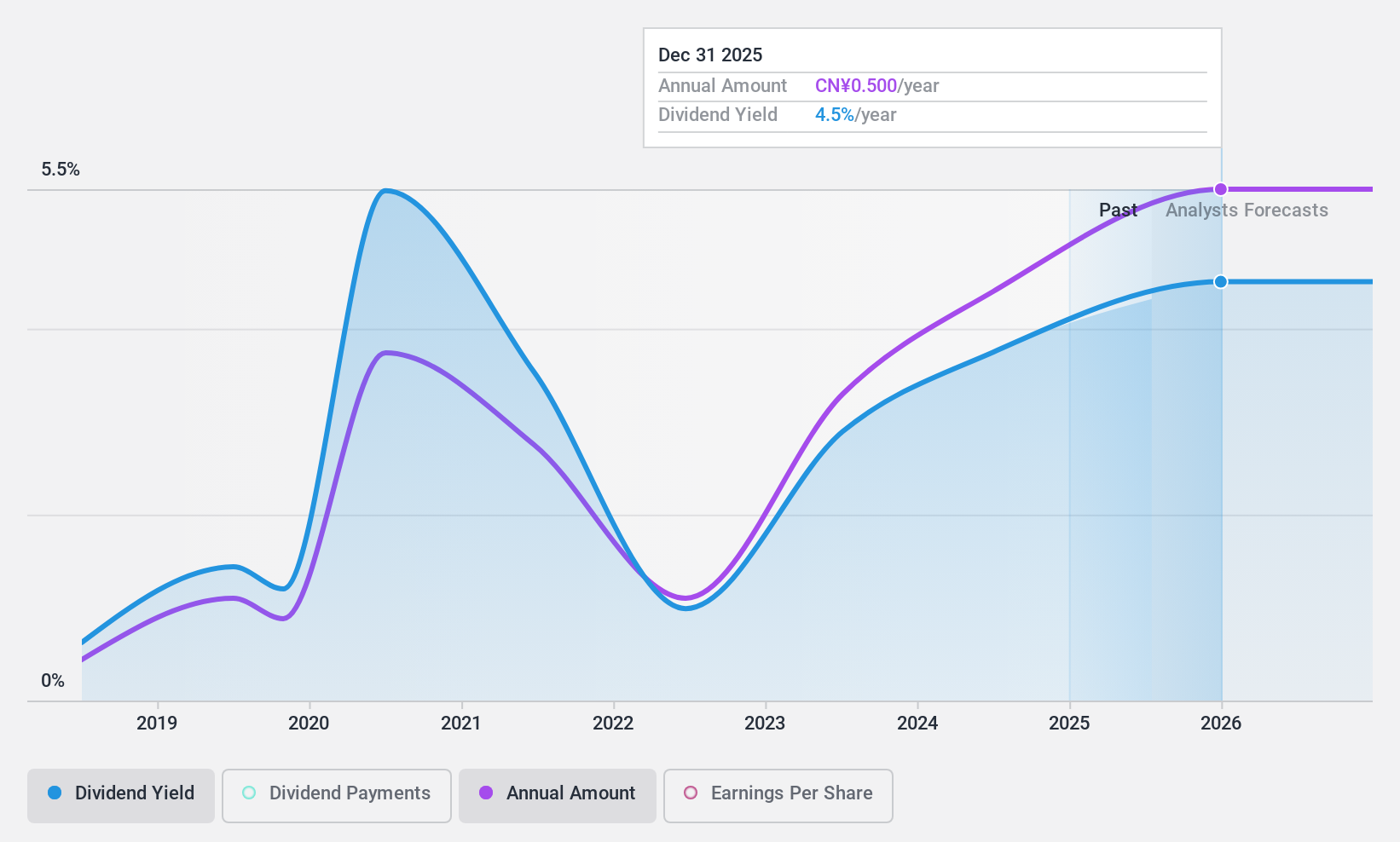

Dividend Yield: 3.5%

Jinduicheng Molybdenum's recent earnings report shows sales of CNY 10.10 billion for the first nine months of 2024, up from CNY 8.85 billion a year prior, though net income decreased slightly to CNY 2.19 billion. The company offers a dividend yield of 3.47%, placing it in the top quartile among Chinese dividend payers, with dividends well-covered by earnings and cash flows (payout ratios at 43.7% and 37.4%, respectively). However, its dividend history has been volatile over the past decade despite overall growth in payments during that period.

- Unlock comprehensive insights into our analysis of Jinduicheng Molybdenum stock in this dividend report.

- Our valuation report unveils the possibility Jinduicheng Molybdenum's shares may be trading at a discount.

Seize The Opportunity

- Gain an insight into the universe of 2023 Top Dividend Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eastern Air Logistics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601156

Eastern Air Logistics

Provides air express, comprehensive ground, and multimodal transport services.

Very undervalued with flawless balance sheet and pays a dividend.