- China

- /

- Marine and Shipping

- /

- SHSE:600179

Asian Penny Stocks To Watch In December 2025

Reviewed by Simply Wall St

As the Asian markets continue to show resilience amid global economic fluctuations, investors are increasingly looking toward smaller and newer companies for potential growth opportunities. Penny stocks, despite their somewhat outdated moniker, remain a relevant area of interest for those seeking to uncover hidden value in these markets. This article highlights three penny stocks that exhibit strong financial foundations and could offer long-term potential in the ever-evolving landscape of Asian equities.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.53 | HK$946.34M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.43 | HK$2.02B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.07 | SGD433.66M | ✅ 4 ⚠️ 2 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.098 | SGD51.3M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.35 | SGD13.18B | ✅ 5 ⚠️ 1 View Analysis > |

| F & J Prince Holdings (PSE:FJP) | ₱2.20 | ₱859.28M | ✅ 2 ⚠️ 3 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.00 | NZ$142.34M | ✅ 2 ⚠️ 5 View Analysis > |

| Cal-Comp Electronics (Thailand) (SET:CCET) | THB4.62 | THB48.28B | ✅ 4 ⚠️ 3 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.86 | NZ$240.51M | ✅ 3 ⚠️ 1 View Analysis > |

| Lum Chang Holdings (SGX:L19) | SGD0.45 | SGD168.58M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 955 stocks from our Asian Penny Stocks screener.

We'll examine a selection from our screener results.

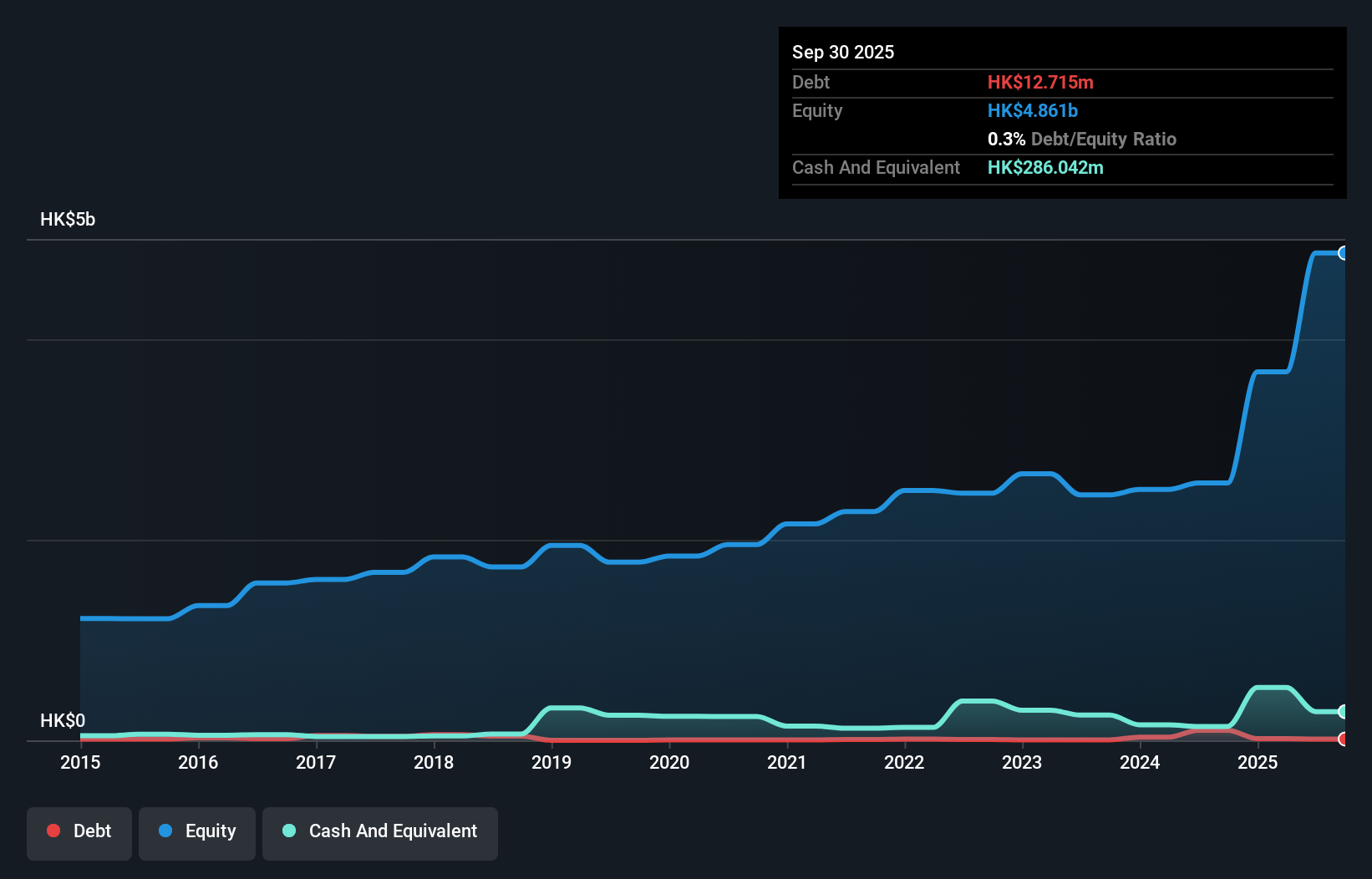

Yeebo (International Holdings) (SEHK:259)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Yeebo (International Holdings) Limited, along with its subsidiaries, focuses on the manufacturing and sale of liquid crystal displays and modules, with a market capitalization of HK$3.46 billion.

Operations: The company generates revenue primarily from its Displays and Other Services segment, totaling HK$1.07 billion.

Market Cap: HK$3.46B

Yeebo (International Holdings) has demonstrated significant financial growth, with recent earnings showing a substantial increase in net income to HK$1.22 billion, primarily due to a large one-off gain from fair value changes in equity interests. Despite the volatility in share price and high weekly volatility compared to other Hong Kong stocks, the company maintains strong fundamentals with short-term assets exceeding liabilities and more cash than total debt. Its Price-To-Earnings ratio of 0.9x suggests potential undervaluation compared to the market average. The experienced management team and board further bolster investor confidence amidst these developments.

- Jump into the full analysis health report here for a deeper understanding of Yeebo (International Holdings).

- Understand Yeebo (International Holdings)'s track record by examining our performance history report.

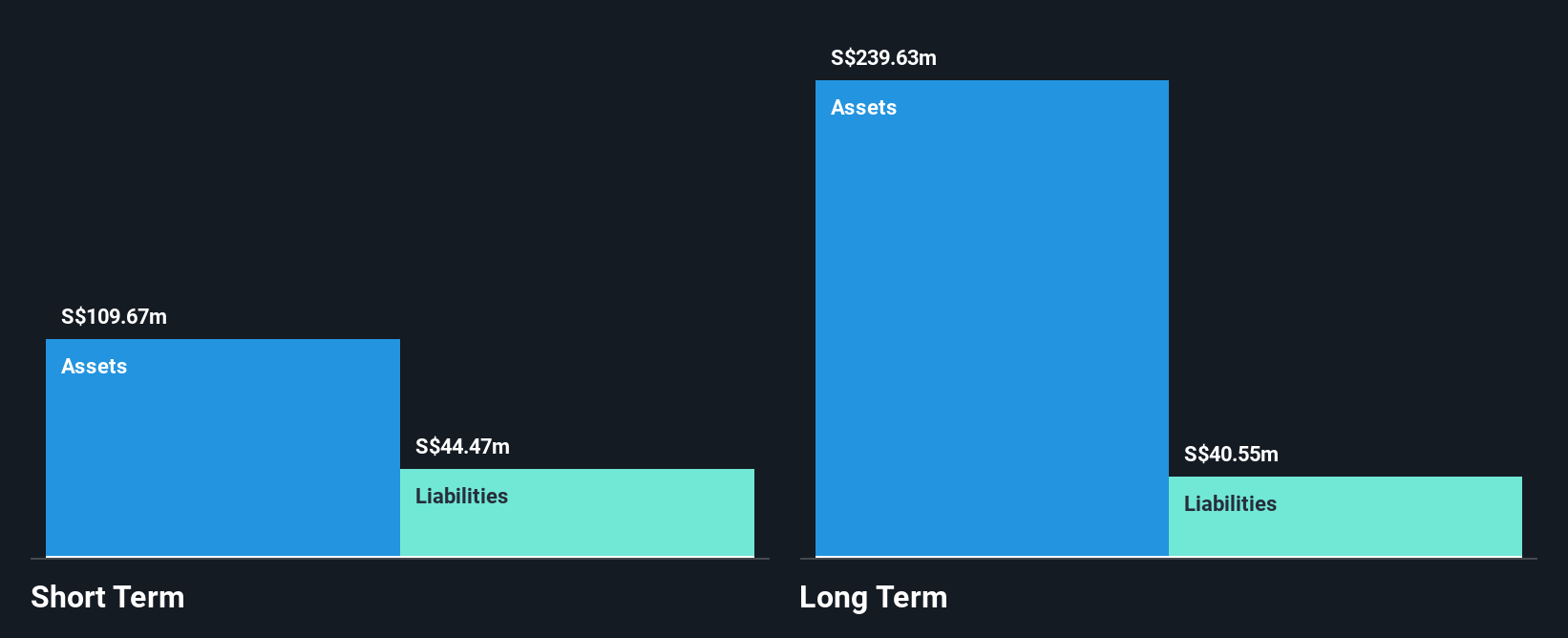

Marco Polo Marine (SGX:5LY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Marco Polo Marine Ltd. is an integrated marine logistics company operating in Singapore, Indonesia, Taiwan, Thailand, Malaysia, and internationally with a market cap of SGD439.42 million.

Operations: Marco Polo Marine Ltd. has not reported any specific revenue segments.

Market Cap: SGD439.42M

Marco Polo Marine Ltd. has shown a robust financial performance, with net income rising significantly to SGD 58.52 million, driven by extraordinary gains from vessel impairment reversals and joint venture disposals. The company is financially sound, as short-term assets surpass liabilities and cash exceeds total debt. Despite forecasts of declining earnings over the next three years, revenue is expected to grow annually by 22.99%. Marco Polo Marine's strategic fleet expansion with two new vessels valued at US$34 million aims to enhance its position in offshore marine sectors while maintaining high-quality earnings and strong interest coverage ratios.

- Get an in-depth perspective on Marco Polo Marine's performance by reading our balance sheet health report here.

- Gain insights into Marco Polo Marine's future direction by reviewing our growth report.

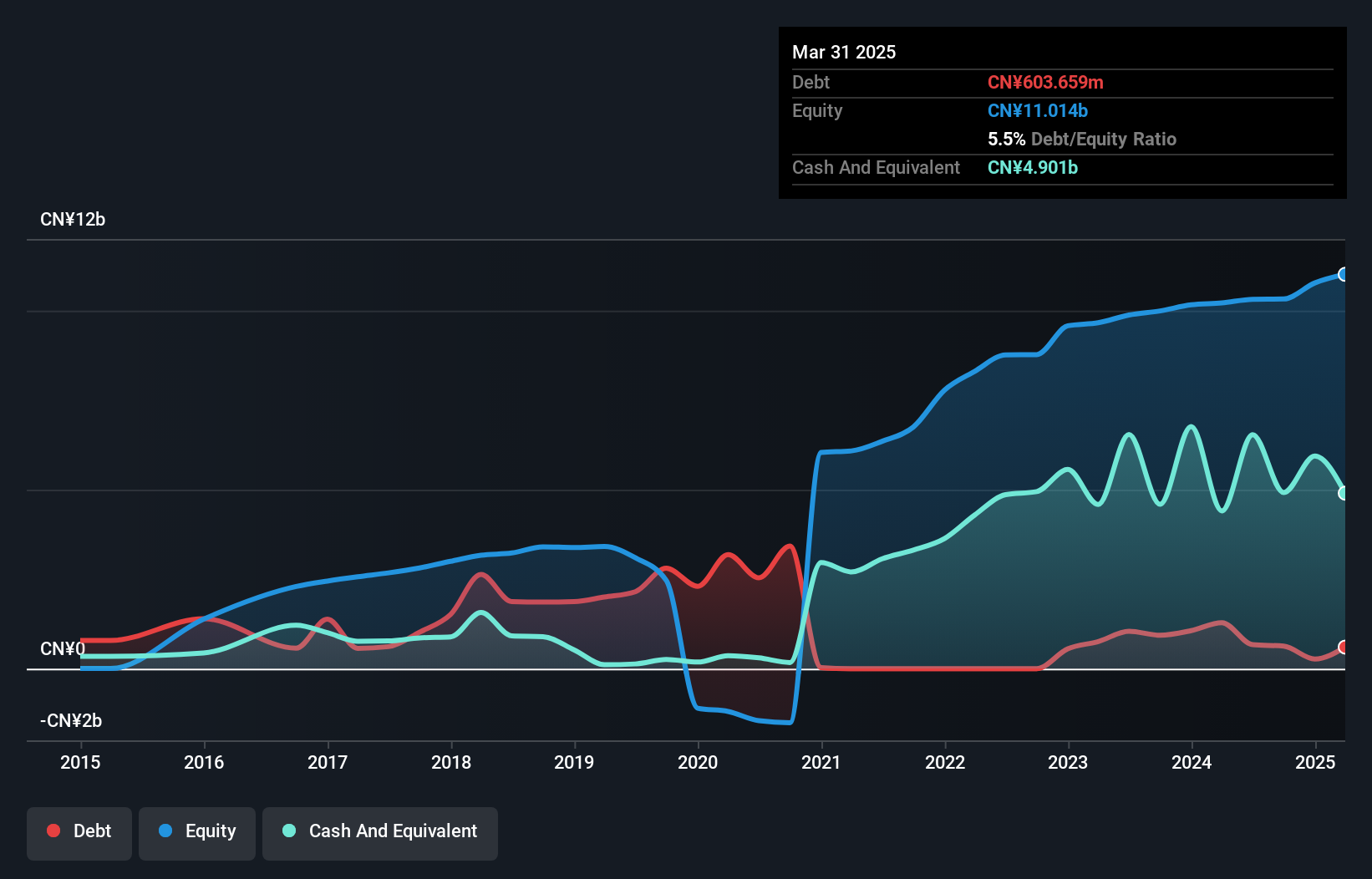

Antong Holdings (SHSE:600179)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Antong Holdings Co., Ltd. operates in the container shipping and transport logistics sector in China, with a market cap of CN¥16.85 billion.

Operations: The company generates revenue primarily from its logistics services segment, which amounted to CN¥8.75 billion.

Market Cap: CN¥16.85B

Antong Holdings demonstrates financial resilience in the container shipping and logistics sector, with a market cap of CN¥16.85 billion and recent revenue of CN¥8.75 billion from logistics services. The company has shown significant earnings growth, with net income increasing to CN¥663.88 million over nine months ending September 2025, compared to the previous year’s figures. Antong's short-term assets exceed both its short- and long-term liabilities, indicating solid liquidity management. Recent strategic transactions include a 5.14% stake acquisition by China Foreign Trade Container Transportation Co., highlighting ongoing corporate restructuring efforts amidst stable yet relatively high share price volatility.

- Click here and access our complete financial health analysis report to understand the dynamics of Antong Holdings.

- Evaluate Antong Holdings' historical performance by accessing our past performance report.

Summing It All Up

- Unlock our comprehensive list of 955 Asian Penny Stocks by clicking here.

- Ready To Venture Into Other Investment Styles? Uncover 13 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600179

Antong Holdings

Engages in the container shipping and transport logistics business in China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026