- Hong Kong

- /

- Personal Products

- /

- SEHK:6090

Discovering Asia's Undiscovered Gems in December 2025

Reviewed by Simply Wall St

As we approach the end of 2025, Asian markets are capturing global attention with their dynamic shifts, particularly in technology and artificial intelligence sectors. With small-cap stocks outperforming larger peers globally and optimism around technological growth potential, now is a compelling time to explore lesser-known opportunities in Asia. Identifying promising stocks often involves looking for companies that can leverage current market trends, such as technological advancements or favorable economic conditions, to fuel sustainable growth.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Konishi | 0.13% | 1.57% | 10.10% | ★★★★★★ |

| Korea Ratings | NA | 1.15% | 4.26% | ★★★★★★ |

| Anapass | 8.99% | 20.82% | 58.41% | ★★★★★★ |

| Hangzhou Xili Intelligent TechnologyLtd | NA | 7.65% | 10.10% | ★★★★★★ |

| Shangri-La Hotel | NA | 33.29% | 66.13% | ★★★★★★ |

| Shenyang Yuanda Intellectual Industry GroupLtd | NA | 9.86% | 33.52% | ★★★★★★ |

| Taiyo KagakuLtd | 0.66% | 6.12% | 4.54% | ★★★★★☆ |

| Shenzhen China Micro Semicon | 6.54% | 5.94% | -43.71% | ★★★★★☆ |

| TSTE | 37.68% | 4.91% | -5.78% | ★★★★★☆ |

| Hollyland (China) Electronics Technology | 6.10% | 17.97% | 20.67% | ★★★★★☆ |

We're going to check out a few of the best picks from our screener tool.

Butong Group (SEHK:6090)

Simply Wall St Value Rating: ★★★★★☆

Overview: Butong Group, with a market cap of approximately HK$9.86 billion, operates in the design, manufacturing, selling, and research and development of nursery products through its subsidiaries.

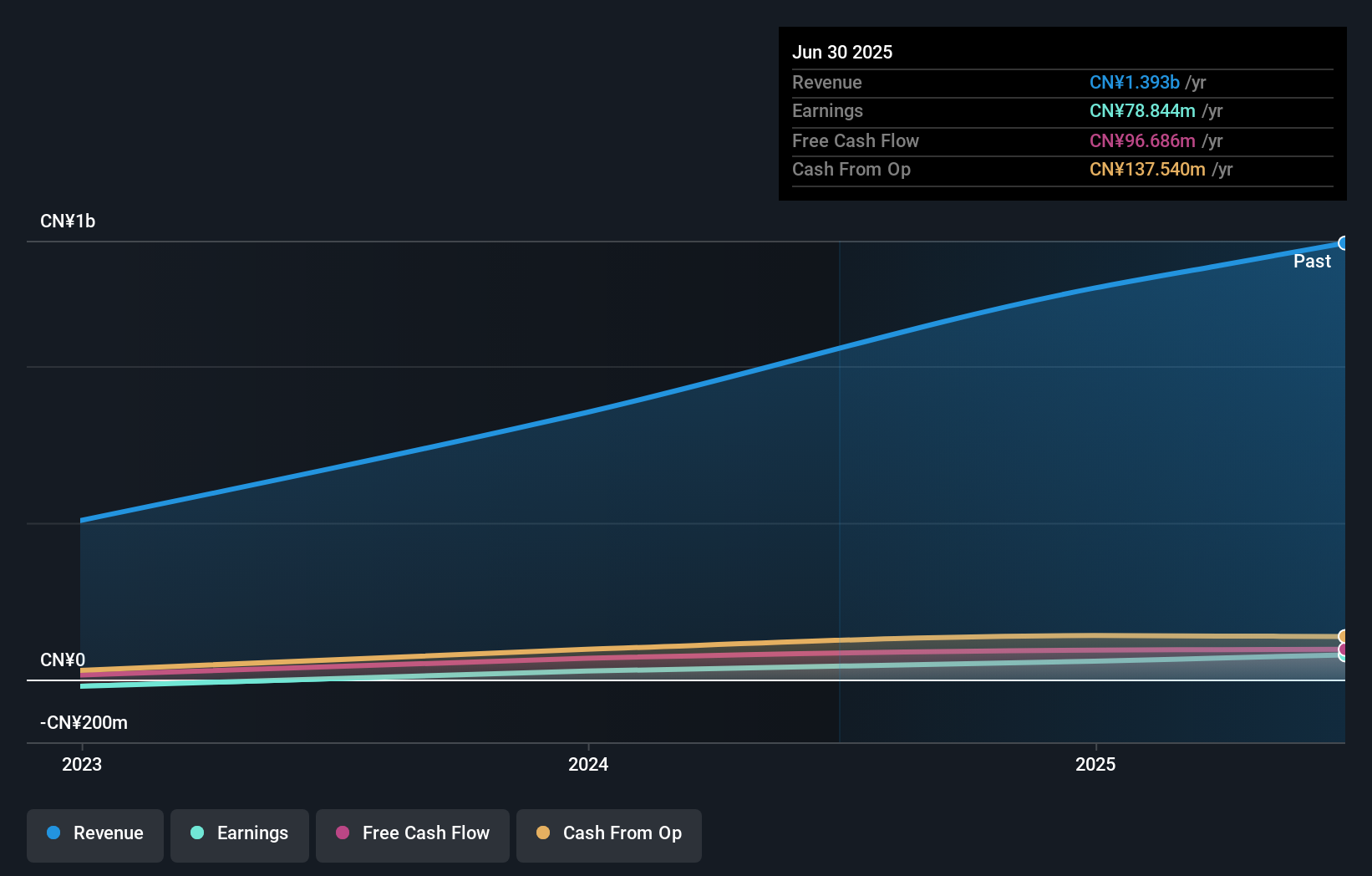

Operations: The primary revenue stream for Butong Group is its premium nursery products, generating CN¥1.39 billion. The company's market cap stands at approximately HK$9.86 billion.

Butong Group, a budding player in the market, recently completed an IPO raising HK$781.84 million, indicating strong investor interest. Their earnings surged by 84% over the past year, outpacing the Personal Products industry growth of 10%. This company boasts high-quality earnings and maintains a robust financial position with more cash than total debt. The interest payments are well-covered by EBIT at 6.7 times coverage, showcasing financial stability. With free cash flow positive and no concerns about cash runway due to profitability, Butong Group seems poised for potential growth in its sector.

Wuxi Longsheng TechnologyLtd (SZSE:300680)

Simply Wall St Value Rating: ★★★★★☆

Overview: Wuxi Longsheng Technology Co., Ltd specializes in the research, development, production, sales, and service of automotive parts products both in China and internationally with a market capitalization of CN¥10.91 billion.

Operations: Longsheng Technology generates revenue primarily through the sale of automotive parts products, serving both domestic and international markets. The company's cost structure includes expenses related to research, development, production, and sales activities. Notably, its net profit margin has shown fluctuations over recent periods.

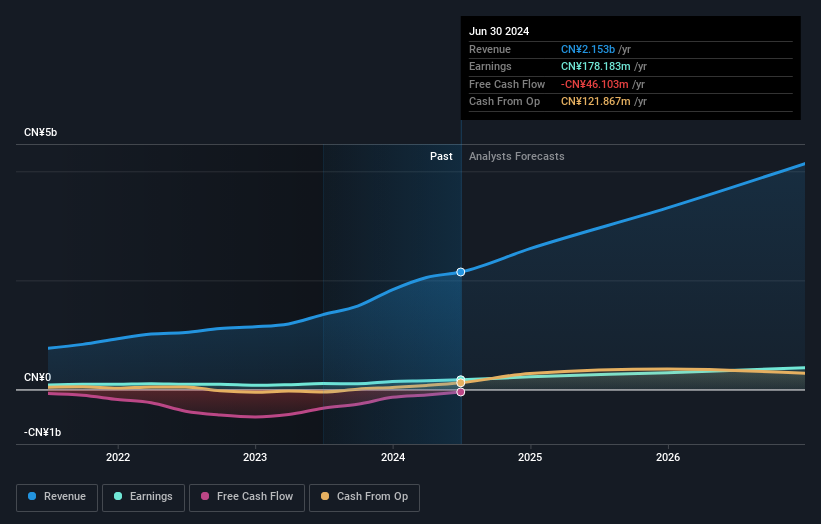

Wuxi Longsheng Technology, a dynamic player in the auto components sector, showcases impressive growth with earnings up 38.2% over the past year, surpassing industry averages. The company reported sales of CN¥1.81 billion for nine months ending September 2025, reflecting an increase from CN¥1.64 billion a year earlier. Net income rose to CN¥210 million compared to CN¥153 million previously, supported by a notable one-off gain of CN¥134.7 million impacting recent results. Despite its highly volatile share price recently, it trades at 23% below estimated fair value and maintains a satisfactory net debt-to-equity ratio of 24%.

Shenzhen Ampron Technology (SZSE:301413)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shenzhen Ampron Technology Co., Ltd. focuses on the research, development, manufacture, sale, and service of sensors in China with a market capitalization of approximately CN¥13.81 billion.

Operations: Ampron generates revenue primarily from its Sensitive Components and Sensor Manufacturing segment, with reported earnings of CN¥1.14 billion.

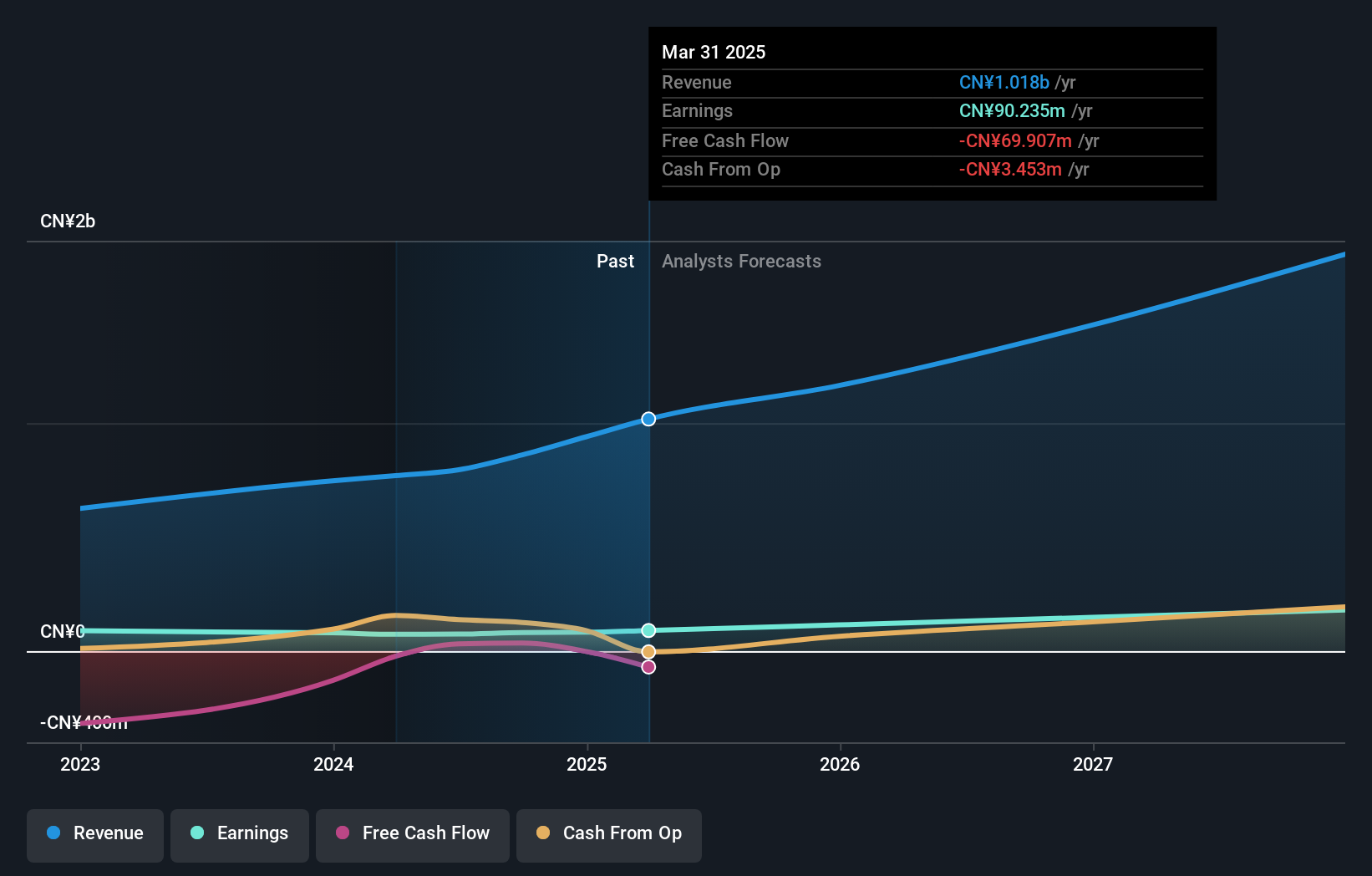

Ampron Technology, a dynamic player in the electronics industry, has shown robust growth with earnings rising 14.8% over the past year, outpacing the sector's 9%. Despite its highly volatile share price recently, Ampron's forecasted annual earnings growth of 26.54% suggests strong future prospects. The company's net income for nine months ending September 2025 reached CN¥73 million from CN¥62 million a year earlier, demonstrating solid performance. However, its debt to equity ratio increased to 38.2% over five years but remains satisfactory at a net level of 19.9%, with interest payments well covered by EBIT at an impressive multiple of 8.8x.

- Click here and access our complete health analysis report to understand the dynamics of Shenzhen Ampron Technology.

Gain insights into Shenzhen Ampron Technology's past trends and performance with our Past report.

Make It Happen

- Navigate through the entire inventory of 2498 Asian Undiscovered Gems With Strong Fundamentals here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Butong Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6090

Butong Group

Through its subsidiaries, engages in the designing, manufacturing, selling and research and development of nursery products.

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026