Stock Analysis

- China

- /

- Electronic Equipment and Components

- /

- SZSE:301391

Exploring High Growth Tech Stocks In November 2024

Reviewed by Simply Wall St

As global markets approach record highs, with smaller-cap indexes outperforming large-caps, investors are closely watching economic indicators such as the unexpected drop in U.S. jobless claims and rising home sales that contribute to positive market sentiment. In this dynamic environment, identifying high growth tech stocks involves looking for companies with strong fundamentals and innovative potential that can thrive amidst broad-based gains and geopolitical uncertainties.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 32.56% | 43.21% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Waystream Holding | 22.16% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 65.73% | 103.55% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1288 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Beijing Enlight Media (SZSE:300251)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Enlight Media Co., Ltd. is involved in the investment, production, and distribution of film and television projects in China, with a market cap of CN¥25.26 billion.

Operations: Enlight Media focuses on the Chinese film and television industry, generating revenue through investment, production, and distribution activities. The company's market cap stands at CN¥25.26 billion.

Beijing Enlight Media's recent earnings report highlights a robust growth trajectory, with revenue soaring to CNY 1.44 billion from the previous year's CNY 940.08 million, an increase of over 53%. This surge is underpinned by a net income jump to CNY 460.88 million, reflecting strong operational efficiency and market demand. The firm's commitment to innovation is evident in its R&D spending trends which have consistently aligned with revenue growth, ensuring sustained development in high-potential areas. With earnings projected to grow at an annual rate of 36.5%, significantly outpacing the CN market average of 26.2%, and revenue expected to increase by 19.2% annually—faster than the market's 13.8%—Beijing Enlight Media is strategically positioned for continued expansion in China’s dynamic entertainment sector.

Shenzhen Phoenix Telecom TechnologyLtd (SZSE:301191)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Phoenix Telecom Technology Co., Ltd. is a company involved in the wireless communications equipment sector, with a market capitalization of CN¥5.51 billion.

Operations: Phoenix Telecom primarily generates revenue from its wireless communications equipment segment, amounting to CN¥1.84 billion.

Shenzhen Phoenix Telecom TechnologyLtd. recently revealed a dip in revenue to CNY 1.26 billion from last year's CNY 1.49 billion, alongside a net income decrease to CNY 104.36 million from CNY 121.47 million, reflecting some challenges in maintaining its financial trajectory amidst competitive pressures. Despite these hurdles, the company's commitment to innovation remains robust with R&D expenses strategically aligned to foster growth, evidenced by an expected annual profit growth of 29.4%, outpacing the CN market average of 26.2%. Moreover, its addition to the S&P Global BMI Index underscores its potential relevance and influence within the tech sector moving forward.

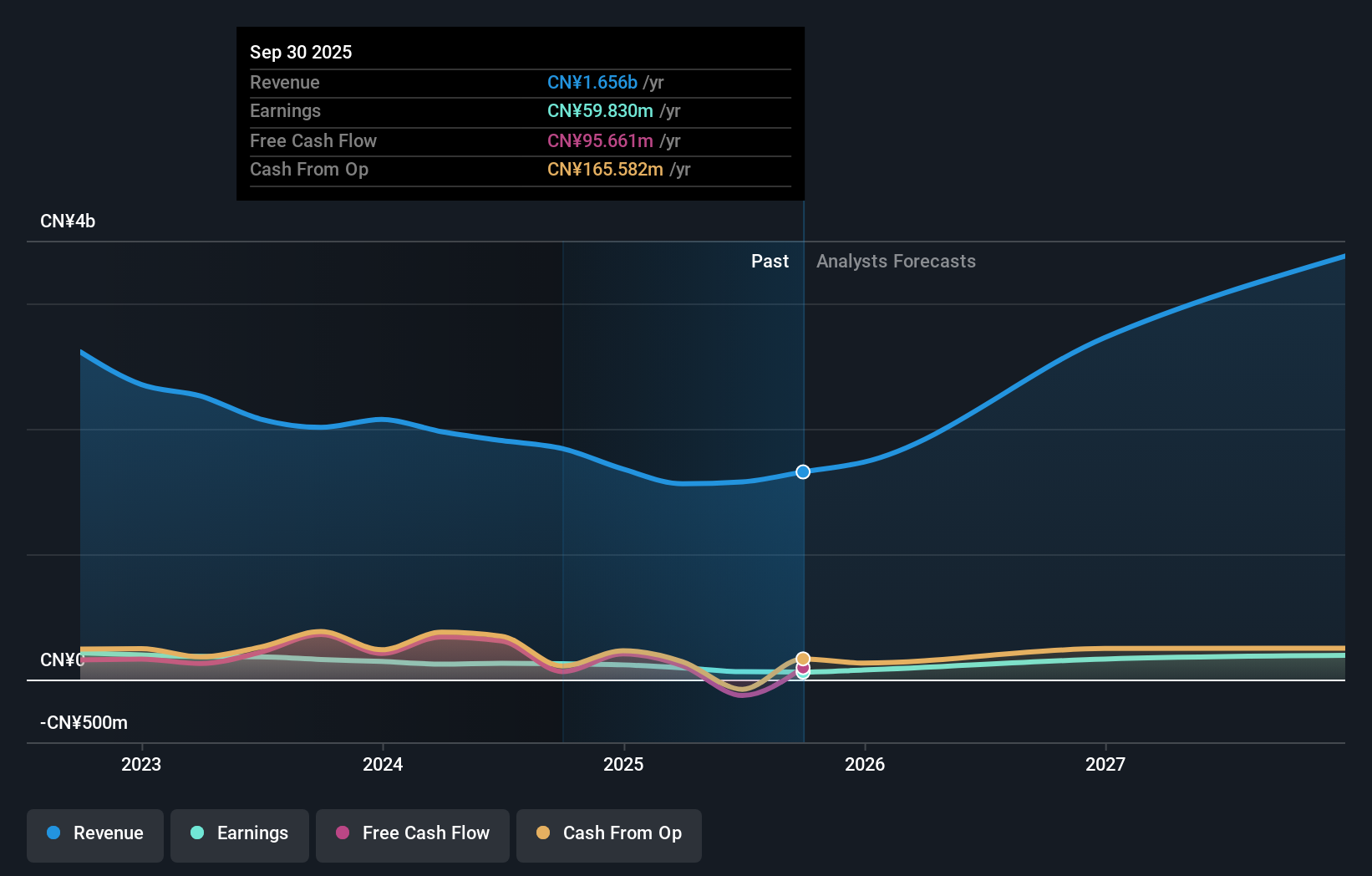

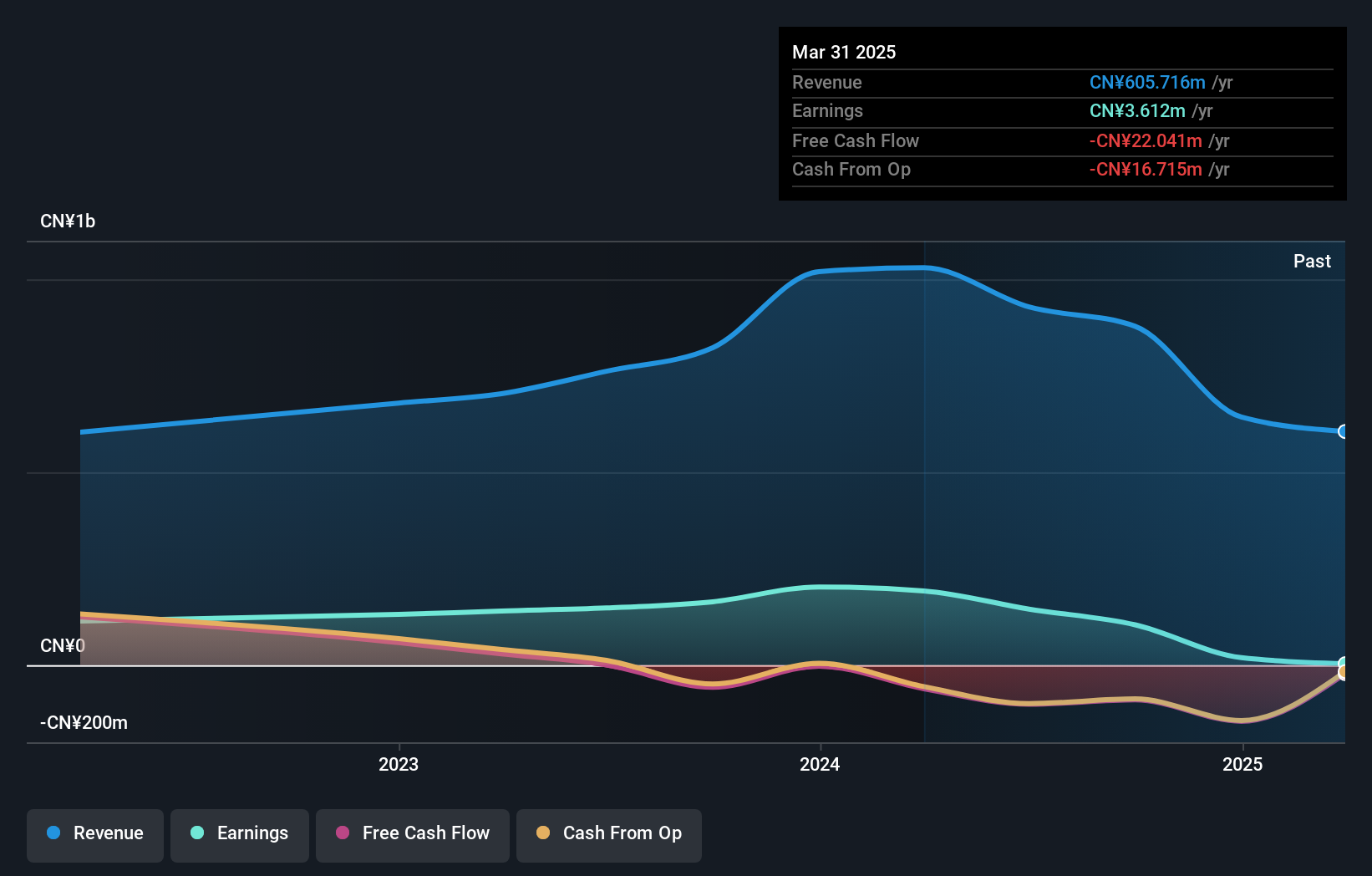

Colorlight Cloud Tech (SZSE:301391)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Colorlight Cloud Tech Ltd is involved in the research, development, manufacture, and sale of LED display control systems and related equipment globally, with a market cap of CN¥3.78 billion.

Operations: Colorlight Cloud Tech Ltd focuses on LED display control systems and related equipment, generating significant revenue from this segment. The company's gross profit margin is a notable aspect of its financial profile.

Despite a challenging year with revenue dropping to CNY 425.82 million from CNY 567.68 million, Colorlight Cloud Tech remains committed to growth, as evidenced by its robust R&D spending. This focus on innovation is critical as the company navigates through market shifts and aims for recovery. Impressively, forecasts indicate a potential revenue increase at an annual rate of 36.3%, significantly outpacing the broader Chinese market's growth of 13.8%. Moreover, earnings are expected to surge by an impressive 47.4% annually, highlighting strong future prospects despite current hurdles. This optimistic outlook is further bolstered by strategic decisions made during recent shareholder meetings concerning cash management and audit appointments, which may enhance operational efficiency and transparency moving forward. Such strategic initiatives could be pivotal in stabilizing the firm’s financials and fostering long-term growth in a highly competitive tech landscape.

- Click to explore a detailed breakdown of our findings in Colorlight Cloud Tech's health report.

Understand Colorlight Cloud Tech's track record by examining our Past report.

Where To Now?

- Gain an insight into the universe of 1288 High Growth Tech and AI Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301391

Colorlight Cloud Tech

Engages in the research and development, manufacture, and sale of LED display control systems, video processing equipment, play servers, and cloud network players worldwide.