- China

- /

- Electronic Equipment and Components

- /

- SZSE:300936

Changzhou Zhongying Science & Technology Co., Ltd's (SZSE:300936) Stock Is Going Strong: Is the Market Following Fundamentals?

Changzhou Zhongying Science & Technology's (SZSE:300936) stock is up by a considerable 19% over the past month. Given the company's impressive performance, we decided to study its financial indicators more closely as a company's financial health over the long-term usually dictates market outcomes. In this article, we decided to focus on Changzhou Zhongying Science & Technology's ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

See our latest analysis for Changzhou Zhongying Science & Technology

How Do You Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Changzhou Zhongying Science & Technology is:

15% = CN¥146m ÷ CN¥1b (Based on the trailing twelve months to June 2024).

The 'return' is the yearly profit. That means that for every CN¥1 worth of shareholders' equity, the company generated CN¥0.15 in profit.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Changzhou Zhongying Science & Technology's Earnings Growth And 15% ROE

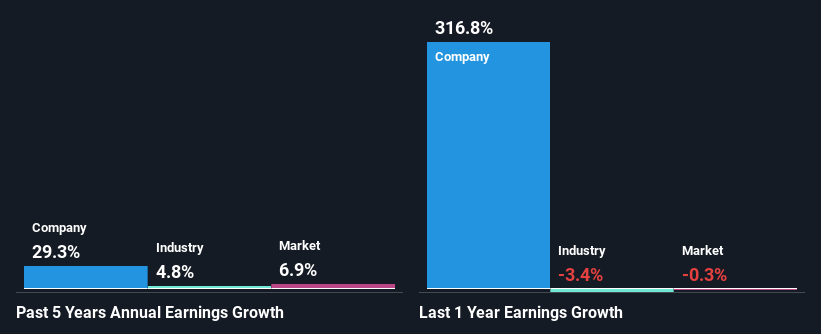

At first glance, Changzhou Zhongying Science & Technology seems to have a decent ROE. Especially when compared to the industry average of 6.4% the company's ROE looks pretty impressive. Probably as a result of this, Changzhou Zhongying Science & Technology was able to see an impressive net income growth of 29% over the last five years. We reckon that there could also be other factors at play here. For example, it is possible that the company's management has made some good strategic decisions, or that the company has a low payout ratio.

As a next step, we compared Changzhou Zhongying Science & Technology's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 4.8%.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is Changzhou Zhongying Science & Technology fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Changzhou Zhongying Science & Technology Using Its Retained Earnings Effectively?

Changzhou Zhongying Science & Technology has a significant three-year median payout ratio of 59%, meaning the company only retains 41% of its income. This implies that the company has been able to achieve high earnings growth despite returning most of its profits to shareholders.

Additionally, Changzhou Zhongying Science & Technology has paid dividends over a period of three years which means that the company is pretty serious about sharing its profits with shareholders.

Conclusion

On the whole, we feel that Changzhou Zhongying Science & Technology's performance has been quite good. In particular, its high ROE is quite noteworthy and also the probable explanation behind its considerable earnings growth. Yet, the company is retaining a small portion of its profits. Which means that the company has been able to grow its earnings in spite of it, so that's not too bad. So far, we've only made a quick discussion around the company's earnings growth. To gain further insights into Changzhou Zhongying Science & Technology's past profit growth, check out this visualization of past earnings, revenue and cash flows.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300936

Changzhou Zhongying Science & Technology

Engages in the research and development, production, and sale of high-frequency communication materials for printed circuit board manufacturers.

Flawless balance sheet with proven track record.