- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2368

Asian Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As global markets navigate a complex landscape of economic indicators and policy shifts, Asian markets have shown resilience, with particular strength in technology and AI sectors. In this environment, growth companies with high insider ownership can be appealing due to their potential for alignment between management incentives and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25.2% | 120.7% |

| SungEel HiTech (KOSDAQ:A365340) | 37.5% | 110.8% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 34.1% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

We're going to check out a few of the best picks from our screener tool.

Ningbo Deye Technology Group (SHSE:605117)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ningbo Deye Technology Group Co., Ltd. produces and sells heat exchangers, inverters, and dehumidifiers across various international markets including South Africa, Brazil, Hong Kong, Germany, and India with a market cap of CN¥73.37 billion.

Operations: The company generates revenue from the production and sales of heat exchangers, inverters, and dehumidifiers across its international markets.

Insider Ownership: 23.1%

Earnings Growth Forecast: 21.2% p.a.

Ningbo Deye Technology Group's revenue is forecasted to grow 22.3% annually, outpacing the broader CN market. Despite a volatile share price, its Price-To-Earnings ratio of 23.9x remains attractive compared to the market average of 43.6x. Earnings are expected to rise significantly at over 20% per year, though recent earnings show stable net income growth with CNY 2,346.94 million reported for nine months ending September 2025.

- Dive into the specifics of Ningbo Deye Technology Group here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Ningbo Deye Technology Group's current price could be inflated.

Sharetronic Data Technology (SZSE:300857)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sharetronic Data Technology Co., Ltd. is a provider of wireless IoT products operating in China, Southeast Asia, and the Americas with a market cap of CN¥48.56 billion.

Operations: Sharetronic Data Technology Co., Ltd. generates its revenue through the provision of wireless IoT products across regions including China, Southeast Asia, and the Americas.

Insider Ownership: 20.5%

Earnings Growth Forecast: 33.8% p.a.

Sharetronic Data Technology shows promising growth potential with earnings forecasted to rise significantly at 33.8% annually, surpassing the CN market average. Despite its volatile share price, it trades at a favorable Price-To-Earnings ratio of 58.3x compared to the industry average of 68.8x. Recent earnings reveal substantial revenue growth from CNY 5.39 billion to CNY 8.33 billion over nine months in 2025, though net income showed modest improvement amidst high non-cash earnings levels.

- Click here and access our complete growth analysis report to understand the dynamics of Sharetronic Data Technology.

- Our comprehensive valuation report raises the possibility that Sharetronic Data Technology is priced lower than what may be justified by its financials.

Gold Circuit Electronics (TWSE:2368)

Simply Wall St Growth Rating: ★★★★★★

Overview: Gold Circuit Electronics Ltd. is a Taiwanese company that designs, manufactures, processes, and distributes printed circuit boards, with a market cap of NT$308.07 billion.

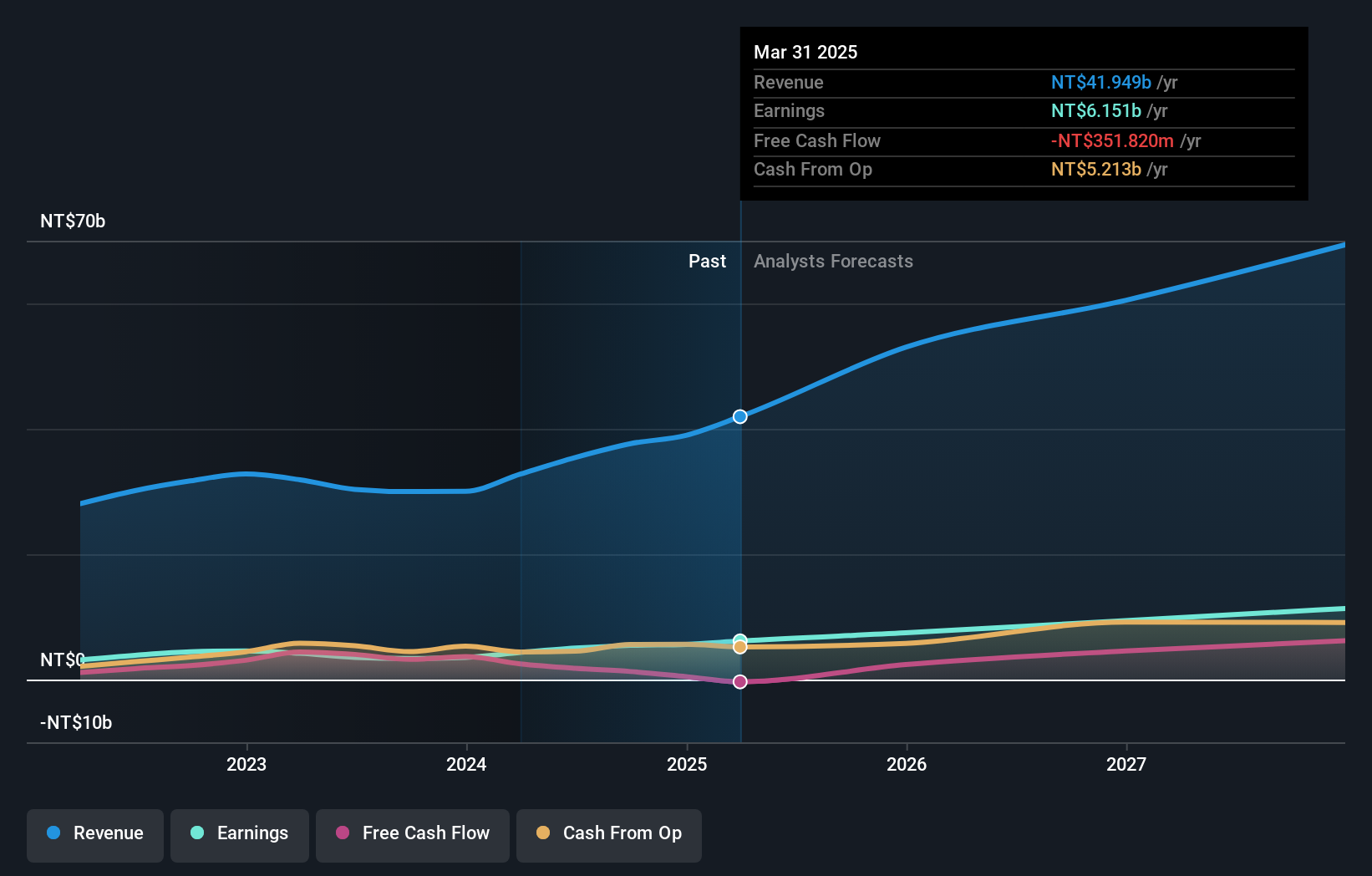

Operations: The company generates revenue of NT$53.45 billion from its manufacturing and sales of printed circuit boards.

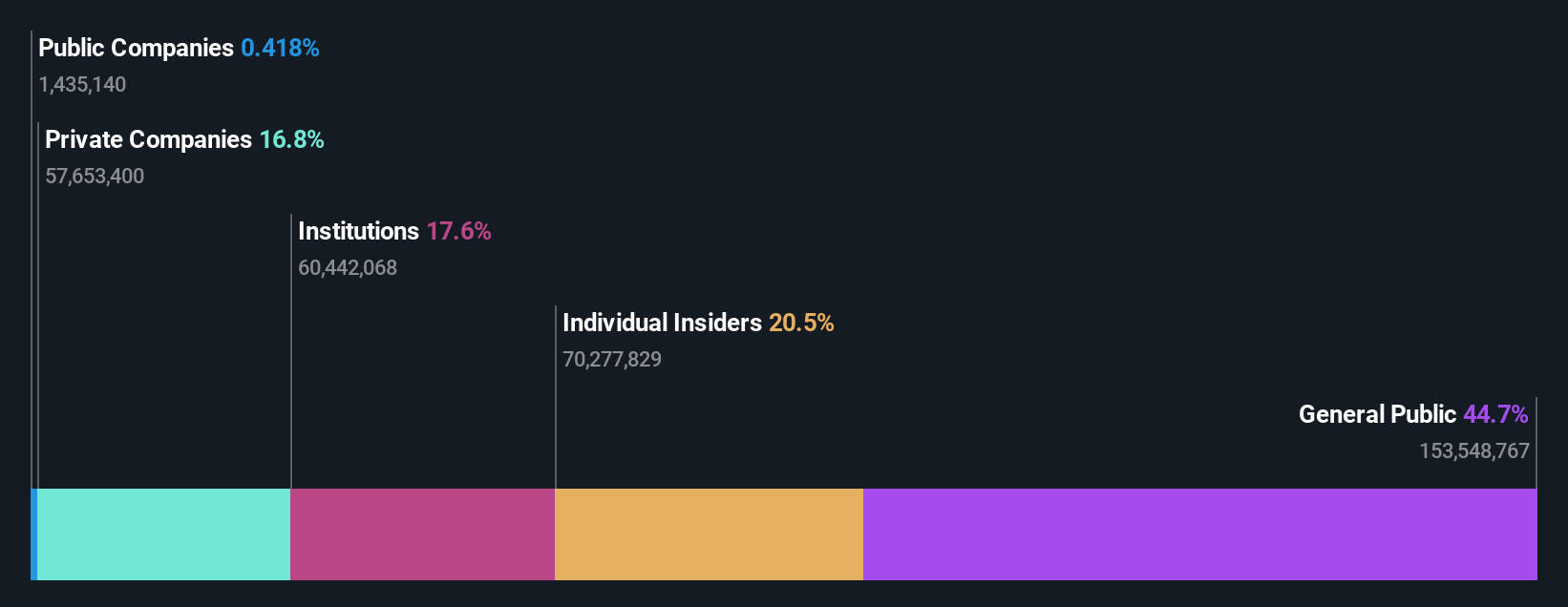

Insider Ownership: 31.4%

Earnings Growth Forecast: 34.1% p.a.

Gold Circuit Electronics demonstrates strong growth prospects with earnings expected to grow significantly at 34.1% annually, outpacing the TW market. Despite recent share price volatility, its revenue is forecasted to rise by 28.4% per year, faster than the market average. Recent earnings reports show substantial increases in both sales and net income for Q3 2025 compared to the previous year. The company was recently added to the FTSE All-World Index, highlighting its rising prominence.

- Take a closer look at Gold Circuit Electronics' potential here in our earnings growth report.

- According our valuation report, there's an indication that Gold Circuit Electronics' share price might be on the expensive side.

Summing It All Up

- Dive into all 635 of the Fast Growing Asian Companies With High Insider Ownership we have identified here.

- Ready For A Different Approach? AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2368

Gold Circuit Electronics

Designs, manufactures, processes, and distributes printed circuit boards in Taiwan.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026