- China

- /

- Entertainment

- /

- SZSE:300860

High Growth Tech Stocks In Asia December 2025

Reviewed by Simply Wall St

As global markets navigate the anticipation of interest rate cuts and mixed economic signals, Asian tech stocks are capturing attention with their potential for high growth, particularly amid enthusiasm for technology and artificial intelligence in China. In this dynamic environment, identifying promising tech stocks often involves looking at companies that demonstrate innovation and adaptability to evolving market conditions.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Suzhou TFC Optical Communication | 35.80% | 36.87% | ★★★★★★ |

| Zhongji Innolight | 34.82% | 35.50% | ★★★★★★ |

| Knowmerce | 42.51% | 33.23% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

T&S CommunicationsLtd (SZSE:300570)

Simply Wall St Growth Rating: ★★★★★★

Overview: T&S Communications Co., Ltd. is engaged in the development, manufacturing, and sale of fiber optics communication products in China, with a market capitalization of CN¥26.64 billion.

Operations: T&S focuses on the development, manufacturing, and sale of fiber optics communication products in China. The optical communication components segment generated revenue of CN¥1.67 billion.

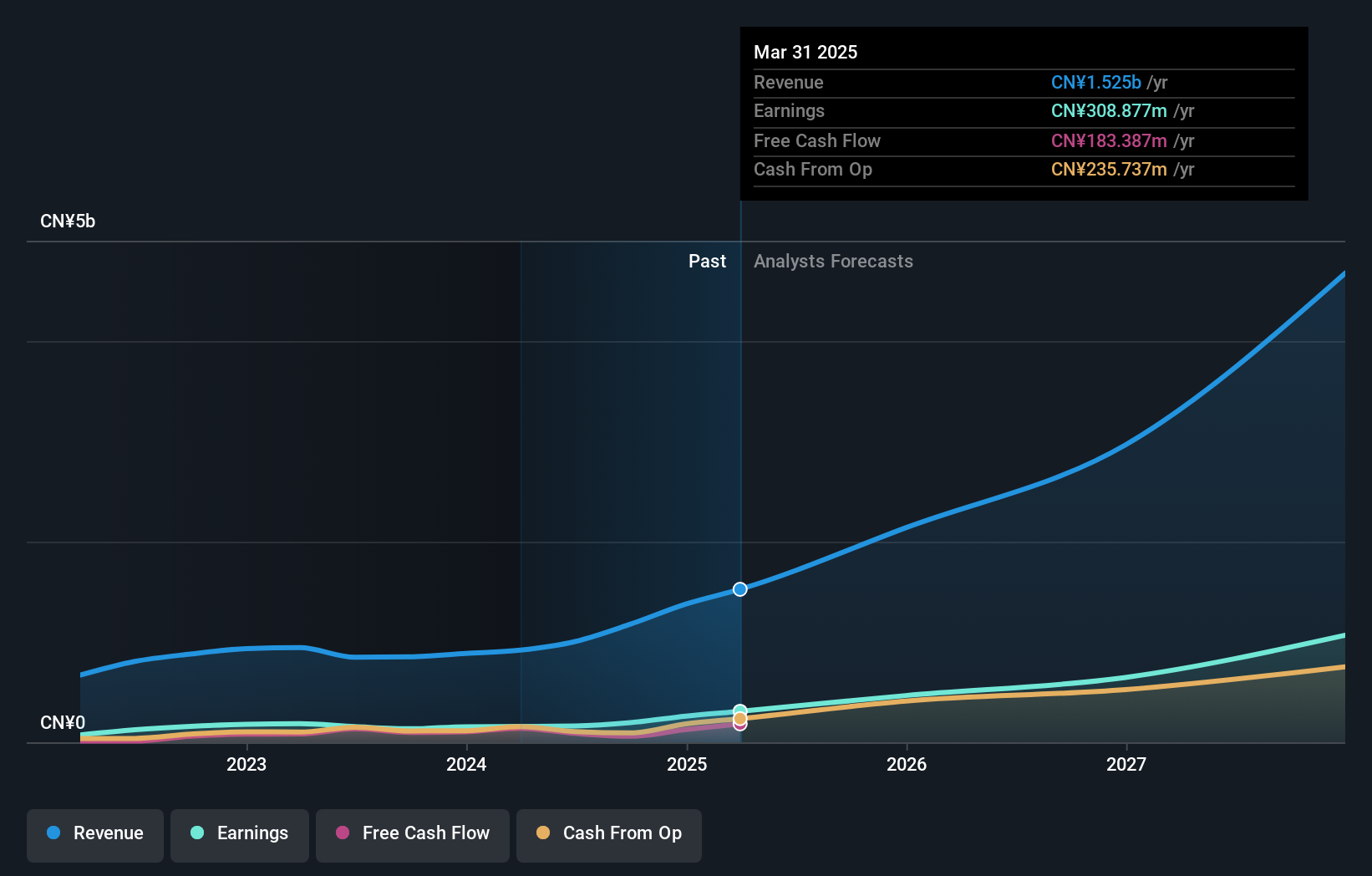

T&S CommunicationsLtd. has demonstrated robust financial performance with a 91.7% earnings growth over the past year, significantly outpacing the Communications industry average of 14.4%. This growth trajectory is supported by an aggressive R&D investment strategy, as evidenced by their recent amendments to company bylaws to foster innovation and technology development. With annual revenue and earnings forecasted to grow at 45.3% and 50.2% respectively, T&S is well-positioned in Asia's high-growth tech sector despite a highly volatile share price in recent months. The company's focus on enhancing its technological capabilities could further solidify its market position, leveraging high-quality non-cash earnings and positive free cash flow to potentially accelerate future expansions.

- Click here to discover the nuances of T&S CommunicationsLtd with our detailed analytical health report.

Explore historical data to track T&S CommunicationsLtd's performance over time in our Past section.

Funshine Culture GroupLtd (SZSE:300860)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Funshine Culture Group Co., Ltd. specializes in the design and production services for cultural performances in China, with a market cap of CN¥5.66 billion.

Operations: The company focuses on providing design and production services for cultural performances across China. It operates within the entertainment sector, leveraging its expertise to deliver tailored performance solutions.

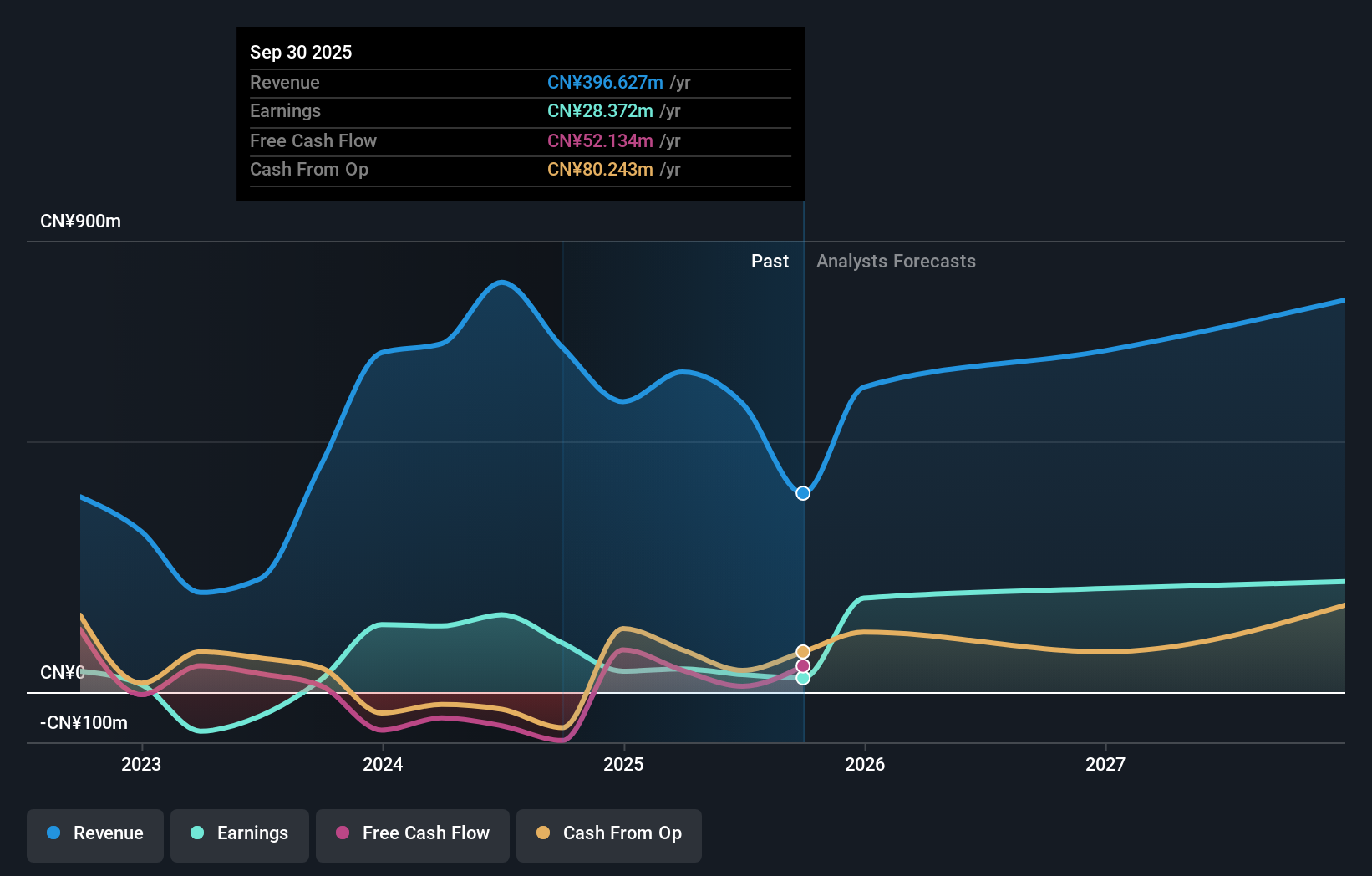

Despite a challenging year with revenue dropping to CNY 198.15 million from CNY 380.71 million, Funshine Culture GroupLtd has shown resilience by maintaining innovation through significant changes in its corporate governance. The firm's commitment to adapting its operational framework, as highlighted in recent extraordinary general meetings, reflects strategic shifts aimed at long-term stability and growth within the tech sector. With an annual earnings growth forecast of 39% and R&D investments aligning with industry advancements, Funshine is strategically positioning itself to capitalize on emerging market trends despite current financial setbacks.

Dexerials (TSE:4980)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dexerials Corporation is a Japanese company that specializes in manufacturing and selling electronic components, bonding materials, and optics materials, with a market capitalization of approximately ¥518.03 billion.

Operations: Dexerials Corporation generates revenue primarily from electronic materials and components, contributing ¥62.16 billion, followed by optical materials and components at ¥46.80 billion.

Dexerials Corporation, amidst a dynamic market, has recently announced a share repurchase of 2.5 million shares for ¥5 billion, signaling confidence in its operational stability and future prospects. This move coincides with an upward revision of its financial forecasts following strong semi-annual performance driven by high-value product expansions and favorable currency shifts. The company's commitment to innovation is evident through strategic alliances like the joint development with Veritas In Silico Inc., aimed at enhancing RNA structural analysis technologies—a venture that could redefine industry standards while bolstering Dexerials' technological footprint in global markets.

- Delve into the full analysis health report here for a deeper understanding of Dexerials.

Assess Dexerials' past performance with our detailed historical performance reports.

Summing It All Up

- Get an in-depth perspective on all 187 Asian High Growth Tech and AI Stocks by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300860

Funshine Culture GroupLtd

Engages in the design and production services for cultural performances in China.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026