- China

- /

- Electronic Equipment and Components

- /

- SZSE:002414

High Growth Tech Stocks To Watch For Promising Portfolio Growth

Reviewed by Simply Wall St

In recent weeks, global markets have experienced a broad-based rally with smaller-cap indexes outperforming large-caps, driven by strong labor market data and positive sentiment from economic indicators such as rising home sales in the U.S. Despite geopolitical tensions and uncertainties surrounding future policies, investor optimism has been bolstered by expectations of potential interest rate cuts from major central banks. In this environment, high-growth tech stocks are gaining attention as they often thrive on innovation and adaptability—key attributes that can provide resilience amid fluctuating market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Waystream Holding | 22.16% | 113.25% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Sarepta Therapeutics | 24.00% | 42.49% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| CD Projekt | 21.17% | 29.59% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Elliptic Laboratories | 65.73% | 103.55% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.35% | 70.33% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1285 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Shenzhen JPT Opto-Electronics (SHSE:688025)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen JPT Opto-Electronics Co., Ltd. focuses on the R&D, production, sale, and technical services of laser technology, intelligent equipment, and optical devices with a market cap of CN¥4.88 billion.

Operations: The company generates revenue primarily from the computer communications and other electronic equipment segment, which amounts to CN¥1.39 billion.

Shenzhen JPT Opto-Electronics has demonstrated robust financial performance with a notable 18.4% increase in sales, reaching CNY 1.07 billion in the first nine months of 2024, compared to the previous year. This growth is underpinned by an impressive forecast of annual earnings growth at 36%, significantly outpacing the Chinese market's average of 26.2%. Additionally, the company's commitment to innovation is evident from its R&D expenses which have consistently aligned with revenue increases, ensuring sustained advancements in opto-electronic technologies and maintaining a competitive edge in a rapidly evolving industry.

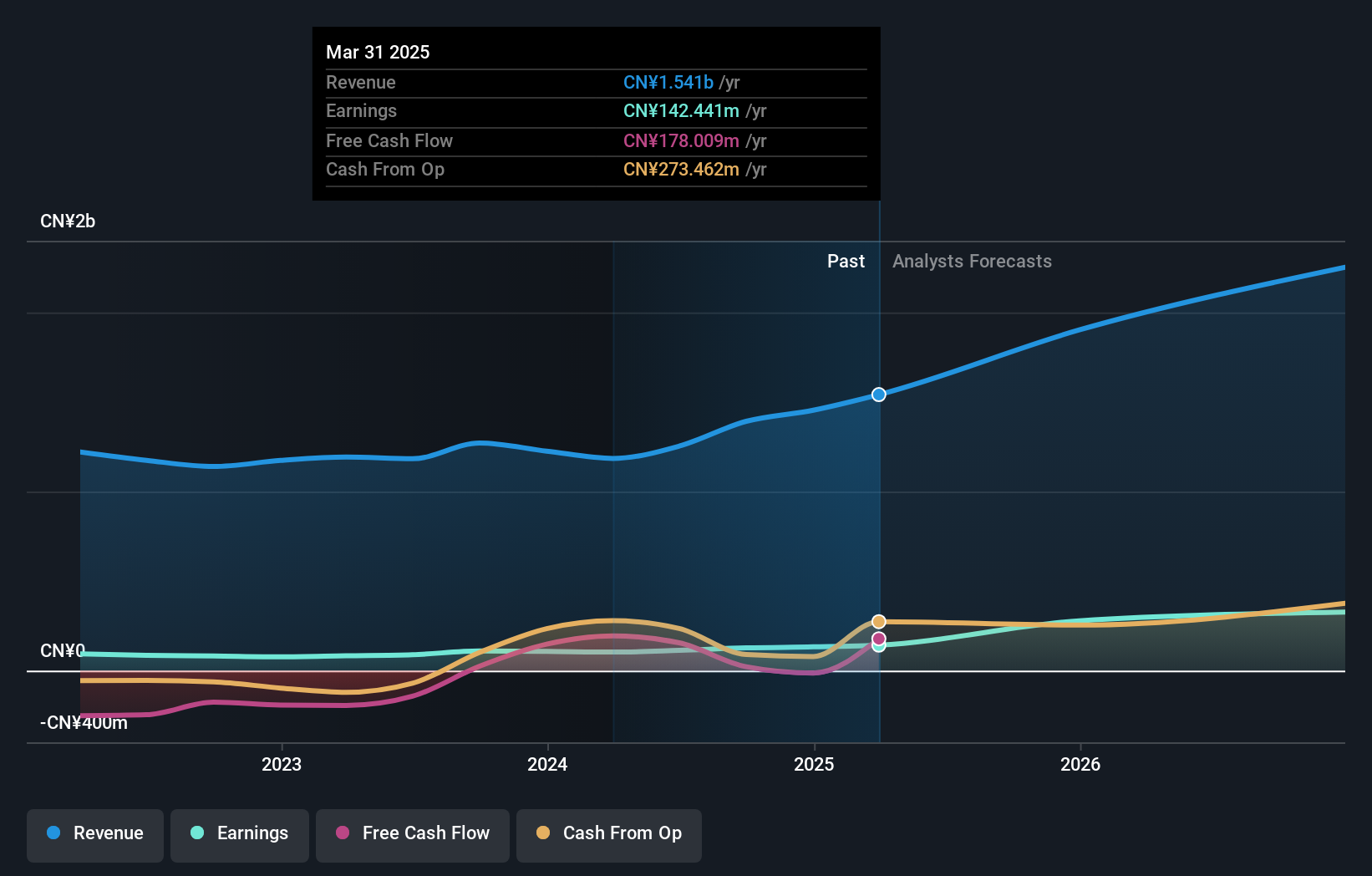

Wuhan Guide Infrared (SZSE:002414)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuhan Guide Infrared Co., Ltd. focuses on the research, development, production, and sale of infrared thermal imaging technology in Asia with a market cap of CN¥33.23 billion.

Operations: The company generates revenue primarily through the sale of infrared thermal imaging technology products. Its operations are centered in Asia, leveraging research and development to enhance its product offerings in this specialized field.

Wuhan Guide Infrared has navigated a challenging landscape with its recent earnings report showing a sales increase to CNY 1.81 billion, up from CNY 1.61 billion year-over-year, despite a significant drop in net income from CNY 285.63 million to CNY 50.21 million. This performance is underpinned by an aggressive R&D commitment, aligning expenses with revenue growth and fueling innovations crucial for staying competitive in the high-tech infrared technology sector. Notably, the company's revenue growth forecast at an impressive 26.3% annually surpasses the Chinese market average of 13.8%, signaling strong future prospects despite current profitability challenges. In light of these dynamics and considering the substantial projected earnings growth rate of 79.1% per year, Wuhan Guide Infrared appears poised for recovery and potential market leadership in its niche of infrared technologies used across various industries including security and surveillance—a sector increasingly reliant on advanced detection systems as global security concerns escalate.

Broadex Technologies (SZSE:300548)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Broadex Technologies Co., Ltd. focuses on the research, development, production, and sale of integrated optoelectronic devices for optical communications both in China and internationally, with a market capitalization of CN¥6.39 billion.

Operations: Broadex Technologies specializes in the production and sale of integrated optoelectronic devices for optical communications, serving both domestic and international markets.

Broadex Technologies, amidst a challenging fiscal year with sales dipping to CNY 1.23 billion from CNY 1.29 billion, still shows potential with an expected revenue growth of 24.3% per annum, outpacing the Chinese market's average of 13.8%. This resilience is partly due to its aggressive R&D spending aimed at fostering innovation in its tech offerings, aligning well with industry shifts towards more integrated tech solutions. Despite a downturn in net income from CNY 140.81 million to CNY 37.5 million, the company is poised for recovery with earnings projected to surge by approximately 63.9% annually, reflecting a robust comeback strategy that leverages both product development and market expansion efforts effectively.

- Dive into the specifics of Broadex Technologies here with our thorough health report.

Evaluate Broadex Technologies' historical performance by accessing our past performance report.

Make It Happen

- Discover the full array of 1285 High Growth Tech and AI Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wuhan Guide Infrared might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002414

Wuhan Guide Infrared

Engages in the research and development, production, and sale of infrared thermal imaging technology in Asia.

High growth potential with adequate balance sheet.