As global markets grapple with renewed U.S.-China trade tensions and economic uncertainties, investors are increasingly looking towards Asia for stability and growth opportunities. In this environment, dividend stocks can offer a reliable income stream, making them an attractive option for those seeking to bolster their portfolios amidst market volatility.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.25% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.83% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.96% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.85% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.91% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

| Daicel (TSE:4202) | 4.53% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.49% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.73% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.67% | ★★★★★★ |

Click here to see the full list of 1072 stocks from our Top Asian Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Star Lake BioscienceZhaoqing Guangdong (SHSE:600866)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Star Lake Bioscience Co., Inc. Zhaoqing Guangdong manufactures and sells pharmaceutical raw materials, and food and feed additives under the Star Lake and Yue Bao brand names in China and internationally, with a market cap of CN¥13.34 billion.

Operations: Star Lake Bioscience Co., Inc. Zhaoqing Guangdong generates revenue through its production and distribution of pharmaceutical raw materials, as well as food and feed additives, serving both domestic and international markets.

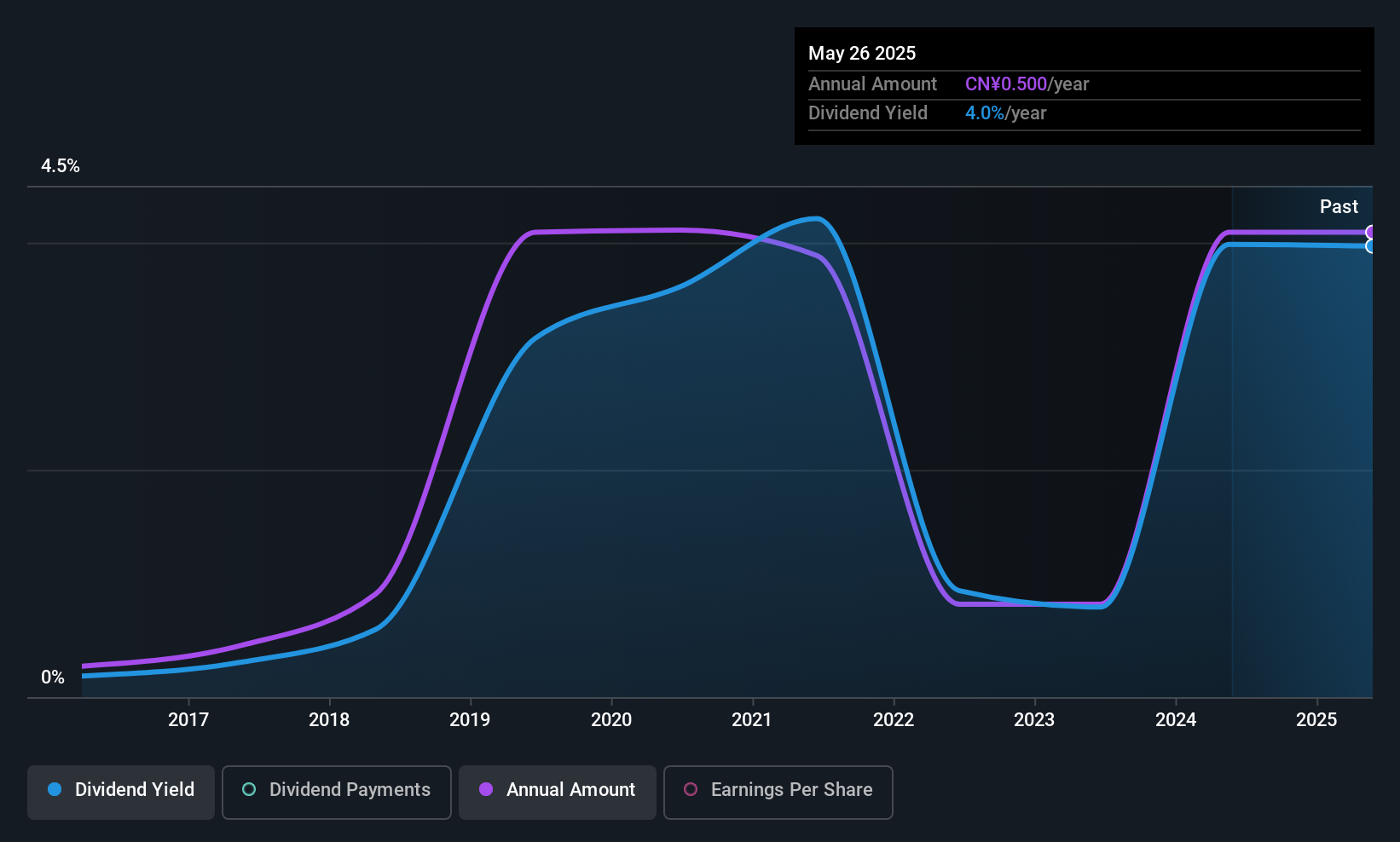

Dividend Yield: 4.7%

Star Lake Bioscience's dividend yield of 4.73% positions it among the top 25% of dividend payers in China, though it's too early to assess stability or growth given recent initiation. The payout ratio is sustainable at 49.6%, supported by earnings and cash flows, with a cash payout ratio of 54.1%. Earnings grew by CNY 330 million over the past year, despite a slight decline in sales and revenue, indicating robust profit growth potential for future dividends.

- Dive into the specifics of Star Lake BioscienceZhaoqing Guangdong here with our thorough dividend report.

- The analysis detailed in our Star Lake BioscienceZhaoqing Guangdong valuation report hints at an deflated share price compared to its estimated value.

Goldcard Smart Group (SZSE:300349)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Goldcard Smart Group Co., Ltd. is a utility digitalization solution provider specializing in smart gas, smart water, and hydrogen metering in China, with a market cap of CN¥5.44 billion.

Operations: Goldcard Smart Group Co., Ltd. generates revenue through its provision of digitalization solutions for the smart gas, smart water, and hydrogen metering sectors in China.

Dividend Yield: 3.8%

Goldcard Smart Group's dividend yield of 3.82% ranks in the top 25% of Chinese dividend payers, yet its sustainability is questionable due to a high cash payout ratio of 108.2%. Recent amendments to company bylaws may affect future dividends. While trading at a favorable P/E ratio of 19.6x compared to the market, its dividends have been volatile over the past decade and not well covered by free cash flows or earnings, with declining net income impacting reliability.

- Click here and access our complete dividend analysis report to understand the dynamics of Goldcard Smart Group.

- In light of our recent valuation report, it seems possible that Goldcard Smart Group is trading behind its estimated value.

Crowell Development (TWSE:2528)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Crowell Development Corp. is involved in the construction of commercial and residential buildings for rental and sale in Taiwan, with a market cap of NT$13.65 billion.

Operations: Crowell Development Corp. generates its revenue primarily from Real Estate Operations & Development, amounting to NT$10.61 billion.

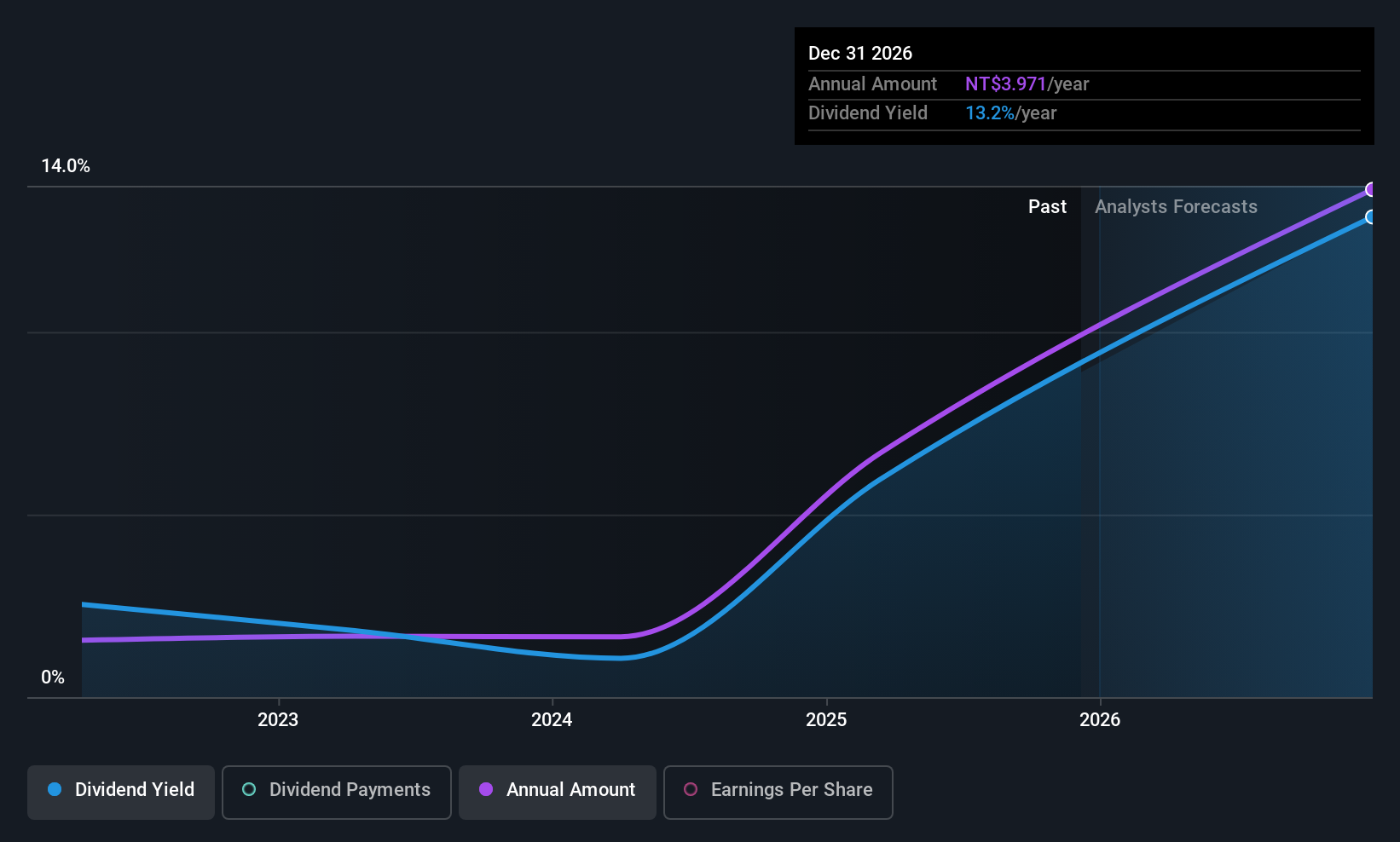

Dividend Yield: 6.4%

Crowell Development's dividend yield of 6.36% is among the top 25% in Taiwan, supported by a low cash payout ratio of 24.2%, indicating strong coverage by cash flows and earnings. However, its dividend history has been volatile over the past decade despite recent profitability and substantial revenue growth to TWD 5.28 billion for the first half of 2025. The stock trades at a significant discount to its estimated fair value but carries high debt levels, raising sustainability concerns.

- Delve into the full analysis dividend report here for a deeper understanding of Crowell Development.

- Insights from our recent valuation report point to the potential undervaluation of Crowell Development shares in the market.

Turning Ideas Into Actions

- Take a closer look at our Top Asian Dividend Stocks list of 1072 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600866

Star Lake BioscienceZhaoqing Guangdong

Engages in the manufacture and sale of pharmaceutical raw materials, and food and feed additives under the Star Lake and Yue Bao brand names in China and internationally.

Very undervalued with solid track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026