Stock Analysis

- China

- /

- Communications

- /

- SZSE:300620

High Growth Tech Stocks Including Beijing eGOVA Co And Two Others

Reviewed by Simply Wall St

Amid a busy week of earnings and economic data, global markets saw mixed performances, with small-cap stocks showing resilience compared to their larger counterparts. In this context, high-growth tech stocks like Beijing eGOVA Co are capturing attention for their potential to thrive in dynamic market environments, where innovation and adaptability become key factors for success.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.41% | 70.53% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 72.26% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1285 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Beijing eGOVA Co (SZSE:300075)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing eGOVA Co., Ltd is a smart city core application and operation service provider in China with a market cap of CN¥11.99 billion.

Operations: The company focuses on providing smart city solutions in China, leveraging technology to enhance urban management and services. It generates revenue through its core application and operational services tailored for smart cities.

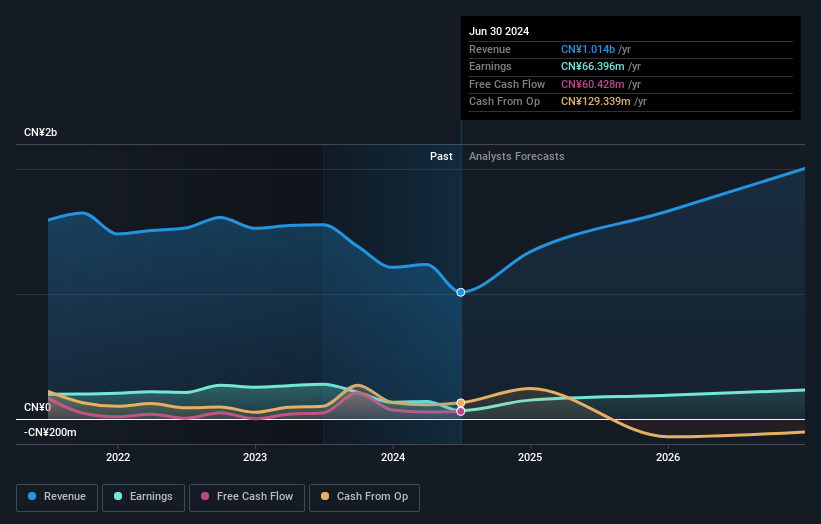

Beijing eGOVA Co. has demonstrated resilience in a challenging market, with an expected revenue growth of 31% annually, significantly outpacing the Chinese market's average of 13.9%. Despite current unprofitability, the company is projected to shift towards profitability within three years, showcasing potential for substantial earnings growth estimated at 60.06% per year. This pivot is underscored by recent financial results indicating a downturn in net income to CNY 20.5 million from CNY 182.37 million year-over-year for the nine months ending September 2024, reflecting short-term challenges yet highlighting long-term growth prospects driven by strategic R&D investments and market expansion efforts. In terms of innovation and sector impact, Beijing eGOVA’s commitment to research and development is pivotal for its future success in the tech industry where continuous innovation defines market leadership. The firm’s strategic focus on enhancing its software solutions could catalyze its transition into profitability and secure a competitive stance in high-growth tech sectors, aligning with broader industry trends towards digital transformation and smart technology integration.

- Navigate through the intricacies of Beijing eGOVA Co with our comprehensive health report here.

Gain insights into Beijing eGOVA Co's past trends and performance with our Past report.

XGD (SZSE:300130)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: XGD Inc. is engaged in the research, development, manufacturing, sales, and servicing of payment terminals both in China and internationally, with a market cap of CN¥15.24 billion.

Operations: XGD focuses on the payment terminal industry, leveraging its capabilities in research, development, and manufacturing to serve both domestic and international markets. The company generates revenue primarily through the sale of these terminals.

XGD Inc. has navigated a challenging fiscal period with resilience, evidenced by a 15.5% decrease in revenue year-over-year, yet maintaining a robust net income growth of 34.9%. This performance is underpinned by strategic R&D investments, which accounted for 18.2% of the revenue, aligning with industry trends towards enhanced technological capabilities and innovation. Despite recent dips in earnings per share from CNY 1.06 to CNY 0.53, the company's commitment to dividend payouts and its agility in adapting to market dynamics reflect a potentially stable future trajectory in the tech sector. Moreover, XGD’s projected earnings growth rate of 33.4% showcases its potential to outpace market averages significantly, positioning it well within the competitive landscape as it continues to evolve its offerings and market approach.

- Unlock comprehensive insights into our analysis of XGD stock in this health report.

Assess XGD's past performance with our detailed historical performance reports.

Advanced Fiber Resources (Zhuhai) (SZSE:300620)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Advanced Fiber Resources (Zhuhai), Ltd. specializes in the design and manufacture of passive optical components for both domestic and international markets, with a market capitalization of CN¥12.79 billion.

Operations: Advanced Fiber Resources (Zhuhai) generates revenue primarily from optoelectronic and electronic devices, totaling CN¥924.78 million. The company focuses on the design and manufacture of these components for both domestic and international markets.

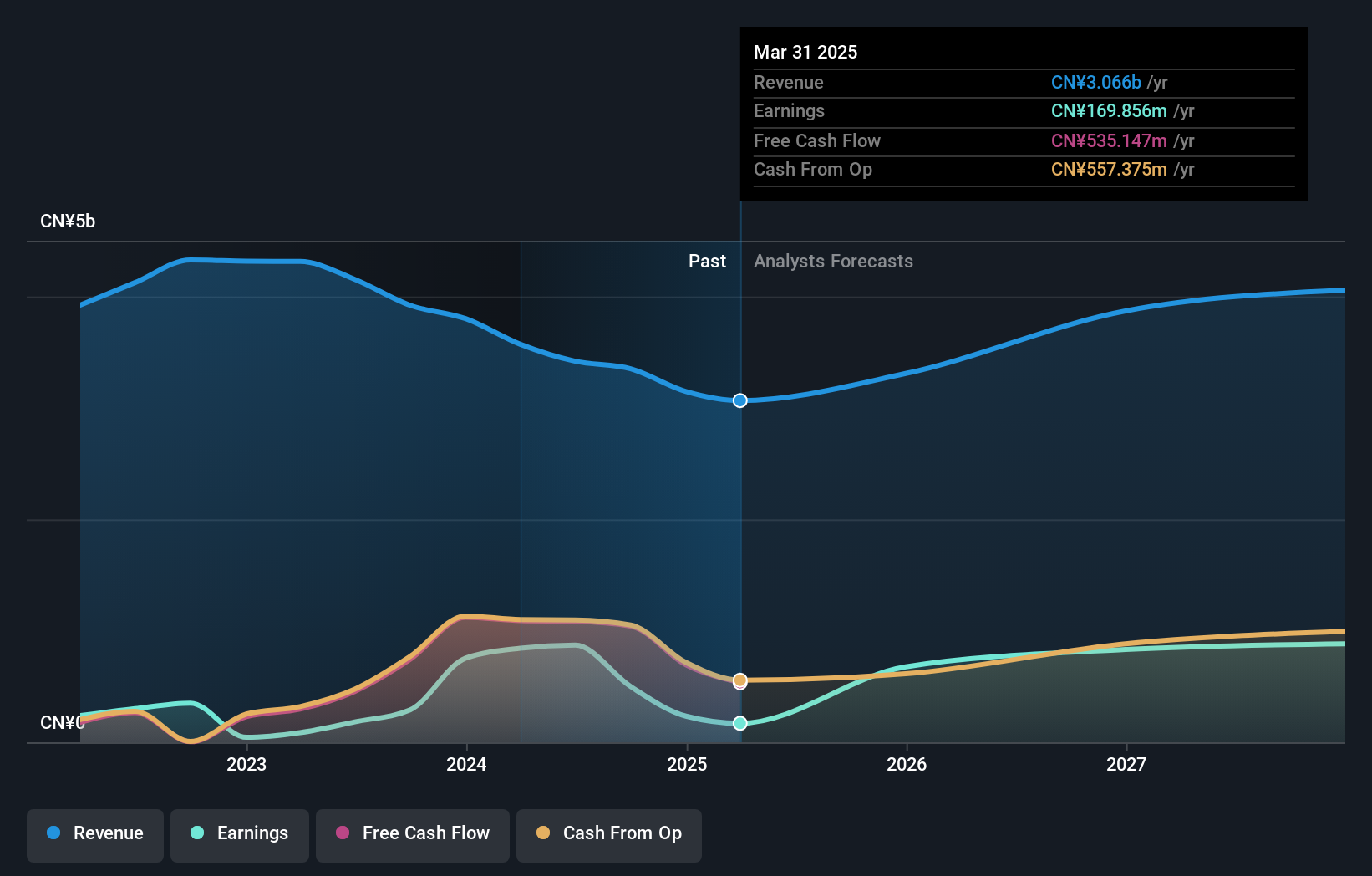

Advanced Fiber Resources (Zhuhai) has demonstrated robust growth, with revenue soaring to CNY 738.95 million from CNY 524.07 million year-over-year, a clear indicator of its expanding market presence. This surge is supported by a significant 42.1% forecast in annual earnings growth, positioning it strongly against the industry average. The firm's strategic focus on R&D is evident from its allocation of funds to this area, which has been instrumental in driving innovation and technological advancements within the sector. Moreover, recent private placements and shareholder meetings suggest proactive governance and potential for future expansions, underpinning its strategic initiatives to maintain competitive advantage in high-tech industries.

Where To Now?

- Unlock our comprehensive list of 1285 High Growth Tech and AI Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300620

Advanced Fiber Resources (Zhuhai)

Designs and manufactures passive optical components in China and internationally.