China Shengmu Organic Milk Leads Our Global Penny Stock Spotlight

Reviewed by Simply Wall St

Global markets have recently shown resilience, with U.S. stock indexes closing higher amid expectations of a potential rate cut by the Federal Reserve and a strong performance from small-cap stocks. For investors interested in exploring beyond established market leaders, penny stocks—often representing smaller or emerging companies—remain an intriguing area for potential investment. Despite the term's outdated connotations, these stocks can offer surprising value when backed by solid financials, presenting opportunities for those looking to uncover hidden gems in today's market landscape.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.53 | HK$946.34M | ✅ 4 ⚠️ 1 View Analysis > |

| IVE Group (ASX:IGL) | A$2.86 | A$433.41M | ✅ 4 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.43 | HK$2.02B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €232.45M | ✅ 3 ⚠️ 3 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.11 | SGD449.87M | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.28 | SGD12.91B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.645 | $374.96M | ✅ 4 ⚠️ 2 View Analysis > |

| RGB International Bhd (KLSE:RGB) | MYR0.20 | MYR308.17M | ✅ 4 ⚠️ 3 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.91 | NZ$252.29M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 3,565 stocks from our Global Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

China Shengmu Organic Milk (SEHK:1432)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: China Shengmu Organic Milk Limited is an investment holding company involved in the production and distribution of raw milk and dairy products in the People’s Republic of China, with a market cap of HK$2.84 billion.

Operations: The company's revenue is primarily derived from its Dairy Farming Business, which generated CN¥3.08 billion.

Market Cap: HK$2.84B

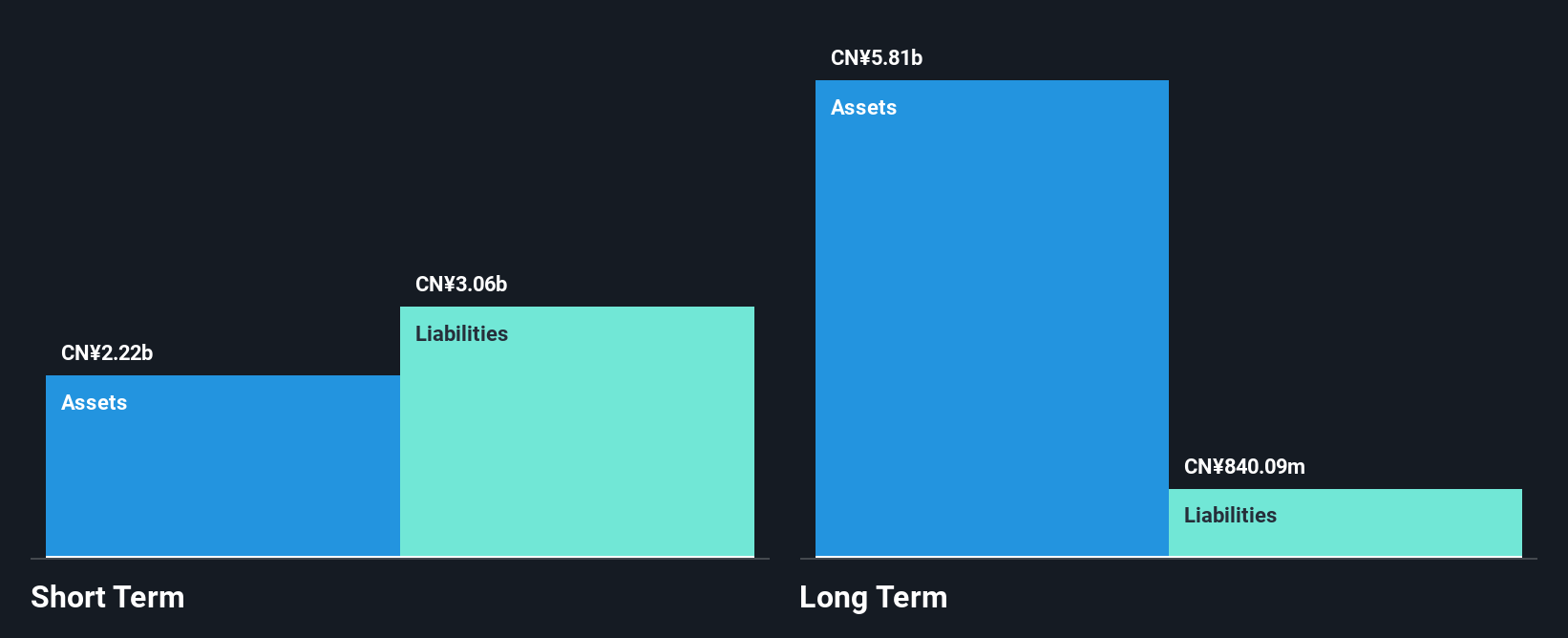

China Shengmu Organic Milk Limited is navigating a pivotal phase, marked by a proposed acquisition by China Modern Dairy Holdings Ltd. for HK$2 billion. This move could consolidate its position in the dairy sector, although the offer's success depends on achieving over 50% voting rights. Financially, the company has shown improvement with its debt levels well-covered by operating cash flow and interest payments comfortably managed by EBIT. However, challenges persist as short-term liabilities exceed assets and recent earnings have been impacted by significant one-off losses. The board's recent changes bring experienced leadership to guide future strategies.

- Jump into the full analysis health report here for a deeper understanding of China Shengmu Organic Milk.

- Gain insights into China Shengmu Organic Milk's historical outcomes by reviewing our past performance report.

AIM Vaccine (SEHK:6660)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: AIM Vaccine Co., Ltd. focuses on the research, development, manufacture, and sale of human-use vaccines in China with a market cap of approximately HK$4.16 billion.

Operations: The company generates revenue primarily from the sale of vaccines and research and development services, amounting to CN¥1.26 billion.

Market Cap: HK$4.16B

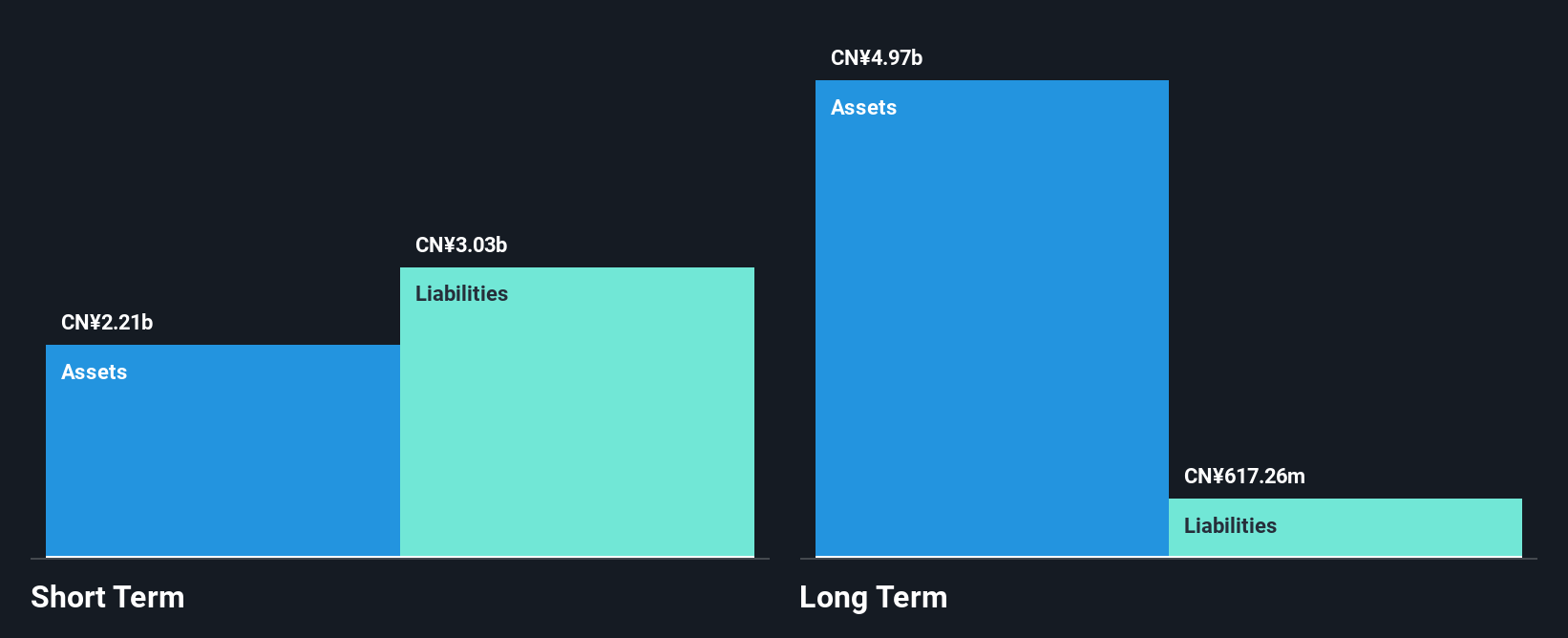

AIM Vaccine Co., Ltd. is currently unprofitable, with losses increasing at a rate of 18.5% per year over the past five years. Despite this, the company's revenue from vaccine sales and R&D services stands at CN¥1.26 billion, indicating potential growth avenues in China's biotech sector. The company has a solid cash runway exceeding three years based on current free cash flow, although short-term liabilities surpass its assets by CN¥800 million. Management and board experience are strengths, with average tenures of 4.8 and 5.5 years respectively, providing stability as AIM Vaccine navigates its financial challenges and growth prospects.

- Unlock comprehensive insights into our analysis of AIM Vaccine stock in this financial health report.

- Assess AIM Vaccine's future earnings estimates with our detailed growth reports.

Hangzhou Century (SZSE:300078)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hangzhou Century Co., Ltd. offers electronic article surveillance and radio frequency identification system solutions both in China and internationally, with a market cap of CN¥5.30 billion.

Operations: No revenue segments have been reported for this company.

Market Cap: CN¥5.3B

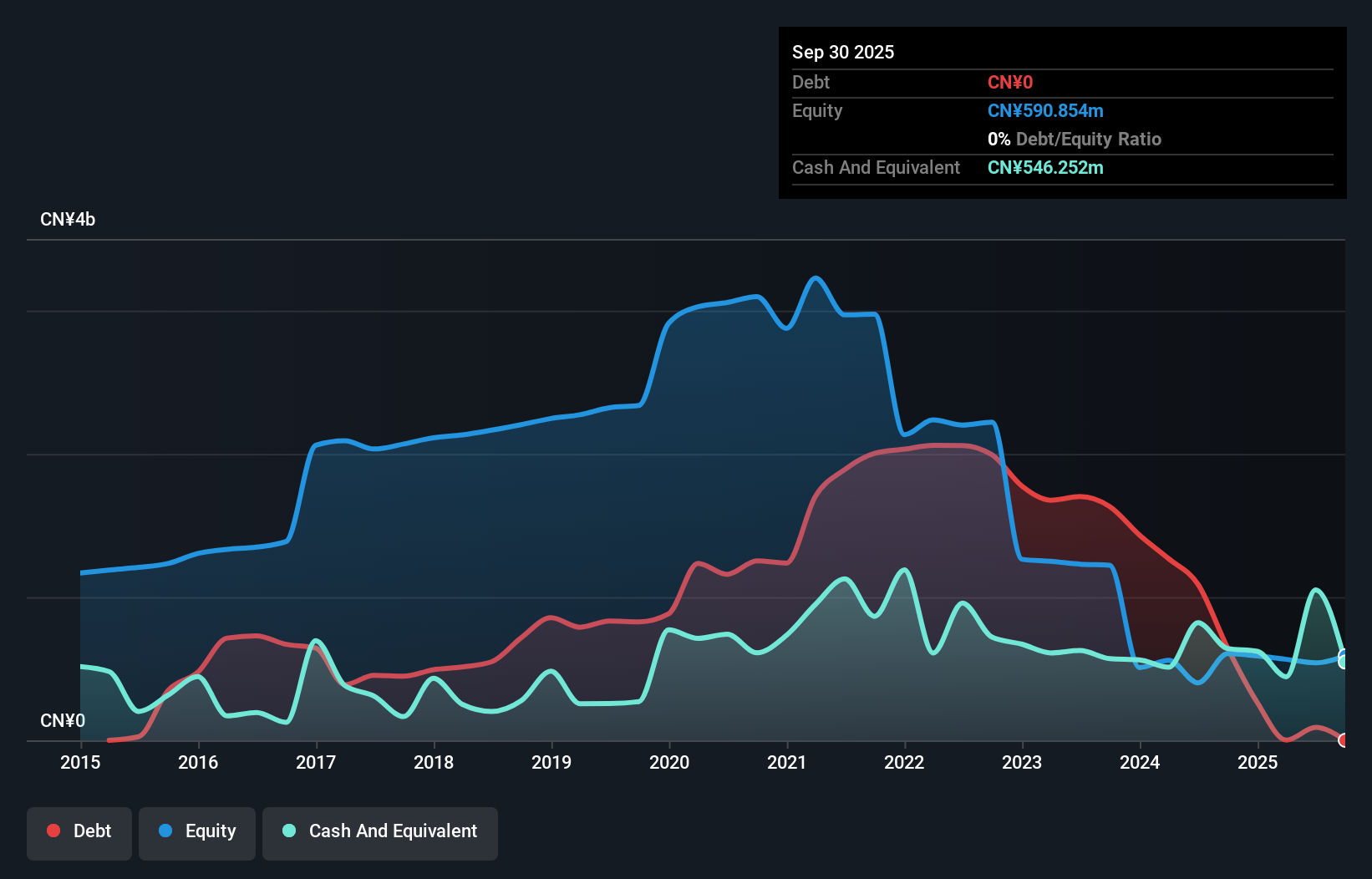

Hangzhou Century Co., Ltd. has reported a net loss of CN¥4.76 million for the nine months ending September 2025, significantly reduced from a CN¥283.64 million loss the previous year, while sales increased to CN¥603.82 million from CN¥564.56 million. The company remains debt-free and maintains sufficient cash runway for over three years based on its current free cash flow, highlighting financial resilience despite ongoing unprofitability and high share price volatility. Recent amendments to its articles of association indicate potential strategic shifts as it seeks to stabilize and grow within the electronic surveillance sector amidst management changes with an inexperienced team in place.

- Click here and access our complete financial health analysis report to understand the dynamics of Hangzhou Century.

- Evaluate Hangzhou Century's historical performance by accessing our past performance report.

Seize The Opportunity

- Discover the full array of 3,565 Global Penny Stocks right here.

- Interested In Other Possibilities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1432

China Shengmu Organic Milk

An investment holding company, engages in the production and distribution of raw milk and dairy products in the People’s Republic of China.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026