Stock Analysis

- China

- /

- Electronic Equipment and Components

- /

- SZSE:002990

Exploring Three High Growth Tech Stocks For Potential Portfolio Enhancement

Reviewed by Simply Wall St

In a week marked by busy earnings reports and mixed economic signals, global markets saw major indices like the Nasdaq Composite and S&P MidCap 400 reach record highs before retreating, with small-cap stocks showing resilience compared to their larger counterparts. Amidst this backdrop of fluctuating market dynamics and cautious investor sentiment, identifying high growth tech stocks that demonstrate robust fundamentals and potential for portfolio enhancement becomes increasingly crucial.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.41% | 70.53% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1282 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Maxvision Technology (SZSE:002990)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Maxvision Technology Corp. focuses on the research of artificial intelligence, big data, and internet of things solutions, with a market capitalization of CN¥5.88 billion.

Operations: Maxvision Technology Corp. specializes in developing solutions in artificial intelligence, big data, and the internet of things.

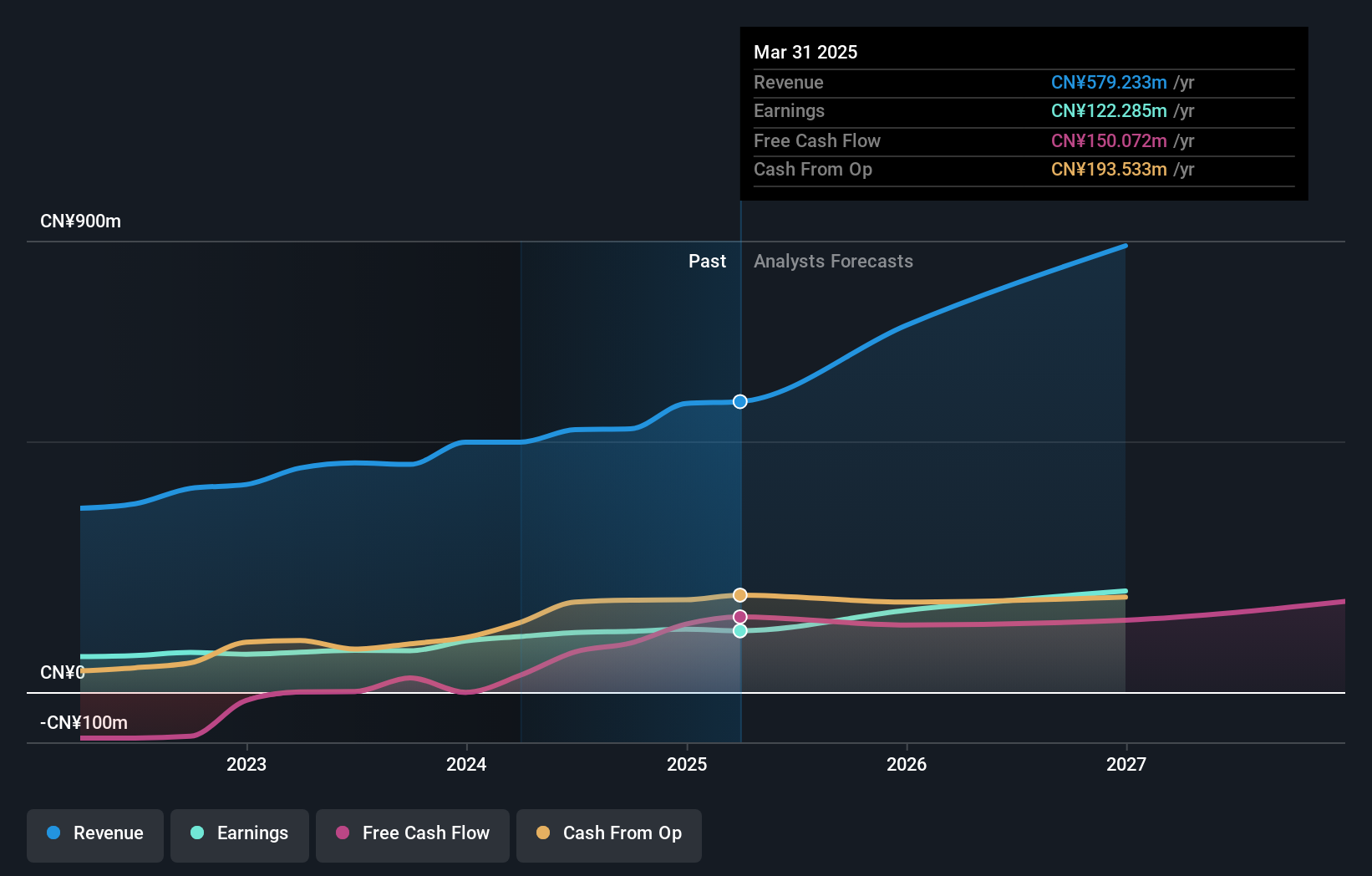

Maxvision Technology, amid a challenging fiscal year with sales dropping to CNY 912.16 million from CNY 1,143.98 million and net income falling to CNY 110.05 million from CNY 169.91 million, still shows promising growth prospects. The company's revenue is expected to increase by an impressive 31.9% annually, outpacing the Chinese market's average of 14%. Furthermore, earnings are projected to surge by 42.2% each year, significantly above the market forecast of 26.1%. Despite recent setbacks reflected in their financial results for the nine months ended September 2024 and a dip in earnings per share from CNY0.66 to CNY0.43, Maxvision is positioned for robust future growth given its higher-than-market forecasted revenue and earnings expansions.

- Click here to discover the nuances of Maxvision Technology with our detailed analytical health report.

Evaluate Maxvision Technology's historical performance by accessing our past performance report.

Beijing ConST Instruments Technology (SZSE:300445)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing ConST Instruments Technology Inc. operates in the field of precision instruments and technology with a market capitalization of CN¥3.52 billion.

Operations: Beijing ConST Instruments Technology focuses on precision instruments and technology. The company generates revenue through various segments, though specific financial details are not provided in the available information.

Beijing ConST Instruments Technology, amidst a competitive tech landscape, has demonstrated robust financial growth with a 24.1% increase in annual revenue, outstripping the broader Chinese market's average of 14%. This surge is complemented by an impressive earnings growth of 26.9% per year, signaling strong operational efficiency and market adaptation. The company's commitment to innovation is evident from its R&D spending trends which are strategically aligned to fuel future technologies and solutions, ensuring sustained growth in a rapidly evolving industry sector.

- Take a closer look at Beijing ConST Instruments Technology's potential here in our health report.

Learn about Beijing ConST Instruments Technology's historical performance.

Shenzhen Vital New Material (SZSE:301319)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Vital New Material Co., Ltd. focuses on the research, development, production, sale, and service of electronic soldering materials both in China and internationally with a market cap of CN¥2.69 billion.

Operations: Vital New Material primarily generates revenue from the computer, communications, and other electronic equipment manufacturing segment, totaling CN¥1.11 billion.

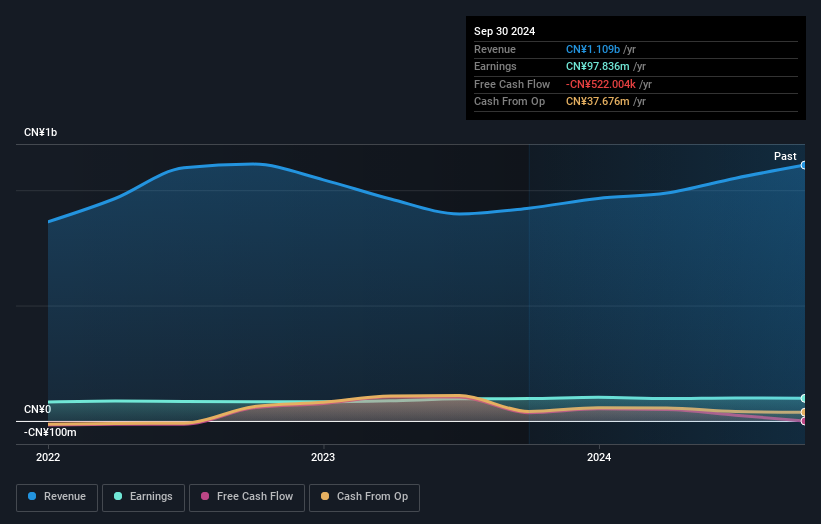

Shenzhen Vital New Material has marked a notable trajectory in the tech sector, with its revenue surging by 20.3% year-over-year to CNY 855.23 million in the first nine months of 2024, underscoring its robust market presence and demand for its innovative materials. This growth is supported by a strategic emphasis on R&D, where expenses have been meticulously aligned to foster advancements in new material technologies—an investment that is crucial for maintaining competitive edge and driving future growth. Despite a slight dip in net income from CNY 77.39 million to CNY 73.07 million over the same period, the company's aggressive growth strategy and earnings forecast of an impressive 28.3% per year suggest strong future potential in high-tech industries reliant on cutting-edge materials.

Make It Happen

- Access the full spectrum of 1282 High Growth Tech and AI Stocks by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002990

Maxvision Technology

Engages in the research of artificial intelligence, big data, internet of things, and other information technology solutions.