- China

- /

- Communications

- /

- SZSE:002935

High Growth Tech Stocks in Asia with Promising Potential

Reviewed by Simply Wall St

As global markets experience fluctuations, with small-cap stocks showing notable resilience and technology sectors rebounding, the Asian tech landscape presents intriguing opportunities for investors. In this context, identifying promising high-growth tech stocks involves assessing their potential to leverage current technological trends and market dynamics effectively.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 33.47% | 39.54% | ★★★★★★ |

| Suzhou TFC Optical Communication | 34.90% | 35.72% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Fositek | 37.50% | 49.56% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Knowmerce | 42.51% | 33.23% | ★★★★★★ |

| Gold Circuit Electronics | 28.44% | 34.07% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

We'll examine a selection from our screener results.

Shenzhen Kinwong Electronic (SHSE:603228)

Simply Wall St Growth Rating: ★★★★★☆

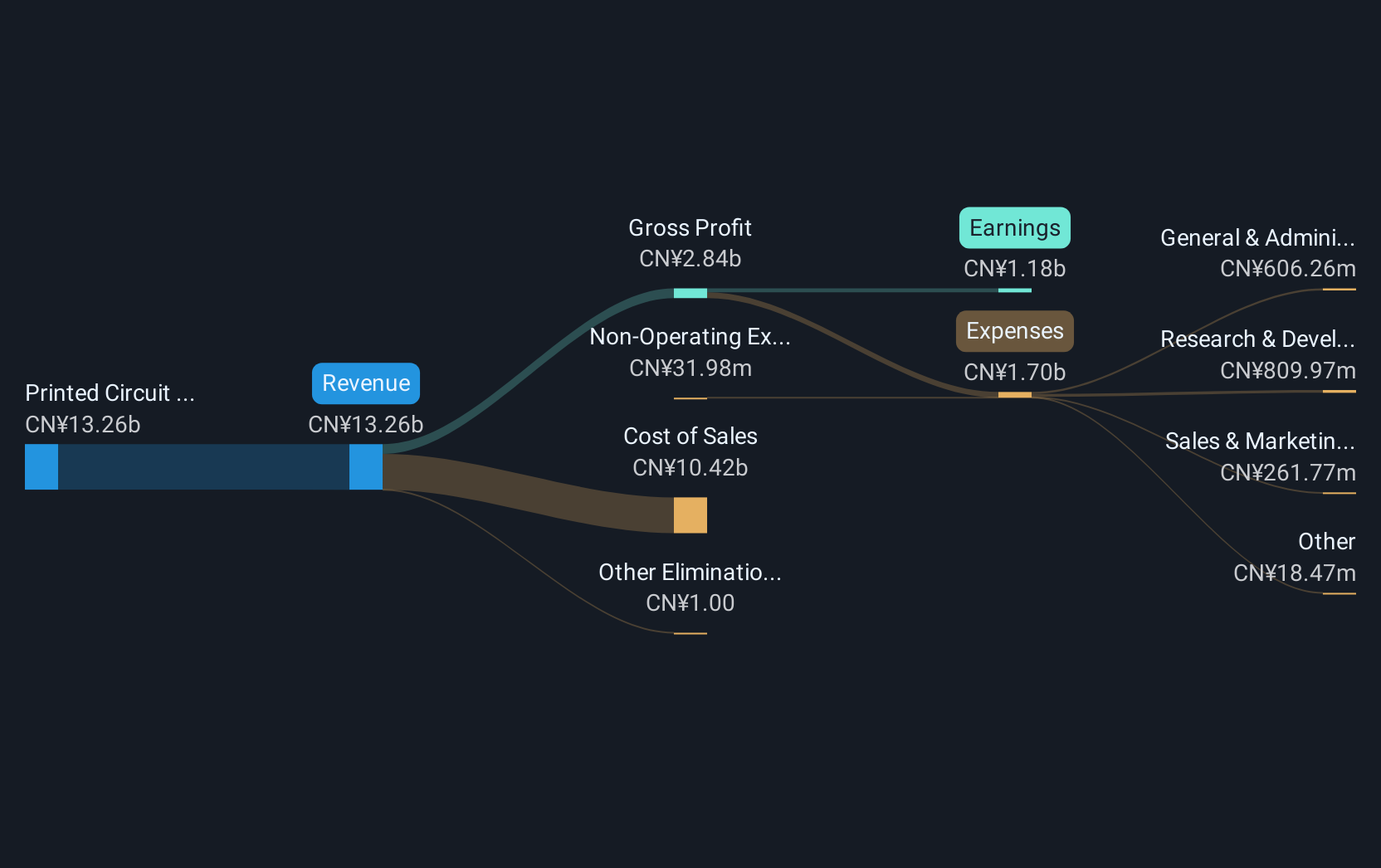

Overview: Shenzhen Kinwong Electronic Co., Ltd. focuses on the research, development, production, and sale of printed circuit boards and electronic materials both in China and internationally, with a market cap of approximately CN¥64.43 billion.

Operations: Kinwong generates revenue primarily through its printed circuit board segment, which accounted for approximately CN¥14.66 billion. The company's focus on PCBs and electronic materials supports its operations both domestically and internationally.

Shenzhen Kinwong Electronic has demonstrated robust financial performance, with a notable 20% annual revenue growth outpacing the Chinese market average of 14.6%. This growth is complemented by an impressive forecast of earnings increasing by 32.1% annually, significantly above the market projection of 27.7%. Despite a highly volatile share price in recent months, the company's commitment to R&D is evident from its substantial investment in innovation, which could be pivotal for sustaining long-term growth in the competitive electronics sector. Recent earnings reports highlight a steady increase in sales and net income, reinforcing Kinwong's potential to leverage its market position and technical expertise for future expansion.

Chengdu Spaceon Electronics (SZSE:002935)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chengdu Spaceon Electronics Co., Ltd. specializes in the research, design, production, and sale of time-frequency and satellite application products both in China and internationally, with a market cap of CN¥7.69 billion.

Operations: Spaceon Electronics generates revenue primarily from its Computer, Communications, and Other Electronic Equipment Manufacturing segment, amounting to CN¥923.28 million.

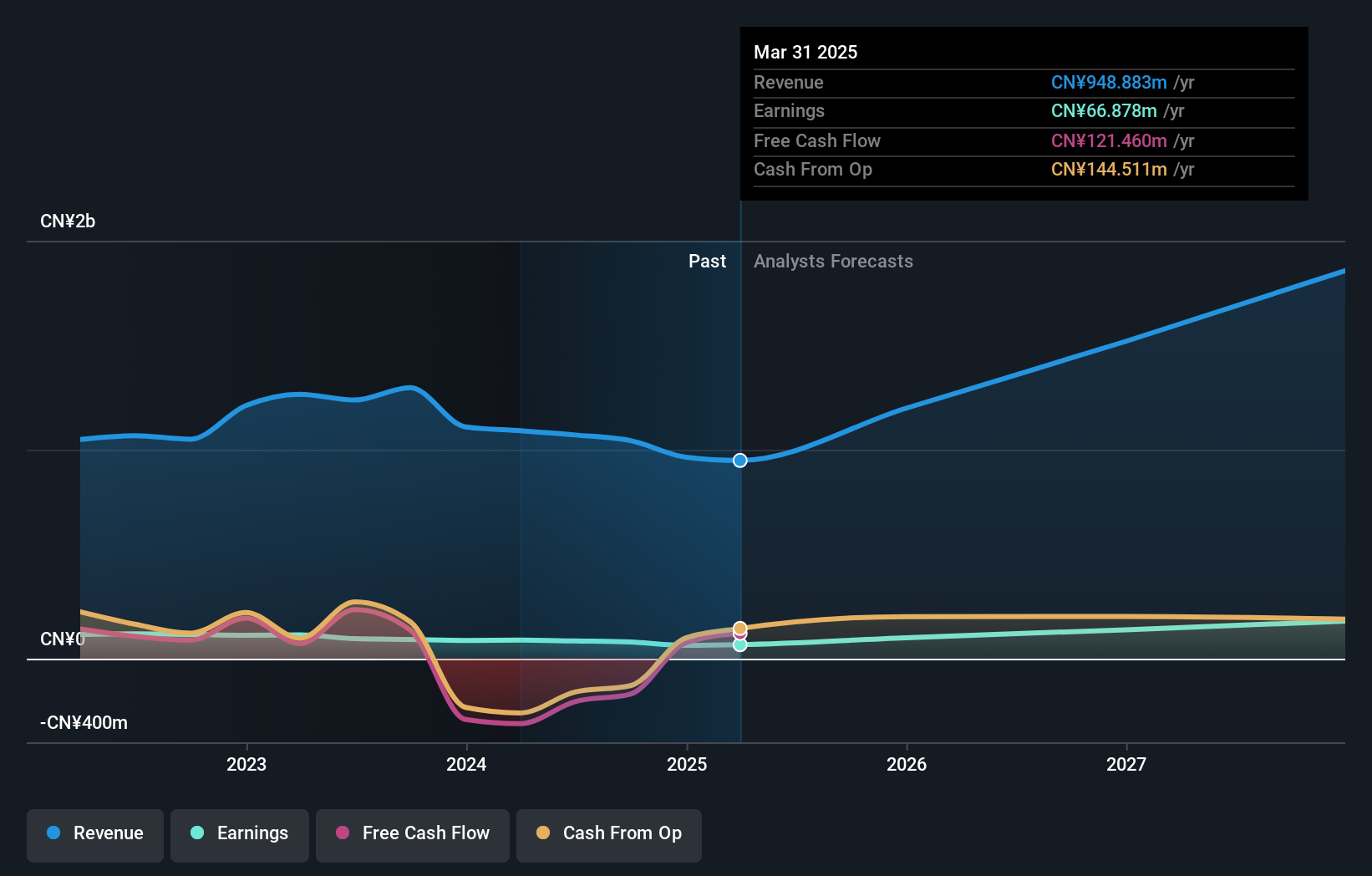

Chengdu Spaceon Electronics, amidst a challenging fiscal period with a slight decline in revenue to CNY 535.81 million from CNY 576.91 million year-over-year, still manages to project substantial growth potential. The company's earnings are expected to surge by an impressive 39.6% annually, outpacing the broader Chinese market's forecast of 27.7%. This growth trajectory is underpinned by strategic R&D investments, which not only reflect the firm’s commitment to innovation but also position it well within Asia’s competitive tech landscape. Despite recent fluctuations in net income and earnings per share, Chengdu Spaceon's focus on leveraging technological advances and maintaining robust earnings growth highlights its resilience and forward-looking approach in a rapidly evolving industry.

Hangzhou DPtech TechnologiesLtd (SZSE:300768)

Simply Wall St Growth Rating: ★★★★☆☆

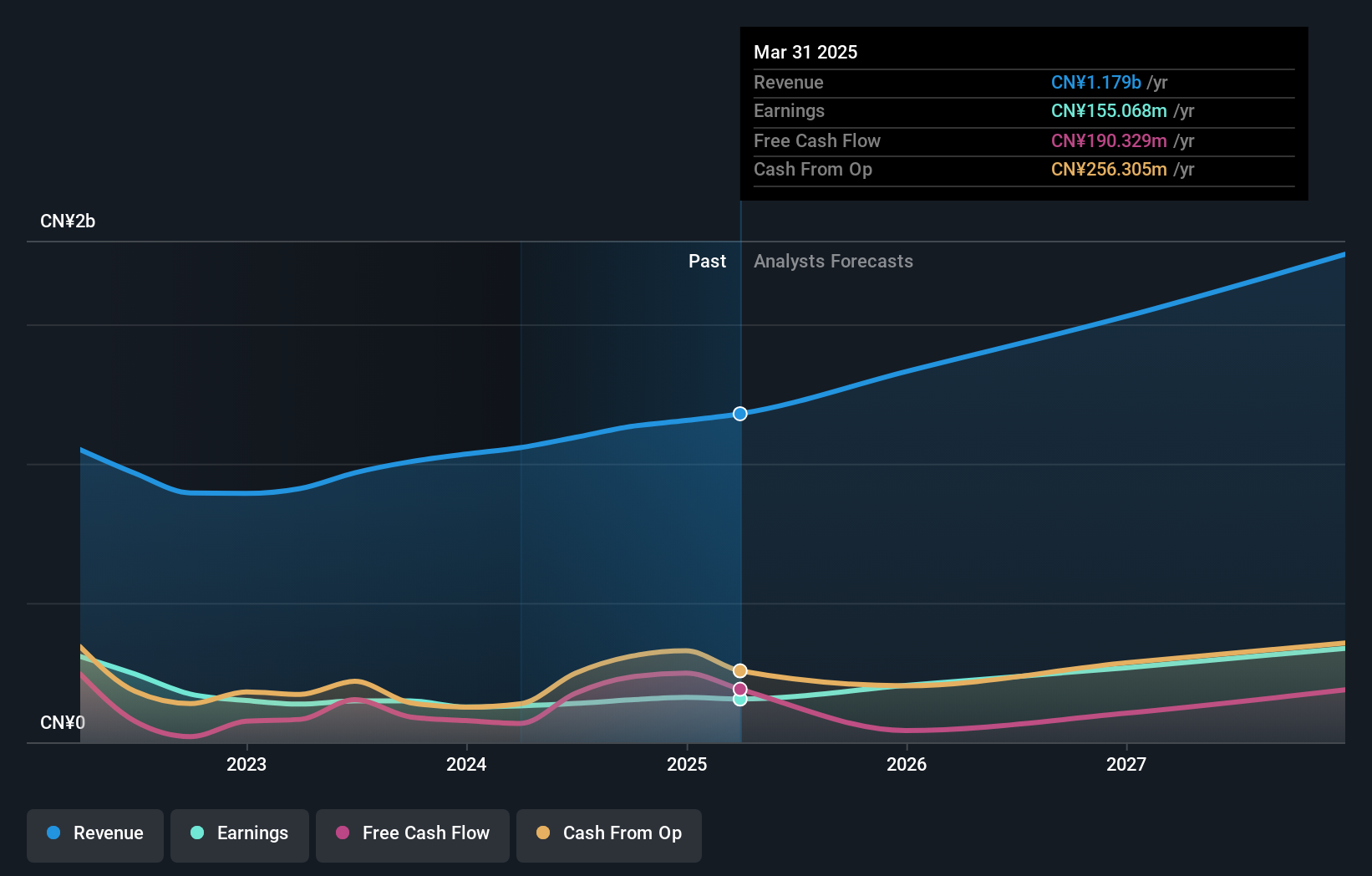

Overview: Hangzhou DPtech Technologies Co., Ltd., along with its subsidiary, operates in the network security sector across China, Hong Kong, and internationally, with a market capitalization of approximately CN¥12.45 billion.

Operations: DPtech Technologies focuses on network security solutions, offering products and services across China, Hong Kong, and international markets. The company operates with a market capitalization of around CN¥12.45 billion, emphasizing its presence in the cybersecurity industry.

Hangzhou DPtech Technologies Ltd., amid a competitive tech landscape, reported a notable increase in revenue to CNY 870.72 million from CNY 819.3 million year-over-year, reflecting a growth of approximately 6.3%. This performance is bolstered by an earnings forecast projecting an annual increase of 30.3%, significantly outpacing the broader Chinese market's expectation of 27.7%. The company's commitment to innovation is evident from its strategic R&D investments, positioning it well for future growth within Asia’s high-tech sector despite the highly volatile share price observed over the past three months.

- Delve into the full analysis health report here for a deeper understanding of Hangzhou DPtech TechnologiesLtd.

Understand Hangzhou DPtech TechnologiesLtd's track record by examining our Past report.

Key Takeaways

- Investigate our full lineup of 187 Asian High Growth Tech and AI Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002935

Chengdu Spaceon Electronics

Engages in the research and development, design, production, and sale of time-frequency and satellite application products in China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026