High Growth Tech And 2 Other Promising Stocks with Potential Expansion

Reviewed by Simply Wall St

In the current global market landscape, major indexes have experienced volatility, with U.S. stocks facing declines due to geopolitical tensions and concerns over consumer spending, while European markets show cautious optimism amid trade policy developments. As investors navigate these uncertain times, identifying high growth tech stocks and other promising opportunities requires a keen understanding of how companies can leverage innovation and market trends to drive potential expansion despite broader economic challenges.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Travere Therapeutics | 28.44% | 65.05% | ★★★★★★ |

| Pharma Mar | 23.77% | 45.40% | ★★★★★★ |

| AVITA Medical | 27.78% | 55.33% | ★★★★★★ |

| TG Therapeutics | 29.48% | 45.20% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.67% | 58.73% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

Click here to see the full list of 1186 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Servyou Software Group (SHSE:603171)

Simply Wall St Growth Rating: ★★★★★☆

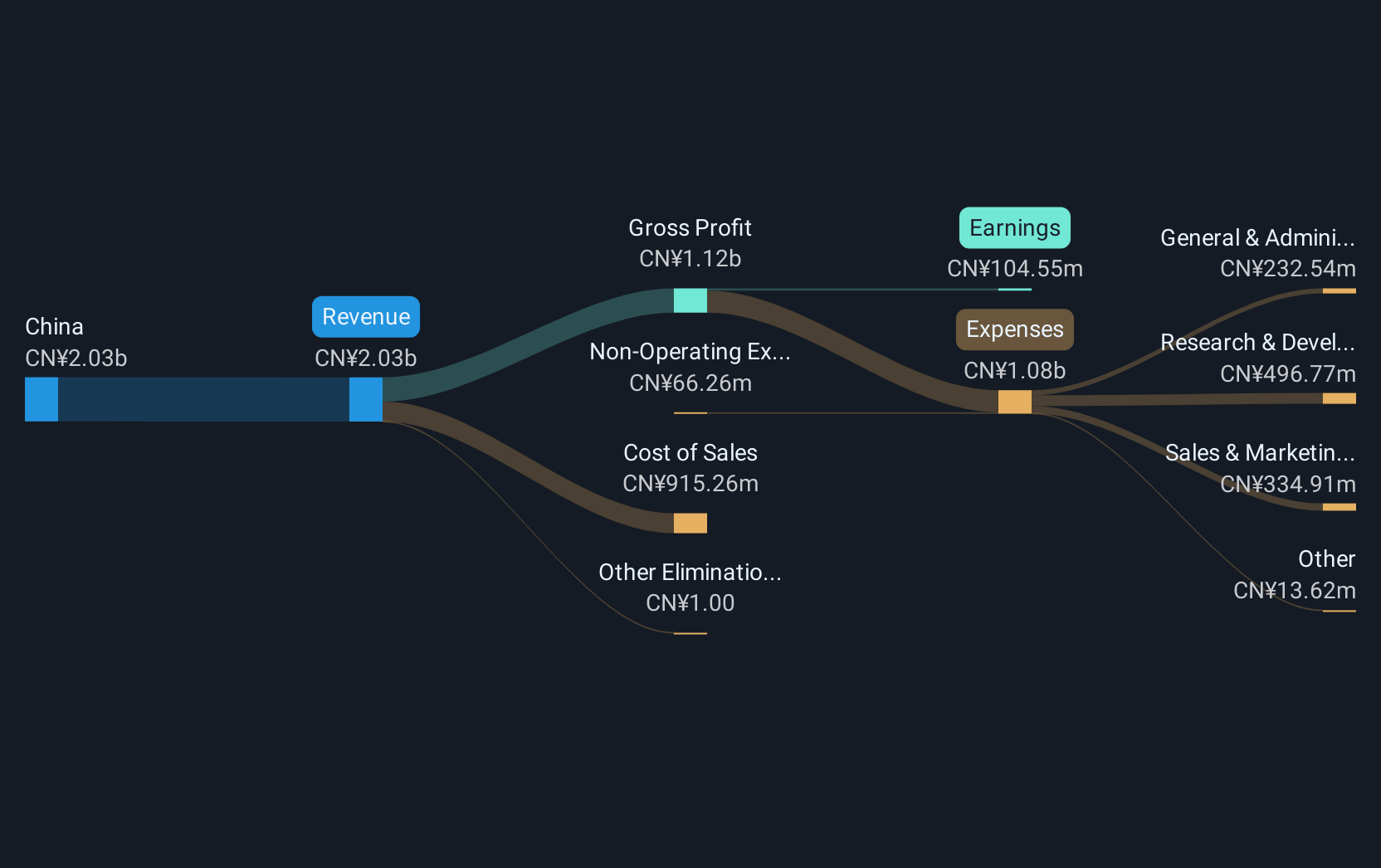

Overview: Servyou Software Group Co., Ltd., along with its subsidiaries, offers financial and tax information services in China with a market cap of CN¥17.84 billion.

Operations: Servyou Software Group Co., Ltd. operates in the financial and tax information services sector in China. The company generates revenue primarily through its comprehensive suite of software solutions designed to assist businesses with financial management and tax compliance.

Servyou Software Group's trajectory in the tech landscape is marked by a robust annual revenue growth rate of 20.8%, outpacing the broader Chinese market's 13.4% expansion. Despite a challenging year with earnings contraction of 38.5%, contrasted against an industry average decline of 10.9%, future forecasts are more promising with anticipated earnings growth at an impressive rate of 57.5% annually, significantly above the market forecast of 25.4%. This growth is underpinned by Servyou’s strategic focus on innovation and adapting to market demands, which could potentially recalibrate its current profit margins from a lower 5% back towards more competitive levels, leveraging its strong R&D commitments and quality earnings to solidify its standing in the software sector.

- Click here to discover the nuances of Servyou Software Group with our detailed analytical health report.

Gain insights into Servyou Software Group's past trends and performance with our Past report.

EmbedWay Technologies (Shanghai) (SHSE:603496)

Simply Wall St Growth Rating: ★★★★☆☆

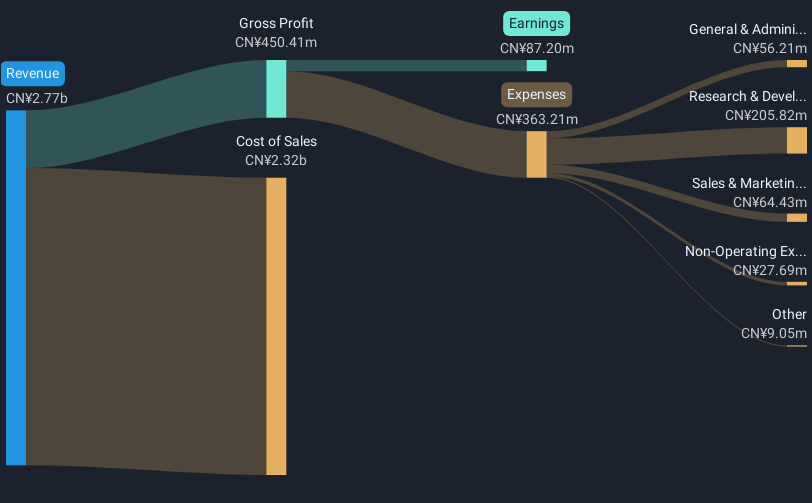

Overview: EmbedWay Technologies (Shanghai) Corporation operates as a network visibility infrastructure and intelligent system platform vendor in China with a market cap of approximately CN¥9.17 billion.

Operations: The company generates revenue primarily from the Computer, Communication, and Other Electronic Equipment Manufacturing segment, totaling approximately CN¥1.15 billion.

EmbedWay Technologies (Shanghai) showcases a dynamic growth trajectory in the tech sector, with an annual revenue increase of 18.3% and earnings surging by 33.9%. This performance is significantly bolstered by its R&D investments, which are robustly aligned with revenue generation, as evidenced by their recent expenditure figures showing a strategic allocation of resources towards innovation. With earnings growth outpacing the broader market's average and a strong focus on cutting-edge technology development, EmbedWay stands poised to capitalize on emerging opportunities within the tech landscape, particularly in areas where technological advancements are critical for competitive advantage.

- Dive into the specifics of EmbedWay Technologies (Shanghai) here with our thorough health report.

Learn about EmbedWay Technologies (Shanghai)'s historical performance.

MeiG Smart Technology (SZSE:002881)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MeiG Smart Technology Co., Ltd. focuses on the research, development, production, and sale of Internet of Things terminals and wireless communication modules and solutions both in China and internationally, with a market cap of CN¥14.61 billion.

Operations: The company specializes in developing and manufacturing Internet of Things (IoT) terminals and wireless communication modules, catering to both domestic and international markets. With a market capitalization of CN¥14.61 billion, it leverages its technological expertise to deliver innovative solutions in the IoT sector.

Amidst a volatile market, MeiG Smart Technology has demonstrated robust growth metrics, with an 18.3% increase in annual revenue and a remarkable 39.3% surge in earnings per year, outpacing the Communications industry's average. The company's commitment to innovation is evident from its R&D spending trends which have been strategically aligned with its revenue streams, ensuring sustained advancements in technology. Recent share repurchases totaling CNY 10 million underscore confidence in future growth potential, further solidifying its position within the tech sector. This strategic focus on high-impact areas of technology not only enhances MeiG's competitive edge but also positions it well for continued expansion in emerging technological domains.

- Take a closer look at MeiG Smart Technology's potential here in our health report.

Evaluate MeiG Smart Technology's historical performance by accessing our past performance report.

Seize The Opportunity

- Gain an insight into the universe of 1186 High Growth Tech and AI Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603171

Servyou Software Group

Provides financial and tax information services in China.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives