- China

- /

- Electronic Equipment and Components

- /

- SZSE:002456

OFILM Group's (SZSE:002456) investors will be pleased with their notable 58% return over the last year

OFILM Group Co., Ltd. (SZSE:002456) shareholders might be concerned after seeing the share price drop 26% in the last month. While that might be a setback, it doesn't negate the nice returns received over the last twelve months. To wit, it had solidly beat the market, up 58%.

So let's assess the underlying fundamentals over the last 1 year and see if they've moved in lock-step with shareholder returns.

See our latest analysis for OFILM Group

While OFILM Group made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

OFILM Group grew its revenue by 38% last year. That's a fairly respectable growth rate. While the share price performed well, gaining 58% over twelve months, you could argue the revenue growth warranted it. If the company can maintain the revenue growth, the share price could go higher still. But it's crucial to check profitability and cash flow before forming a view on the future.

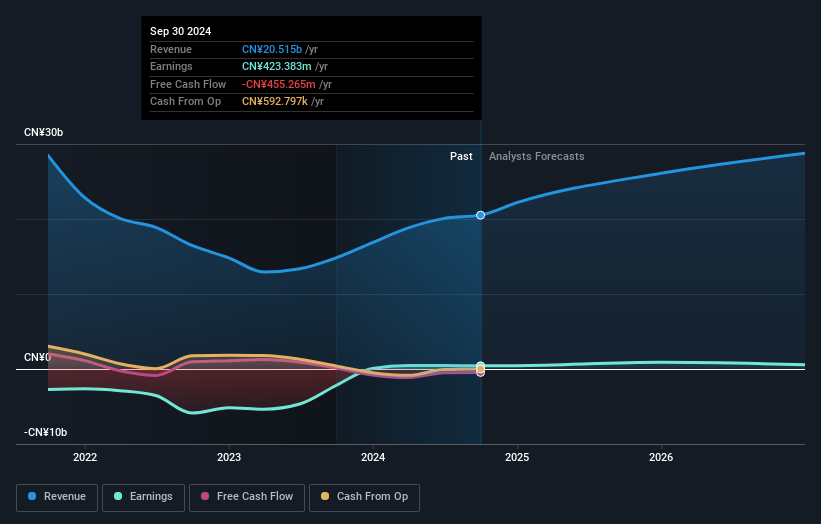

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. You can see what analysts are predicting for OFILM Group in this interactive graph of future profit estimates.

A Different Perspective

It's good to see that OFILM Group has rewarded shareholders with a total shareholder return of 58% in the last twelve months. Notably the five-year annualised TSR loss of 3% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that OFILM Group is showing 3 warning signs in our investment analysis , and 1 of those shouldn't be ignored...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002456

OFILM Group

Manufactures and sells optic and optoelectronic products in China and internationally.

Moderate growth potential low.