- China

- /

- Communications

- /

- SZSE:002296

Unveiling None And 2 Other Hidden Small Cap Gems With Solid Foundations

Reviewed by Simply Wall St

In a week marked by geopolitical tensions and consumer spending concerns, major U.S. indices like the S&P 500 and Russell 2000 experienced declines, reflecting broader market sentiment that has been cautious amid economic uncertainties. Despite these challenges, small-cap stocks can present unique opportunities for investors seeking growth potential in companies with solid foundations and resilience to navigate turbulent times.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Quemchi | 0.66% | 82.67% | 21.69% | ★★★★★★ |

| Zambia Sugar | 1.04% | 20.60% | 44.34% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Minsud Resources | NA | nan | -29.01% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Sociedad Matriz SAAM | 38.79% | -0.59% | -19.23% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Sonaecom SGPS (ENXTLS:SNC)

Simply Wall St Value Rating: ★★★★★★

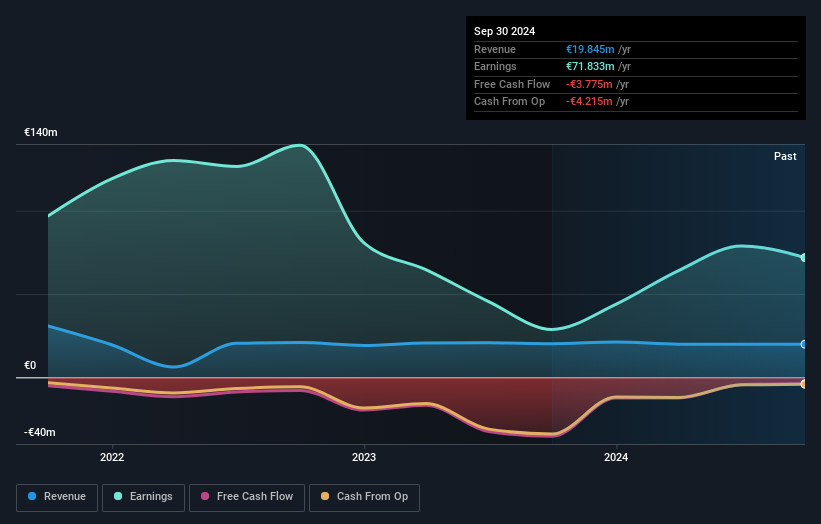

Overview: Sonaecom SGPS operates globally in the technology, media, and telecommunications sectors with a market capitalization of approximately €739.96 million.

Operations: Sonaecom SGPS generates revenue primarily from its media segment (€16.38 million) and technology segment (€3.02 million), with additional contributions from holding activities (€0.74 million).

Sonaecom SGPS, a smaller player in the telecom sector, has shown impressive growth with earnings surging by 150% over the past year, outpacing the industry average of 3%. Despite sales and revenue dipping to €4.75 million and €13.68 million respectively for nine months ending September 2024 compared to the previous year, net income climbed significantly to €61.67 million from €33.63 million. The company benefits from being debt-free now versus a debt-to-equity ratio of 0.7 five years ago, though its financial results were impacted by a one-off loss of €19.3 million recently.

- Dive into the specifics of Sonaecom SGPS here with our thorough health report.

Assess Sonaecom SGPS' past performance with our detailed historical performance reports.

Hong Leong Asia (SGX:H22)

Simply Wall St Value Rating: ★★★★★☆

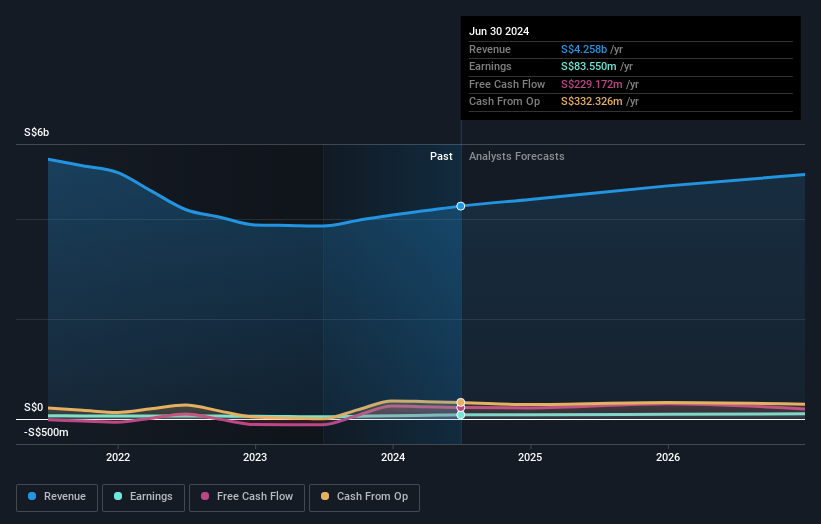

Overview: Hong Leong Asia Ltd. is an investment holding company that manufactures and distributes powertrain solutions, building materials, and rigid packaging products across China, Singapore, Malaysia, and internationally with a market capitalization of approximately SGD763.04 million.

Operations: Hong Leong Asia generates significant revenue from powertrain solutions, contributing SGD3.57 billion, and building materials at SGD665.81 million. The company's financial performance is influenced by the gross profit margin trend over recent periods.

Hong Leong Asia, a smaller player in its industry, has shown impressive financial performance with earnings growth of 94.4% over the past year, significantly outpacing the Machinery industry's -6.3%. Trading at 46.2% below its estimated fair value, it presents an attractive proposition for those seeking undervalued opportunities. The company boasts high-quality earnings and maintains a debt-to-equity ratio that has slightly increased from 37.4% to 38.1% over five years, yet remains manageable as interest payments are well covered by EBIT at a multiple of 3.4x. Recent board changes include appointing Ng Chee Khern as an Independent Non-Executive Director to strengthen governance and sustainability efforts.

HeNan Splendor Science & Technology (SZSE:002296)

Simply Wall St Value Rating: ★★★★★★

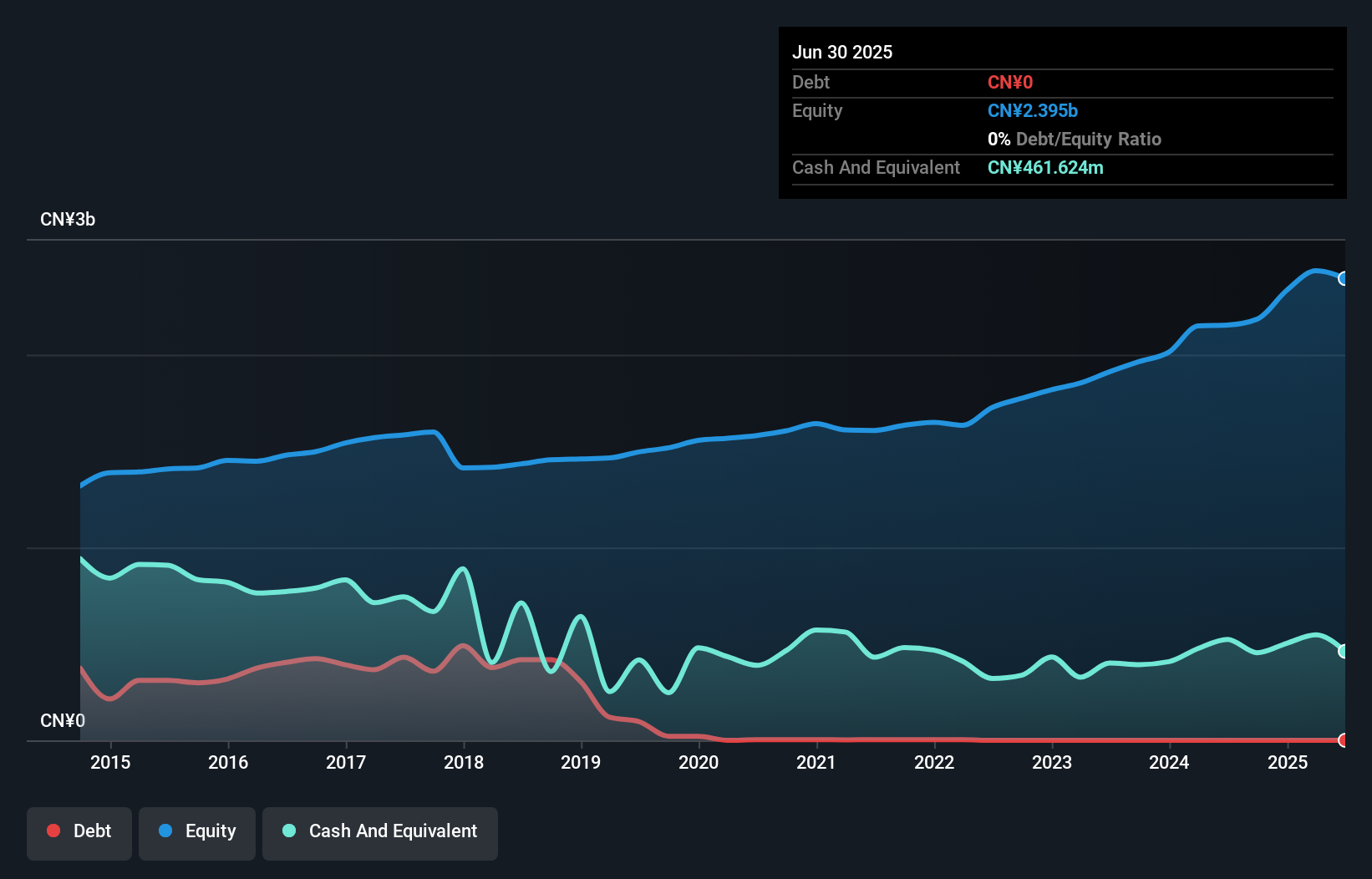

Overview: HeNan Splendor Science & Technology Co., Ltd. operates in the technology sector, focusing on scientific and technological advancements, with a market cap of CN¥4.40 billion.

Operations: HeNan Splendor generates revenue primarily from its technological and scientific advancements. The company's cost structure includes expenses related to research, development, and production activities. It has a market cap of CN¥4.40 billion.

HeNan Splendor Science & Technology, a nimble player in the communications field, has shown impressive earnings growth of 65.2% over the past year, outpacing its industry peers who saw a -3% performance. The company stands debt-free today compared to five years ago when it had a debt-to-equity ratio of 1.3%, reflecting prudent financial management. With high-quality earnings and free cash flow positivity, it seems well-positioned for future endeavors. Its price-to-earnings ratio of 23.4x is attractively below the CN market average of 38.1x, suggesting potential value for investors seeking opportunities in emerging markets like China.

Key Takeaways

- Access the full spectrum of 4752 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HeNan Splendor Science & Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002296

HeNan Splendor Science & Technology

HeNan Splendor Science & Technology Co., Ltd.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives