Stock Analysis

High Growth Tech Stocks To Watch In The None Exchange

Reviewed by Simply Wall St

As global markets experience broad-based gains with smaller-cap indexes outperforming large-caps, investors are closely monitoring economic indicators such as the unexpected drop in U.S. initial jobless claims and rising home sales, which have helped drive positive sentiment. In this environment of optimism and macroeconomic focus on potential interest rate cuts by the Federal Reserve, identifying high-growth tech stocks that can capitalize on these conditions becomes crucial for those looking to navigate the dynamic landscape of small-cap investments.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 32.56% | 43.21% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Waystream Holding | 22.16% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 65.73% | 103.55% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1285 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Jonhon Optronic Technology (SZSE:002179)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jonhon Optronic Technology Co., Ltd. focuses on the research and development of optical, electrical, and fluid connection technologies and equipment in China, with a market capitalization of CN¥84.57 billion.

Operations: The company generates revenue primarily through its development of advanced connection technologies, serving sectors such as telecommunications, aerospace, and automotive industries. It leverages its expertise in optical and electrical solutions to cater to a diverse client base.

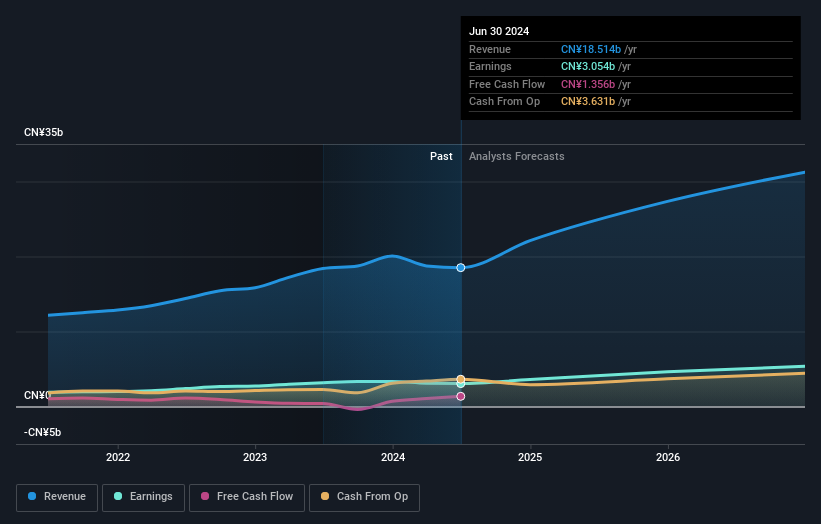

Jonhon Optronic Technology, recently rebranded, is navigating a challenging landscape with its latest financials showing a revenue dip to CNY 14.1 billion from CNY 15.36 billion year-over-year and net income sliding to CNY 2.51 billion. Despite these figures, the firm's commitment to innovation is evident in its R&D strategy, crucial for staying competitive in the high-tech optics sector. Looking ahead, Jonhon's revenue is expected to grow at an impressive rate of 22.2% annually, outpacing the Chinese market projection of 13.8%, signaling potential resilience and adaptability in its market strategies. Moreover, while Jonhon's earnings forecast suggests a slower growth at 24.8% compared to the broader market’s 26.2%, this trajectory still represents significant potential growth within the tech industry’s demanding standards for innovation and development outputs. The company’s recent corporate actions including a name change and special shareholders' meeting underscore strategic shifts possibly aimed at aligning more closely with global market demands and opportunities for expansion in new tech domains.

CASTECH (SZSE:002222)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CASTECH Inc. focuses on the research, development, production, and sale of crystal components, precision optical components, and laser devices mainly in China with a market capitalization of CN¥14.86 billion.

Operations: The company generates revenue primarily from the optoelectronics industry, amounting to CN¥851 million. It is involved in producing and selling crystal components, precision optical components, and laser devices.

CASTECH Inc. has demonstrated a robust growth trajectory, with revenue climbing to CNY 665.11 million from CNY 595.75 million year-over-year, reflecting a notable increase of 11.6%. This performance is underpinned by an aggressive R&D strategy, where the firm invested significantly in innovation—evident from its R&D expenses which are crucial for maintaining competitive edge in the tech sector. Moreover, earnings projections suggest an annual growth rate of 29.5%, outstripping the broader Chinese market's forecast of 26.2%. This indicates not just resilience but also potential leadership in its niche, despite operating in a highly competitive environment where continuous innovation and adaptation are key to sustainability and growth.

iFLYTEKLTD (SZSE:002230)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: iFLYTEK CO., LTD. is a company that provides artificial intelligence (AI) technology services in China, with a market capitalization of CN¥109.66 billion.

Operations: The company focuses on AI technology services in China. Its revenue model is centered around leveraging AI solutions across various sectors, contributing to its significant market presence.

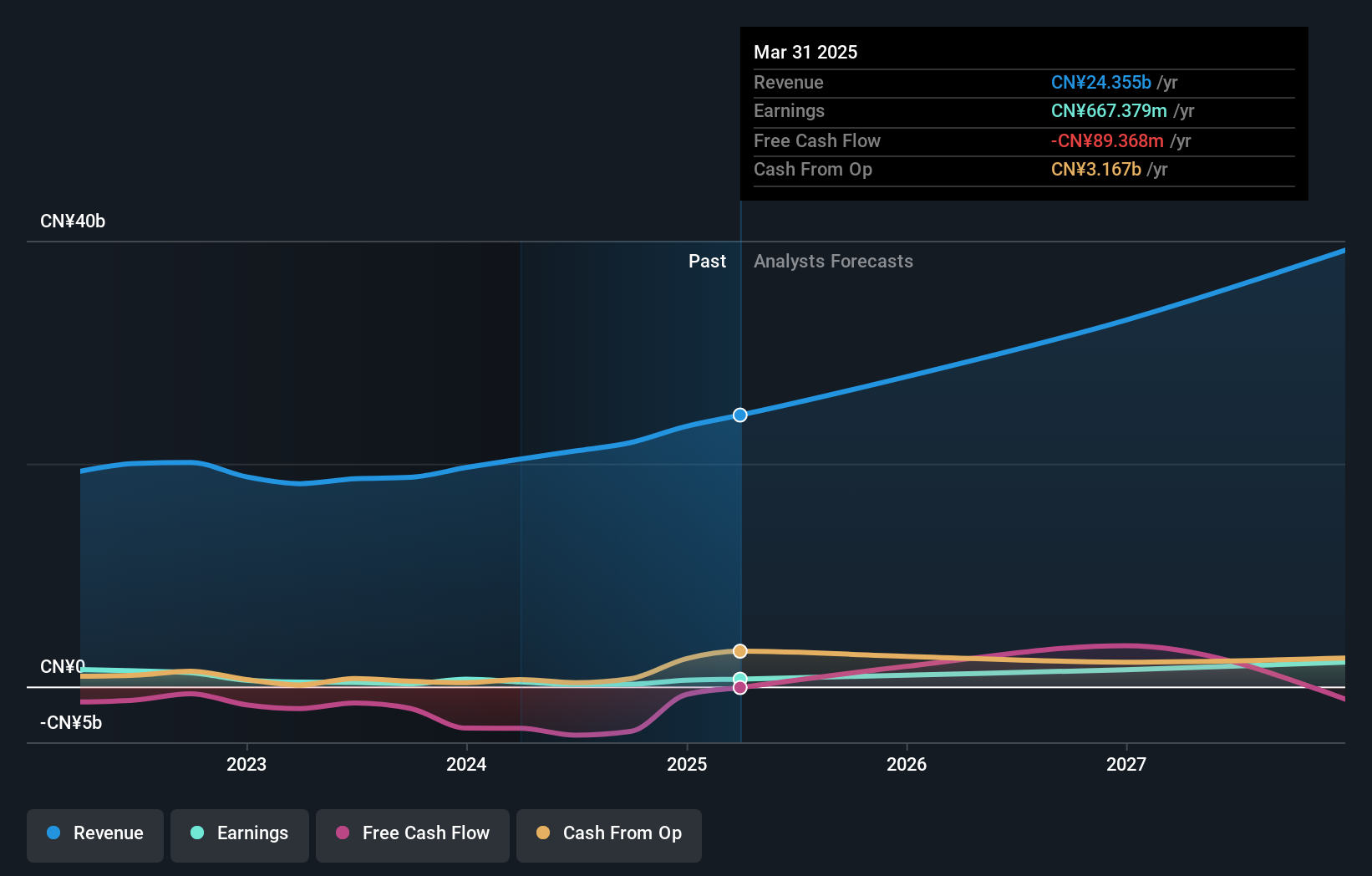

iFLYTEK CO.,LTD has seen a significant revenue surge to CNY 14.85 billion, up from CNY 12.61 billion last year, marking a growth of 15.1%. Despite this, the company faced a shift from a net profit of CNY 99.36 million to a net loss of CNY 343.7 million within the same period, reflecting challenges in maintaining profitability amidst expansion efforts. The firm's commitment to innovation is evident with substantial R&D spending aimed at future-proofing its operations in the competitive tech landscape; however, it remains essential for iFLYTEK to balance growth-oriented investments with financial sustainability strategies as earnings are projected to grow by an ambitious 62.7% annually.

- Navigate through the intricacies of iFLYTEKLTD with our comprehensive health report here.

Gain insights into iFLYTEKLTD's historical performance by reviewing our past performance report.

Make It Happen

- Click this link to deep-dive into the 1285 companies within our High Growth Tech and AI Stocks screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if iFLYTEKLTD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002230

iFLYTEKLTD

Engages artificial intelligence (AI) technologies services in China.