As global markets navigate a landscape marked by dovish Federal Reserve signals and mixed economic indicators, small-cap stocks have notably outperformed their large-cap counterparts, with the Russell 2000 Index showing significant gains. In this environment, identifying undiscovered gems requires a keen eye for companies that demonstrate resilience and potential in sectors poised for growth amidst evolving market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| HG Metal Manufacturing | 3.31% | 8.63% | 5.71% | ★★★★★★ |

| Thai Steel Cable | NA | 3.35% | 17.89% | ★★★★★★ |

| VICOM | NA | 6.95% | 4.06% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| Taiyo KagakuLtd | 0.66% | 6.12% | 4.54% | ★★★★★☆ |

| Pizu Group Holdings | 45.21% | -1.54% | -3.14% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Billion Industrial Holdings | 33.11% | 16.86% | -16.10% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Guangdong Goworld (SZSE:000823)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guangdong Goworld Co., Ltd. operates in China, offering electronic components and ultrasonic electronic instruments, with a market cap of CN¥7.48 billion.

Operations: The company generates revenue primarily through the sale of electronic components and ultrasonic electronic instruments. The net profit margin has shown variability, reflecting changes in cost structures and market conditions.

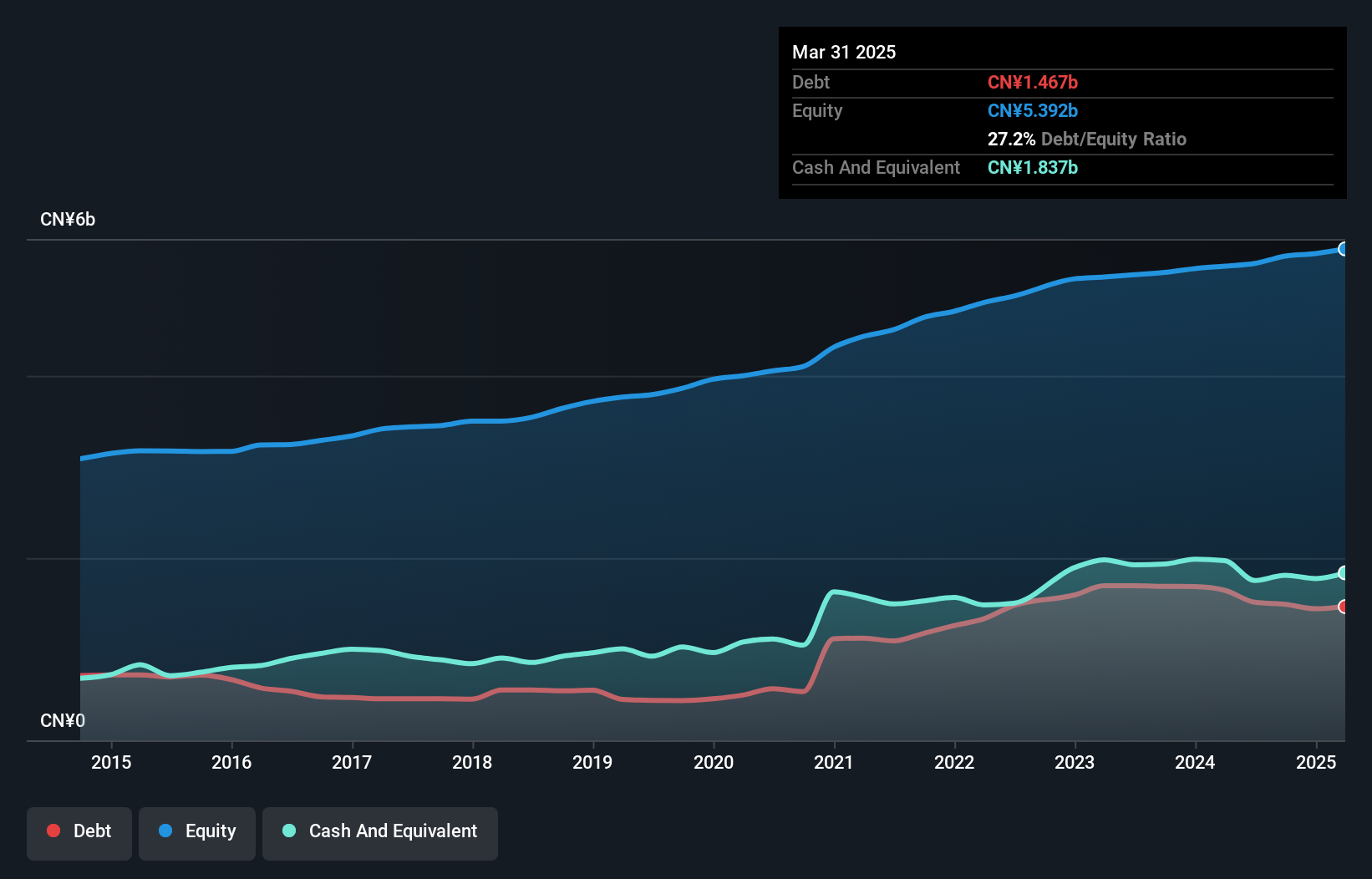

Guangdong Goworld, a smaller player in the electronics sector, has shown resilience with earnings growing 15.6% over the past year, outpacing the industry average of 9%. The company boasts a price-to-earnings ratio of 30.3x, which is favorable compared to the broader CN market's 43.5x. Despite an increase in its debt-to-equity ratio from 13% to 24.9% over five years, it maintains high-quality earnings and sufficient cash to cover its total debt obligations comfortably. Recent results reveal net income rising to CNY 178 million for nine months ended September compared to CNY 147 million last year, indicating solid performance improvements.

- Take a closer look at Guangdong Goworld's potential here in our health report.

Assess Guangdong Goworld's past performance with our detailed historical performance reports.

WuHu Foresight TechnologyLtd (SZSE:301529)

Simply Wall St Value Rating: ★★★★★★

Overview: WuHu Foresight Technology Co., Ltd. focuses on the research, development, manufacture, and sale of automotive interior parts in China with a market cap of CN¥5.97 billion.

Operations: WuHu Foresight Technology Ltd generates revenue primarily from its Auto Parts & Accessories segment, amounting to CN¥1.66 billion. The company's financial performance is highlighted by a focus on this core revenue stream within the automotive sector in China.

WuHu Foresight Technology, a smaller player in the auto components sector, has demonstrated impressive earnings growth of 100.4% over the past year, outpacing the industry's 8%. Despite a highly volatile share price recently, its revenue is forecast to grow by 21.56% annually. The company reported sales of CNY1.27 billion for nine months ending September 2025, up from CNY940 million last year, with net income doubling to CNY106 million. While not free cash flow positive due to high capital expenditures reaching CNY231 million in recent quarters, it holds more cash than total debt and maintains strong non-cash earnings quality.

- Get an in-depth perspective on WuHu Foresight TechnologyLtd's performance by reading our health report here.

Gain insights into WuHu Foresight TechnologyLtd's past trends and performance with our Past report.

Techman Robot (TWSE:4585)

Simply Wall St Value Rating: ★★★★★☆

Overview: Techman Robot Inc. specializes in providing collaborative robots with integrated visual systems, software, and application-based solutions across various regions including Taiwan, China, Europe, Japan, South Korea, and Southeast Asia; the company has a market cap of NT$34.64 billion.

Operations: The primary revenue stream for Techman Robot Inc. comes from the manufacturing of robot arms, sales, and warranty repair services, totaling NT$1.74 billion.

Techman Robot, a nimble player in the robotics sector, has shown impressive financial strides. Over the past year, its earnings surged by 102.5%, outpacing the broader Machinery industry's -4% performance. The company reported a debt to equity ratio increase from 0% to 1.5% over five years but maintains more cash than total debt, indicating robust financial health. Recent quarterly results revealed sales of TWD 455 million and net income of TWD 36 million, both significantly higher than last year's figures. A successful follow-on equity offering raised TWD 4.74 billion, likely bolstering future growth prospects as earnings are forecasted to grow by 52.61% annually.

- Navigate through the intricacies of Techman Robot with our comprehensive health report here.

Explore historical data to track Techman Robot's performance over time in our Past section.

Key Takeaways

- Investigate our full lineup of 3023 Global Undiscovered Gems With Strong Fundamentals right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Techman Robot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:4585

Techman Robot

Provides collaborative robots with visual systems, software, and application-based solutions in Taiwan, China, Europe, Japan, South Korea, and Southeast Asia.

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026