- China

- /

- Electronic Equipment and Components

- /

- SHSE:688531

Exploring High Growth Tech Stocks In Global Markets

Reviewed by Simply Wall St

In recent weeks, global markets have experienced volatility driven by geopolitical tensions and consumer spending concerns, with major indices like the S&P 500 experiencing fluctuations amid tariff news and economic data releases indicating potential slowdowns. As investors navigate these uncertain conditions, identifying high-growth tech stocks that demonstrate resilience and adaptability in a shifting economic landscape can be crucial for those looking to capitalize on innovation-driven opportunities.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| eWeLLLtd | 24.94% | 24.24% | ★★★★★★ |

| CD Projekt | 27.11% | 39.37% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Pharma Mar | 23.77% | 45.40% | ★★★★★★ |

| Yggdrazil Group | 52.42% | 134.19% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

Siglent TechnologiesLtd (SHSE:688112)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Siglent Technologies CO., Ltd. is engaged in the research, development, production, sale, and servicing of electronic test and measurement equipment both in China and internationally, with a market cap of CN¥5.15 billion.

Operations: Siglent Technologies focuses on the electronic test and measurement equipment sector, catering to both domestic and international markets. The company generates revenue through the sale of its developed products, with a notable emphasis on innovation in its offerings.

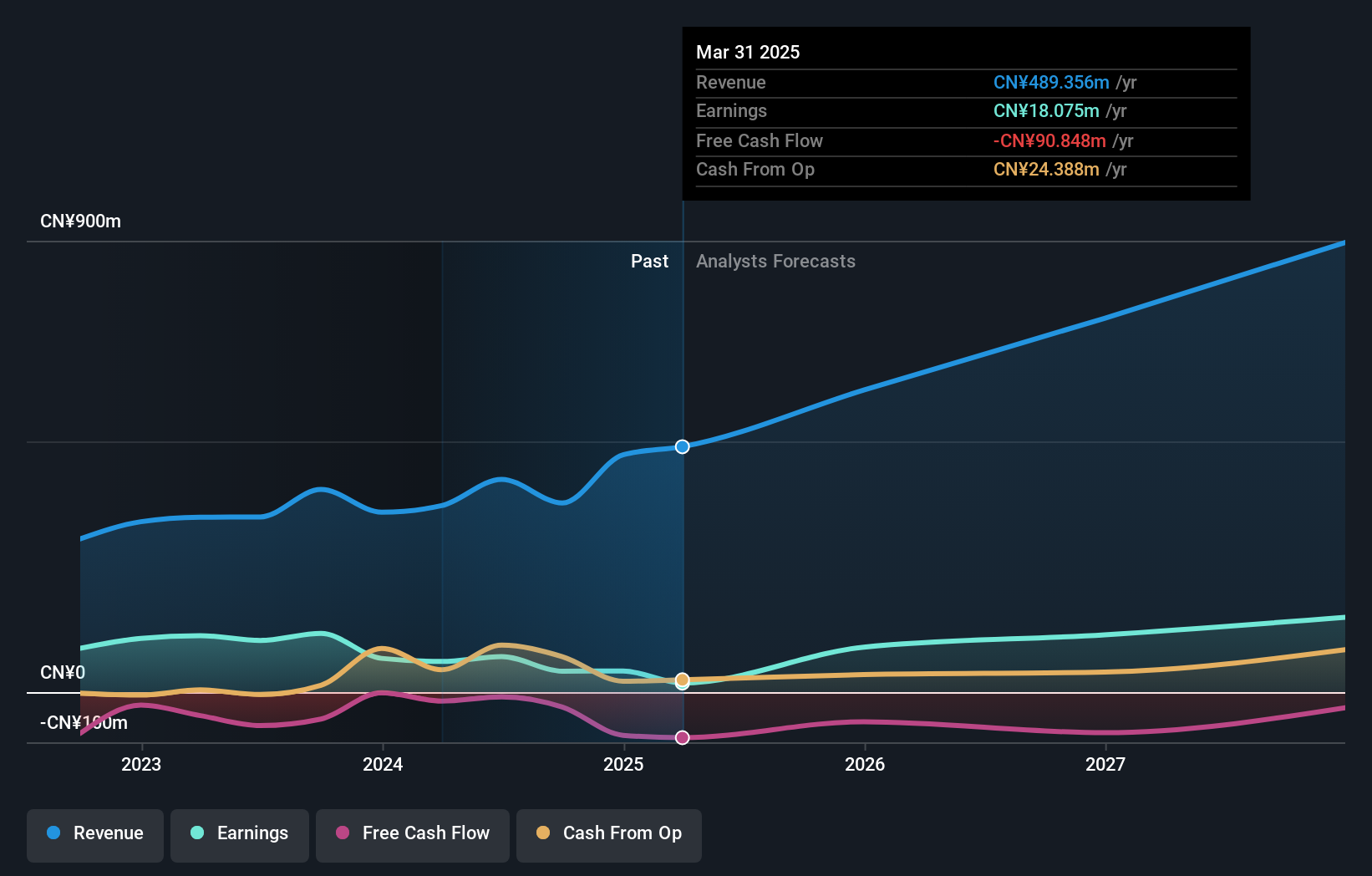

Siglent TechnologiesLtd, amidst a challenging electronic industry landscape with a modest -19.7% earnings growth last year, still projects robust future prospects with anticipated revenue and earnings surges. Forecasted to expand revenues by 22% annually, outpacing the CN market's 13.3%, and an impressive earnings growth of 26.4% per year, Siglent is aligning its strategies to leverage these gains effectively. The firm's commitment to innovation is underscored by its R&D investments, crucial for sustaining long-term competitiveness in the swiftly evolving tech sector. Despite a lower forecasted Return on Equity at 12.2%, the company's positive free cash flow positions it well for ongoing reinvestment and financial health, promising an intriguing trajectory ahead in high-growth tech realms.

- Get an in-depth perspective on Siglent TechnologiesLtd's performance by reading our health report here.

Gain insights into Siglent TechnologiesLtd's past trends and performance with our Past report.

Sansec Technology (SHSE:688489)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sansec Technology Co., Ltd. focuses on the research, development, and production of commercial cryptographic products and solutions for internet information security in China, with a market capitalization of CN¥4.44 billion.

Operations: Sansec Technology specializes in developing cryptographic products and solutions aimed at enhancing internet information security within China. The company's operations center around the production and innovation of these security solutions, contributing to its market presence.

Sansec Technology, despite its recent exclusion from the S&P Global BMI Index, is demonstrating promising growth dynamics. The company's revenue is expected to increase by 25.3% annually, outperforming the CN market's average of 13.3%. This growth is supported by an impressive forecast of a 44.1% annual increase in earnings. Notably, Sansec has completed a significant share repurchase program, acquiring 2.53% of its shares for CNY 79.96 million, underscoring confidence in its financial health and future prospects. Furthermore, with R&D expenses aligned strategically to foster innovation and maintain competitive advantage in the tech sector, Sansec appears poised for continued expansion in high-demand technology markets.

Wuxi Unicomp Technology (SHSE:688531)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuxi Unicomp Technology Co., Ltd. focuses on the research, development, manufacture, and sale of X-ray technology and intelligent detection equipment in China, with a market cap of CN¥6.40 billion.

Operations: The company generates revenue primarily through the sale of X-ray technology and intelligent detection equipment. It is involved in the entire process from research and development to manufacturing and sales within China. The business model centers on leveraging advanced technology to cater to industrial needs for inspection and quality control.

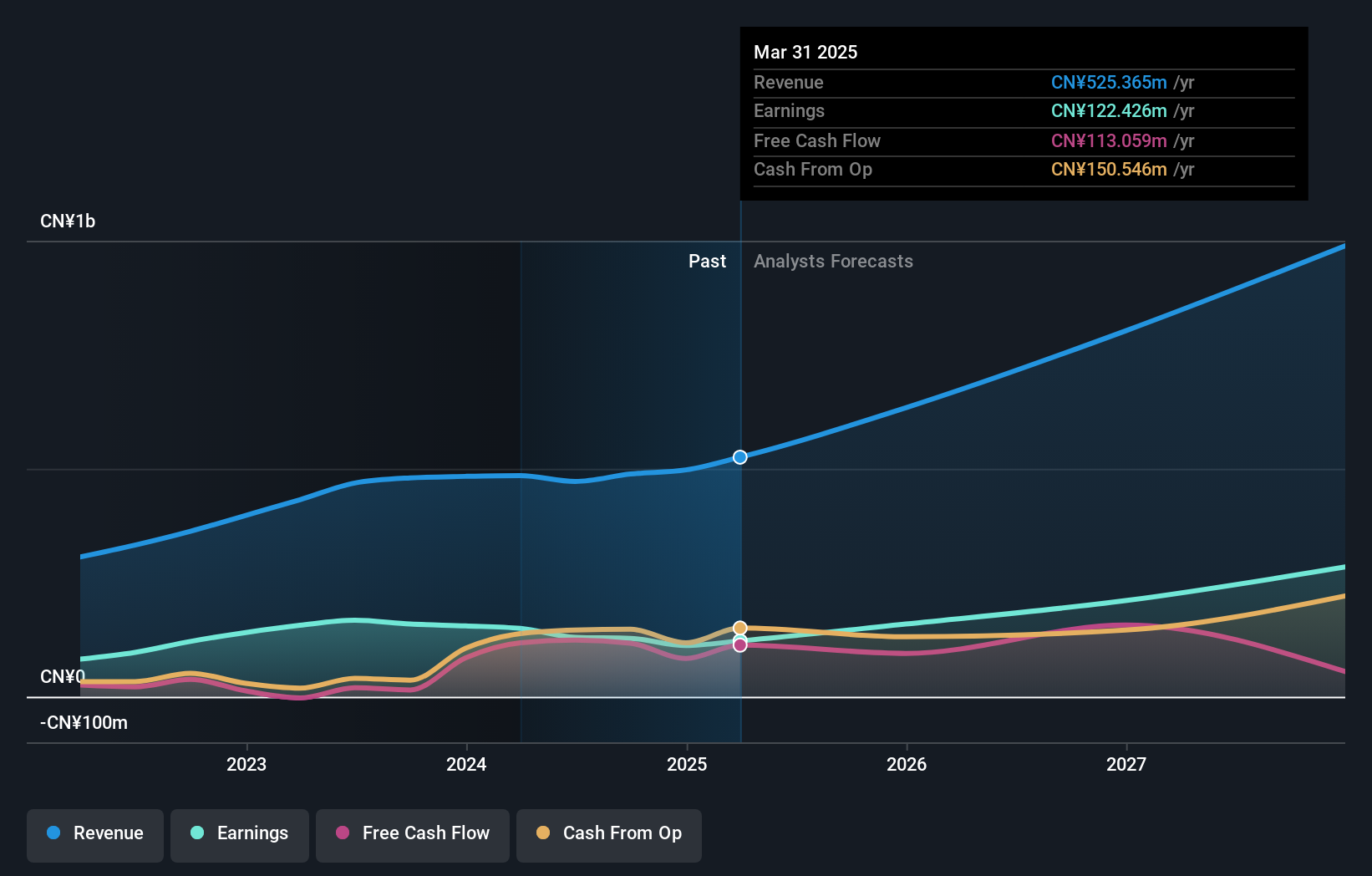

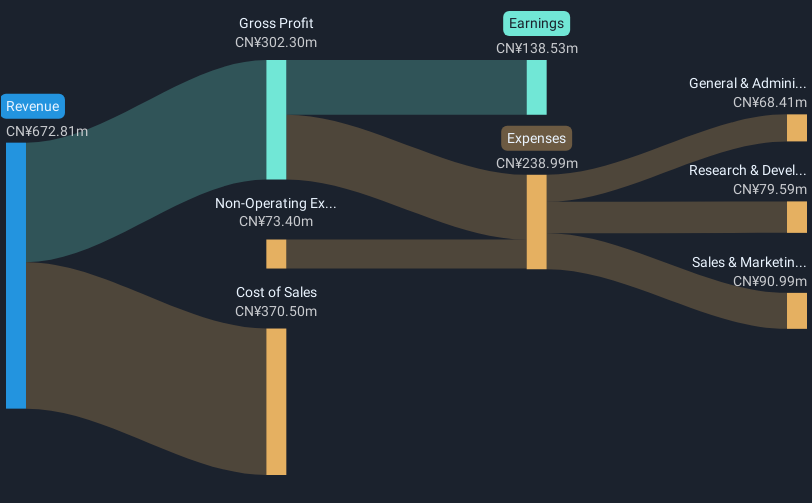

Wuxi Unicomp Technology is carving a niche in the tech sector with its robust annual revenue growth at 28.6% and earnings expansion by 37.2% per year, outpacing the broader CN market's averages of 13.3% and 25.5%, respectively. This growth trajectory is underpinned by strategic R&D investments, which are crucial for maintaining its competitive edge in evolving markets. Despite not engaging in recent share repurchases, the company’s focus on innovation through substantial R&D spending, which aligns with industry demands for advanced technology solutions, positions it favorably for future opportunities.

- Click here and access our complete health analysis report to understand the dynamics of Wuxi Unicomp Technology.

Evaluate Wuxi Unicomp Technology's historical performance by accessing our past performance report.

Summing It All Up

- Navigate through the entire inventory of 800 Global High Growth Tech and AI Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi Unicomp Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688531

Wuxi Unicomp Technology

Engages in the research, development, manufacture, and sale of X-ray technology and intelligent detection equipment in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives