Stock Analysis

- China

- /

- Electronic Equipment and Components

- /

- SHSE:688007

High Growth Tech Stocks Including Appotronics With Promising Potential

Reviewed by Simply Wall St

In a week marked by busy earnings reports and unexpected economic data, global markets experienced mixed performances, with small-cap stocks displaying resilience compared to their larger counterparts. As the technology sector continues to navigate cautious earnings from major players, identifying high-growth tech stocks with promising potential requires careful consideration of market dynamics and economic indicators that can influence these smaller yet innovative companies.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.41% | 70.53% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1282 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Appotronics (SHSE:688007)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Appotronics Corporation Limited focuses on the research, development, production, sale, and leasing of laser display devices and machines in China with a market cap of approximately CN¥7.57 billion.

Operations: The company generates revenue primarily from the sale and leasing of laser display devices and machines. It engages in extensive research and development to enhance its product offerings within the laser display sector.

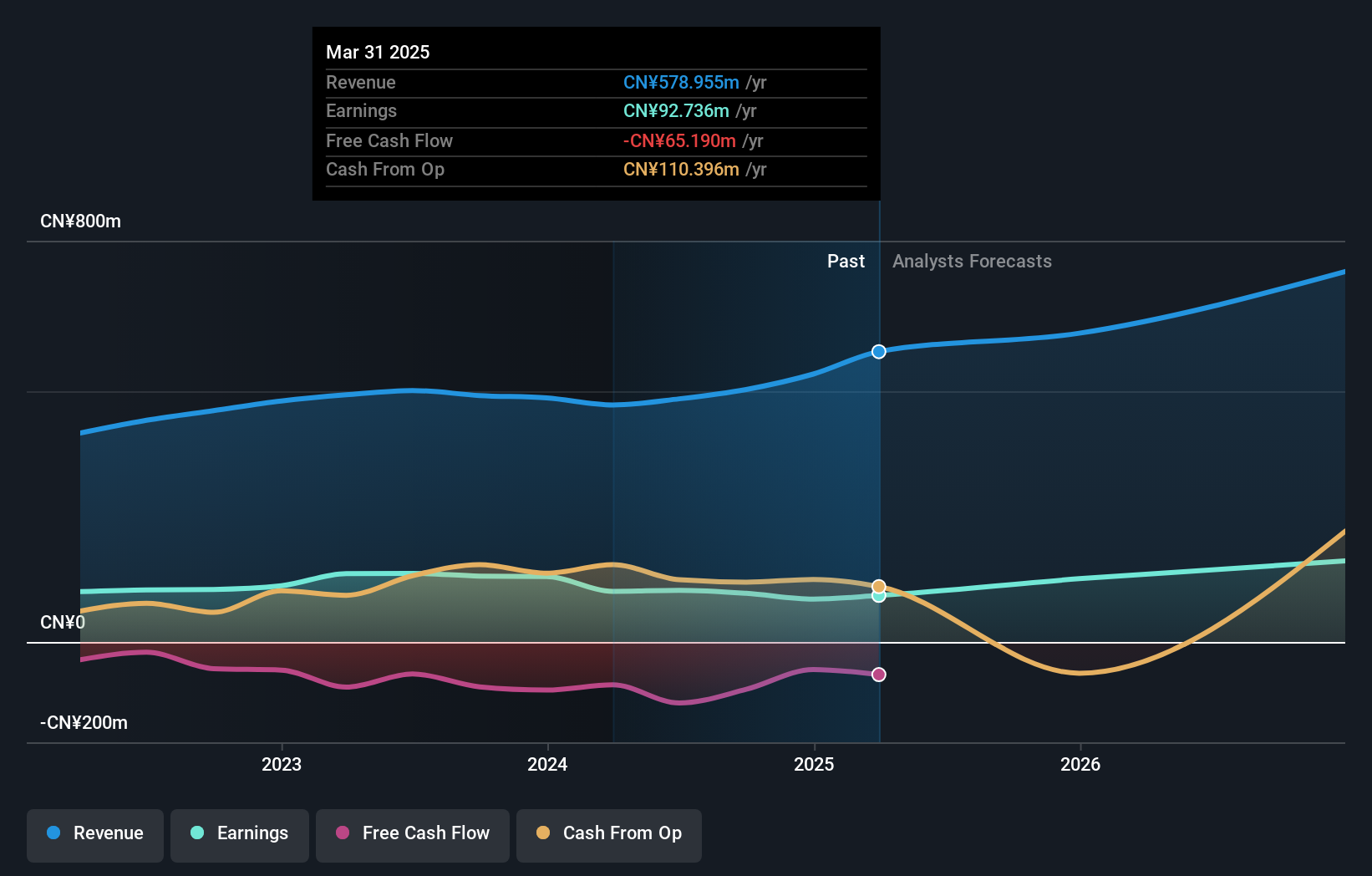

Appotronics has demonstrated a robust commitment to innovation with its R&D expenses, reflecting a strategic focus on sustaining its technological edge. The company invested significantly in research and development, aligning with its recent revenue growth of 21.2% per year, which outpaces the broader Chinese market's 14% growth rate. Despite facing earnings challenges this year with net income dropping to CNY 42.95 million from CNY 128.56 million, Appotronics is poised for potential recovery, forecasting an aggressive earnings growth rate of 81% annually. This projection underscores the firm's resilience and adaptability in a competitive tech landscape, further supported by their recent share buyback initiative signaling confidence in long-term value creation for stakeholders.

- Click to explore a detailed breakdown of our findings in Appotronics' health report.

Examine Appotronics' past performance report to understand how it has performed in the past.

Shenzhen Newway Photomask Making (SHSE:688401)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Newway Photomask Making Co., Ltd is a lithography company involved in the design, development, and production of mask products in China, with a market cap of CN¥5.26 billion.

Operations: Shenzhen Newway Photomask Making Co., Ltd focuses on designing, developing, and producing lithographic mask products in China. The company operates within the photomask industry, contributing to the semiconductor manufacturing process.

Shenzhen Newway Photomask Making has demonstrated solid financial performance with a reported 25% increase in sales to CNY 602.57 million and a net income rise of approximately 12% to CNY 121.06 million for the nine months ending September 2024. This growth is underpinned by strategic R&D investments, which are crucial as the company navigates through highly volatile market conditions and maintains its competitive edge in the tech sector. Notably, its commitment to innovation is reflected in its substantial R&D expenses that align with an impressive forecasted annual earnings growth of 30.9%, significantly outpacing the broader Chinese market's projection of 26.1%. These figures highlight Shenzhen Newway's potential resilience and adaptability within the dynamic tech landscape, further evidenced by their recent inclusion in the S&P Global BMI Index, marking it as a noteworthy contender on a global scale.

- Click here and access our complete health analysis report to understand the dynamics of Shenzhen Newway Photomask Making.

Learn about Shenzhen Newway Photomask Making's historical performance.

WCON Electronics (Guangdong) (SZSE:301328)

Simply Wall St Growth Rating: ★★★★★☆

Overview: WCON Electronics (Guangdong) Co., Ltd. focuses on the research, development, manufacturing, and marketing of connectors and cable assemblies in China with a market capitalization of CN¥4.23 billion.

Operations: The company generates revenue primarily from its connector segment, amounting to CN¥500.40 million.

Amidst a challenging backdrop, WCON Electronics (Guangdong) has managed to sustain its market position with a modest revenue increase to CNY 384.46 million from CNY 367.64 million year-over-year as of September 2024. Despite a drop in net income from CNY 101.29 million to CNY 68.03 million, the company continues to prioritize R&D, which is evident from its consistent investment in innovation, crucial for staying competitive in the fast-evolving tech landscape. These efforts are mirrored in their projected revenue growth at an impressive rate of 20.8% annually, surpassing the broader Chinese market forecast of 14%. Moreover, WCON's strategic focus on R&D is set to propel future earnings with an expected annual growth rate of 26.5%, slightly ahead of the market's projection at 26.1%. This commitment not only underscores their resilience but also positions them well for potential advancements and increased market share within the tech sector.

- Get an in-depth perspective on WCON Electronics (Guangdong)'s performance by reading our health report here.

Understand WCON Electronics (Guangdong)'s track record by examining our Past report.

Taking Advantage

- Explore the 1282 names from our High Growth Tech and AI Stocks screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688007

Appotronics

Engages in the research and development, production, sale, and leasing of laser display devices and machines in China.