Stock Analysis

- China

- /

- Electronic Equipment and Components

- /

- SHSE:688400

High Growth Tech Stocks To Watch For Potential Expansion

Reviewed by Simply Wall St

As global markets show resilience with major U.S. indexes nearing record highs and smaller-cap indexes outperforming their larger counterparts, investors are closely watching the tech sector for potential growth opportunities amidst a backdrop of geopolitical tensions and economic indicators pointing to a strong labor market. In this dynamic environment, identifying promising high-growth tech stocks involves looking at companies with innovative products or services that can capitalize on broad-based gains and positive market sentiment.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| Seojin SystemLtd | 32.56% | 43.21% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Waystream Holding | 22.16% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| JNTC | 20.52% | 57.26% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Elliptic Laboratories | 65.73% | 103.55% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1295 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

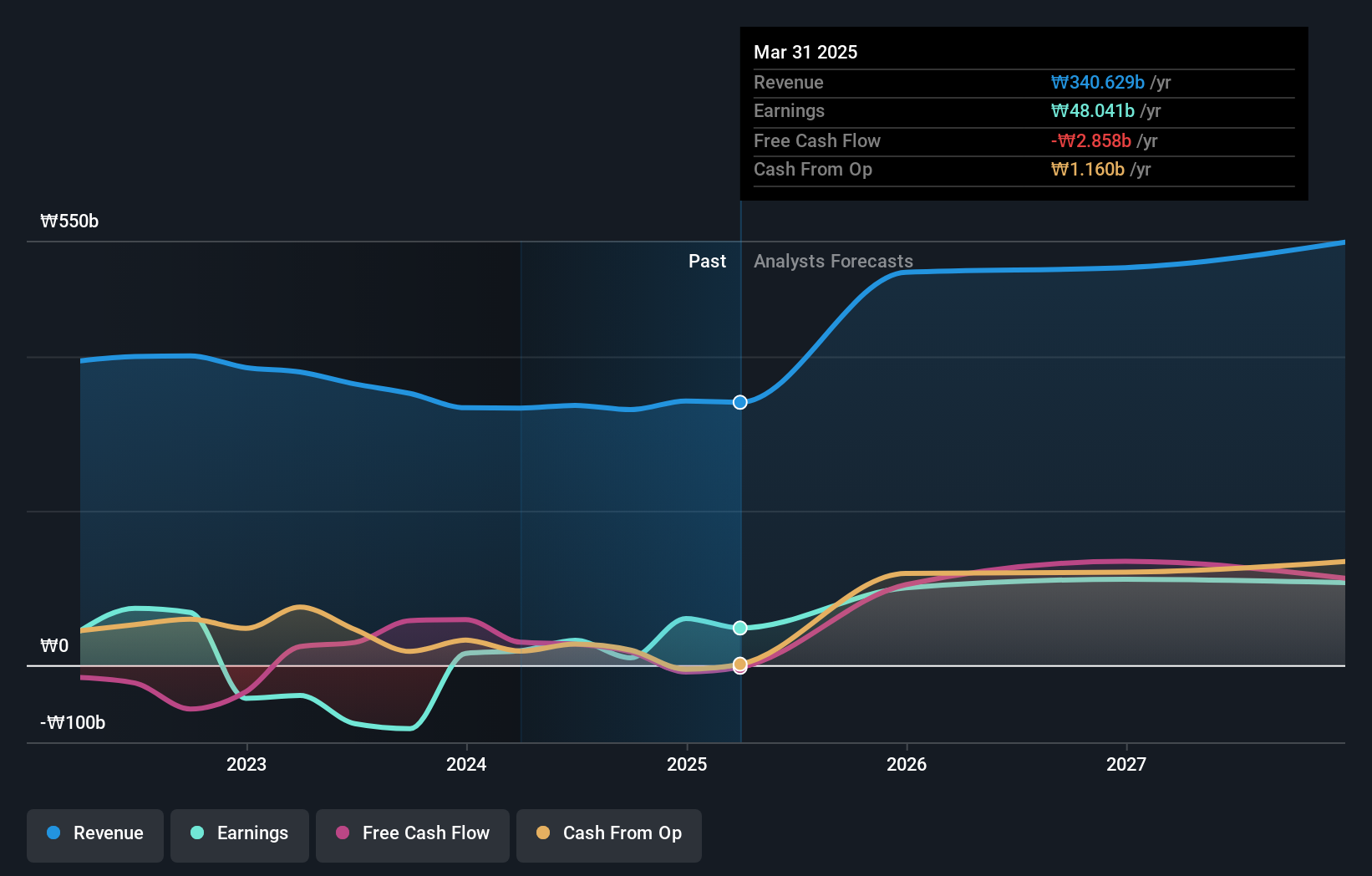

Pearl Abyss (KOSDAQ:A263750)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pearl Abyss Corp. is a company involved in software development for games, with a market capitalization of ₩2.45 trillion.

Operations: The company generates revenue primarily through the development and sale of video games. It focuses on creating engaging gaming experiences, which form the core of its business model.

Pearl Abyss, transitioning into profitability this year, showcases a promising trajectory with forecasted revenue and earnings growth at 23.7% and 69.6% per year respectively, outpacing the KR market projections of 9% and 29.1%. This robust expansion is underpinned by significant R&D investment, aligning with industry shifts towards more immersive entertainment experiences. Despite a low forecasted Return on Equity at 11.8%, the company's strategic focus on innovative game development could enhance its competitive edge in the bustling tech landscape.

- Delve into the full analysis health report here for a deeper understanding of Pearl Abyss.

Examine Pearl Abyss' past performance report to understand how it has performed in the past.

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HYBE Co., Ltd. is involved in music production, publishing, and artist development and management, with a market capitalization of ₩8.91 trillion.

Operations: The company's revenue streams primarily consist of Label and Solution segments, generating ₩1.29 trillion and ₩1.21 trillion respectively, alongside a Platform segment contributing ₩337.18 billion.

HYBE's trajectory in the tech sector is underscored by a robust commitment to innovation, as evidenced by its significant R&D investments which align with industry shifts towards advanced entertainment technologies. Despite recent financial pressures, with net income dropping to KRW 6.37 billion from KRW 102.68 billion year-over-year for Q3, the company's strategic initiatives include substantial future growth drivers like a private placement aimed at raising KRW 400 billion, convertible into shares at KRW 218,000 each. This move not only underscores HYBE’s adaptive strategies in response to market demands but also highlights their proactive stance in capitalizing on emerging tech trends.

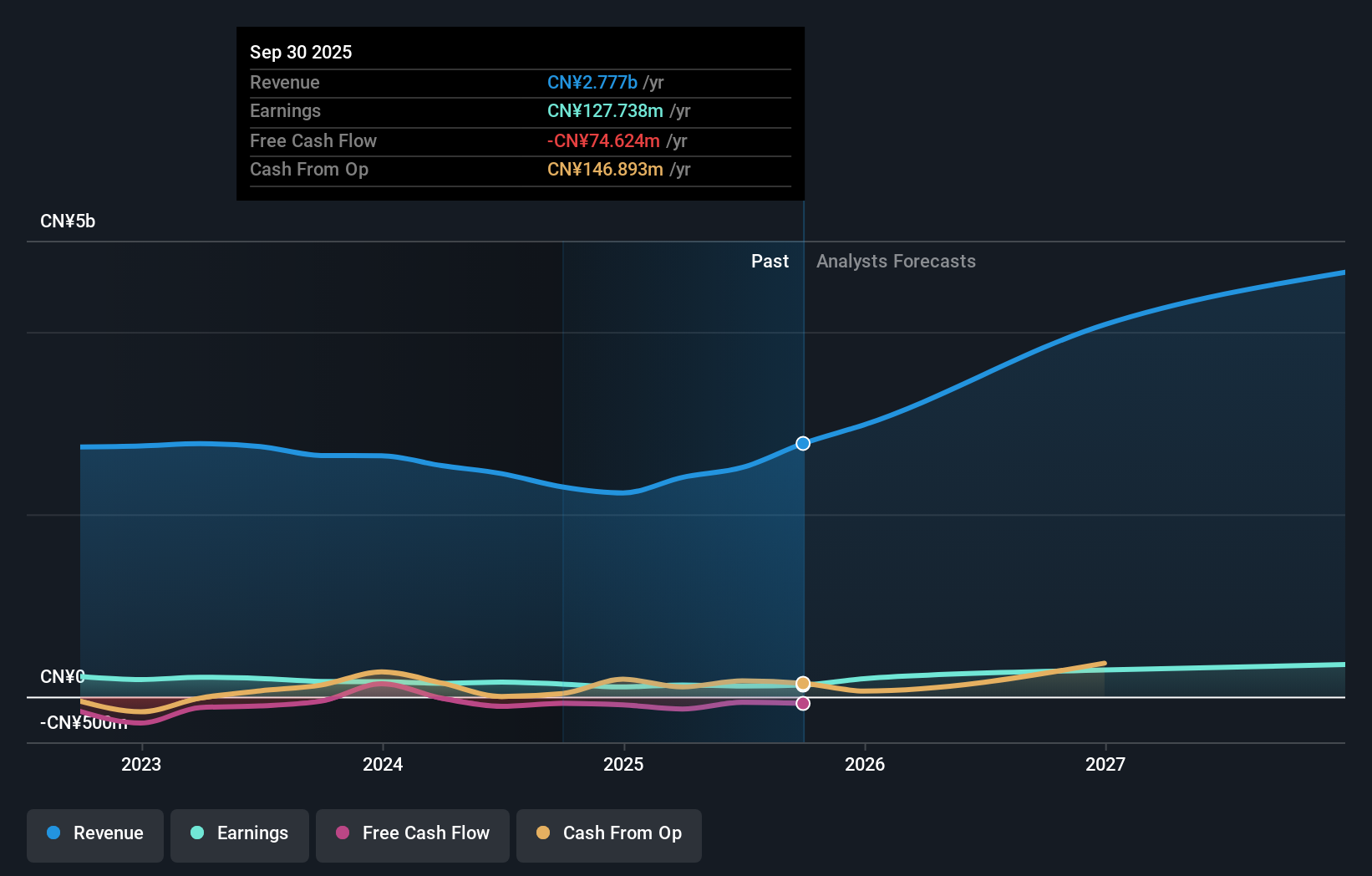

LUSTER LightTech (SHSE:688400)

Simply Wall St Growth Rating: ★★★★★☆

Overview: LUSTER LightTech Co., LTD. focuses on the research and development of configurable visual systems, intelligent visual equipment, and core visual devices in China, with a market cap of CN¥10.77 billion.

Operations: LUSTER LightTech Co., LTD. specializes in the development of visual technology products, including configurable systems and intelligent equipment. The company's operations are centered in China, contributing to its market presence with a valuation of CN¥10.77 billion.

LUSTER LightTech's recent performance and strategic maneuvers signal a nuanced trajectory in the tech landscape. Despite a year-over-year revenue drop to CNY 1.58 billion, the firm is poised for robust growth with projected revenue and earnings increases of 22.3% and 35.7% per annum respectively, outpacing the Chinese market averages significantly. The company's commitment to innovation is evident from its R&D spending trends which align closely with these ambitious growth targets, ensuring LUSTER remains competitive in its sector. Additionally, their recent share repurchase initiative underscores a strategic approach to shareholder value, enhancing investor confidence amidst market volatility.

- Get an in-depth perspective on LUSTER LightTech's performance by reading our health report here.

Evaluate LUSTER LightTech's historical performance by accessing our past performance report.

Where To Now?

- Navigate through the entire inventory of 1295 High Growth Tech and AI Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688400

LUSTER LightTech

Researches and develops configurable visual systems, intelligent visual equipment, and core visual devices in China.