Stock Analysis

Exploring Three High Growth Tech Stocks with Potential Expansion

Reviewed by Simply Wall St

As global markets experience broad-based gains and smaller-cap indexes outperform larger counterparts, the tech sector continues to capture investor attention amid a backdrop of economic resilience and positive sentiment driven by strong labor market data. In this environment, identifying high growth tech stocks with potential for expansion involves looking for companies that demonstrate innovation, adaptability to evolving technologies, and the ability to capitalize on emerging trends in sectors such as artificial intelligence and clean energy.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 32.56% | 43.21% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Waystream Holding | 22.16% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 65.73% | 103.55% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1285 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

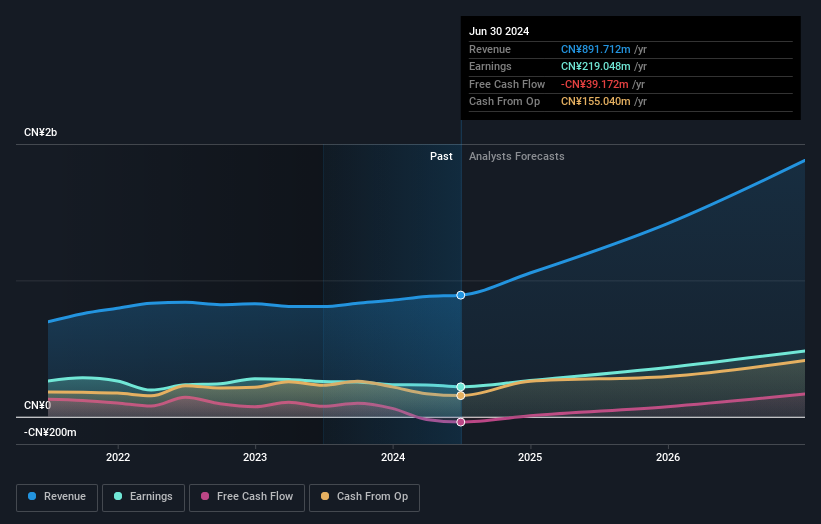

Ningbo Yongxin OpticsLtd (SHSE:603297)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ningbo Yongxin Optics Co., Ltd specializes in the manufacturing and sale of precision optical instruments and components within China, with a market capitalization of CN¥9.80 billion.

Operations: Yongxin Optics focuses on the production and distribution of precision optical instruments and components, generating revenue primarily from its Optical Product Manufacturing segment, which amounts to CN¥894.06 million.

Ningbo Yongxin Optics Co., Ltd. is navigating a complex landscape with its recent financial performance reflecting both challenges and growth potential. Despite a revenue increase to CNY 650.58 million from CNY 610.64 million year-over-year as of September 2024, the company witnessed a decline in net income to CNY 140.26 million from CNY 173.76 million, indicating pressure on profitability amidst expansion efforts. However, the firm's commitment to innovation is evident in its R&D investments, crucial for sustaining its competitive edge in the high-precision optics sector. Looking ahead, with expected annual earnings growth at an impressive rate of 35.4%, Yongxin aims to leverage these developments to enhance market share and customer value proposition in evolving tech landscapes.

- Take a closer look at Ningbo Yongxin OpticsLtd's potential here in our health report.

Gain insights into Ningbo Yongxin OpticsLtd's past trends and performance with our Past report.

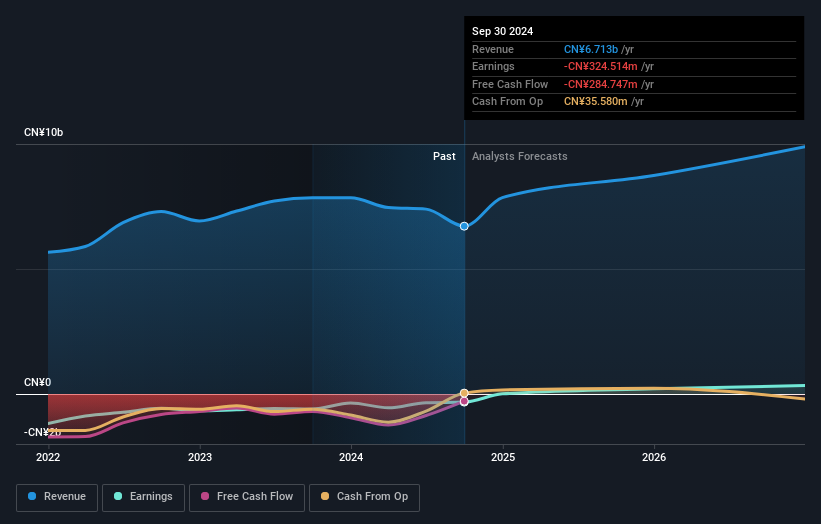

CICT Mobile Communication Technology (SHSE:688387)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CICT Mobile Communication Technology Co., Ltd. operates in the mobile communication technology sector and has a market capitalization of approximately CN¥21.06 billion.

Operations: The company derives its revenue primarily from the mobile communication technology sector. It focuses on developing and providing advanced communication solutions, with a particular emphasis on innovation within the industry.

CICT Mobile Communication Technology is navigating a challenging yet transformative phase, marked by a significant revenue dip to CNY 4.15 billion from CNY 5.28 billion year-over-year as of September 2024, alongside a narrowed net loss from CNY 202.63 million to CNY 169.83 million, reflecting stringent cost management and operational adjustments. Despite current unprofitability, the firm's aggressive R&D focus is evident with expenses aimed at fostering innovations that align with industry shifts towards enhanced mobile communication solutions. This strategic emphasis on research is projected to underpin an impressive earnings growth of 116.53% annually, outpacing the broader communications sector significantly and positioning the company for a potential turnaround in profitability within three years amidst competitive market dynamics.

Beijing Shiji Information Technology (SZSE:002153)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Shiji Information Technology Co., Ltd. operates as a provider of technology solutions for the hospitality, retail, and entertainment industries with a market capitalization of CN¥20.33 billion.

Operations: Beijing Shiji Information Technology focuses on delivering technology solutions across the hospitality, retail, and entertainment sectors. The company's revenue streams are derived from software development, system integration, and technical services tailored to these industries.

Beijing Shiji Information Technology has demonstrated resilience with a revenue increase to CNY 2.02 billion, up from CNY 1.86 billion year-over-year as of September 2024, coupled with a modest net income growth to CNY 15.88 million from CNY 14.42 million. This performance is underpinned by robust R&D investments, which are crucial for maintaining competitive edge in the fast-evolving tech landscape; notably, earnings are expected to surge by an impressive 95.3% annually. Despite current challenges in achieving profitability, the company's strategic focus on innovation and market expansion is poised to accelerate its growth trajectory significantly above the industry average of 13.8%, promising a bright outlook in the burgeoning sectors it serves.

- Get an in-depth perspective on Beijing Shiji Information Technology's performance by reading our health report here.

Learn about Beijing Shiji Information Technology's historical performance.

Make It Happen

- Discover the full array of 1285 High Growth Tech and AI Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Shiji Information Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002153

Beijing Shiji Information Technology

Beijing Shiji Information Technology Co., Ltd.