As global markets show broad-based gains, with smaller-cap indexes outperforming large-caps and the S&P 500 nearing record highs, investor sentiment is buoyed by strong labor market data and encouraging home sales reports. In this environment of positive economic indicators, identifying high-growth tech stocks like ArcSoft can offer potential opportunities for those looking to capitalize on technological advancements and robust market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 32.56% | 43.21% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Waystream Holding | 22.16% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 65.73% | 103.55% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1285 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

ArcSoft (SHSE:688088)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ArcSoft Corporation Limited is a global provider of algorithms and software solutions in the computer vision industry, with a market capitalization of CN¥13.93 billion.

Operations: ArcSoft focuses on developing algorithms and software solutions for the computer vision sector globally.

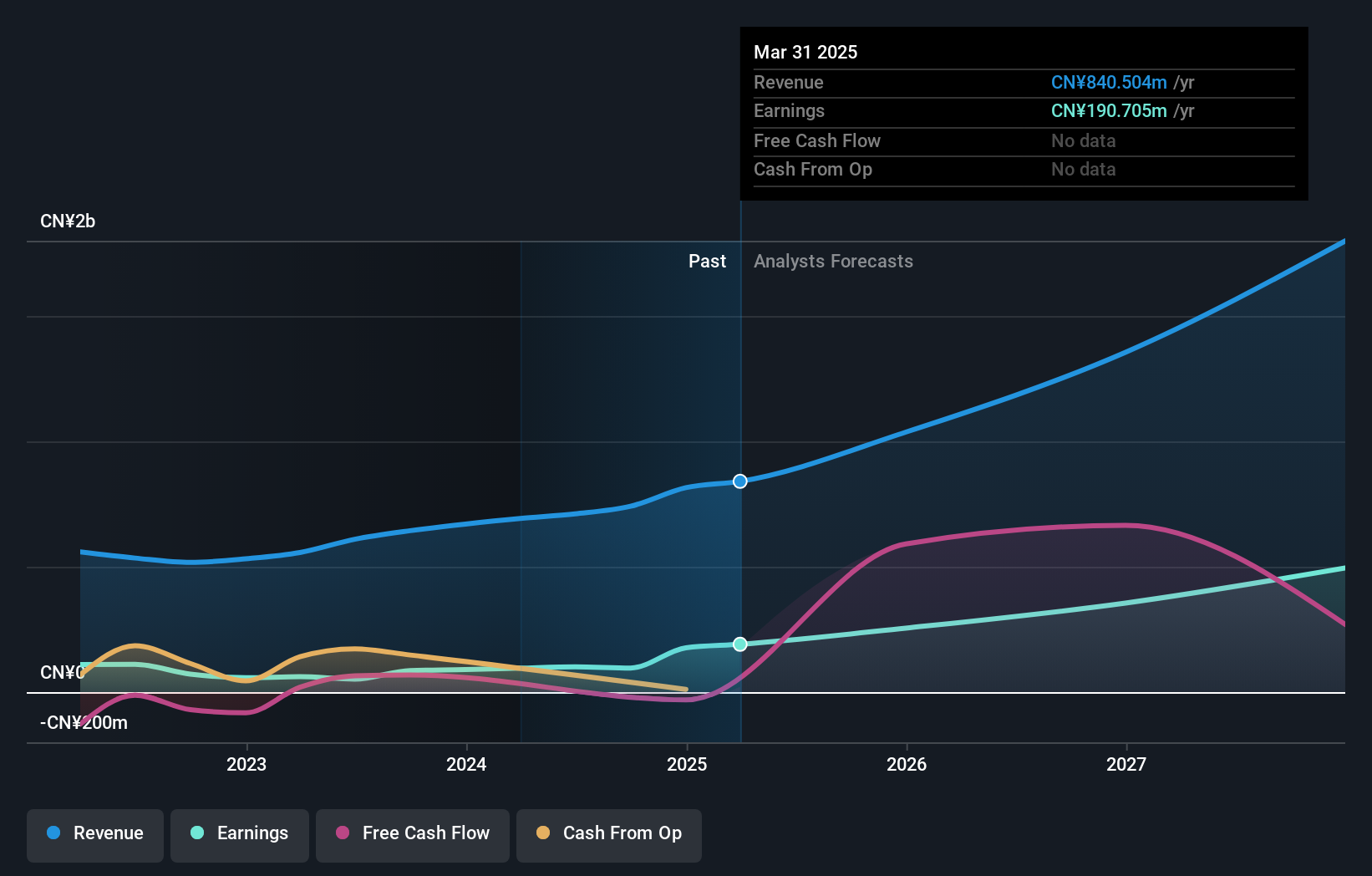

ArcSoft's recent performance and projections paint a promising yet challenging picture. With earnings up by 11.7% over the past year, surpassing the software industry's average decline of 11.2%, ArcSoft demonstrates resilience and potential in a volatile market. This growth is underscored by a significant forecast that sees revenues increasing at 28.3% annually, outpacing the Chinese market prediction of 13.8%. Moreover, expected annual profit growth is projected at an impressive 40.7%, indicating robust future prospects despite current equity returns anticipated to be modest at 8%. These figures highlight ArcSoft's ability to not only navigate but also capitalize on the demands of an evolving tech landscape, driven by strategic R&D investments that align with industry shifts towards more integrated software solutions.

- Click here to discover the nuances of ArcSoft with our detailed analytical health report.

Explore historical data to track ArcSoft's performance over time in our Past section.

Venustech Group (SZSE:002439)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Venustech Group Inc. offers network security products, trusted security management platforms, and specialized security services globally, with a market cap of CN¥20.16 billion.

Operations: The company focuses on delivering a diverse range of network security solutions, including advanced security management platforms and specialized services. It operates globally, leveraging its expertise to address various cybersecurity needs across different sectors.

Venustech Group's recent financial performance reflects a challenging phase, with a reported net loss of CNY 210.07 million for the nine months ending September 2024, a stark contrast to the net income of CNY 241.39 million from the previous year. Despite these setbacks, the company is poised for recovery with projected revenue growth at 16.4% annually, outpacing the Chinese market forecast of 13.8%. Additionally, earnings are expected to surge by 33.6% per year, signaling potential resilience and adaptability in its operational strategy. This optimism is tempered by current profit margins at only 6.7%, down significantly from last year's 23.3%, underscoring the need for strategic realignments to bolster financial health and market position in an increasingly competitive tech landscape.

- Unlock comprehensive insights into our analysis of Venustech Group stock in this health report.

Evaluate Venustech Group's historical performance by accessing our past performance report.

Suzhou YourBest New-type MaterialsLtd (SZSE:301266)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Suzhou YourBest New-type Materials Co. Ltd. is a company engaged in the production and sale of advanced materials, with a market capitalization of CN¥4.46 billion.

Operations: The company focuses on producing and selling advanced materials, deriving its revenue primarily from these activities. It operates with a market capitalization of CN¥4.46 billion.

Suzhou YourBest New-type Materials Ltd. has demonstrated robust growth, with revenue soaring by 18.8% per year, outpacing the Chinese market average of 13.8%. Despite a downturn in net income from CNY 117.66 million to CNY 46.42 million over the past nine months, the company's aggressive R&D spending is a testament to its commitment to innovation and future readiness, positioning it well within a competitive high-tech materials industry where ongoing development is crucial for maintaining technological leadership. The firm's strategic focus on R&D has led to an increase in expenses directly tied to these efforts, reflecting an investment in future capabilities that could drive long-term growth despite short-term financial pressures. This approach suggests potential for significant advancements in material sciences and technologies that could cater to high-demand sectors such as electronics and renewable energy systems, where Suzhou YourBest aims to carve out a substantial market presence.

Turning Ideas Into Actions

- Take a closer look at our High Growth Tech and AI Stocks list of 1285 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688088

ArcSoft

Operates as an algorithm and software solution provider in the computer vision industry worldwide.

Flawless balance sheet with high growth potential.