- China

- /

- Semiconductors

- /

- SHSE:688535

November 2024's High Insider Ownership Growth Stocks

Reviewed by Simply Wall St

In a week marked by busy earnings reports and mixed economic signals, global markets experienced some turbulence, with major indices like the Nasdaq Composite and S&P MidCap 400 reaching record highs before retreating. Amidst this backdrop, growth stocks underperformed compared to value shares, highlighting the cautious sentiment among investors as they navigated through macroeconomic uncertainties and corporate earnings results. In such a volatile environment, companies that exhibit strong insider ownership can be particularly appealing. High insider ownership often suggests confidence from those who know the company best in its long-term potential and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.6% |

| Medley (TSE:4480) | 34% | 30.4% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Brightstar Resources (ASX:BTR) | 14.8% | 84.6% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's explore several standout options from the results in the screener.

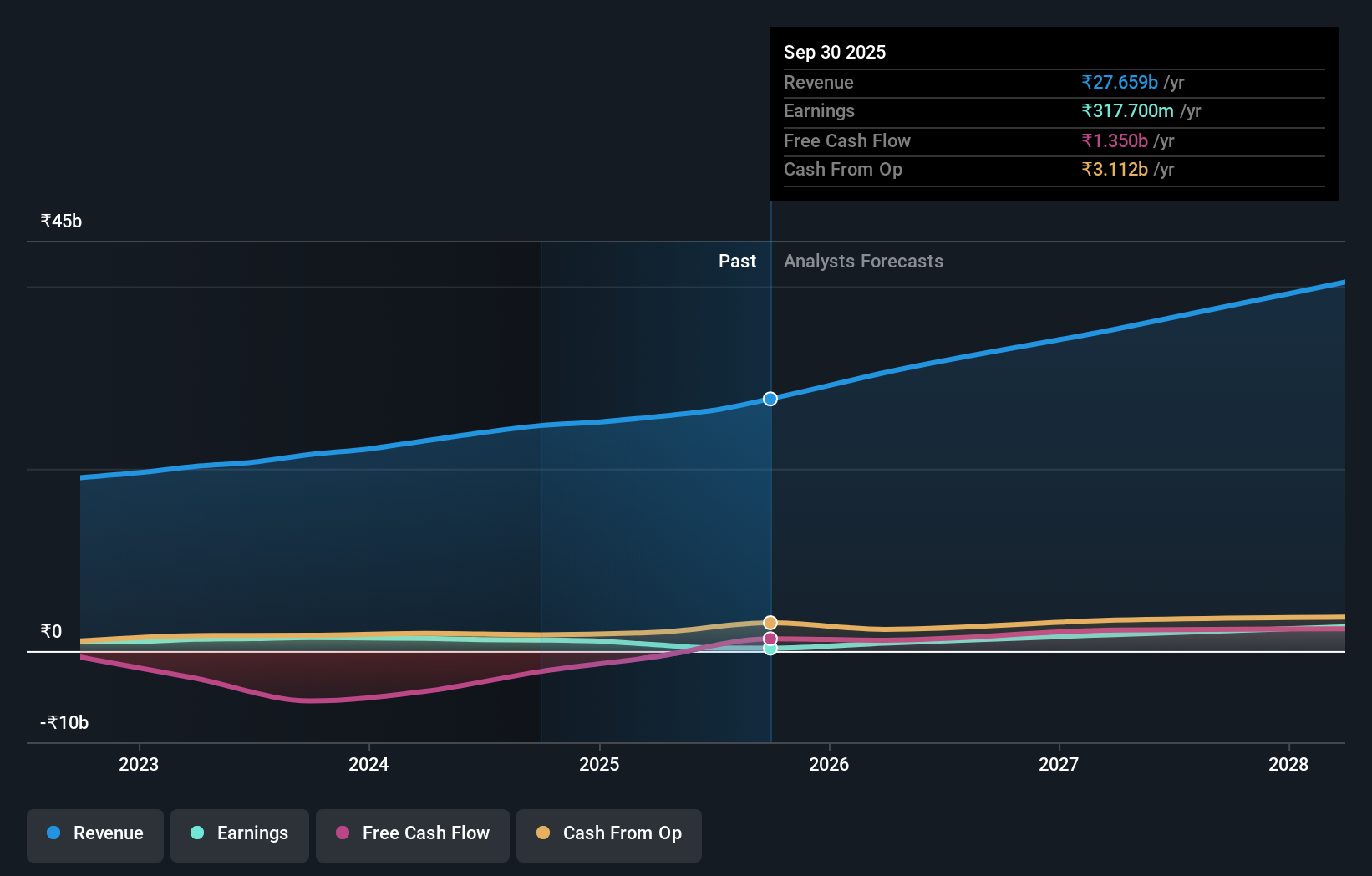

Greenlam Industries (NSEI:GREENLAM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Greenlam Industries Limited is a company that manufactures and sells laminates, decorative veneers, and allied products both in India and internationally, with a market cap of ₹71.17 billion.

Operations: The company's revenue segments include Laminate & Allied Products at ₹21.68 billion, Veneers & Allied Products at ₹2.09 billion, and Plywood & Allied Products at ₹958 million.

Insider Ownership: 24.6%

Greenlam Industries is poised for significant earnings growth, forecasted at 38.9% annually, outpacing the Indian market's 17.9%. Despite this, revenue growth of 19% per year is slower than its earnings trajectory. Recent financials show increased sales and revenue but a decline in net income and EPS compared to the previous year. Insider ownership remains stable with no substantial trading activity reported recently, indicating confidence in future performance despite current financial challenges.

- Take a closer look at Greenlam Industries' potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Greenlam Industries shares in the market.

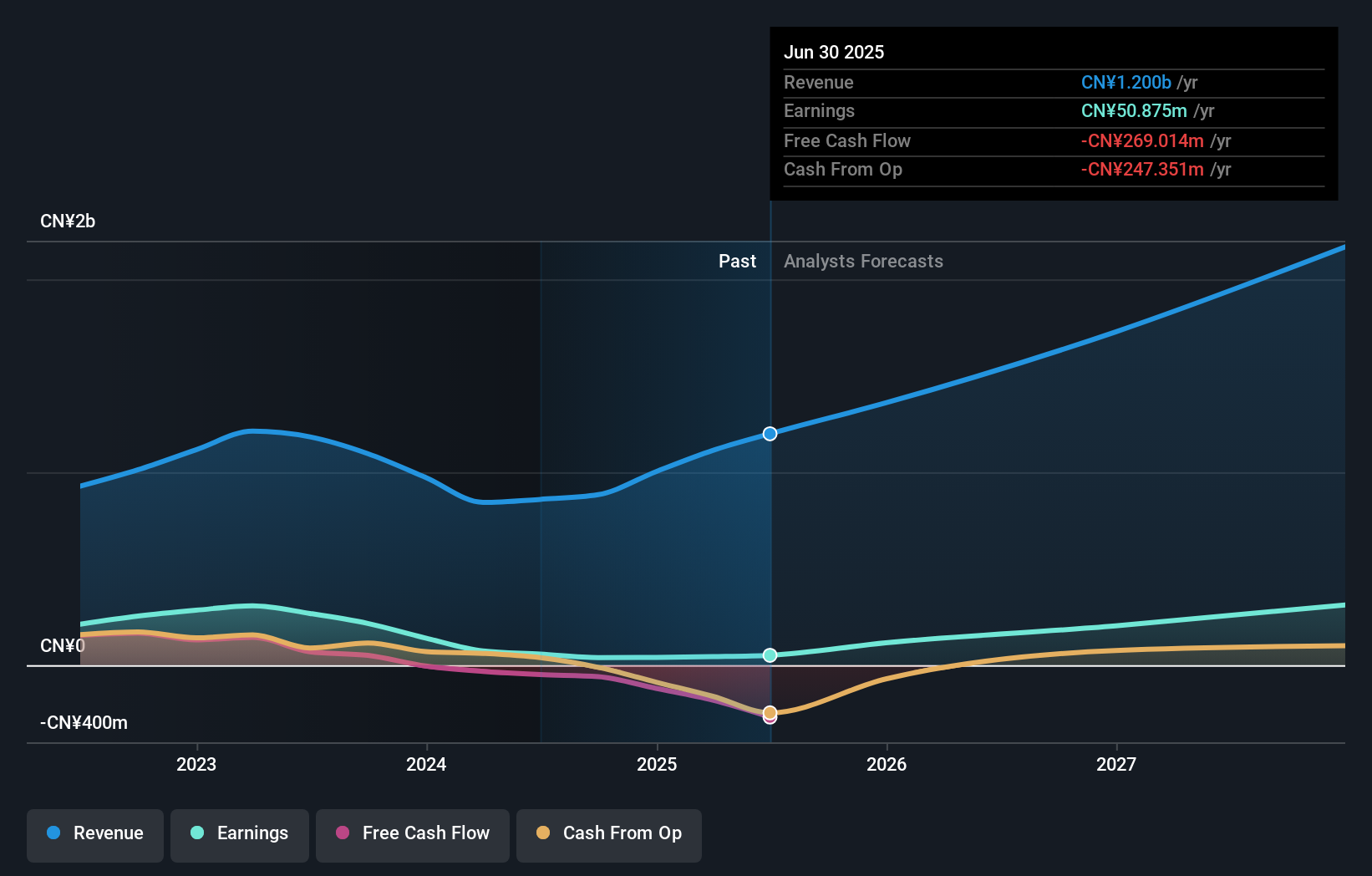

Suzhou Oriental Semiconductor (SHSE:688261)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suzhou Oriental Semiconductor Company Limited is a semiconductor technology company based in China with a market cap of CN¥6.08 billion.

Operations: Suzhou Oriental Semiconductor Company Limited's revenue segments are not provided in the given text.

Insider Ownership: 33.4%

Suzhou Oriental Semiconductor is forecasted to achieve significant earnings growth of 66.2% annually, surpassing the Chinese market's average. Despite this positive outlook, recent financials reveal a decline in sales and net income compared to last year, with sales at CNY 680.52 million and net income at CNY 30.64 million for the first nine months of 2024. The company completed a share buyback program but has shown no substantial insider trading activity recently.

- Delve into the full analysis future growth report here for a deeper understanding of Suzhou Oriental Semiconductor.

- Upon reviewing our latest valuation report, Suzhou Oriental Semiconductor's share price might be too optimistic.

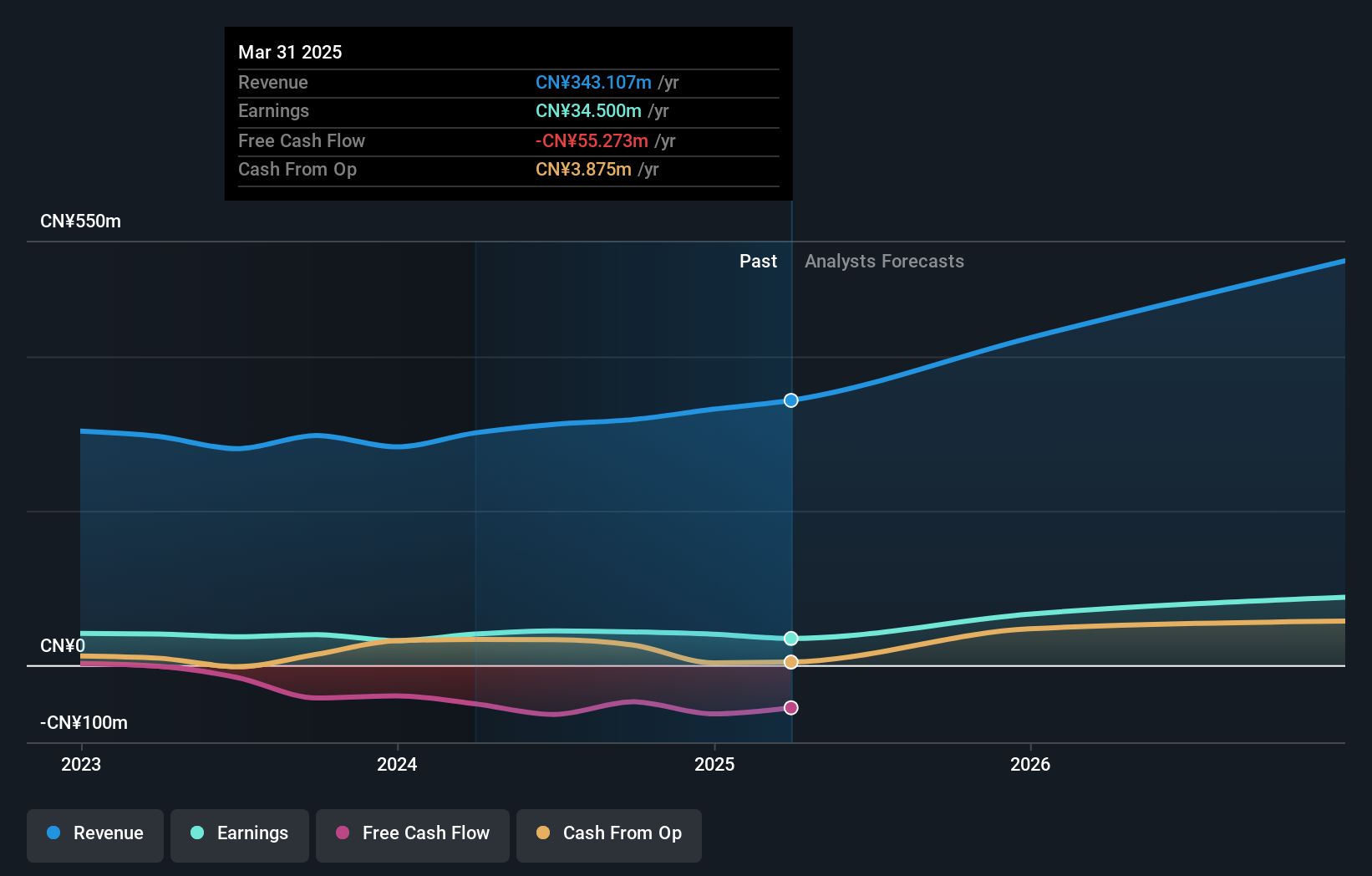

Jiangsu HHCK Advanced MaterialsLtd (SHSE:688535)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu HHCK Advanced Materials Co., Ltd. focuses on the research, development, production, and sale of electronic packaging materials in China, with a market cap of CN¥5.91 billion.

Operations: The company generates revenue from its Specialty Chemicals segment, amounting to CN¥318.30 million.

Insider Ownership: 34.4%

Jiangsu HHCK Advanced Materials has demonstrated strong financial growth, with sales increasing to CNY 239.65 million and net income rising to CNY 34.92 million for the first nine months of 2024. Earnings are forecasted to grow significantly at 31.38% annually, outpacing the Chinese market average. Despite a volatile share price recently, revenue growth is expected to exceed market rates at 22.3% per year, although no substantial insider trading activity has been reported recently.

- Dive into the specifics of Jiangsu HHCK Advanced MaterialsLtd here with our thorough growth forecast report.

- The analysis detailed in our Jiangsu HHCK Advanced MaterialsLtd valuation report hints at an inflated share price compared to its estimated value.

Where To Now?

- Navigate through the entire inventory of 1522 Fast Growing Companies With High Insider Ownership here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688535

Jiangsu HHCK Advanced MaterialsLtd

Engages in the research, development, production, and sale of electronic packaging materials in China.

Flawless balance sheet with high growth potential.