- China

- /

- Semiconductors

- /

- SHSE:603501

The total return for Will Semiconductor (SHSE:603501) investors has risen faster than earnings growth over the last five years

Stock pickers are generally looking for stocks that will outperform the broader market. And the truth is, you can make significant gains if you buy good quality businesses at the right price. To wit, the Will Semiconductor share price has climbed 96% in five years, easily topping the market decline of 1.7% (ignoring dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 2.1%, including dividends.

While this past week has detracted from the company's five-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

See our latest analysis for Will Semiconductor

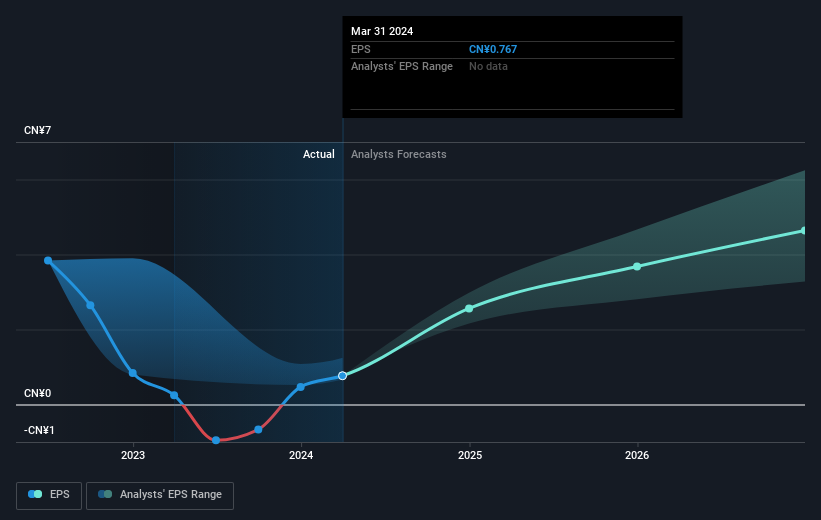

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over half a decade, Will Semiconductor managed to grow its earnings per share at 28% a year. The EPS growth is more impressive than the yearly share price gain of 14% over the same period. So one could conclude that the broader market has become more cautious towards the stock. Having said that, the market is still optimistic, given the P/E ratio of 134.83.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Will Semiconductor has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

A Different Perspective

We're pleased to report that Will Semiconductor shareholders have received a total shareholder return of 2.1% over one year. That's including the dividend. However, the TSR over five years, coming in at 15% per year, is even more impressive. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

But note: Will Semiconductor may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Will Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603501

Will Semiconductor

A semiconductor design company, provides sensor solutions, analog solutions and touch screen and display solutions.

Flawless balance sheet with reasonable growth potential.