While shareholders of Northeast Pharmaceutical Group (SZSE:000597) are in the red over the last year, underlying earnings have actually grown

Northeast Pharmaceutical Group Co., Ltd. (SZSE:000597) shareholders should be happy to see the share price up 14% in the last quarter. But that doesn't alter the fact that returns have lagged the market over the last year. Indeed, shareholders received returns of 14% whereas the market is down , returning (-14%) over the last year.

On a more encouraging note the company has added CN¥372m to its market cap in just the last 7 days, so let's see if we can determine what's driven the one-year loss for shareholders.

See our latest analysis for Northeast Pharmaceutical Group

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the unfortunate twelve months during which the Northeast Pharmaceutical Group share price fell, it actually saw its earnings per share (EPS) improve by 3.2%. It could be that the share price was previously over-hyped.

It seems quite likely that the market was expecting higher growth from the stock. But other metrics might shed some light on why the share price is down.

In contrast, the 11% drop in revenue is a real concern. Many investors see falling revenue as a likely precursor to lower earnings, so this could well explain the weak share price.

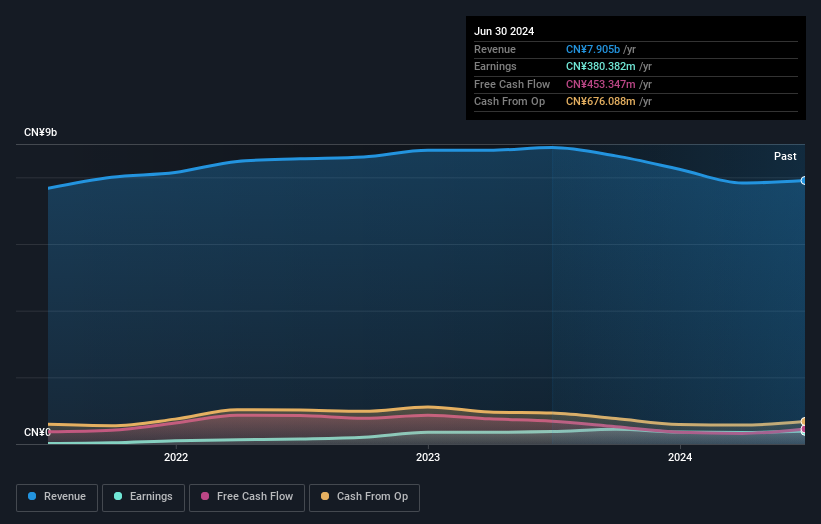

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Northeast Pharmaceutical Group shareholders are down 14% over twelve months (even including dividends), which isn't far from the market return of -14%. So last year was actually even worse than the last five years, which cost shareholders 2% per year. Weak performance over the long term usually destroys market confidence in a stock, but bargain hunters may want to take a closer look for signs of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Northeast Pharmaceutical Group better, we need to consider many other factors. For example, we've discovered 3 warning signs for Northeast Pharmaceutical Group that you should be aware of before investing here.

Of course Northeast Pharmaceutical Group may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Northeast Pharmaceutical Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000597

Northeast Pharmaceutical Group

Engages in the chemical raw materials, chemical preparations, pharmaceutical, pharmaceutical engineering, biomedicine, and other businesses in China.

Flawless balance sheet and fair value.