Amidst a backdrop of global market volatility and concerns over elevated valuations, Asian tech stocks have garnered attention as investors seek opportunities in regions showing resilience. As the U.S.-China trade tensions ease, enhancing risk appetite, the focus shifts to identifying high-growth tech companies in Asia that can navigate current economic challenges and capitalize on emerging trends.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 34.13% | 39.54% | ★★★★★★ |

| Suzhou TFC Optical Communication | 34.08% | 35.52% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Zhongji Innolight | 30.75% | 31.56% | ★★★★★★ |

| ASROCK Incorporation | 29.29% | 31.08% | ★★★★★★ |

| Fositek | 36.92% | 48.42% | ★★★★★★ |

| Gold Circuit Electronics | 26.88% | 35.34% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| ALTEOGEN | 56.27% | 65.14% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

Shanghai OPM Biosciences (SHSE:688293)

Simply Wall St Growth Rating: ★★★★☆☆

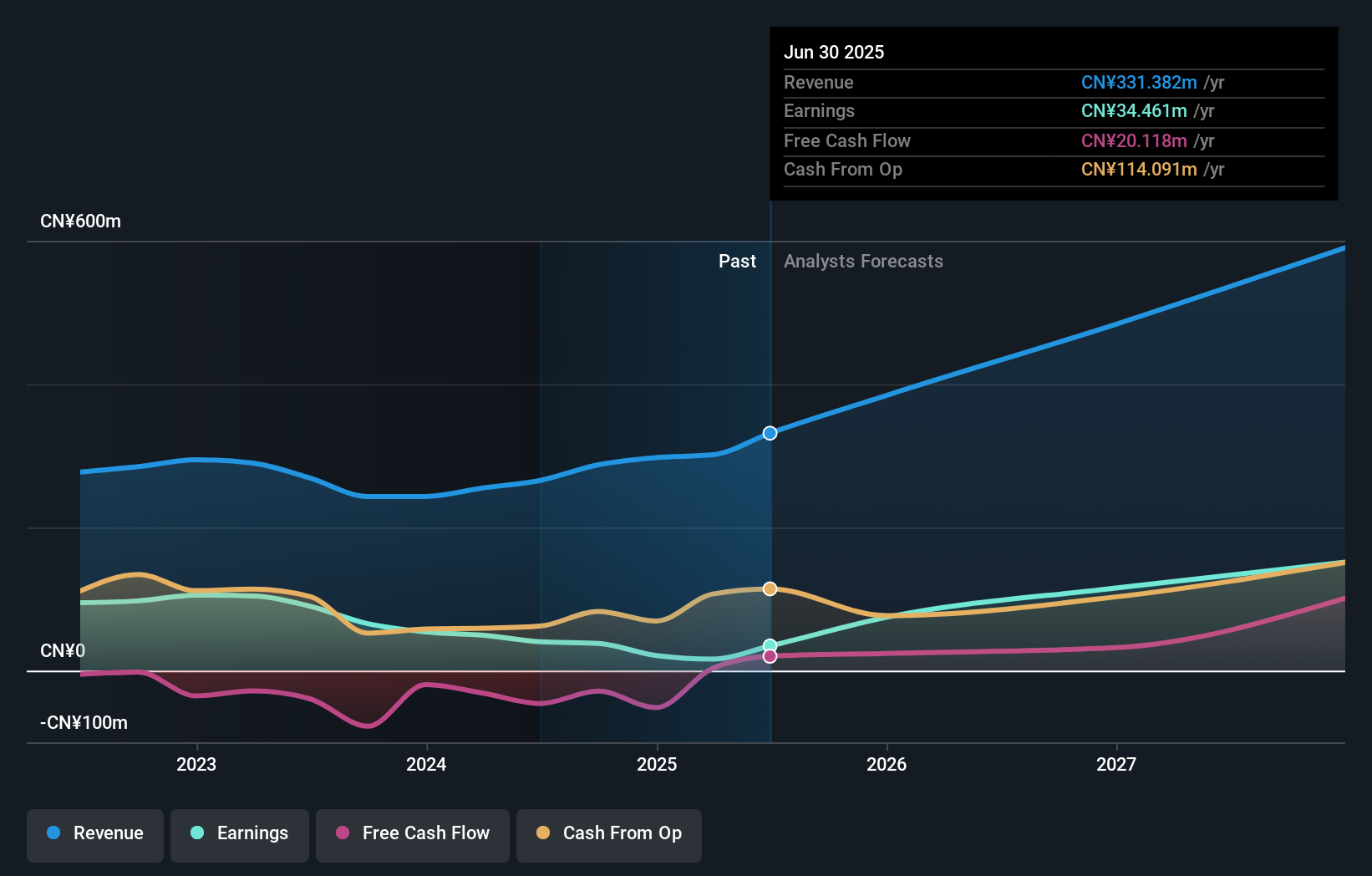

Overview: Shanghai OPM Biosciences Co., Ltd. operates in the biotechnology industry by offering cell culture media and CDMO services both within China and internationally, with a market cap of CN¥6.74 billion.

Operations: The company generates revenue through its cell culture media and CDMO services. With a market cap of CN¥6.74 billion, these offerings cater to both domestic and international markets in the biotechnology sector.

Shanghai OPM Biosciences has demonstrated robust financial performance with a notable increase in sales to CNY 271.53 million from CNY 215.86 million year-over-year, and a surge in net income to CNY 49.43 million from CNY 27.23 million, reflecting an earnings growth of 46.5% annually. This growth trajectory surpasses the broader Chinese market's average, positioning the company well within the high-growth biotech sector in Asia despite its volatile share price over the past three months. With earnings projected to expand significantly over the next three years and revenue growth outpacing the market at 19.9% annually, Shanghai OPM Biosciences is carving a niche for itself by leveraging cutting-edge biotechnologies that address critical health challenges, setting a promising outlook for its future endeavors in this dynamic industry landscape.

eWeLLLtd (TSE:5038)

Simply Wall St Growth Rating: ★★★★★★

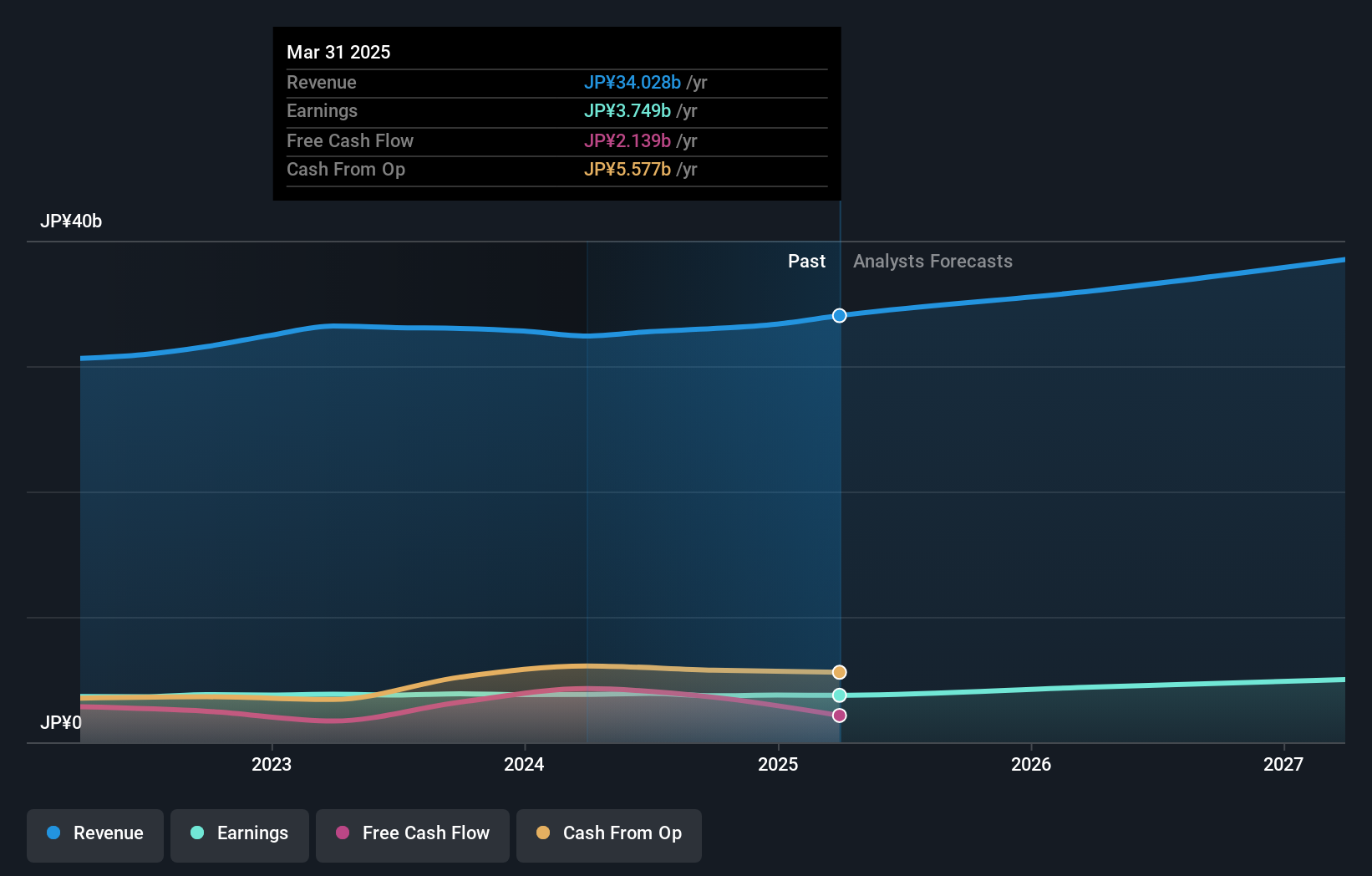

Overview: eWeLL Co., Ltd. specializes in providing cloud-based business support services for visiting nursing stations across Japan, with a market capitalization of ¥44.16 billion.

Operations: eWeLL Ltd. focuses on developing cloud services tailored for the operational needs of visiting nursing stations in Japan. The company leverages its expertise to streamline workflows and enhance efficiency in the healthcare sector.

eWeLLtd, recently added to the S&P Global BMI Index, is carving out a significant presence in the tech sector with a remarkable 25% annual revenue growth and 24.9% expected earnings increase per year. This performance is substantially above the Japanese market's average of 4.5% and 7.9%, respectively. The company's strategic focus on innovation is evident from its R&D investments, which have been pivotal in maintaining its competitive edge in a rapidly evolving industry landscape. With recent earnings calls highlighting sustained financial health and an aggressive growth trajectory, eWeLLtd stands out for its robust operational strategies and market adaptation capabilities, promising an optimistic future amidst high industry competition.

- Click here to discover the nuances of eWeLLLtd with our detailed analytical health report.

Gain insights into eWeLLLtd's past trends and performance with our Past report.

Shibaura ElectronicsLtd (TSE:6957)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shibaura Electronics Co., Ltd. specializes in the production and sale of thermistor elements and related products, with a market capitalization of ¥106.88 billion.

Operations: The company generates revenue primarily from the sale of thermistor elements and related products, with significant contributions from Japan and Asia, amounting to ¥26.38 billion and ¥19.19 billion respectively. The European and U.S. markets contribute smaller portions, at ¥989 million and ¥1.07 billion respectively.

Shibaura ElectronicsLtd, amid dynamic shifts in the tech landscape, has demonstrated resilience with a 6.8% annual revenue growth, outpacing the Japanese market average of 4.5%. The company's commitment to innovation is underscored by its R&D spending trends which align closely with its strategic priorities in high-tech sectors. Recently, Shibaura was involved in a significant M&A transaction where Yageo Corporation acquired a major stake for ¥94.9 billion, reflecting confidence in Shibaura’s potential to enhance technological synergies and market reach. This move could potentially accelerate Shibaura's growth trajectory by leveraging Yageo’s resources and networks, signaling promising prospects for its integration into global tech advancements.

- Navigate through the intricacies of Shibaura ElectronicsLtd with our comprehensive health report here.

Understand Shibaura ElectronicsLtd's track record by examining our Past report.

Where To Now?

- Discover the full array of 187 Asian High Growth Tech and AI Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688293

Shanghai OPM Biosciences

Provides cell culture media and CDMO services in China and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives