- China

- /

- Semiconductors

- /

- SHSE:688120

3 Stocks Estimated To Be Trading Below Intrinsic Value By 18.1% To 25.2%

Reviewed by Simply Wall St

As global markets experience broad-based gains with U.S. indexes nearing record highs, investor sentiment is buoyed by strong labor market data and positive home sales reports. In this environment of cautious optimism, identifying undervalued stocks can be a strategic move for investors looking to capitalize on potential growth opportunities.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shenzhen King Explorer Science and Technology (SZSE:002917) | CN¥9.60 | CN¥18.82 | 49% |

| NBT Bancorp (NasdaqGS:NBTB) | US$50.08 | US$99.93 | 49.9% |

| HangzhouS MedTech (SHSE:688581) | CN¥63.94 | CN¥124.16 | 48.5% |

| Nordic Waterproofing Holding (OM:NWG) | SEK172.40 | SEK344.27 | 49.9% |

| Insyde Software (TPEX:6231) | NT$466.50 | NT$923.50 | 49.5% |

| Power Root Berhad (KLSE:PWROOT) | MYR1.46 | MYR2.92 | 50% |

| EnomotoLtd (TSE:6928) | ¥1472.00 | ¥2935.42 | 49.9% |

| DUG Technology (ASX:DUG) | A$1.67 | A$3.40 | 50.8% |

| Intermedical Care and Lab Hospital (SET:IMH) | THB4.94 | THB9.86 | 49.9% |

| Audinate Group (ASX:AD8) | A$8.83 | A$17.54 | 49.7% |

Let's dive into some prime choices out of the screener.

Hwatsing Technology (SHSE:688120)

Overview: Hwatsing Technology Co., Ltd. is a Chinese company that manufactures semiconductor equipment products and has a market cap of approximately CN¥44.14 billion.

Operations: The company's revenue from semiconductor equipment and services amounts to CN¥3.12 billion.

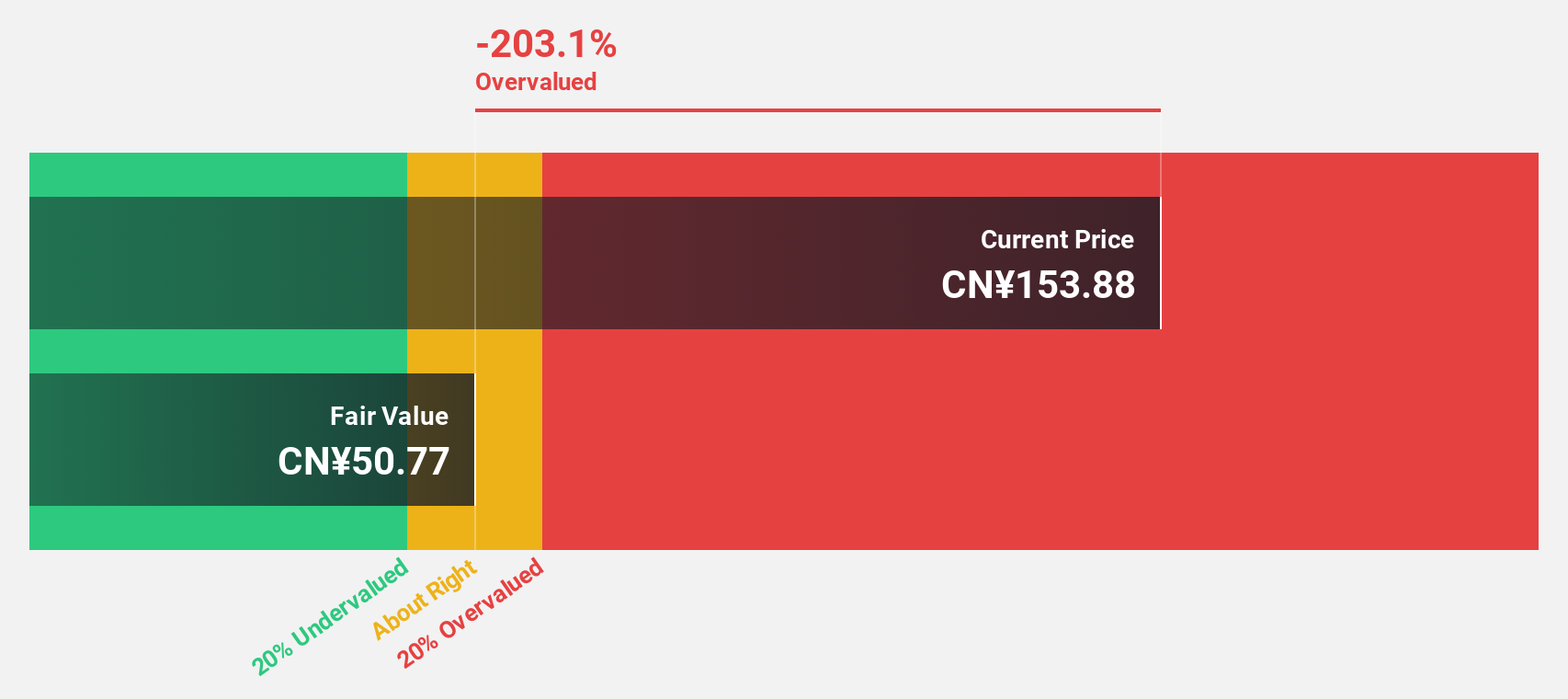

Estimated Discount To Fair Value: 18.1%

Hwatsing Technology is trading at CN¥189.46, below its estimated fair value of CN¥231.38, indicating potential undervaluation based on cash flows. The company reported strong earnings growth with net income rising to CN¥720.7 million for the nine months ending September 2024, compared to CN¥563.93 million a year ago. Earnings are forecast to grow significantly at 27.1% annually, outpacing market expectations despite recent share price volatility and modest buyback activities.

- In light of our recent growth report, it seems possible that Hwatsing Technology's financial performance will exceed current levels.

- Click here to discover the nuances of Hwatsing Technology with our detailed financial health report.

Xiamen Amoytop Biotech (SHSE:688278)

Overview: Xiamen Amoytop Biotech Co., Ltd. is involved in the manufacture, marketing, and sale of recombinant protein drugs in China, with a market cap of CN¥29.92 billion.

Operations: The company's revenue is primarily generated from its biologics segment, amounting to CN¥2.60 billion.

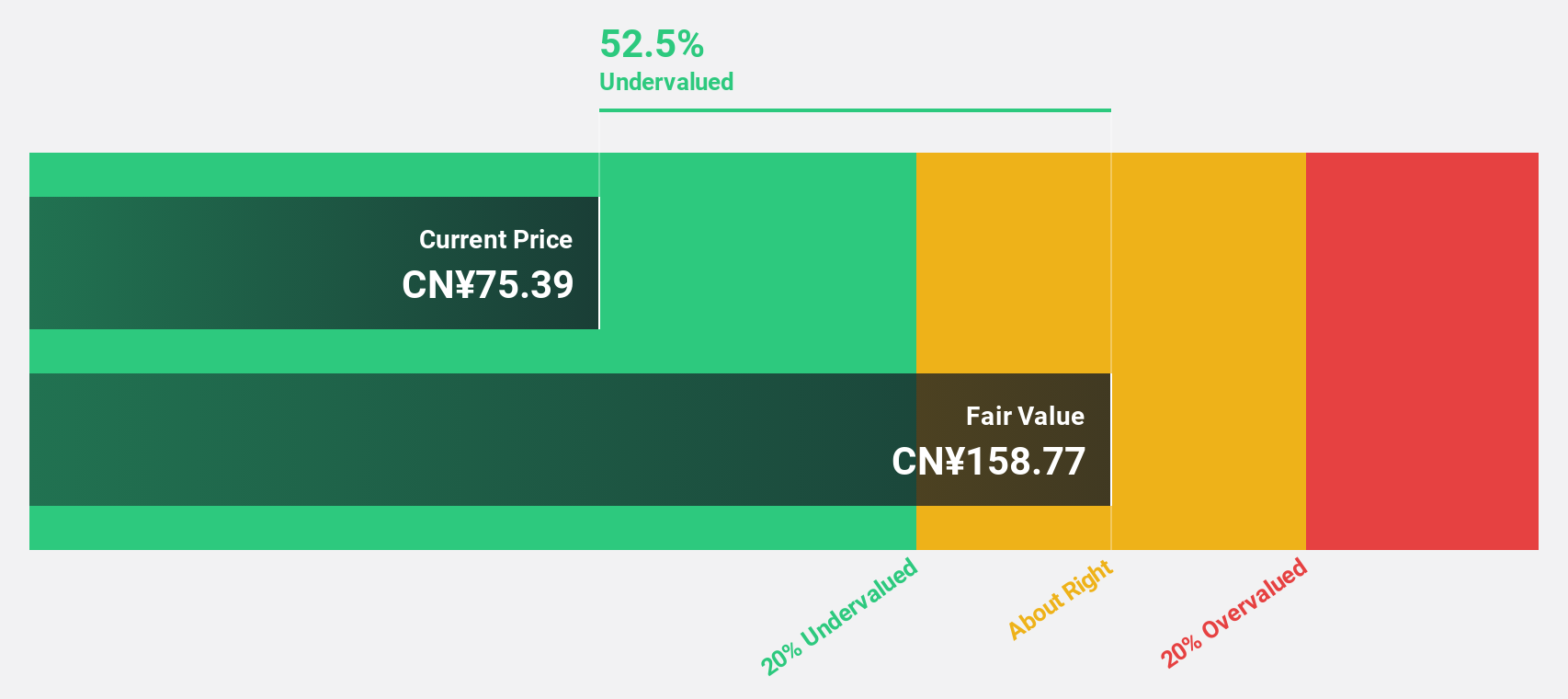

Estimated Discount To Fair Value: 22.7%

Xiamen Amoytop Biotech is trading at CN¥74.5, significantly below its estimated fair value of CN¥96.38, suggesting it may be undervalued based on cash flows. The company reported robust growth with sales reaching CN¥1.95 billion and net income rising to CN¥554.15 million for the nine months ending September 2024, compared to the previous year. Earnings are projected to grow substantially at 32% annually, surpassing market averages despite a low dividend coverage by free cash flows.

- Our growth report here indicates Xiamen Amoytop Biotech may be poised for an improving outlook.

- Navigate through the intricacies of Xiamen Amoytop Biotech with our comprehensive financial health report here.

Geovis TechnologyLtd (SHSE:688568)

Overview: Geovis Technology Co., Ltd focuses on the research, development, and industrialization of digital earth products for various sectors in China, with a market cap of CN¥31.85 billion.

Operations: Geovis Technology Co., Ltd's revenue is derived from its digital earth products tailored for government, enterprise, and public sectors in China.

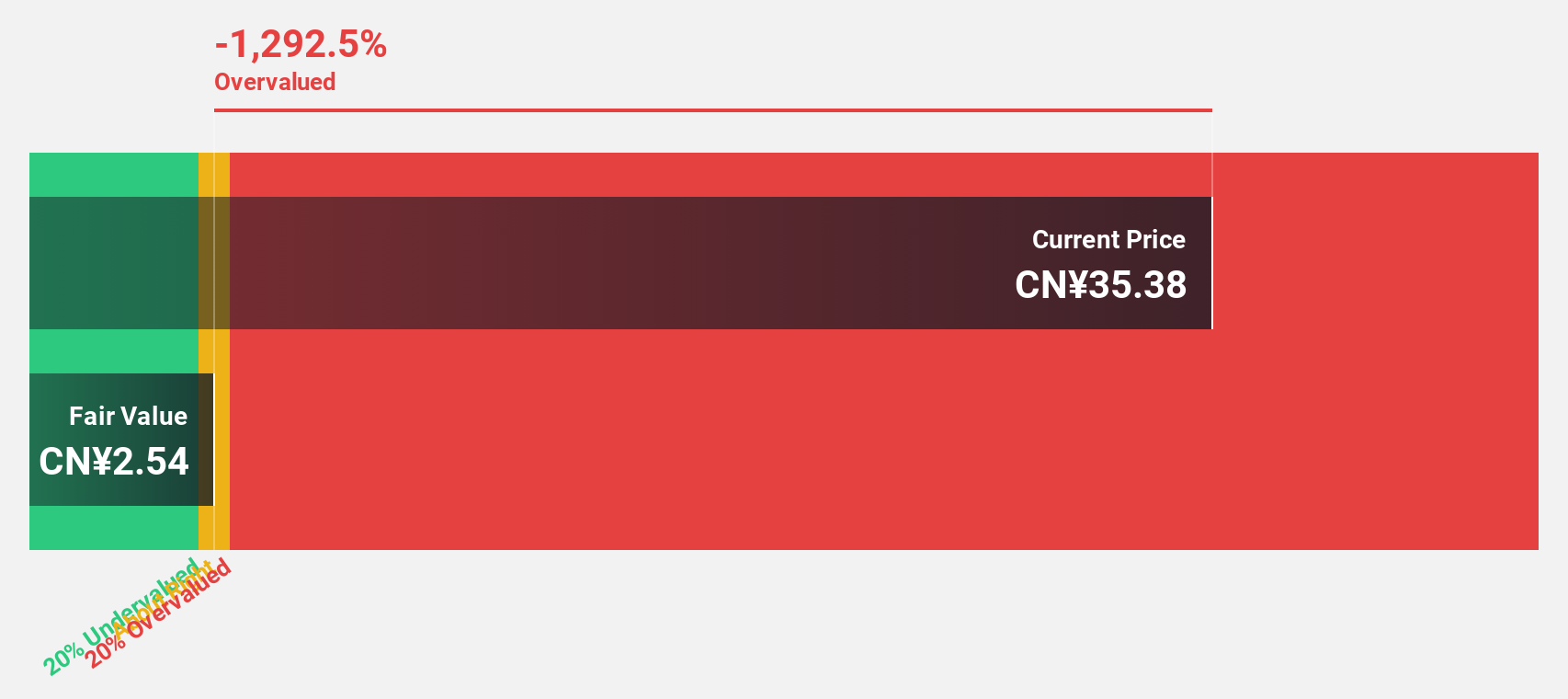

Estimated Discount To Fair Value: 25.2%

Geovis Technology Ltd. is trading at CN¥59.58, well below its estimated fair value of CN¥79.7, indicating potential undervaluation based on cash flows. The company posted strong financial performance with sales of CNY 2 billion and net income of CNY 145.68 million for the nine months ending September 2024, showing significant growth from the previous year. Earnings are forecast to grow substantially at 37% annually, outpacing market averages despite recent share price volatility.

- The analysis detailed in our Geovis TechnologyLtd growth report hints at robust future financial performance.

- Dive into the specifics of Geovis TechnologyLtd here with our thorough financial health report.

Key Takeaways

- Click through to start exploring the rest of the 909 Undervalued Stocks Based On Cash Flows now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hwatsing Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688120

Hwatsing Technology

Manufactures semiconductor equipment products in China.

Flawless balance sheet with high growth potential.