- China

- /

- Electronic Equipment and Components

- /

- SHSE:688183

3 Asian Stocks That Could Be Undervalued By Up To 31%

Reviewed by Simply Wall St

Amidst ongoing global trade tensions and economic uncertainties, Asian markets have shown resilience, with some indices advancing despite challenges such as U.S. tariffs impacting China and Japan's cautious monetary stance. In this environment, identifying undervalued stocks can be key to capitalizing on potential market inefficiencies; a good stock often exhibits strong fundamentals or growth potential that may not yet be fully recognized by the market.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Pegasus (TSE:6262) | ¥467.00 | ¥917.42 | 49.1% |

| Micro-Star International (TWSE:2377) | NT$133.00 | NT$265.36 | 49.9% |

| Chongqing Zaisheng Technology (SHSE:603601) | CN¥3.48 | CN¥6.80 | 48.9% |

| Tongqinglou Catering (SHSE:605108) | CN¥20.85 | CN¥41.25 | 49.5% |

| Rise Consulting Group (TSE:9168) | ¥921.00 | ¥1813.80 | 49.2% |

| Shanghai HIUV New MaterialsLtd (SHSE:688680) | CN¥36.49 | CN¥71.51 | 49% |

| giftee (TSE:4449) | ¥1521.00 | ¥2981.54 | 49% |

| Visional (TSE:4194) | ¥8334.00 | ¥16548.68 | 49.6% |

| Swire Properties (SEHK:1972) | HK$16.44 | HK$32.22 | 49% |

| Bloks Group (SEHK:325) | HK$122.60 | HK$244.78 | 49.9% |

Here's a peek at a few of the choices from the screener.

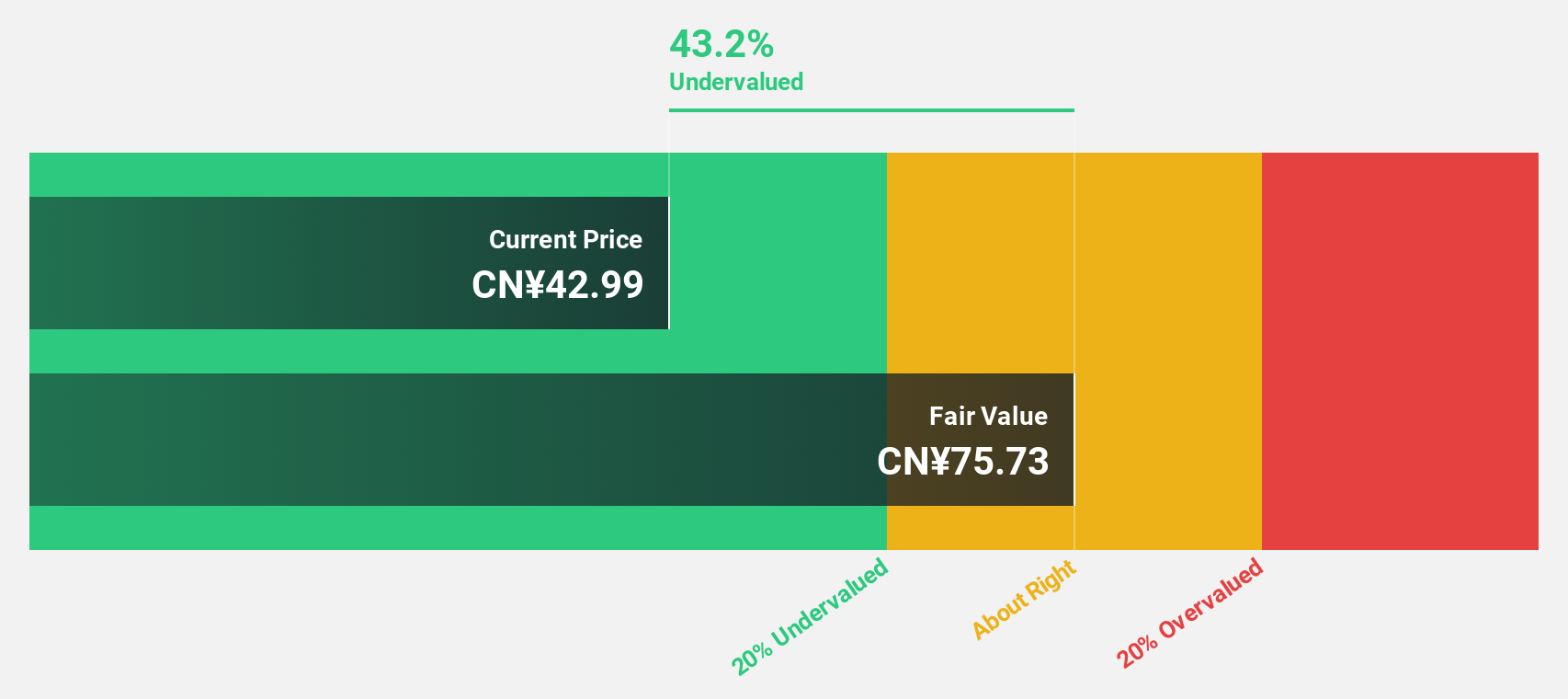

Mabwell (Shanghai) Bioscience (SHSE:688062)

Overview: Mabwell (Shanghai) Bioscience Co., Ltd. is a biopharmaceutical company involved in the research, development, manufacture, and commercialization of biological products both in China and internationally, with a market cap of CN¥9.08 billion.

Operations: The company generates revenue primarily from its Pharmaceuticals segment, which amounted to CN¥199.78 million.

Estimated Discount To Fair Value: 20.6%

Mabwell (Shanghai) Bioscience is trading at CN¥22.72, over 20% below its estimated fair value of CN¥28.61, suggesting potential undervaluation based on cash flows. The company forecasts robust revenue growth of 59.5% annually, outpacing the market average and indicating strong future cash flow potential despite a current net loss of CN¥1.07 billion for 2024. Recent clinical advancements in ADCs underscore Mabwell's strategic focus on oncology innovation, which could enhance long-term profitability prospects.

- The growth report we've compiled suggests that Mabwell (Shanghai) Bioscience's future prospects could be on the up.

- Click here to discover the nuances of Mabwell (Shanghai) Bioscience with our detailed financial health report.

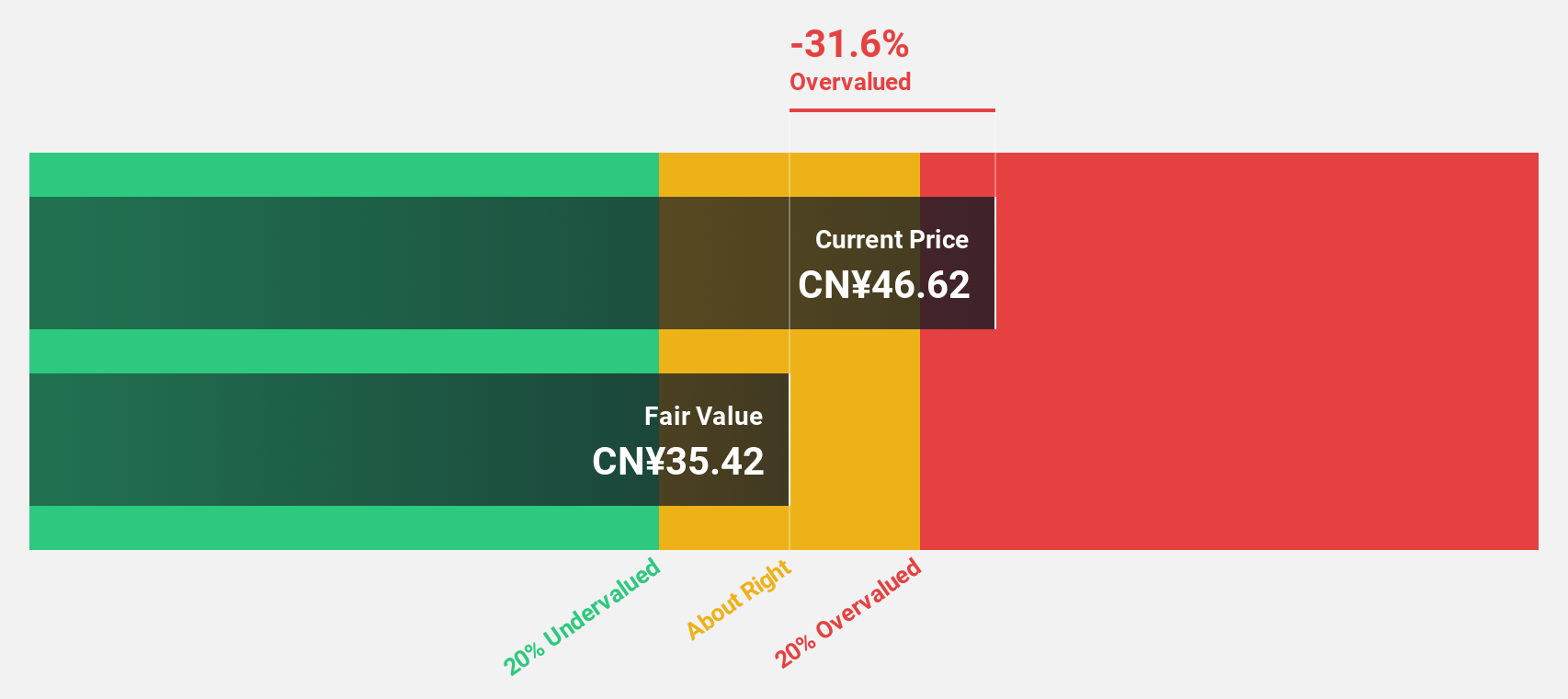

Shengyi Electronics (SHSE:688183)

Overview: Shengyi Electronics Co., Ltd. focuses on the research, development, production, and sales of various printed circuit boards in China with a market cap of CN¥20.20 billion.

Operations: Shengyi Electronics Co., Ltd. generates revenue through its research, development, production, and sales of various printed circuit boards in China.

Estimated Discount To Fair Value: 20.1%

Shengyi Electronics, trading at CN¥24.74, is over 20% below its estimated fair value of CN¥30.95, reflecting potential undervaluation based on cash flows. The company recently became profitable with a net income of CN¥331.97 million for 2024, reversing the previous year's loss. Forecasts indicate earnings growth significantly outpacing the market at nearly 40% annually, despite revenue growth being slower than 20%. Recent inclusion in the FTSE All-World Index highlights its growing market presence.

- Insights from our recent growth report point to a promising forecast for Shengyi Electronics' business outlook.

- Dive into the specifics of Shengyi Electronics here with our thorough financial health report.

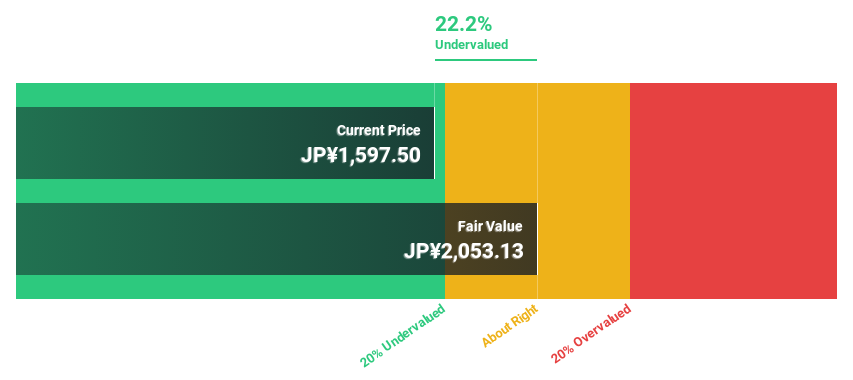

Chugin Financial GroupInc (TSE:5832)

Overview: Chugin Financial Group Inc., with a market cap of ¥275.79 billion, operates through its subsidiary The Chugoku Bank, Limited to offer a range of financial services to both corporate and individual clients in Japan.

Operations: Chugin Financial Group Inc. generates revenue through its subsidiary, The Chugoku Bank, Limited, by offering diverse financial services to both corporate and individual customers in Japan.

Estimated Discount To Fair Value: 31%

Chugin Financial Group, Inc. is trading at ¥1,541.5, over 30% below its estimated fair value of ¥2,234.95, indicating potential undervaluation based on cash flows. The company projects ordinary revenues of ¥212 billion and profit attributable to owners of parent at ¥25 billion for the fiscal year ending March 31, 2025. Despite a highly volatile share price recently and a low return on equity forecast (6.7%), revenue growth is expected to outpace the Japanese market significantly at 22.6% annually.

- The analysis detailed in our Chugin Financial GroupInc growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Chugin Financial GroupInc's balance sheet health report.

Key Takeaways

- Access the full spectrum of 272 Undervalued Asian Stocks Based On Cash Flows by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688183

Shengyi Electronics

Engages in the research and development, production, and sales of various printed circuit boards in China.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives