- China

- /

- Entertainment

- /

- SZSE:300467

Undiscovered Gems With Potential To Explore In November 2024

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, small-cap stocks have seen a notable surge, with the Russell 2000 Index leading gains despite not reaching record highs. This environment of potential economic growth and regulatory changes highlights the importance of identifying stocks that are well-positioned to capitalize on these shifts, offering intriguing opportunities for investors seeking undiscovered gems in November 2024.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 86.64% | 24.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Linc | NA | 12.52% | 16.39% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 16.56% | 6.15% | 10.19% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Aurisco PharmaceuticalLtd (SHSE:605116)

Simply Wall St Value Rating: ★★★★★☆

Overview: Aurisco Pharmaceutical Co., Ltd. is involved in the research, manufacturing, and marketing of pharmaceutical intermediates, specialty active pharmaceutical ingredients (APIs), and formulations for the global pharmaceutical market, with a market cap of CN¥9.26 billion.

Operations: Aurisco generates revenue primarily from pharmaceutical intermediates, specialty APIs, and formulations. The company's financials reveal a focus on optimizing production costs to enhance profitability. Notably, the net profit margin demonstrates significant variation across reporting periods.

Aurisco Pharma, a small player in the pharmaceutical sector, is showing promising signs with its earnings growth of 32.5% last year, outpacing the industry average. The company’s price-to-earnings ratio stands at 27.2x, below the CN market average of 36.3x, indicating potential value for investors. Recent financials reveal revenue for the first nine months reached CNY 1.09 billion (approx US$148 million), up from CNY 922 million (approx US$125 million) last year, while net income increased to CNY 284 million (approx US$39 million). Despite a debt-to-equity rise to 37%, it maintains more cash than total debt and high-quality non-cash earnings suggest robust financial health moving forward.

Sichuan Xunyou Network Technology (SZSE:300467)

Simply Wall St Value Rating: ★★★★★★

Overview: Sichuan Xunyou Network Technology Co., Ltd. operates in the technology sector and has a market capitalization of CN¥3.53 billion.

Operations: Xunyou Network Technology generates revenue primarily from its technology-related services. The company's financials reveal a net profit margin trend worth noting, though specific figures are not available in the provided data.

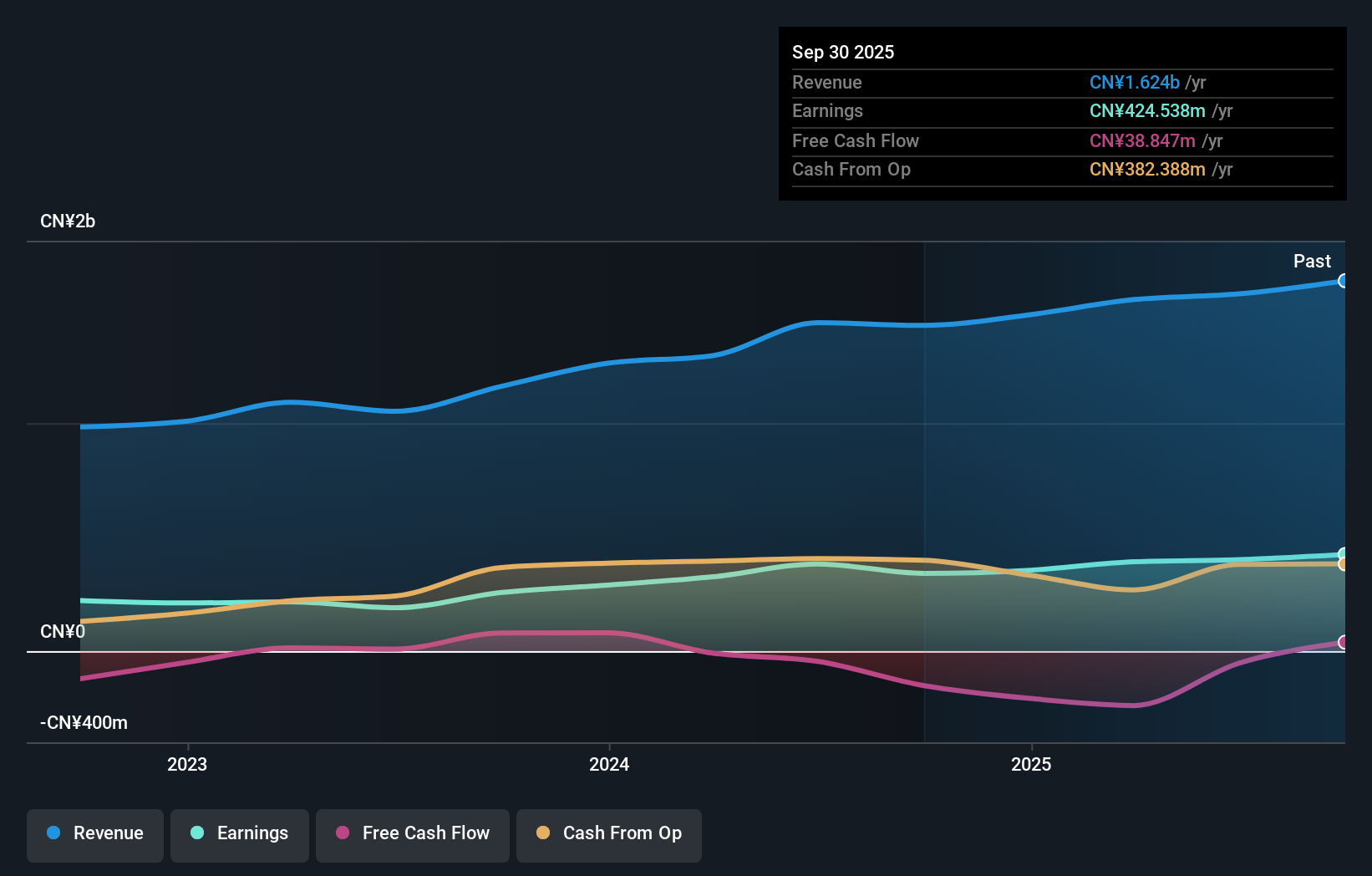

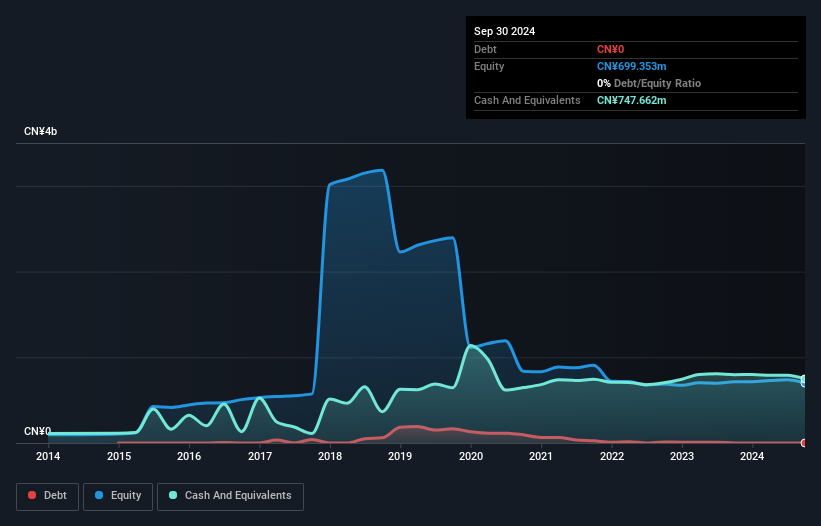

Sichuan Xunyou Network Technology, a smaller player in the tech scene, has shown impressive earnings growth of 211.8% over the past year, outpacing its industry peers. Despite this growth, recent figures indicate a dip in sales to CNY 228.32 million from CNY 287.9 million and net income to CNY 22.06 million compared to CNY 29.98 million year-on-year for the nine months ending September 2024. The company is debt-free now, contrasting with a debt-to-equity ratio of 6.9% five years ago, suggesting improved financial stability despite challenges in revenue streams recently.

- Take a closer look at Sichuan Xunyou Network Technology's potential here in our health report.

Learn about Sichuan Xunyou Network Technology's historical performance.

Sublime China Information (SZSE:301299)

Simply Wall St Value Rating: ★★★★★★

Overview: Sublime China Information Co., Ltd. offers information and consulting services in China, with a market capitalization of CN¥3.44 billion.

Operations: Sublime China Information generates revenue primarily from its online financial information services, amounting to CN¥290.77 million.

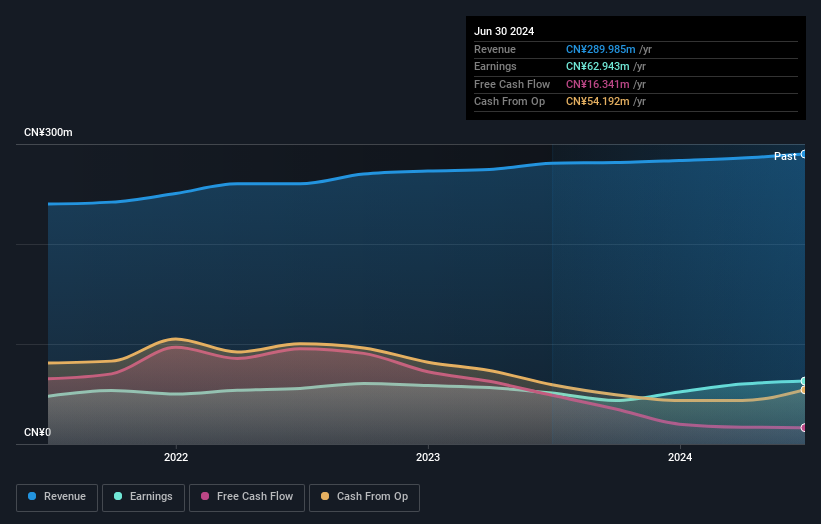

Sublime China Information, a nimble player in the market, has demonstrated impressive financial health with earnings growing by 47.9% over the past year, outpacing its industry peers. The company remains debt-free for five years and boasts high-quality earnings, highlighting robust operational efficiency. Recent financials show revenue of CNY 219.07 million for nine months ending September 2024, up from CNY 211.84 million previously; net income rose to CNY 52.64 million from CNY 40.39 million last year. Despite a volatile share price recently, the company's solid performance and declared dividends suggest stable prospects ahead.

Summing It All Up

- Delve into our full catalog of 4673 Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300467

Sichuan Xunyou Network Technology

Sichuan Xunyou Network Technology Co., Ltd.

Flawless balance sheet with solid track record.