Huanxi Media Group Leads These 3 Asian Penny Stocks To Consider

Reviewed by Simply Wall St

Amidst a backdrop of easing U.S.-China trade tensions and a cautiously optimistic sentiment in Chinese markets, investors are increasingly looking towards Asia for new opportunities. Penny stocks, though often associated with speculative trading, remain an intriguing investment area due to their potential for unexpected growth and value. In this article, we explore three Asian penny stocks that exhibit strong financial foundations and the possibility of uncovering hidden value in today's market conditions.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.84 | HK$2.31B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.52 | HK$940.15M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.54 | HK$2.11B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.13 | SGD457.98M | ✅ 4 ⚠️ 2 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.94 | THB2.96B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.10 | SGD52.35M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.39 | SGD13.34B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$1.05 | HK$2.82B | ✅ 4 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.07 | NZ$152.31M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.44 | THB8.97B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 940 stocks from our Asian Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

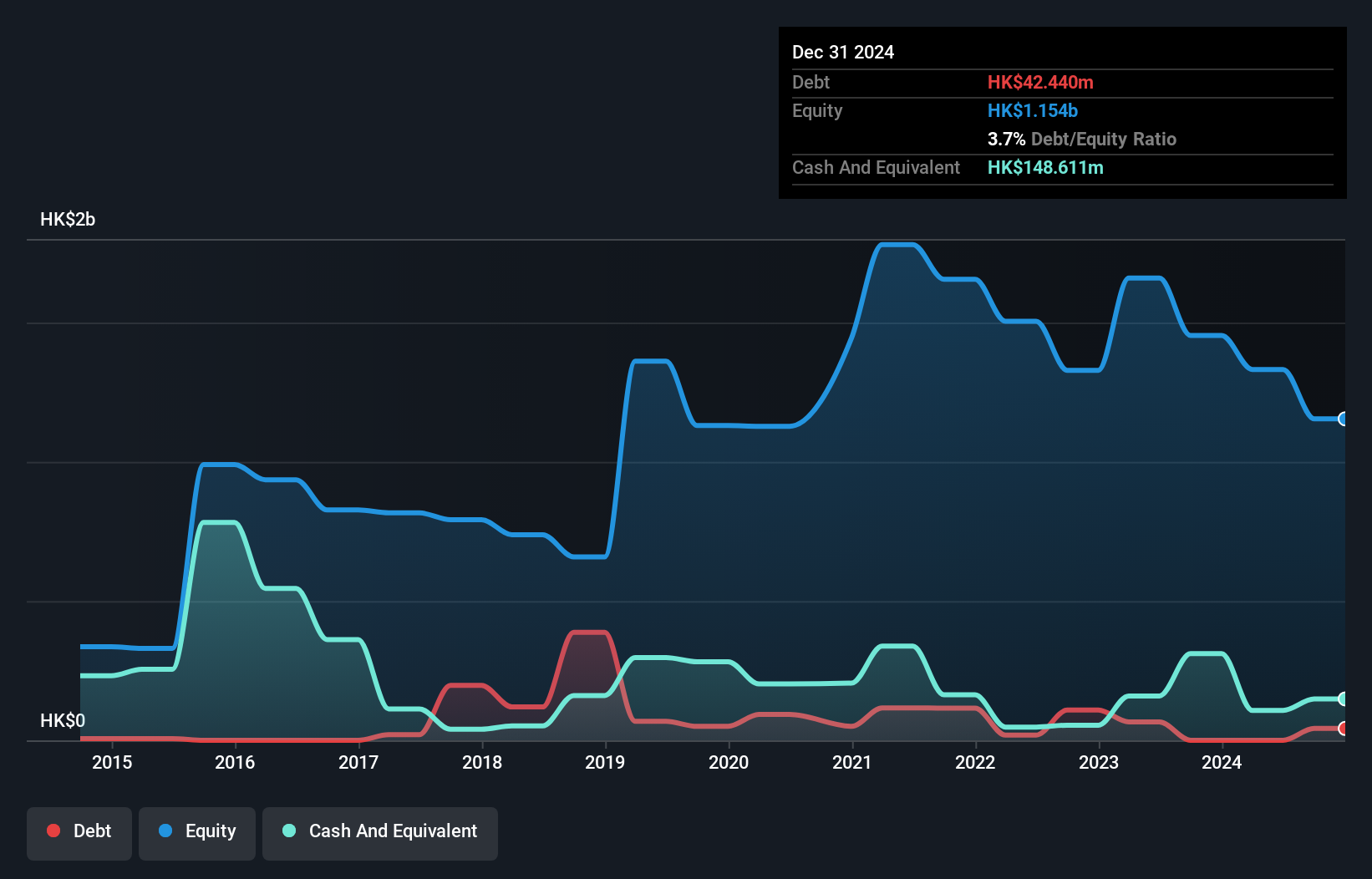

Huanxi Media Group (SEHK:1003)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Huanxi Media Group Limited is an investment holding company involved in media and entertainment operations in the People’s Republic of China and Hong Kong, with a market cap of HK$1.41 billion.

Operations: The company's revenue is primarily derived from its investment in film and TV programmes rights, totaling HK$98.91 million.

Market Cap: HK$1.41B

Huanxi Media Group Limited, with a market cap of HK$1.41 billion, operates in the media and entertainment sector across China and Hong Kong. Despite being unprofitable with a net loss of HK$102.23 million for the half year ended June 2025, it has shown revenue growth to HK$179.94 million from last year's figures. The company benefits from a seasoned board and management team, while its short-term assets exceed both short- and long-term liabilities significantly. However, it faces challenges like high share price volatility and less than one year of cash runway based on current free cash flow trends.

- Click here and access our complete financial health analysis report to understand the dynamics of Huanxi Media Group.

- Explore Huanxi Media Group's analyst forecasts in our growth report.

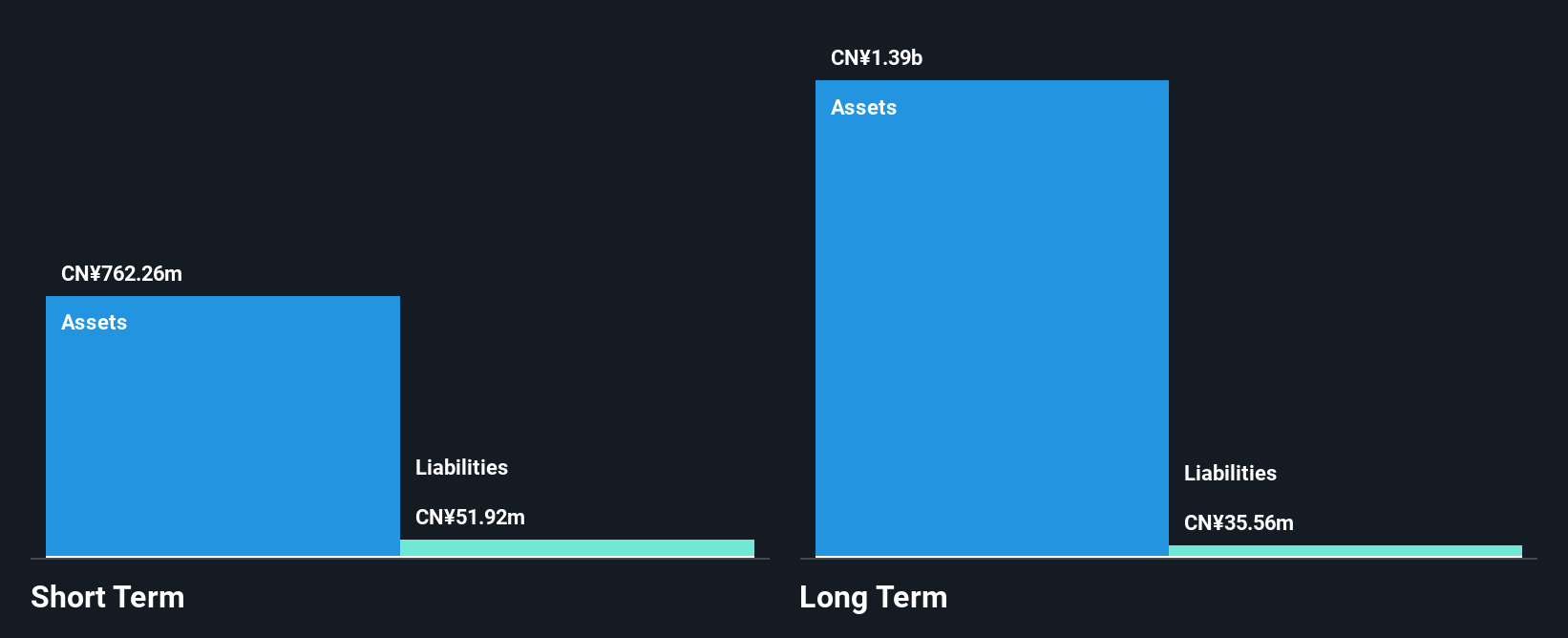

Jiangsu Jiangnan High Polymer FiberLtd (SHSE:600527)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Jiangsu Jiangnan High Polymer Fiber Co., Ltd is involved in the production and sale of polyester tops and composite staple fibers both in China and internationally, with a market capitalization of CN¥4.13 billion.

Operations: The company has not reported specific revenue segments.

Market Cap: CN¥4.13B

Jiangsu Jiangnan High Polymer Fiber Co., Ltd, with a market cap of CN¥4.13 billion, reported sales of CN¥404.46 million for the nine months ending September 2025, reflecting a slight decline from the previous year. Despite stable weekly volatility and more cash than total debt, the company's earnings have been negatively impacted by large one-off gains and declining profit margins. The board lacks experience with an average tenure under three years, while its return on equity remains low at 1.4%. Although trading below estimated fair value and having strong short-term asset coverage over liabilities, earnings growth has been negative recently.

- Take a closer look at Jiangsu Jiangnan High Polymer FiberLtd's potential here in our financial health report.

- Assess Jiangsu Jiangnan High Polymer FiberLtd's previous results with our detailed historical performance reports.

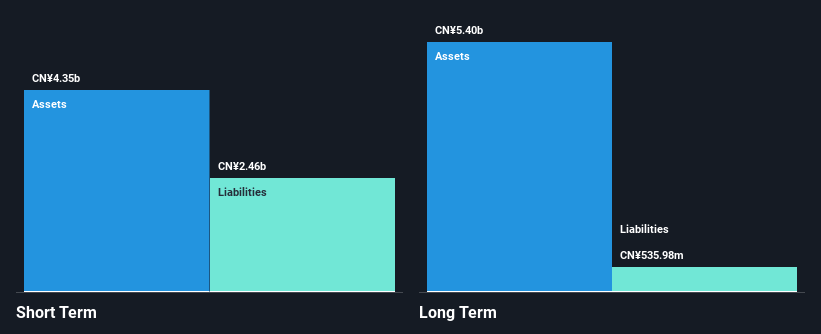

Zhejiang CONBA PharmaceuticalLtd (SHSE:600572)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhejiang CONBA Pharmaceutical Co., Ltd. focuses on the research, development, production, and sales of pharmaceuticals and health products in mainland China with a market cap of CN¥12.12 billion.

Operations: The company generates revenue primarily from its operations in China, amounting to CN¥6.58 billion.

Market Cap: CN¥12.12B

Zhejiang CONBA Pharmaceutical Co., Ltd. demonstrates robust financial health with a market cap of CN¥12.12 billion and revenue of CN¥6.58 billion, primarily from its Chinese operations. The company's earnings growth over the past year (41.3%) significantly outpaced the industry average, supported by improved net profit margins (10.5% up from 7.5%). While trading below estimated fair value and maintaining strong cash flow coverage for debt, recent financials reveal stable revenue growth and increased net income to CN¥584 million for nine months ending September 2025, despite large one-off gains affecting quality earnings perception and an inexperienced board with short tenures.

- Click here to discover the nuances of Zhejiang CONBA PharmaceuticalLtd with our detailed analytical financial health report.

- Evaluate Zhejiang CONBA PharmaceuticalLtd's historical performance by accessing our past performance report.

Taking Advantage

- Get an in-depth perspective on all 940 Asian Penny Stocks by using our screener here.

- Curious About Other Options? These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang CONBA PharmaceuticalLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600572

Zhejiang CONBA PharmaceuticalLtd

Engages in the research, development, production, and sales of pharmaceuticals and health products in mainland China.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives