- China

- /

- Entertainment

- /

- SZSE:002739

Top Growth Stocks With High Insider Ownership For September 2024

Reviewed by Simply Wall St

As global markets celebrate the Federal Reserve's first rate cut in over four years, U.S. stocks have surged to new highs, reflecting investor optimism about a prolonged period of monetary easing. This favorable economic backdrop makes it an opportune time to explore growth companies with high insider ownership, as these firms often demonstrate strong alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 33.7% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.5% | 52.1% |

| Yggdrazil Group (SET:YGG) | 12% | 85.5% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Here we highlight a subset of our preferred stocks from the screener.

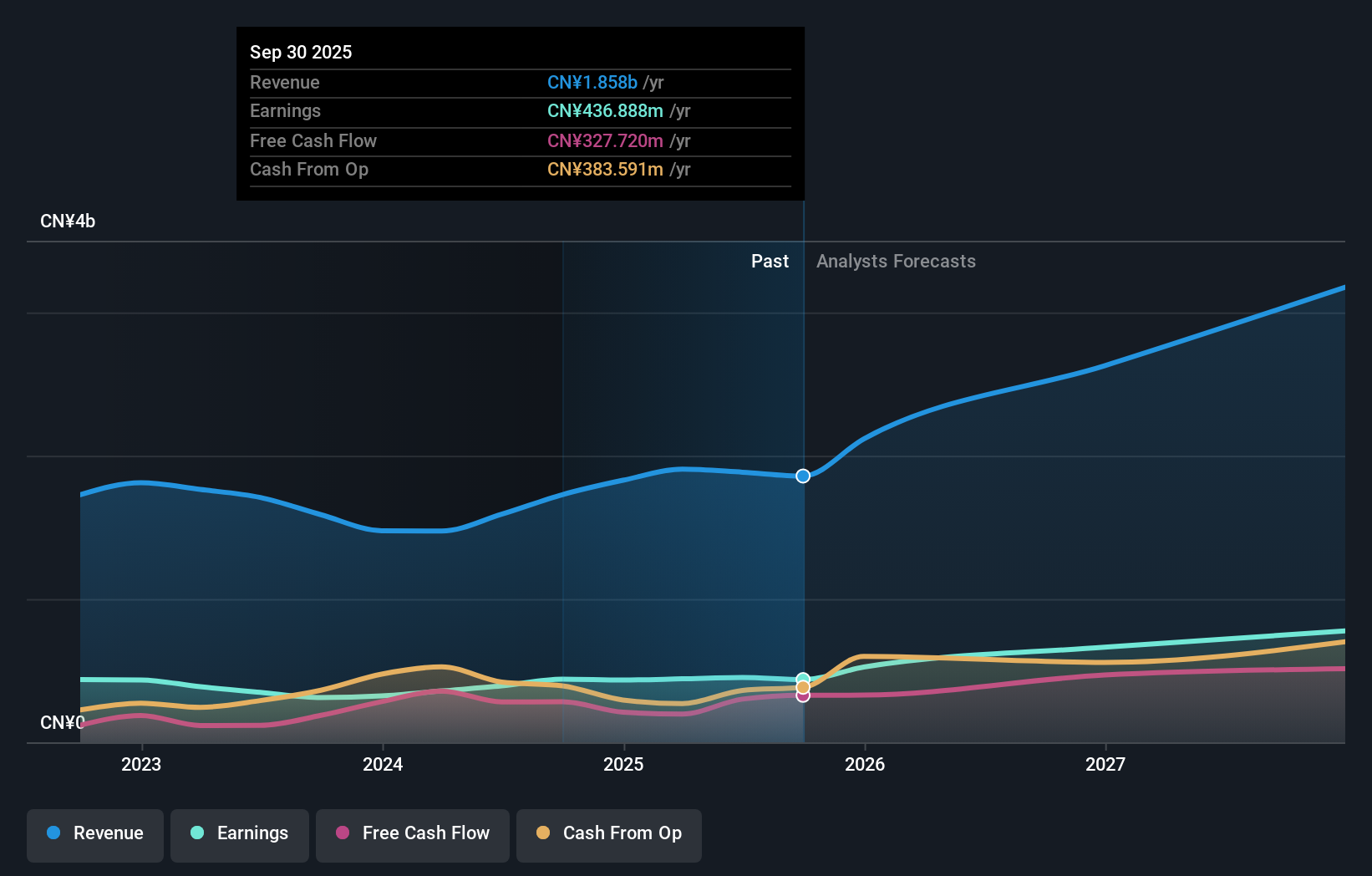

Wuxi NCE PowerLtd (SHSE:605111)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wuxi NCE Power Co., Ltd. focuses on the research, development, and marketing of semiconductor power devices in China, with a market cap of CN¥12.26 billion.

Operations: The company generates revenue primarily from electronic components, amounting to CN¥1.59 billion.

Insider Ownership: 24.5%

Revenue Growth Forecast: 16.4% p.a.

Wuxi NCE Power Ltd. shows strong growth potential with a forecasted annual earnings increase of 23.81%, outpacing the CN market's 22.9%. Recent half-year results reflect robust performance, with revenue rising to CNY 873.49 million and net income reaching CNY 217.65 million, up from last year. The company’s price-to-earnings ratio of 31.2x is attractive compared to the industry average of 45.5x, though its share price has been highly volatile recently.

- Delve into the full analysis future growth report here for a deeper understanding of Wuxi NCE PowerLtd.

- Insights from our recent valuation report point to the potential undervaluation of Wuxi NCE PowerLtd shares in the market.

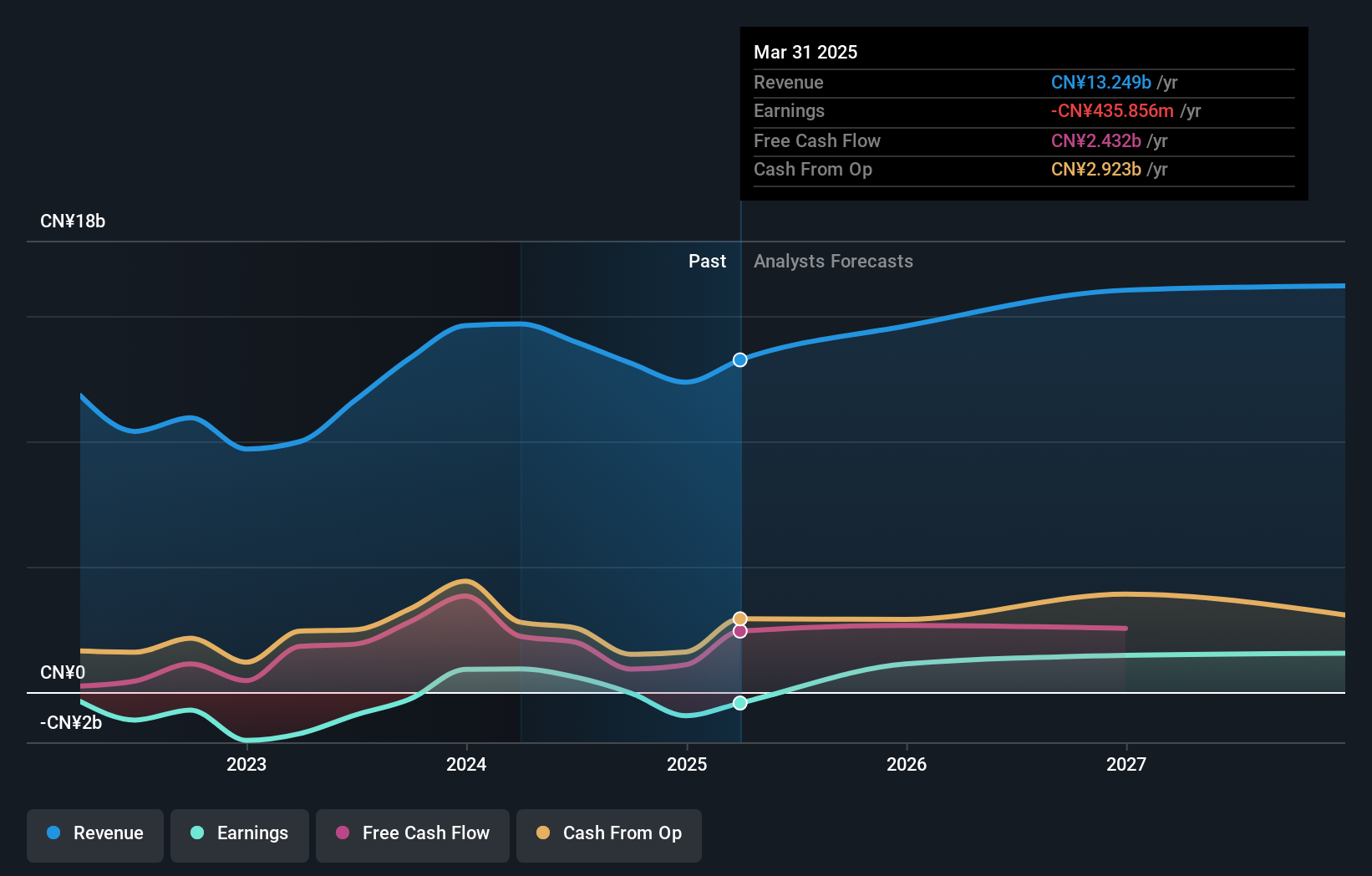

Wanda Film Holding (SZSE:002739)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wanda Film Holding Co., Ltd. operates movie theaters in China, Australia, and New Zealand, with a market cap of CN¥22.99 billion.

Operations: Wanda Film Holding Co., Ltd. generates revenue through the investment, construction, and operation of movie theaters across China, Australia, and New Zealand.

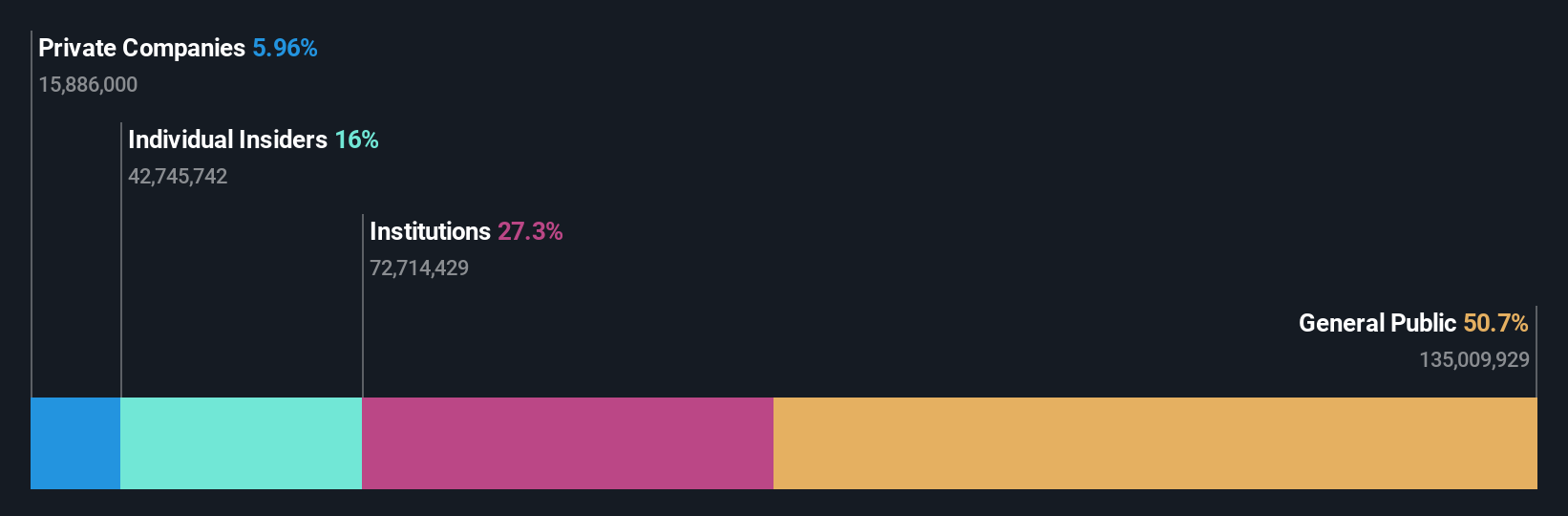

Insider Ownership: 11.2%

Revenue Growth Forecast: 13.1% p.a.

Wanda Film Holding's earnings are forecast to grow significantly at 46.76% per year, outpacing the CN market's 22.9%. Despite this, recent half-year results showed a decline in sales and revenue to CNY 5.10 billion and CNY 6.22 billion respectively, with net income dropping to CNY 113.39 million from last year's CNY 422.76 million. Analysts agree on a potential stock price rise of 25.1%, though the Return on Equity is expected to remain low at 15.3%.

- Get an in-depth perspective on Wanda Film Holding's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Wanda Film Holding's share price might be on the cheaper side.

Inner Mongolia Furui Medical Science (SZSE:300049)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Inner Mongolia Furui Medical Science Co., Ltd. (SZSE:300049) operates in the medical science sector with a market cap of approximately CN¥10.58 billion.

Operations: Inner Mongolia Furui Medical Science generates revenue from various segments within the medical science sector.

Insider Ownership: 18%

Revenue Growth Forecast: 30.6% p.a.

Inner Mongolia Furui Medical Science's recent half-year earnings show strong growth, with sales rising to CNY 639.15 million and net income increasing to CNY 75.36 million. The company trades at 50% below its estimated fair value and has no substantial insider trading in the past three months. Forecasts indicate significant annual earnings growth of 43.47%, outpacing the CN market's average, with revenue expected to grow faster than 20% per year at a rate of 30.6%.

- Click here to discover the nuances of Inner Mongolia Furui Medical Science with our detailed analytical future growth report.

- Our valuation report unveils the possibility Inner Mongolia Furui Medical Science's shares may be trading at a premium.

Summing It All Up

- Click here to access our complete index of 1518 Fast Growing Companies With High Insider Ownership.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Wanda Film Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002739

Wanda Film Holding

Engages in the investment, construction, and operation of movie theaters in China, Australia, and New Zealand.

Reasonable growth potential and fair value.