Exploring Three High Growth Tech Stocks with Global Potential

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by a tech sell-off and concerns over elevated valuations, particularly in artificial intelligence spending, investor sentiment has been further dampened by the longest U.S. federal government shutdown on record and rising job cuts. In this environment, identifying high-growth tech stocks with strong fundamentals and global potential becomes crucial for investors seeking opportunities amidst broader market volatility.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★☆ |

| Pharma Mar | 26.56% | 44.88% | ★★★★★★ |

| Zhongji Innolight | 30.75% | 31.56% | ★★★★★☆ |

| Fositek | 36.92% | 48.42% | ★★★★★★ |

| Hacksaw | 32.71% | 37.88% | ★★★★★★ |

| Gold Circuit Electronics | 27.50% | 35.18% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| KebNi | 24.89% | 61.24% | ★★★★★★ |

| CD Projekt | 35.69% | 51.01% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Celltrion (KOSE:A068270)

Simply Wall St Growth Rating: ★★★★☆☆

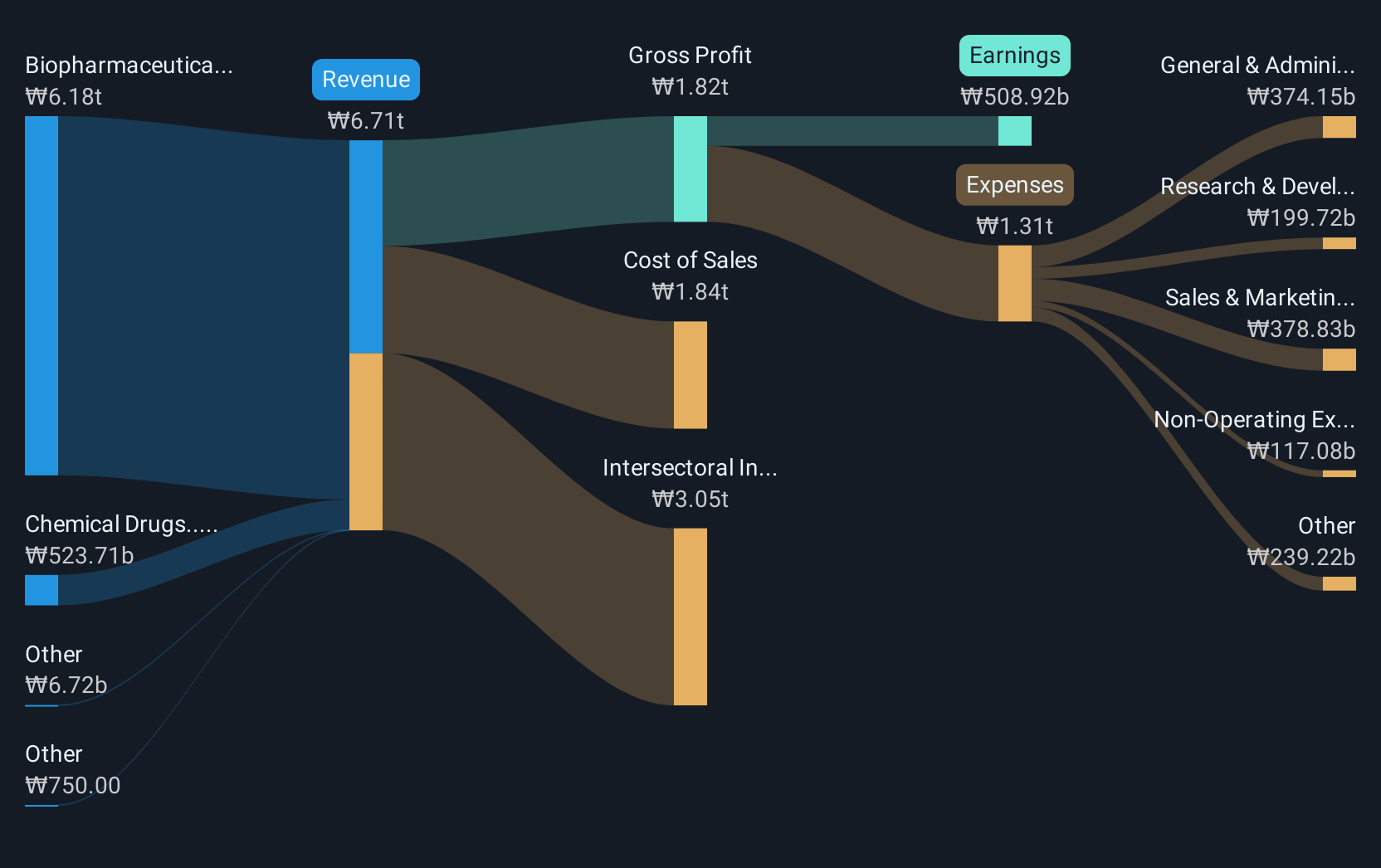

Overview: Celltrion, Inc. is a biopharmaceutical company focused on developing, producing, and selling therapeutic proteins for oncology treatments with a market cap of ₩38.07 trillion.

Operations: Celltrion, Inc. primarily generates revenue through its biopharmaceutical segment, which contributed ₩6.66 trillion to its earnings. The company also engages in the sale of chemical drugs, adding ₩517 billion to its revenue stream.

Celltrion's recent FDA approval of STOBOCLO® and OSENVELT® as interchangeable biosimilars marks a significant stride in enhancing patient accessibility to essential treatments, reflecting a robust 14.1% annual revenue growth. This regulatory milestone, coupled with the strategic partnership with WellsCare for advanced pain management technologies, underscores Celltrion's commitment to expanding its innovative offerings in North America. Additionally, the company's active share repurchase program, buying back shares worth KRW 100 billion, aligns with its strategy to bolster shareholder value amidst a forecasted earnings growth of 38.6% per year, outpacing the industry average significantly.

- Click to explore a detailed breakdown of our findings in Celltrion's health report.

Gain insights into Celltrion's historical performance by reviewing our past performance report.

Wanda Film Holding (SZSE:002739)

Simply Wall St Growth Rating: ★★★★☆☆

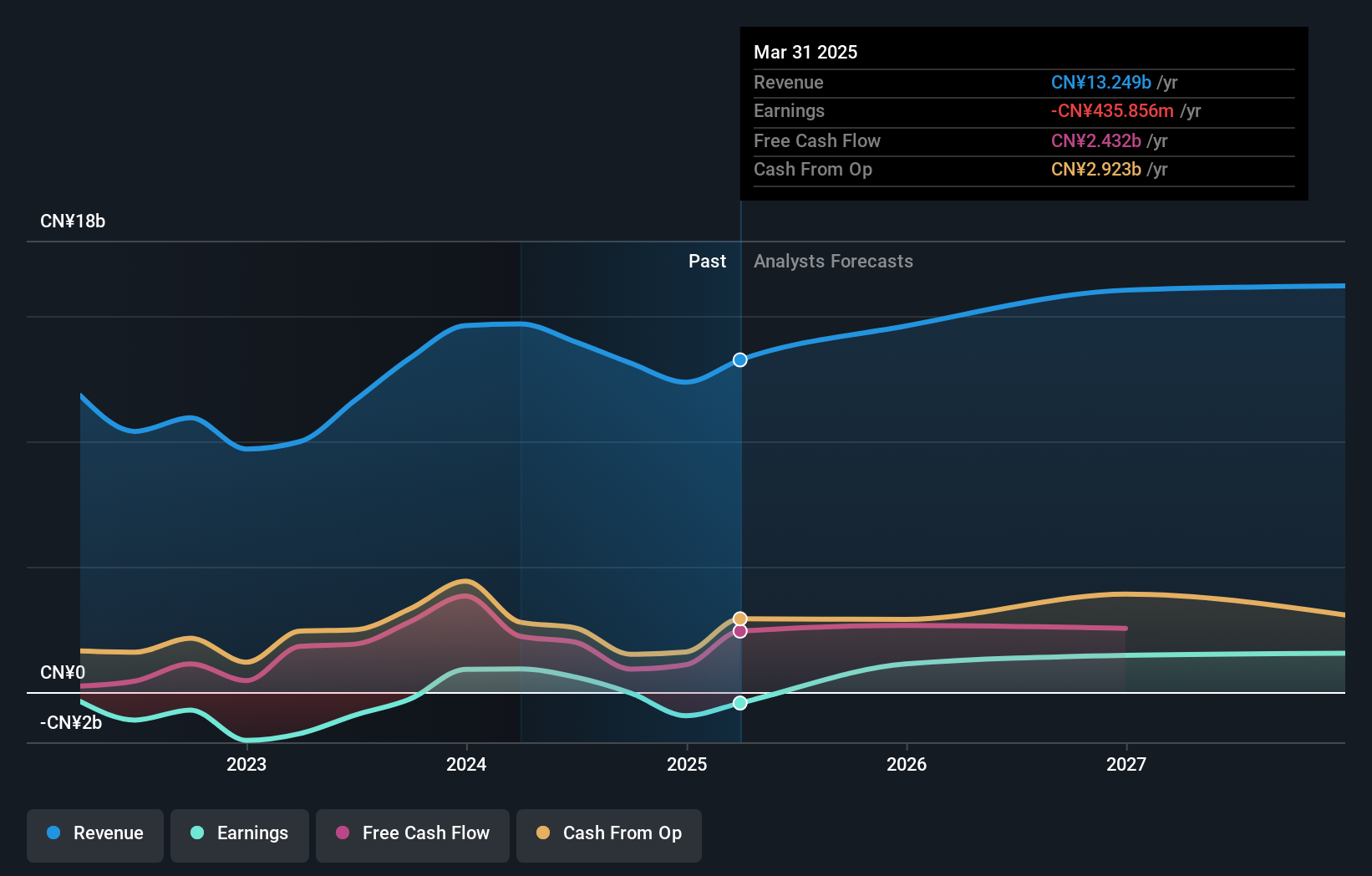

Overview: Wanda Film Holding Co., Ltd. operates in the cinema film screening and related businesses both in China and internationally, with a market cap of CN¥24.52 billion.

Operations: Wanda Film Holding Co., Ltd. focuses on cinema film screening and related activities across China and internationally, generating revenue primarily from box office sales, film distribution, and advertising. The company has a market capitalization of CN¥24.52 billion.

Wanda Film Holding has demonstrated a remarkable turnaround, with net income soaring to CNY 708.39 million from CNY 168.69 million year-over-year as of September 2025. This surge reflects a robust earnings growth rate of approximately 320%, significantly outpacing broader market trends. The company's strategic focus on enhancing cinematic experiences, coupled with effective cost management strategies, has proven fruitful despite a slight decline in revenue to CNY 9,786.73 million from CNY 9,846.85 million the previous year. Looking ahead, Wanda Film is poised for continued growth with expectations set on becoming profitable within the next three years, supported by an anticipated annual profit growth rate of 84.5%.

- Unlock comprehensive insights into our analysis of Wanda Film Holding stock in this health report.

Gain insights into Wanda Film Holding's past trends and performance with our Past report.

CELSYS (TSE:3663)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CELSYS, Inc. operates in Japan providing content creation solutions and has a market capitalization of ¥49.74 billion.

Operations: CELSYS, Inc. focuses on content creation solutions in Japan. The company generates revenue primarily through its software products and services aimed at artists and creators.

CELSYS has been actively expanding its market presence, underscored by a robust annual revenue growth of 10.3%, outpacing the Japanese market's average of 4.5%. The company's commitment to innovation is evident from its R&D spending, which has consistently aligned with strategic goals to enhance product offerings and technological capabilities. Recently, CELSYS also completed a significant share repurchase program, buying back shares worth ¥499.95 million, signaling confidence in its financial health and future prospects. This strategy not only underscores CELSYS’s robust operational framework but also enhances shareholder value in a competitive tech landscape.

- Dive into the specifics of CELSYS here with our thorough health report.

Explore historical data to track CELSYS' performance over time in our Past section.

Make It Happen

- Click here to access our complete index of 236 Global High Growth Tech and AI Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3663

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives