Stock Analysis

- China

- /

- Electronic Equipment and Components

- /

- SZSE:300976

High Growth Tech Stocks To Watch In November 2024

Reviewed by Simply Wall St

As global markets navigate a busy earnings season and fluctuating economic indicators, small-cap stocks have shown resilience compared to their larger counterparts, with the Russell 2000 Index maintaining gains amidst broader market declines. In this dynamic environment, identifying high-growth tech stocks requires a focus on companies that demonstrate strong fundamentals and adaptability to shifting economic landscapes.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.41% | 70.53% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 72.26% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1285 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

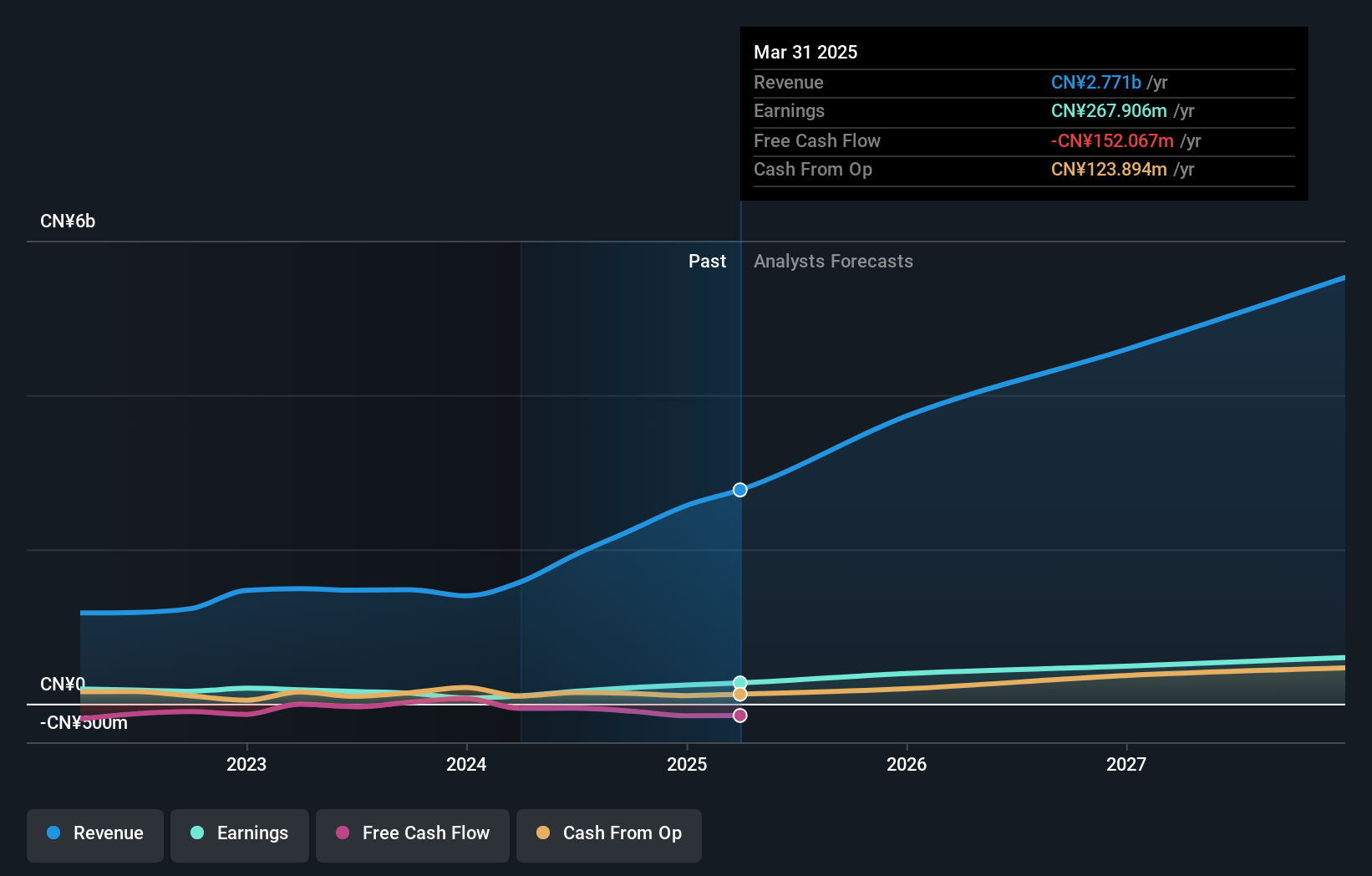

Unionman TechnologyLtd (SHSE:688609)

Simply Wall St Growth Rating: ★★★★★★

Overview: Unionman Technology Co., Ltd. engages in the production, sale, and servicing of multimedia information terminals, smart home network communication equipment, IoT communication modules, optical communication modules, smart security equipment, and related software systems and platforms with a market cap of CN¥6.18 billion.

Operations: Unionman Technology Co., Ltd. generates revenue primarily from the Computer, Communications, and Other Electronic Intelligent Equipment Manufacturing Industry, amounting to CN¥2.48 billion.

Unionman TechnologyLtd, despite its current unprofitability, is on a trajectory to overturn its financials with an anticipated profit growth of 88.3% per year. This optimistic forecast aligns with its aggressive R&D spending, which has been strategically aimed at fostering innovation and maintaining competitiveness in the tech sector. Recently, the company reported a reduction in net loss to CNY 105.15 million from CNY 120.65 million year-over-year for the nine months ending September 2024, indicating potential stabilization and improvement in operational efficiency. Additionally, Unionman's inclusion in the S&P Global BMI Index suggests growing recognition within financial markets, potentially increasing investor confidence despite its past performance challenges.

- Click to explore a detailed breakdown of our findings in Unionman TechnologyLtd's health report.

Explore historical data to track Unionman TechnologyLtd's performance over time in our Past section.

Ciwen MediaLtd (SZSE:002343)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ciwen Media Co., Ltd. operates in the film, television dramas, game products, channel promotions, and artist management sectors both in China and internationally with a market cap of CN¥4.11 billion.

Operations: Ciwen Media Co., Ltd. generates revenue from its diverse operations in film, television dramas, game products, channel promotions, and artist management across China and international markets. The company leverages these segments to create a multifaceted entertainment portfolio.

With an expected revenue growth of 45% per year, Ciwen MediaLtd stands out in the entertainment sector, surpassing the CN market forecast of 13.9%. This robust projection is complemented by an anticipated profit surge of 84.3% annually, significantly outpacing the broader market's expectation of 26.1%. However, recent financials reveal a downturn with net income halving to CNY 11.41 million from last year's CNY 24.04 million in just nine months. Despite these challenges, Ciwen's aggressive pursuit in R&D investments could catalyze future innovations and market competitiveness, aligning with industry shifts towards more dynamic content delivery models.

- Unlock comprehensive insights into our analysis of Ciwen MediaLtd stock in this health report.

Gain insights into Ciwen MediaLtd's past trends and performance with our Past report.

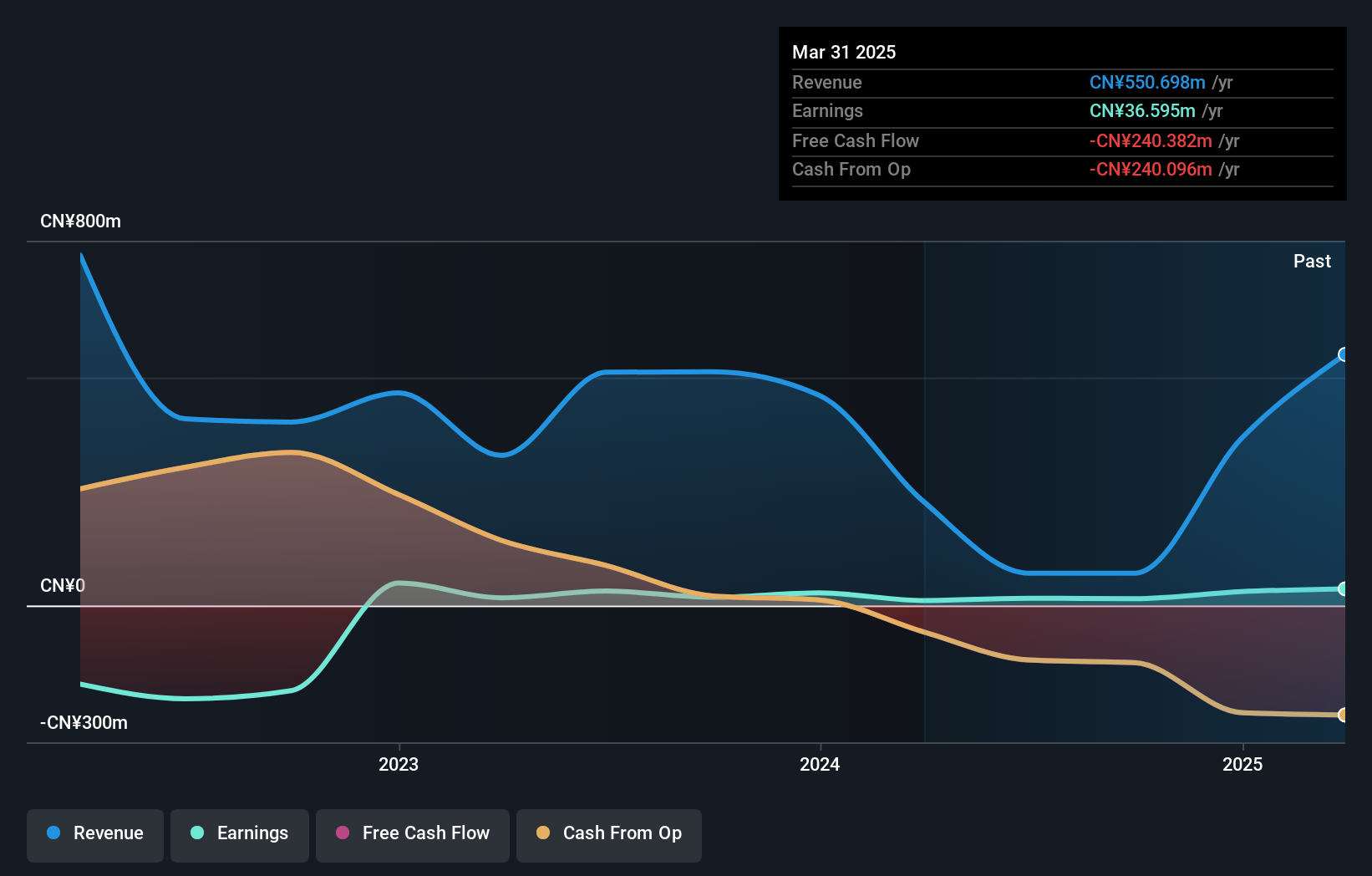

Dongguan Tarry ElectronicsLtd (SZSE:300976)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dongguan Tarry Electronics Co., Ltd. specializes in manufacturing and selling precision die cutting products, foam protective film tapes, insulation heat conduction products, EMI shielding products, sewing and high frequency earmuffs, headbands, and assembly automation equipment in China with a market cap of CN¥5.73 billion.

Operations: The company generates revenue primarily from its manufacturing industry segment, totaling CN¥2.24 billion. Its product range includes precision die cutting products and various electronic components, with a focus on the Chinese market.

Dongguan Tarry Electronics has demonstrated notable growth, with revenue soaring to CNY 1.77 billion in the nine months up to September 2024, nearly doubling from CNY 925.06 million the previous year. This surge is supported by a robust increase in net income, which quadrupled from CNY 47.78 million to CNY 182.14 million over the same period, reflecting a significant improvement in profitability and operational efficiency. The company's commitment to innovation is evident in its R&D spending, which remains a critical factor in sustaining its competitive edge within the tech industry; however, specific figures on recent R&D investments were not disclosed in the latest reports.

Summing It All Up

- Reveal the 1285 hidden gems among our High Growth Tech and AI Stocks screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300976

Dongguan Tarry ElectronicsLtd

Manufactures and sells precision die cutting products, foam protective film tapes, insulation heat conduction products, EMI shielding products, sewing and high frequency earmuffs, headbands, and assembly automation equipment in China.