- China

- /

- Electronic Equipment and Components

- /

- SZSE:300679

High Growth Tech Stocks To Watch In November 2024

Reviewed by Simply Wall St

In a week marked by busy earnings reports and economic data, global markets experienced some turbulence, with major indices like the Nasdaq Composite and S&P MidCap 400 hitting record highs before retreating. Despite this volatility, small-cap stocks showed resilience compared to their larger counterparts, highlighting the potential for high-growth tech stocks that can navigate such dynamic environments. As investors look for opportunities in this sector, key considerations include strong fundamentals and innovative capabilities that align with evolving market demands.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| Sarepta Therapeutics | 23.80% | 44.01% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| TG Therapeutics | 34.69% | 57.41% | ★★★★★★ |

| Alkami Technology | 21.90% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.17% | 70.49% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 71.73% | ★★★★★★ |

Click here to see the full list of 1291 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Zhejiang Sunriver Culture TourismLtd (SHSE:600576)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zhejiang Sunriver Culture Tourism Co., Ltd. operates in the cultural tourism industry, with a market capitalization of CN¥5.96 billion.

Operations: Zhejiang Sunriver Culture Tourism Co., Ltd. generates revenue primarily through its cultural tourism operations, focusing on providing unique and engaging experiences for visitors. The company leverages its assets and expertise to attract tourists, contributing significantly to its financial performance.

Zhejiang Sunriver Culture TourismLtd., navigating through a competitive landscape, has demonstrated resilience with a 20% annual revenue growth, surpassing the broader Chinese market's 14%. Despite a recent dip in net income to CNY 110.18 million from CNY 131.52 million, the firm continues its aggressive capital return strategy, repurchasing shares worth CNY 59.96 million this year. This strategic move underscores its commitment to shareholder value amidst forecasts of significant earnings growth at 30.2% annually, positioning it well for future scalability within the tech-driven tourism sector.

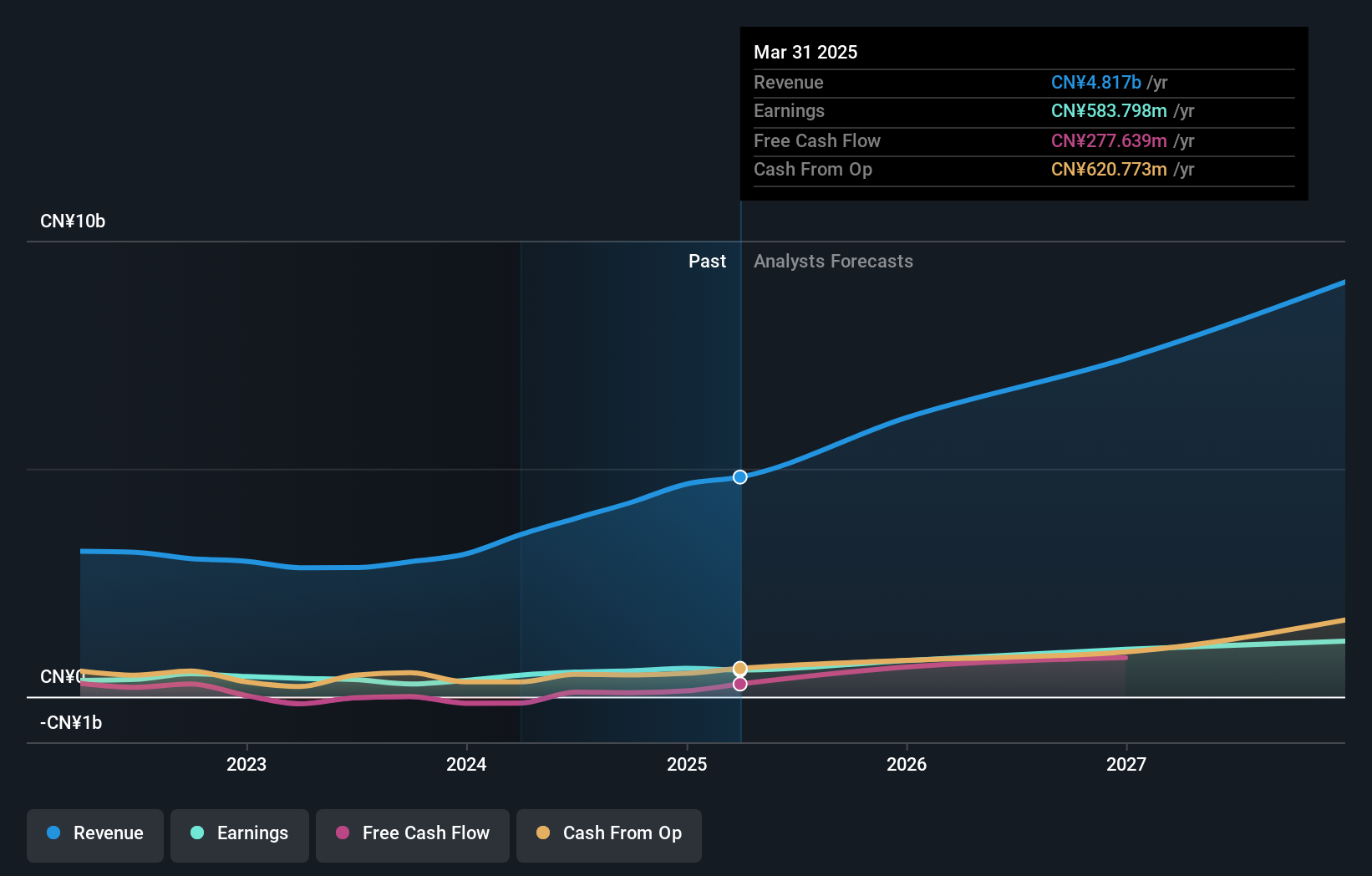

Qi An Xin Technology Group (SHSE:688561)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Qi An Xin Technology Group Inc. is a cyber-security company that offers cybersecurity products and services to government, enterprises, and other institutions both in China and internationally, with a market cap of CN¥20.84 billion.

Operations: Qi An Xin Technology Group generates revenue primarily from the information security industry, amounting to CN¥5.47 billion. Its market cap stands at CN¥20.84 billion, reflecting its significant presence in the cybersecurity sector.

Despite a challenging financial period, Qi An Xin Technology Group has showcased resilience with its R&D investments, which remain robust at 15.1% of its revenue. This commitment is crucial as it navigates through a revenue dip to CNY 2.71 billion from last year's CNY 3.69 billion. The firm's strategic focus on innovation is evident from its projected earnings growth of 42.3% annually, positioning it to potentially leverage emerging tech trends and enhance its market competitiveness in the cybersecurity sector.

- Unlock comprehensive insights into our analysis of Qi An Xin Technology Group stock in this health report.

Gain insights into Qi An Xin Technology Group's past trends and performance with our Past report.

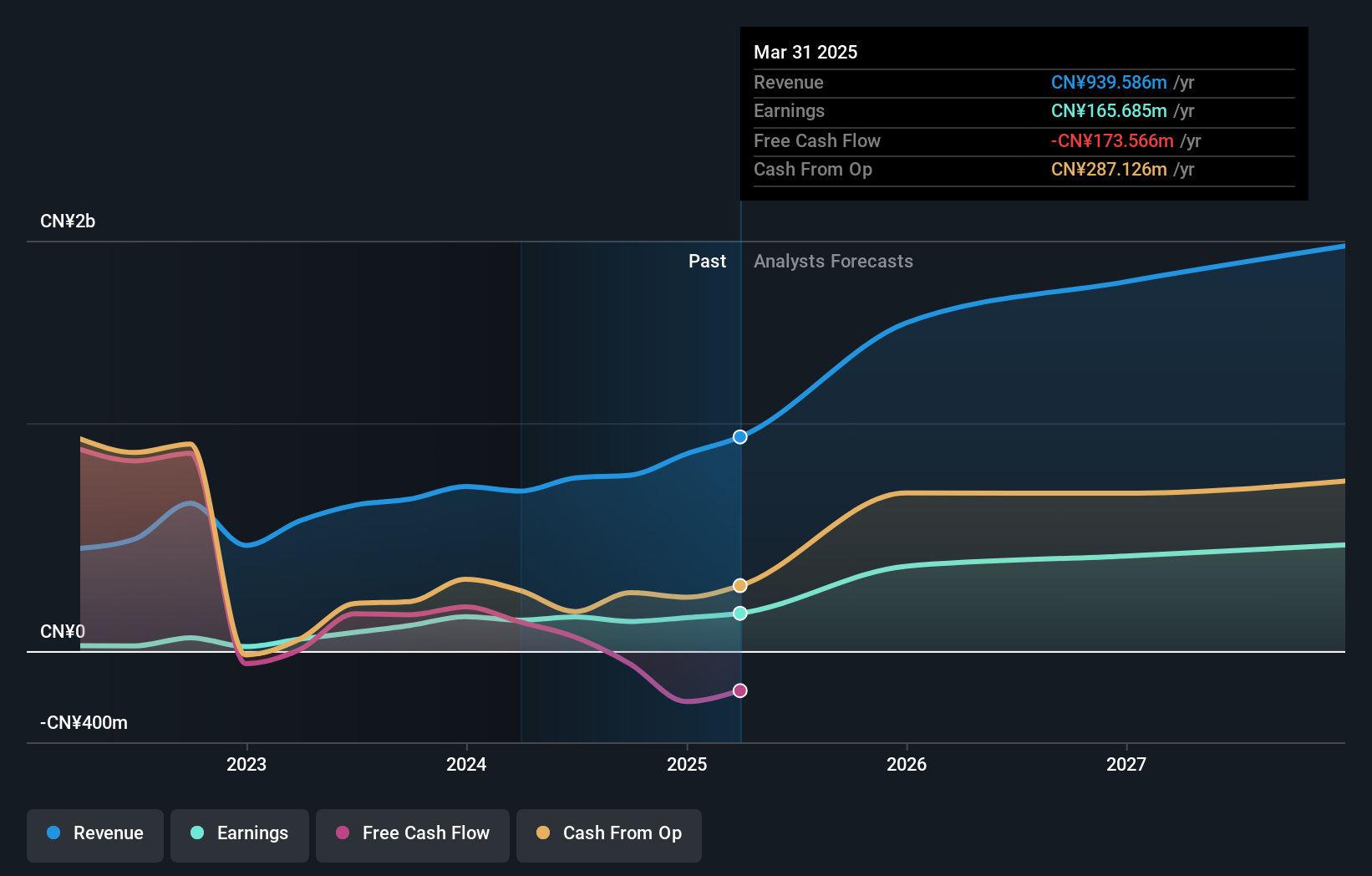

Electric Connector Technology (SZSE:300679)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Electric Connector Technology Co., Ltd. focuses on the research, design, development, manufacture, sale, and marketing of electronic connectors and interconnection system products globally with a market cap of CN¥18.43 billion.

Operations: The company generates revenue primarily from the connector industry, amounting to CN¥3.89 billion. Its operations encompass technical research, design, and development in electronic connectors and interconnection systems worldwide.

Electric Connector Technology has demonstrated robust growth, with a notable increase in revenue to CNY 3.33 billion, up from CNY 2.20 billion the previous year, reflecting a surge of over 50%. This performance is underpinned by significant R&D investments, maintaining a competitive edge in the tech sector. Additionally, the company's strategic share repurchase program, concluding with 1.29 million shares bought back recently for CNY 43.44 million, underscores confidence in its financial health and future prospects. With earnings forecasted to grow at an impressive rate of 28.4% annually, Electric Connector Technology is well-positioned to capitalize on expanding market demands and technological advancements.

Summing It All Up

- Discover the full array of 1291 High Growth Tech and AI Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Electric Connector Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300679

Electric Connector Technology

Engages in the technical research, design, development, manufacture, sale, and marketing of electronic connectors and interconnection system related products worldwide.

Flawless balance sheet with high growth potential.