Discovering Undiscovered Gems In Global Markets This May 2025

Reviewed by Simply Wall St

In May 2025, global markets are experiencing a wave of optimism following the U.S.-China agreement to pause tariffs for 90 days, leading to significant rallies across major indices such as the Nasdaq Composite and S&P 500. This positive sentiment is further buoyed by cooling inflation rates in the U.S., though consumer sentiment remains cautious amid ongoing trade uncertainties. In this environment, identifying undiscovered gems involves seeking stocks with strong fundamentals that can thrive amidst shifting economic landscapes and capitalize on emerging opportunities in global markets.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Anpec Electronics | NA | 1.77% | 4.97% | ★★★★★★ |

| Daphne International Holdings | NA | -40.78% | 85.98% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 15.01% | 0.09% | ★★★★★★ |

| VICOM | NA | 5.01% | 2.30% | ★★★★★★ |

| Yibin City Commercial Bank | 136.61% | 11.29% | 20.39% | ★★★★★★ |

| Uju Holding | 33.18% | 8.01% | -15.93% | ★★★★★☆ |

| TSTE | 36.22% | 3.96% | -8.49% | ★★★★★☆ |

| Billion Industrial Holdings | 7.13% | 18.54% | -14.41% | ★★★★★☆ |

| TOT BIOPHARM International | 54.00% | 61.14% | 50.47% | ★★★★★☆ |

| VCREDIT Holdings | 115.47% | 25.47% | 30.34% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Shanghai Huide Science & TechnologyLtd (SHSE:603192)

Simply Wall St Value Rating: ★★★★★★

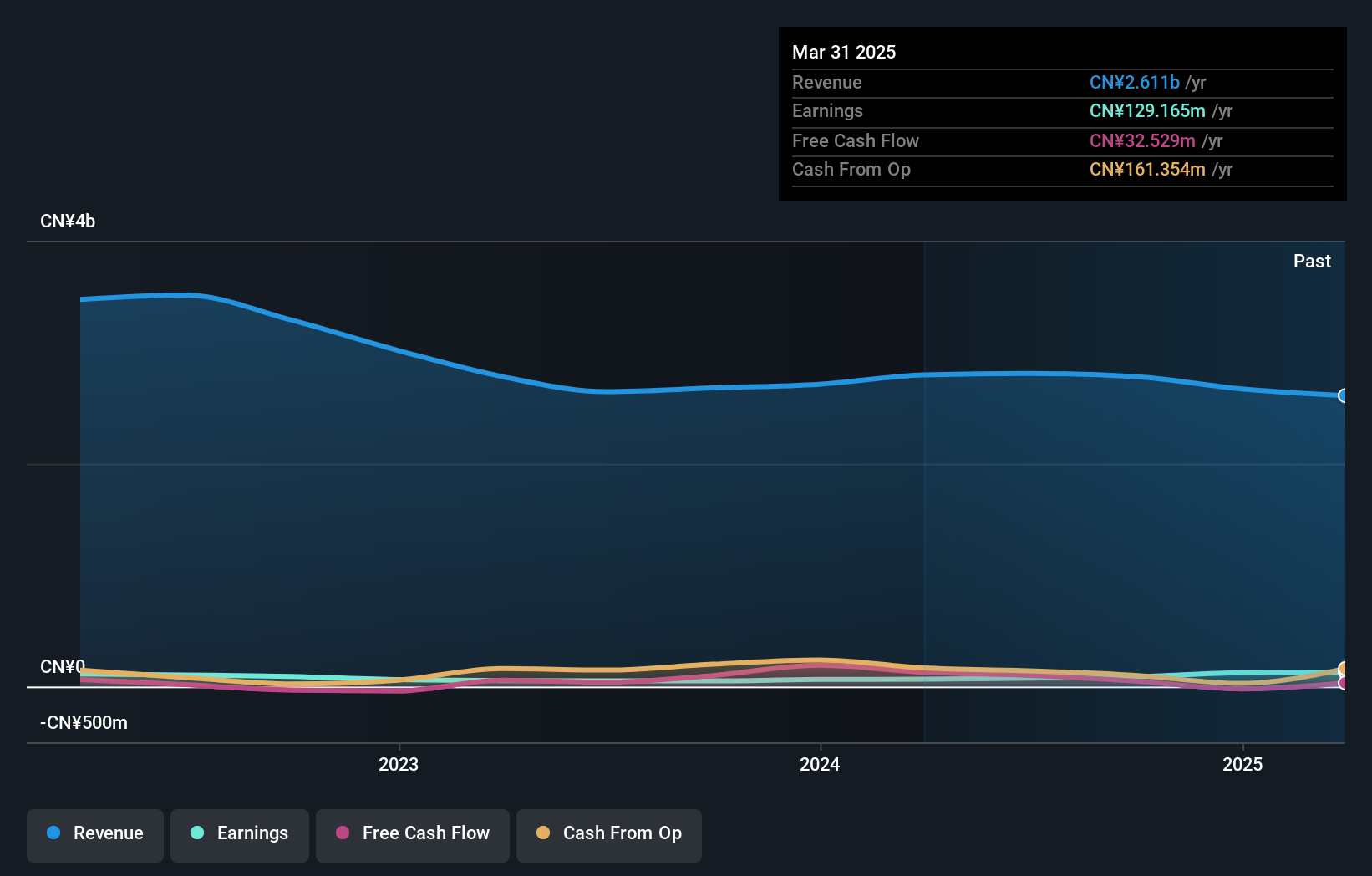

Overview: Shanghai Huide Science & Technology Co., Ltd operates in the research, production, sale, and service of polyurethane resin for leather and polyurethane elastomer-related products both in China and internationally, with a market cap of CN¥2.97 billion.

Operations: Shanghai Huide Science & Technology Co., Ltd's revenue is primarily derived from its polyurethane resin and elastomer-related products. The company's financial performance includes a net profit margin trend that has shown variability over recent periods, reflecting fluctuations in operational efficiency and cost management.

Shanghai Huide Science & Technology has shown a robust performance, with earnings growth of 95.7% over the past year, significantly outpacing the Chemicals industry average of 3.3%. The company boasts high-quality earnings and maintains a favorable debt-to-equity ratio, which has improved from 4.4% to 1.5% over five years. Despite a recent dip in revenue to CNY 610.7 million for Q1 2025 compared to CNY 670.52 million last year, net income rose to CNY 19.34 million from CNY 14.73 million, reflecting strong operational efficiency and profitability amidst changing market conditions.

Shandong Sacred Sun Power SourcesLtd (SZSE:002580)

Simply Wall St Value Rating: ★★★★★★

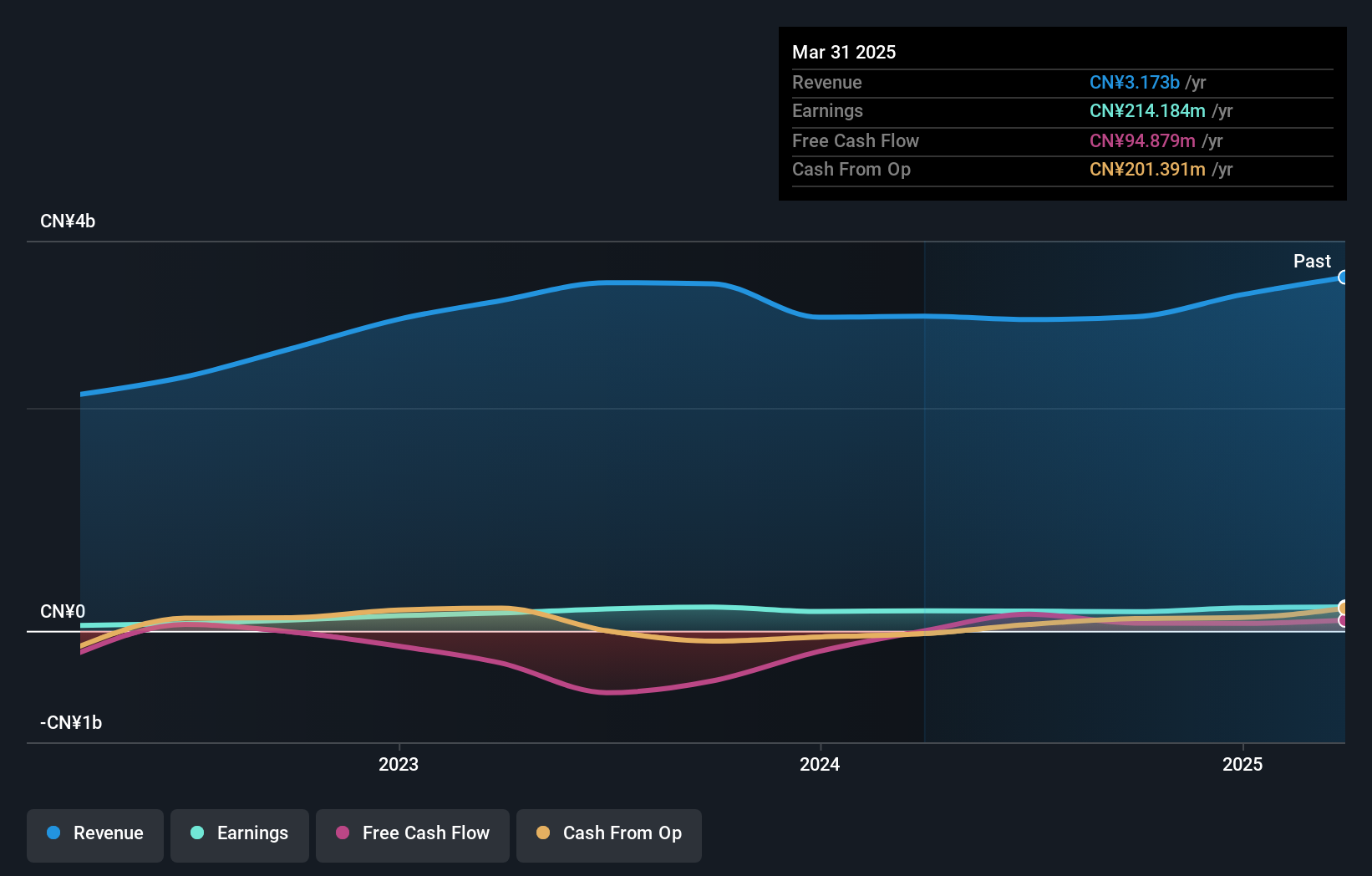

Overview: Shandong Sacred Sun Power Sources Co., Ltd, with a market cap of CN¥6.19 billion, offers green energy solutions globally.

Operations: The company generates revenue primarily from its industrial segment, particularly in batteries, amounting to CN¥3.17 billion.

Shandong Sacred Sun Power Sources, a notable player in the energy sector, has shown promising financial performance with its earnings growing by 19.1% over the past year, outpacing the electrical industry's -1.4%. The company's debt-to-equity ratio improved from 24.5% to 19.1% in five years, indicating better financial health and reduced leverage. With a price-to-earnings ratio of 30.3x below the CN market average of 38x, it appears attractively valued for investors seeking growth potential in smaller companies. In recent news, Q1 sales reached ¥754 million compared to ¥596 million last year, with net income rising to ¥60 million from ¥52 million previously.

Longkou Union Chemical (SZSE:301209)

Simply Wall St Value Rating: ★★★★★★

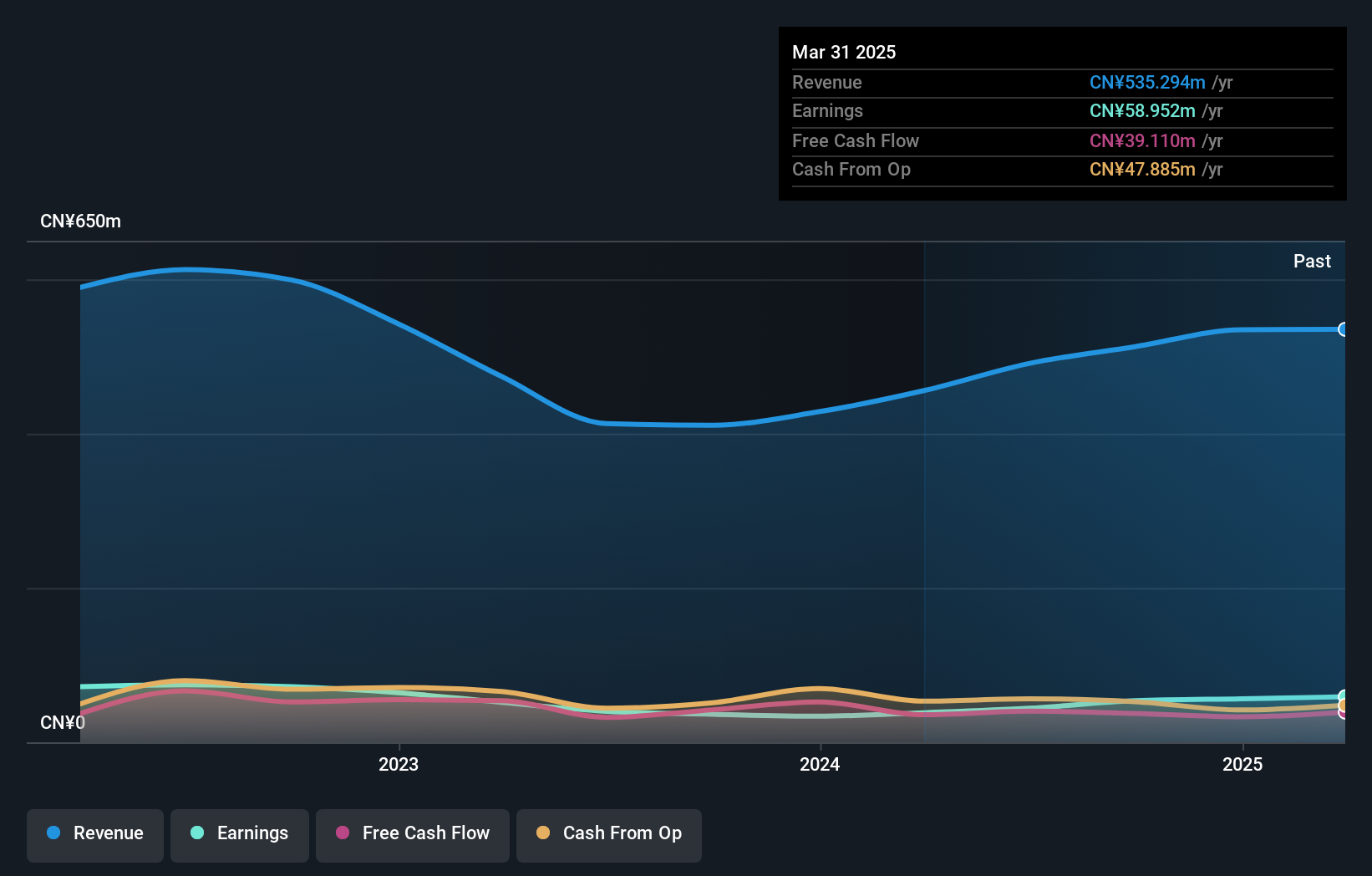

Overview: Longkou Union Chemical Co., Ltd. is involved in the production and sale of organic pigments both domestically in China and internationally, with a market capitalization of CN¥8.62 billion.

Operations: Longkou Union Chemical generates revenue primarily from the sale of organic pigments. The company's financial performance is highlighted by a net profit margin trend, providing insight into its profitability.

Longkou Union Chemical, a company with notable earnings growth, saw its net income rise to CNY 16.54 million in Q1 2025 from CNY 14.02 million the previous year. The company's earnings per share also improved to CNY 0.2068 from CNY 0.1753, reflecting a positive trend in profitability despite a modest increase in sales to CNY 130.06 million from CNY 129.39 million year-on-year. Over the past five years, their debt-to-equity ratio has significantly reduced from 29.2% to just 6.6%, indicating effective financial management and positioning them well within the chemicals industry landscape for future opportunities.

Seize The Opportunity

- Take a closer look at our Global Undiscovered Gems With Strong Fundamentals list of 3172 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603192

Shanghai Huide Science & TechnologyLtd

Engages in the research, production, sale, and service of polyurethane resin for leather and polyurethane elastomer related products in China and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives