Three Prominent Asian Growth Companies With Significant Insider Ownership

Reviewed by Simply Wall St

As global markets face challenges, including concerns over AI spending and economic uncertainties, Asian markets have shown resilience, with Chinese stocks experiencing a boost from easing trade tensions. In this environment, growth companies with high insider ownership can offer unique insights into potential opportunities, as insiders often have a deeper understanding of their company's prospects and are more likely to align their interests with shareholders.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 30% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.3% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 56.2% |

Let's explore several standout options from the results in the screener.

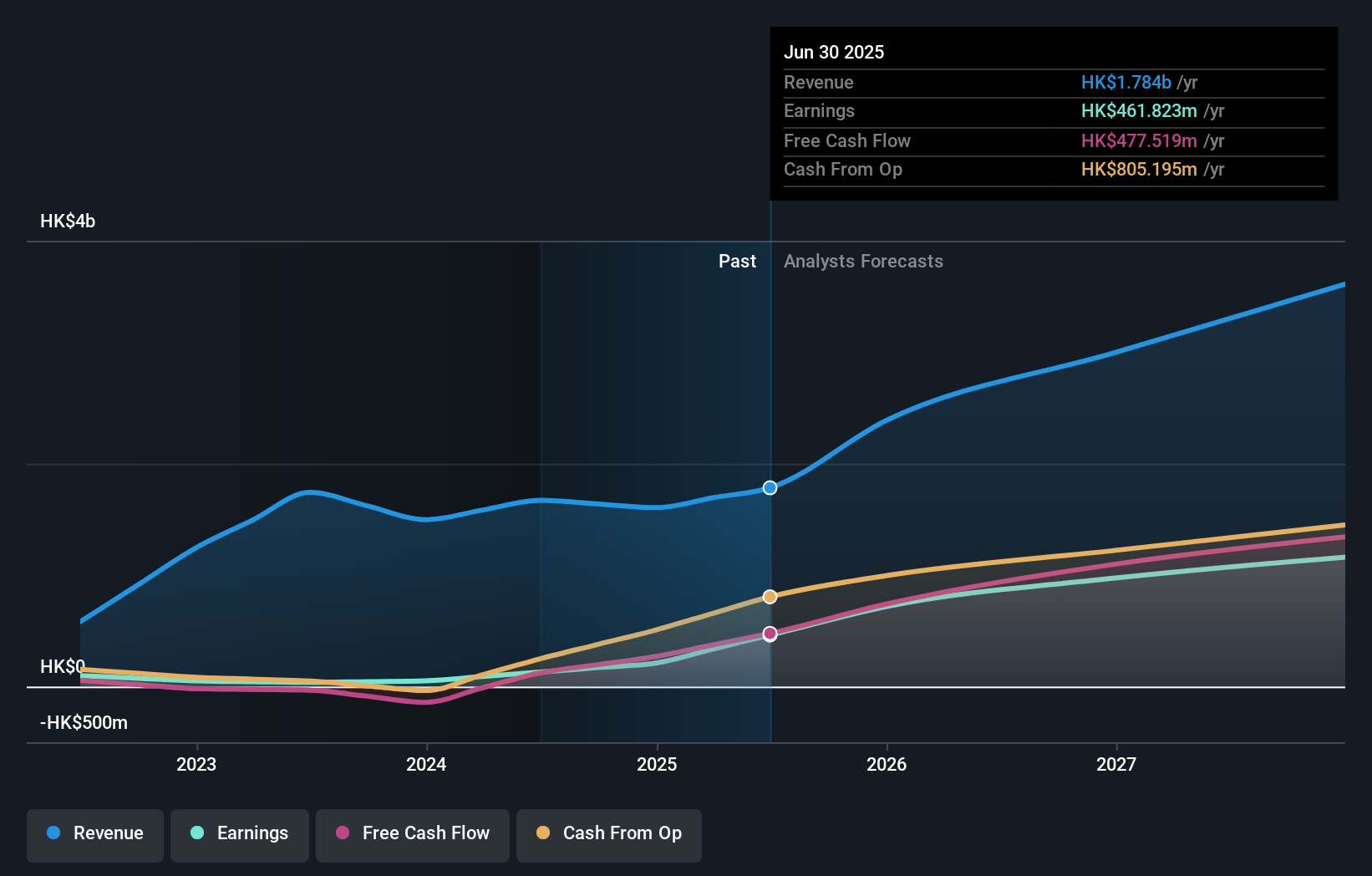

Tongguan Gold Group (SEHK:340)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Tongguan Gold Group Limited is an investment holding company involved in the exploration, mining, processing, smelting, and sale of gold and related products in China with a market capitalization of approximately HK$12.45 billion.

Operations: The company's revenue is primarily derived from its gold mining operations, amounting to HK$1.69 billion.

Insider Ownership: 25.6%

Revenue Growth Forecast: 18% p.a.

Tongguan Gold Group demonstrates significant growth potential, with earnings projected to grow 33.3% annually, surpassing the Hong Kong market's 11.7%. Despite a highly volatile share price and no recent insider trading activity, it trades at 44.6% below its estimated fair value. The company reported strong financial results for the first half of 2025, with sales reaching HK$1 billion and net income increasing substantially from the previous year. Recent executive changes include appointing Mr. Wang Dequan as CEO, bringing extensive industry expertise to guide future exploration and development initiatives.

- Click here to discover the nuances of Tongguan Gold Group with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of Tongguan Gold Group shares in the market.

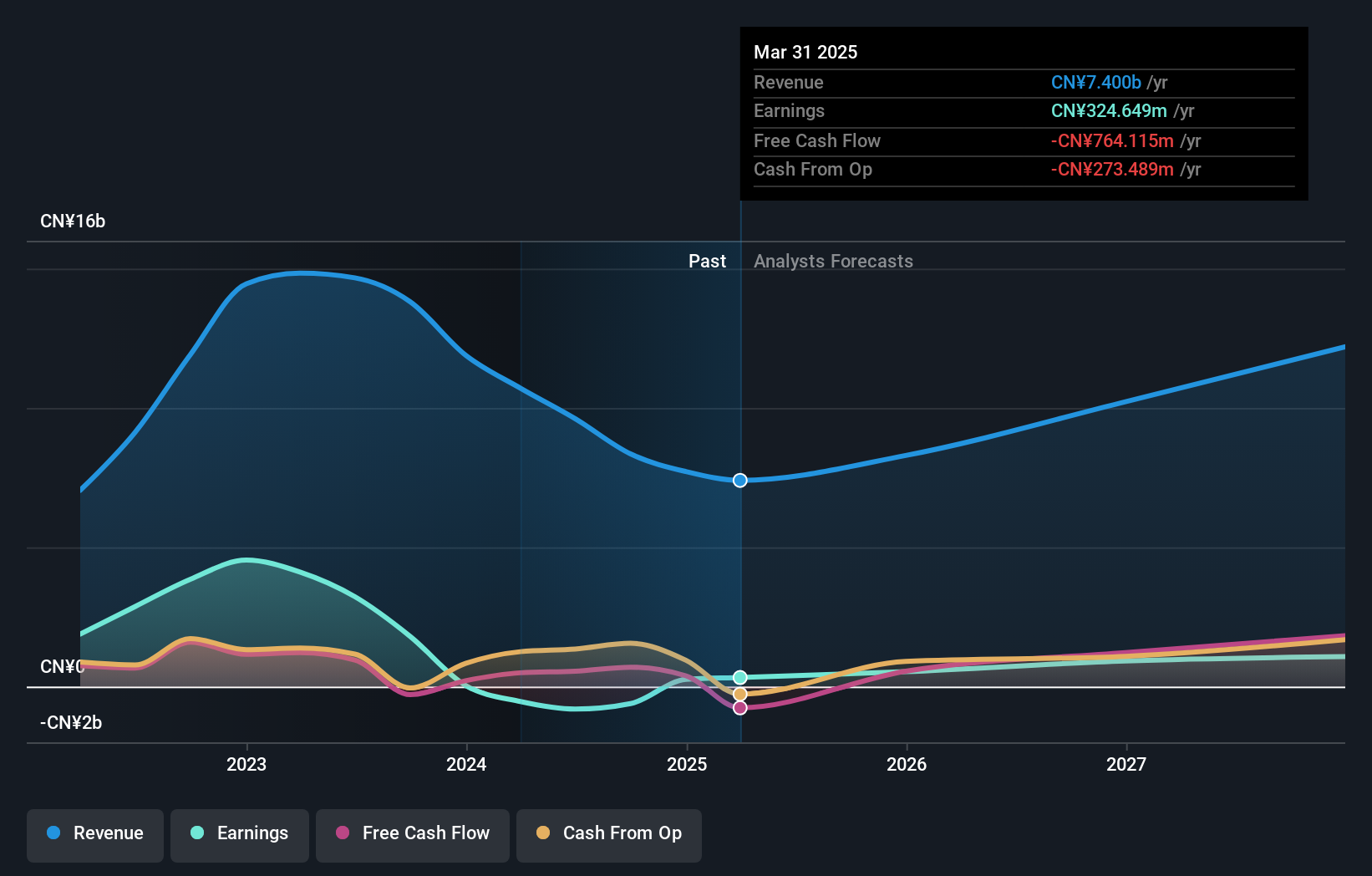

Sichuan Yahua Industrial Group (SZSE:002497)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sichuan Yahua Industrial Group Co., Ltd. engages in the research, production, and sale of civil explosive equipment and blasting engineering services both in China and internationally, with a market cap of CN¥23.32 billion.

Operations: Sichuan Yahua Industrial Group Co., Ltd. generates revenue through its civil explosive equipment and blasting engineering services, catering to both domestic and international markets.

Insider Ownership: 16.1%

Revenue Growth Forecast: 21.2% p.a.

Sichuan Yahua Industrial Group shows robust growth prospects, with earnings expected to increase 42.6% annually, outpacing the Chinese market's 27%. Despite no recent insider trading activity, it trades at 65.8% below its fair value estimate. For the nine months ended September 2025, sales reached CNY 6 billion and net income rose significantly from the previous year. Recent amendments to company bylaws could influence future strategic directions and operational efficiencies.

- Unlock comprehensive insights into our analysis of Sichuan Yahua Industrial Group stock in this growth report.

- Our valuation report here indicates Sichuan Yahua Industrial Group may be undervalued.

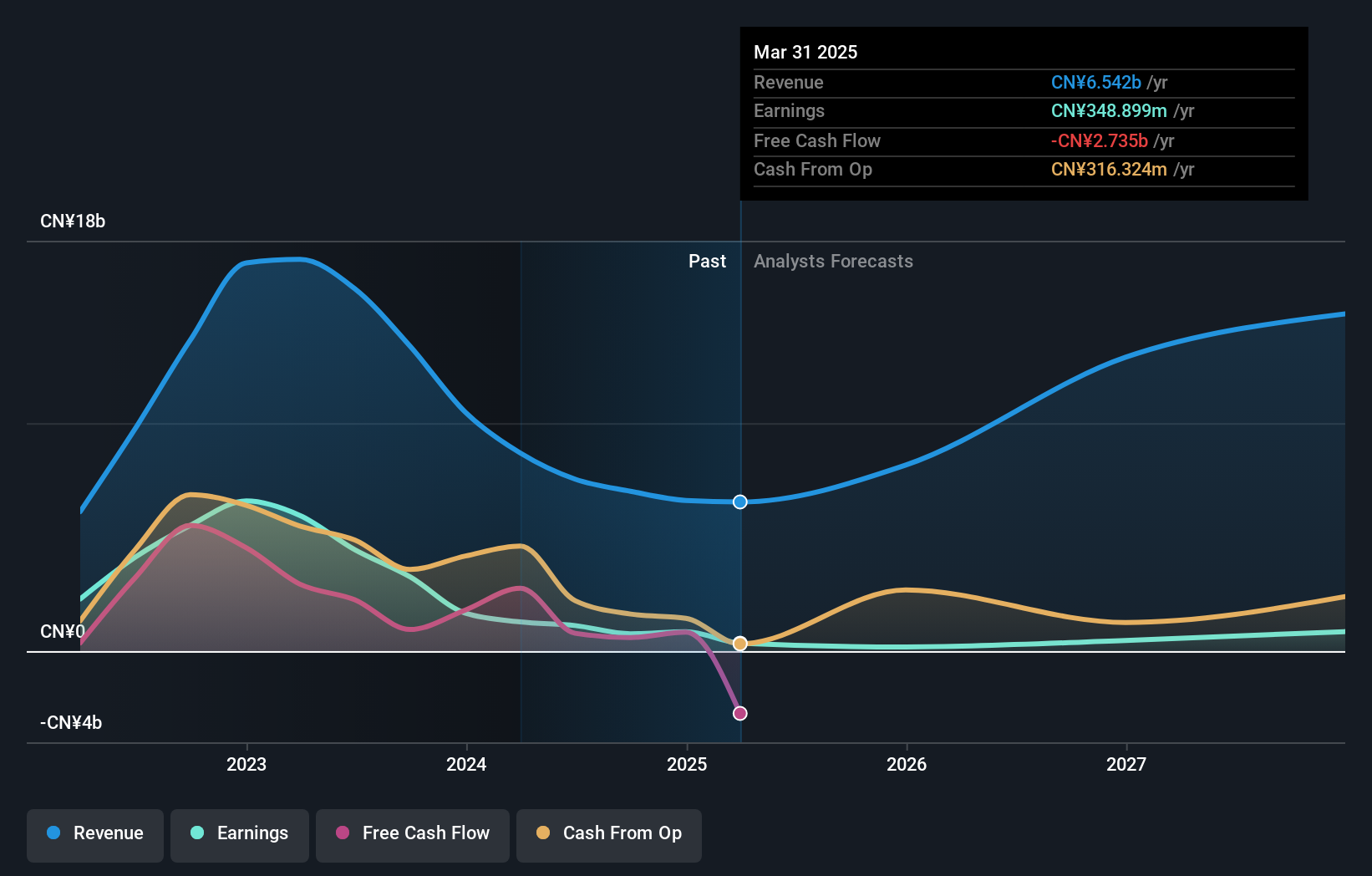

Canmax Technologies (SZSE:300390)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Canmax Technologies Co., Ltd. focuses on the R&D, production, and sale of new energy lithium battery materials as well as anti-static ultra-clean technology and medical equipment, with a market cap of approximately CN¥34.69 billion.

Operations: Canmax Technologies Co., Ltd. generates revenue through its activities in the research, development, production, and sale of lithium battery materials and anti-static ultra-clean technology and medical equipment both domestically and internationally.

Insider Ownership: 32.9%

Revenue Growth Forecast: 34.1% p.a.

Canmax Technologies is experiencing significant growth with revenue expected to increase 34.1% annually, surpassing the Chinese market's average. Despite recent earnings challenges, including a net income drop to CNY 32.87 million for the first nine months of 2025, its long-term profitability outlook remains positive with forecasts suggesting profitability within three years. Contemporary Amperex Technology's acquisition of an additional stake highlights confidence in Canmax’s potential amidst high insider ownership and strategic changes approved recently at shareholder meetings.

- Delve into the full analysis future growth report here for a deeper understanding of Canmax Technologies.

- In light of our recent valuation report, it seems possible that Canmax Technologies is trading beyond its estimated value.

Summing It All Up

- Navigate through the entire inventory of 625 Fast Growing Asian Companies With High Insider Ownership here.

- Curious About Other Options? We've found 15 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300390

Canmax Technologies

Engages in the research and development, production, and sale of new energy lithium battery materials, and anti-static ultra-clean technology and medical equipment in China and internationally.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives