- China

- /

- Entertainment

- /

- SZSE:300467

Wuhan Ddmc Culture&SportsLtd And 2 Other Undiscovered Gems On None

Reviewed by Simply Wall St

In a market landscape where major indexes like the S&P 500 and Nasdaq Composite continue to reach record highs, small-cap stocks have faced divergent performance, with the Russell 2000 Index recently experiencing a decline. Amid this backdrop of mixed economic indicators and sector-specific shifts, investors are increasingly on the lookout for promising opportunities in lesser-known stocks that may offer potential for growth despite broader market volatility. Identifying such undiscovered gems often involves seeking companies with strong fundamentals and unique value propositions that can thrive even when geopolitical or economic uncertainties loom large.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SHL Consolidated Bhd | NA | 16.14% | 19.01% | ★★★★★★ |

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| PSC | 17.90% | 2.07% | 13.38% | ★★★★★★ |

| Société Multinationale de Bitumes Société Anonyme | 54.45% | 24.68% | 23.10% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.65% | 21.96% | ★★★★☆☆ |

| Bhakti Multi Artha | 45.21% | 32.37% | -16.43% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Wuhan Ddmc Culture&SportsLtd (SHSE:600136)

Simply Wall St Value Rating: ★★★★★☆

Overview: Wuhan Ddmc Culture&Sports Co., Ltd. operates in the film, television, and sports industries both in China and internationally, with a market cap of CN¥4.39 billion.

Operations: The company generates revenue primarily from its film, television, and sports operations. It has a market capitalization of CN¥4.39 billion.

Wuhan Ddmc Culture&Sports Ltd. shows a mixed financial picture, with recent earnings revealing a net loss of CN¥28.51 million for the first nine months of 2024, significantly better than last year's CN¥1.94 billion loss. The company's debt situation seems manageable as it holds more cash than total debt and has reduced its debt-to-equity ratio from 79.8% to 3.3% over five years, indicating improved financial health. Despite being profitable now, a one-off loss of CN¥2.5 billion impacted its results, yet the price-to-earnings ratio at 0.9x suggests potential undervaluation compared to the broader market's 37.3x.

Xilong Scientific (SZSE:002584)

Simply Wall St Value Rating: ★★★★★☆

Overview: Xilong Scientific Co., Ltd. is engaged in the research, development, manufacturing, and sale of chemical reagents in China with a market cap of CN¥5.27 billion.

Operations: The company generates revenue primarily from the sale of chemical reagents. Its cost structure includes expenses related to manufacturing and development activities. The net profit margin has shown variability over recent periods, reflecting changes in operational efficiency and market conditions.

Xilong Scientific, a nimble player in the chemicals sector, has showcased impressive earnings growth of 124.5% over the past year, outpacing its industry significantly. The company's net debt to equity ratio stands at a satisfactory 32.7%, indicating prudent financial management. Despite not being free cash flow positive recently, Xilong's interest payments are well covered with an EBIT coverage of 3.4 times interest repayments. Recent developments include a CNY 230 million acquisition by Jingge Win-Win Exclusive Fund for a 5.98% stake and approval of a dividend payout of CNY 0.33 per share for Q3 2024, reflecting shareholder value focus.

Sichuan Xunyou Network Technology (SZSE:300467)

Simply Wall St Value Rating: ★★★★★★

Overview: Sichuan Xunyou Network Technology Co., Ltd. operates in the technology sector and has a market capitalization of CN¥3.86 billion.

Operations: The company generates revenue primarily from its technology-related services, with a significant focus on digital solutions. Its financial performance is highlighted by a notable gross profit margin trend, reflecting efficiency in managing production and service costs.

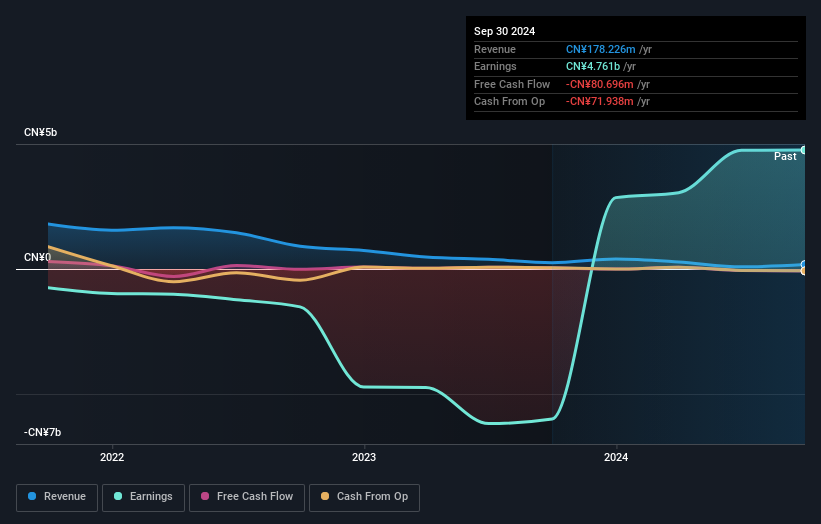

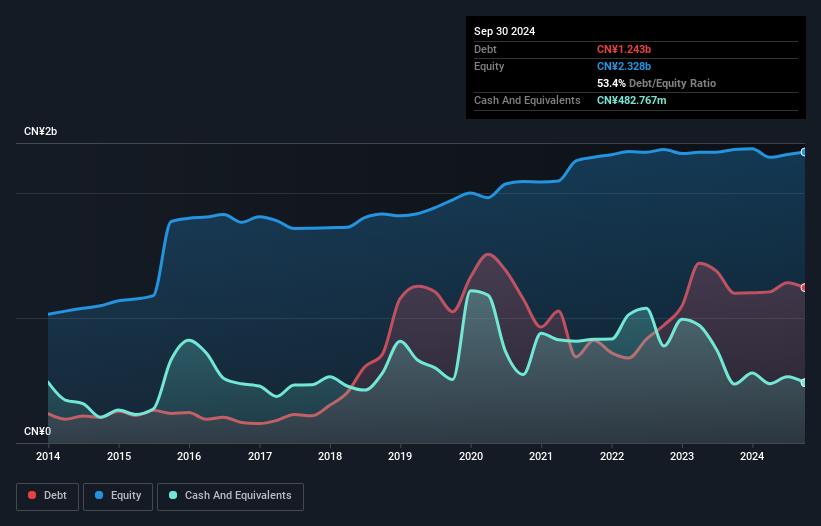

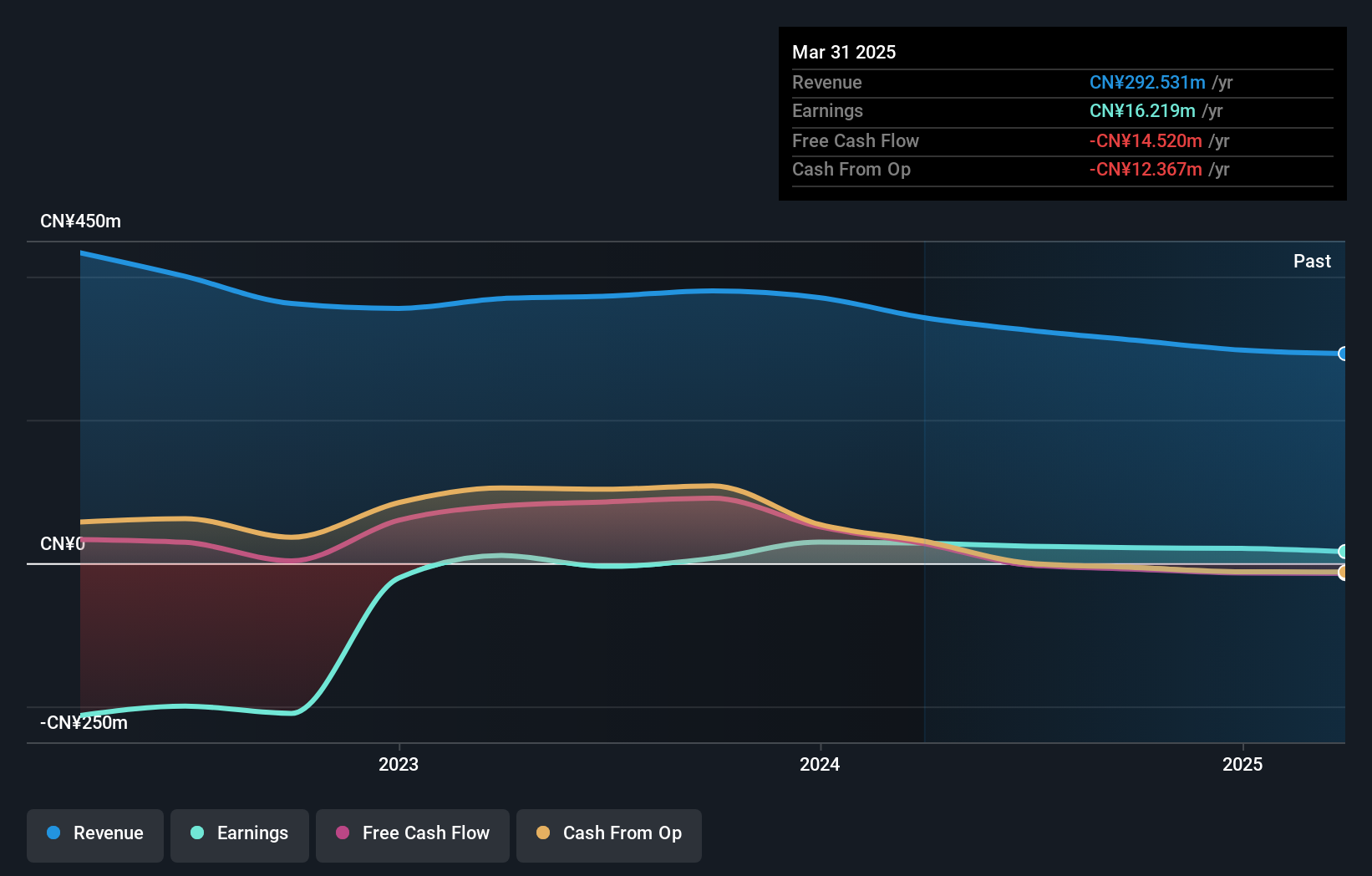

Sichuan Xunyou Network Technology, a smaller player in the technology sector, has shown impressive earnings growth of 211.8% over the past year, outpacing its industry peers. Despite this surge, recent financial results for nine months ending September 2024 reveal a revenue dip to CNY 228.32 million from CNY 287.9 million previously, with net income at CNY 22.06 million down from CNY 29.98 million. The company operates debt-free and boasts high-quality earnings but faces challenges in free cash flow generation as it reported negative figures recently, potentially impacting future investments or expansions.

- Take a closer look at Sichuan Xunyou Network Technology's potential here in our health report.

Understand Sichuan Xunyou Network Technology's track record by examining our Past report.

Key Takeaways

- Unlock our comprehensive list of 4632 Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300467

Sichuan Xunyou Network Technology

Sichuan Xunyou Network Technology Co., Ltd.

Flawless balance sheet with solid track record.