- Hong Kong

- /

- Medical Equipment

- /

- SEHK:3600

Asian Penny Stocks Poised For Growth In August 2025

Reviewed by Simply Wall St

As global markets respond to significant economic shifts, including interest rate movements and trade policy changes, investors are keenly observing opportunities across various sectors. In Asia, the concept of penny stocks—often seen as an outdated term—still holds relevance for those seeking growth prospects in smaller or newer companies. These stocks can offer a unique blend of affordability and potential for substantial returns when backed by strong financials, making them an intriguing option for investors looking to uncover hidden value in the market.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB4.34 | THB4.29B | ✅ 4 ⚠️ 0 View Analysis > |

| JBM (Healthcare) (SEHK:2161) | HK$2.94 | HK$2.39B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.47 | HK$927.5M | ✅ 4 ⚠️ 1 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$2.08 | HK$3.6B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.46 | HK$2.05B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.535 | SGD216.83M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.89 | SGD11.37B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.95 | NZ$135.23M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.86 | THB9.82B | ✅ 3 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.59 | SGD984.92M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 977 stocks from our Asian Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Modern Dental Group (SEHK:3600)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Modern Dental Group Limited is an investment holding company involved in the production, distribution, and trading of dental prosthetic devices across Europe, Greater China, North America, Australia, and other international markets with a market cap of HK$4.27 billion.

Operations: The company's revenue is primarily derived from Fixed Prosthetic Devices at HK$2.05 billion and Removable Prosthetic Devices at HK$799.01 million.

Market Cap: HK$4.27B

Modern Dental Group has demonstrated a stable financial position with short-term assets of HK$1.7 billion surpassing both short and long-term liabilities, reflecting robust liquidity. The company’s debt is well-managed, covered by operating cash flow and reduced over the past five years to a debt-to-equity ratio of 27%. Recent initiatives include a share buyback program aimed at enhancing shareholder value. Despite high-quality earnings and significant profit growth over five years, recent earnings growth has slowed to 1%, trailing industry averages. Additionally, Modern Dental's dividend history remains unstable, potentially impacting investor confidence in consistent returns.

- Unlock comprehensive insights into our analysis of Modern Dental Group stock in this financial health report.

- Learn about Modern Dental Group's historical performance here.

Suning UniversalLtd (SZSE:000718)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Suning Universal Co., Ltd is a real estate development company in China with a market cap of CN¥6.77 billion.

Operations: Suning Universal Co., Ltd has not reported any specific revenue segments.

Market Cap: CN¥6.77B

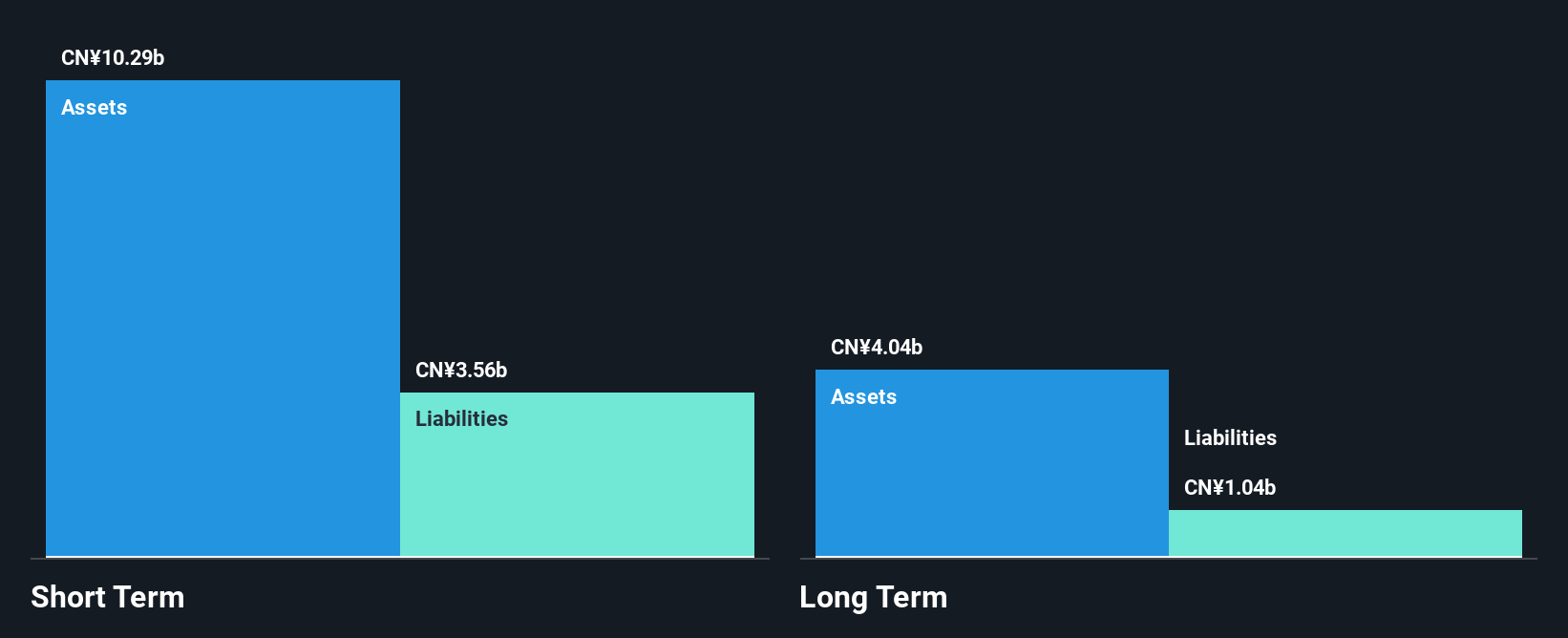

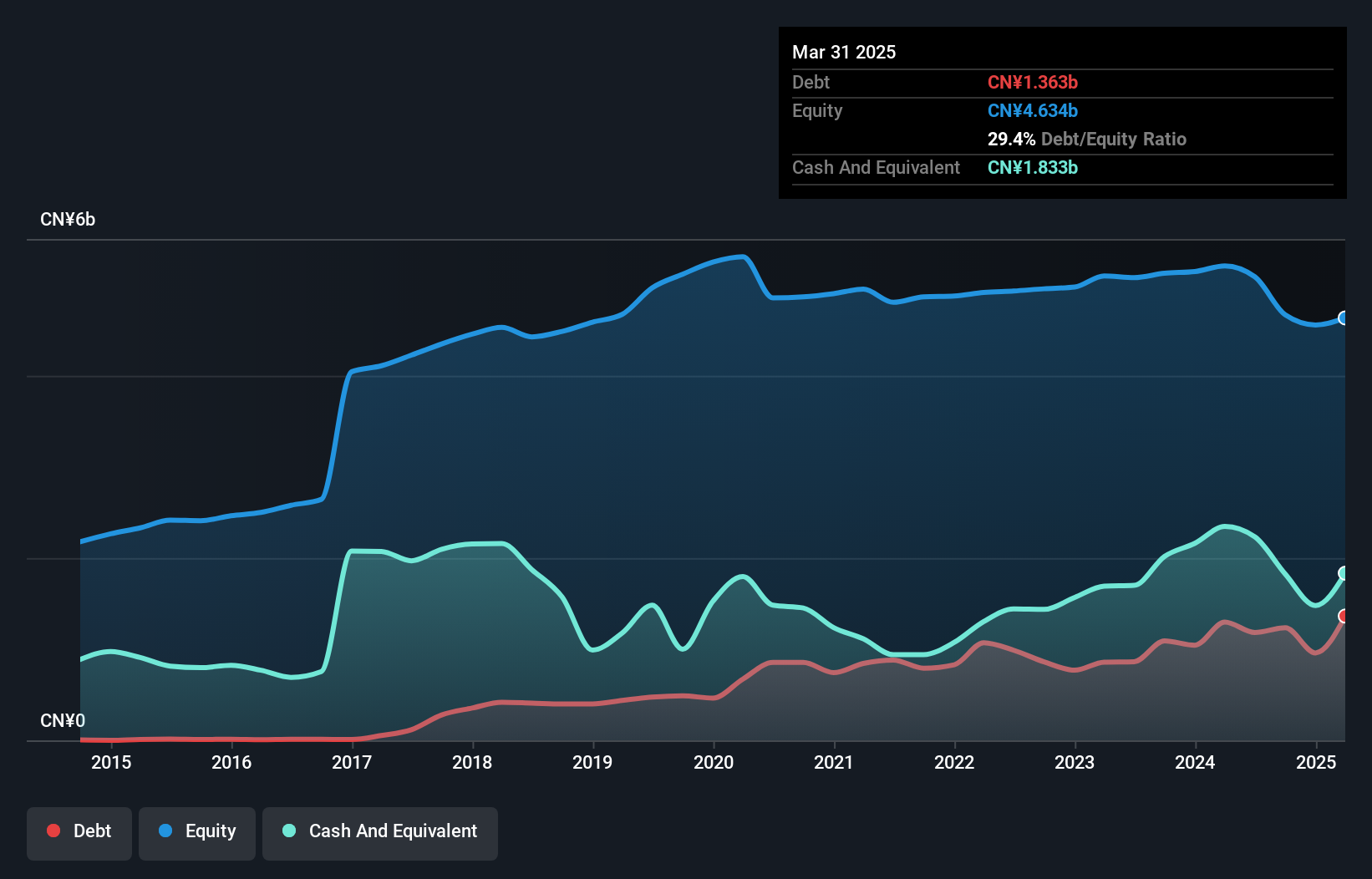

Suning Universal Co., Ltd maintains a stable financial structure with short-term assets of CN¥10.3 billion exceeding both short and long-term liabilities, indicating strong liquidity. The company's net debt to equity ratio stands at 10.1%, showing satisfactory leverage, while its operating cash flow effectively covers its debt obligations. Despite this financial stability, Suning Universal has experienced negative earnings growth over the past year and five years, with current profit margins declining from 6.8% to 5.9%. The board's average tenure of 5.7 years suggests experienced governance amidst these challenges in maintaining dividend sustainability and profitability growth.

- Get an in-depth perspective on Suning UniversalLtd's performance by reading our balance sheet health report here.

- Assess Suning UniversalLtd's previous results with our detailed historical performance reports.

MYS Group (SZSE:002303)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: MYS Group Co., Ltd. develops, produces, and sells packaging products both in China and internationally, with a market cap of CN¥6.46 billion.

Operations: MYS Group Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥6.46B

MYS Group Co., Ltd. demonstrates financial stability with its short-term assets (CN¥3.6 billion) exceeding both short and long-term liabilities, ensuring solid liquidity. The company's debt is well-covered by operating cash flow, although its return on equity remains low at 6.4%. Despite a significant increase in earnings by 28.7% over the past year, MYS Group's earnings have declined by an average of 8.1% annually over the past five years. The dividend yield of 13.53% is not well-supported by earnings or free cash flow, suggesting potential sustainability challenges despite high-quality earnings and stable weekly volatility at 4%.

- Dive into the specifics of MYS Group here with our thorough balance sheet health report.

- Evaluate MYS Group's historical performance by accessing our past performance report.

Seize The Opportunity

- Explore the 977 names from our Asian Penny Stocks screener here.

- Ready To Venture Into Other Investment Styles? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3600

Modern Dental Group

An investment holding company, engages in production, distribution, and trading of dental prosthetic devices in Europe, Greater China, North America, Australia, and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives