Asian Growth Companies With High Insider Ownership In November 2025

Reviewed by Simply Wall St

As of November 2025, Asian markets have shown resilience amid global economic uncertainties, with easing U.S.-China trade tensions providing a boost to investor sentiment. In this environment, growth companies in Asia with high insider ownership are particularly noteworthy as they often indicate strong confidence from those closely tied to the business, potentially aligning with broader market optimism.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Vuno (KOSDAQ:A338220) | 15.6% | 113.4% |

| Techwing (KOSDAQ:A089030) | 19.2% | 84.7% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Samyang Foods (KOSE:A003230) | 11.7% | 28.5% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 104.1% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 56.2% |

Here we highlight a subset of our preferred stocks from the screener.

Anhui Huaheng Biotechnology (SHSE:688639)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Anhui Huaheng Biotechnology Co., Ltd. is involved in the development, production, and sale of amino acids and other organic acids both in China and internationally, with a market cap of approximately CN¥9.61 billion.

Operations: The company's revenue primarily comes from its Bio Manufacturing Industry segment, generating CN¥2.83 billion.

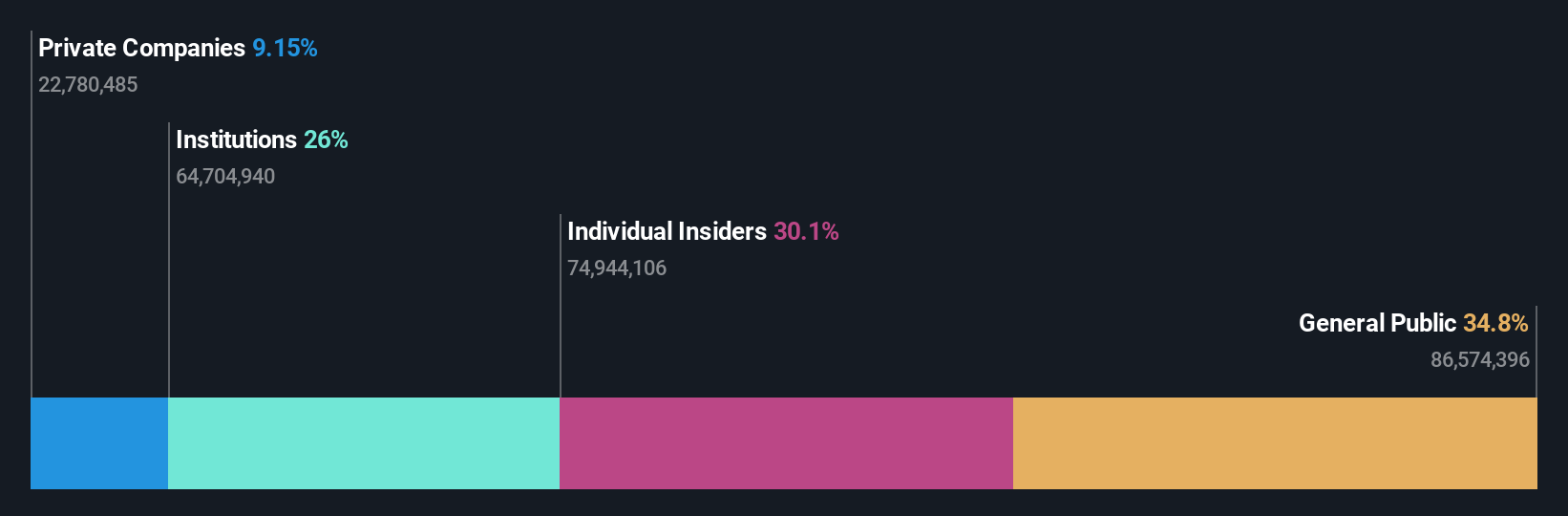

Insider Ownership: 30.1%

Earnings Growth Forecast: 43.7% p.a.

Anhui Huaheng Biotechnology is poised for substantial growth, with revenue expected to increase over 20% annually, outpacing the broader Chinese market. Despite a decline in profit margins from 14.1% to 6.6%, earnings are projected to grow significantly at over 43% per year. Recent financials show sales rising to CNY 2.19 billion for the first nine months of 2025, though net income slightly decreased compared to last year, highlighting both potential and challenges ahead.

- Delve into the full analysis future growth report here for a deeper understanding of Anhui Huaheng Biotechnology.

- According our valuation report, there's an indication that Anhui Huaheng Biotechnology's share price might be on the expensive side.

Shenzhen Batian Ecotypic Engineering (SZSE:002170)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Batian Ecotypic Engineering Co., Ltd. operates in the eco-friendly engineering sector and has a market cap of CN¥12.10 billion.

Operations: Unfortunately, the provided text does not include specific revenue segment details for Shenzhen Batian Ecotypic Engineering Co., Ltd.

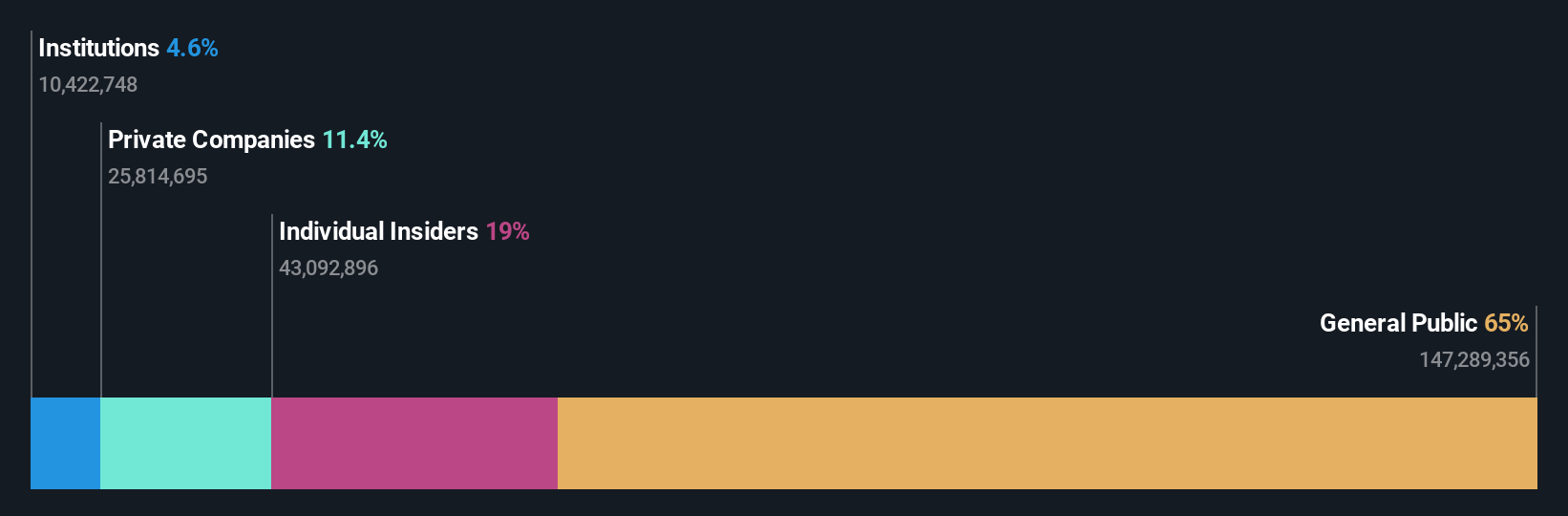

Insider Ownership: 32.9%

Earnings Growth Forecast: 25.2% p.a.

Shenzhen Batian Ecotypic Engineering demonstrates strong growth potential, with earnings rising by a very large amount over the past year. Despite an unstable dividend track record, the company offers good relative value and trades significantly below its estimated fair value. Forecasts suggest annual revenue growth of 18.2%, surpassing the broader Chinese market's pace, although expected profit growth lags behind at 25.18% annually compared to market expectations. Recent financial results reveal robust sales and net income increases for 2025's first nine months.

- Click here to discover the nuances of Shenzhen Batian Ecotypic Engineering with our detailed analytical future growth report.

- Our valuation report unveils the possibility Shenzhen Batian Ecotypic Engineering's shares may be trading at a discount.

Xiamen Wanli Stone StockLtd (SZSE:002785)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Xiamen Wanli Stone Stock Co., Ltd engages in the development, processing, and installation of stone products and related items across various international markets, with a market cap of CN¥8.76 billion.

Operations: The company's revenue segments include the development, processing, and installation of stone products, construction stones, stone carving handicrafts, and mineral products across China, Japan, South Korea, the United States, and other international markets.

Insider Ownership: 19%

Earnings Growth Forecast: 132.3% p.a.

Xiamen Wanli Stone Stock Ltd. shows potential with forecasted annual revenue growth of 25.7%, outpacing the Chinese market's average. Despite recent earnings showing a slight decline in net income and EPS, the company's overall revenue has increased year-over-year to CNY 936.23 million for the first nine months of 2025. The share price remains highly volatile, and insider trading activity over the past three months is minimal, indicating stable insider confidence amidst proposed changes to company bylaws.

- Click here and access our complete growth analysis report to understand the dynamics of Xiamen Wanli Stone StockLtd.

- The analysis detailed in our Xiamen Wanli Stone StockLtd valuation report hints at an inflated share price compared to its estimated value.

Key Takeaways

- Click through to start exploring the rest of the 588 Fast Growing Asian Companies With High Insider Ownership now.

- Want To Explore Some Alternatives? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002170

Shenzhen Batian Ecotypic Engineering

Shenzhen Batian Ecotypic Engineering Co., Ltd.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives