- China

- /

- Metals and Mining

- /

- SZSE:001203

Asian Growth Companies With High Insider Ownership To Watch

Reviewed by Simply Wall St

As global markets navigate a complex landscape of economic indicators and policy shifts, Asian equities have been drawing attention, particularly in sectors like technology and artificial intelligence. In this environment, growth companies with high insider ownership can be appealing to investors due to the potential alignment of interests between company insiders and shareholders.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25.2% | 120.7% |

| SungEel HiTech (KOSDAQ:A365340) | 37.5% | 110.8% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 34.1% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

Let's uncover some gems from our specialized screener.

Shanghai Putailai New Energy Technology GroupLtd (SHSE:603659)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Putailai New Energy Technology Group Co., Ltd. develops and sells lithium-ion battery materials and automation equipment in China, with a market cap of CN¥57.24 billion.

Operations: The company's revenue is derived from the development and sale of lithium-ion battery materials and automation equipment in China.

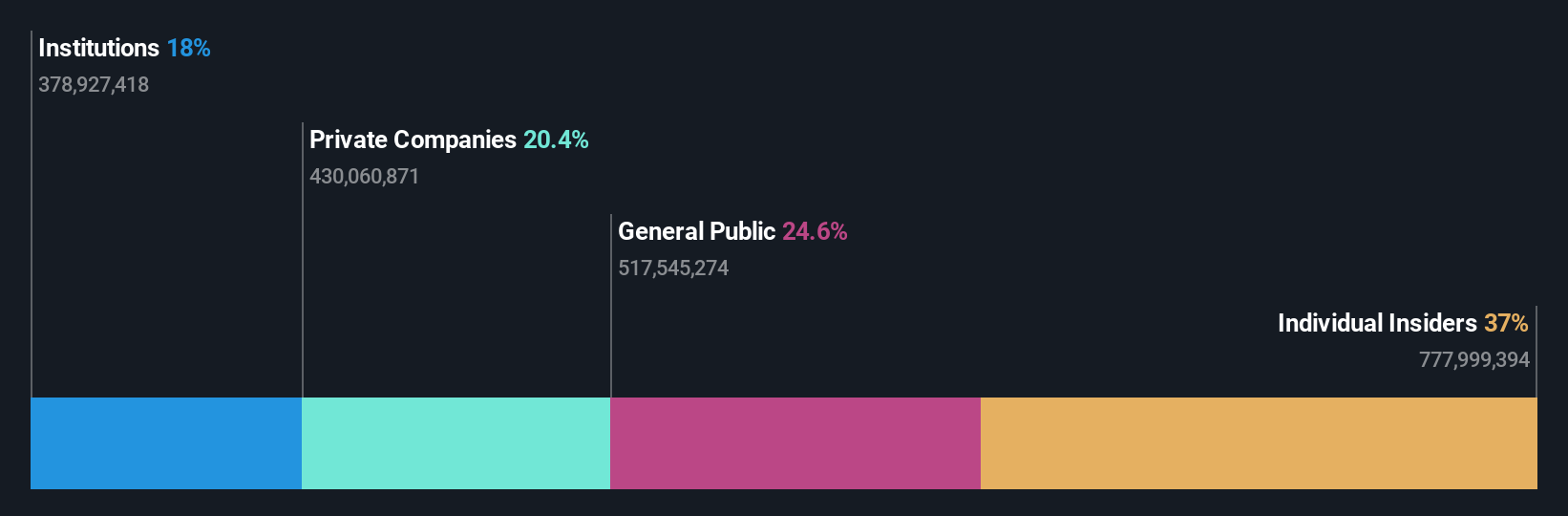

Insider Ownership: 37%

Shanghai Putailai New Energy Technology Group Ltd. demonstrates strong growth potential, with revenue expected to grow at 22.4% annually, outpacing the Chinese market's 14.6%. The recent joint development agreement with OneD Material Inc. aims to enhance its lithium-ion battery anode materials, leveraging advanced technology and manufacturing capabilities for global reach. Despite a volatile share price and an unstable dividend track record, it trades at a substantial discount to estimated fair value, suggesting good relative value compared to peers.

- Dive into the specifics of Shanghai Putailai New Energy Technology GroupLtd here with our thorough growth forecast report.

- The analysis detailed in our Shanghai Putailai New Energy Technology GroupLtd valuation report hints at an deflated share price compared to its estimated value.

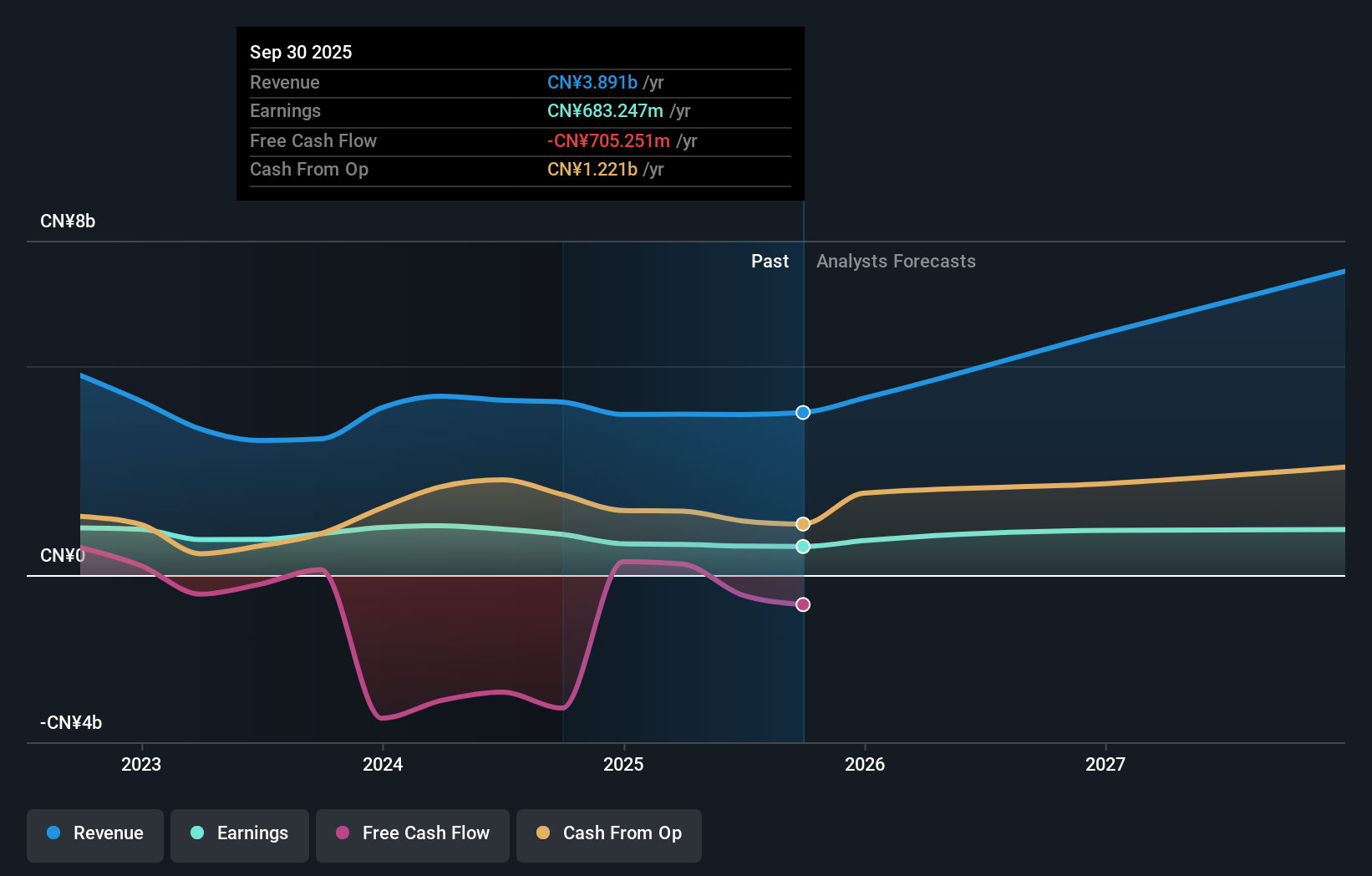

Dazhong Mining (SZSE:001203)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Dazhong Mining Co., Ltd. is involved in the mining and dressing of iron ore with a market cap of CN¥44.46 billion.

Operations: The company generates revenue of CN¥3.89 billion from its mining and smelting industry segment.

Insider Ownership: 27.6%

Dazhong Mining shows promising growth prospects, with revenue forecasted to increase by 32.7% annually, surpassing the Chinese market's 14.6%. Despite a volatile share price and low return on equity projections, its earnings are set to grow significantly at 28.1% per year. Recent financials reveal a slight dip in net income but strong sales figures of CNY 3 billion for the first nine months of 2025. The company also completed a share buyback worth CNY 202 million, indicating confidence in its future performance.

- Click to explore a detailed breakdown of our findings in Dazhong Mining's earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Dazhong Mining shares in the market.

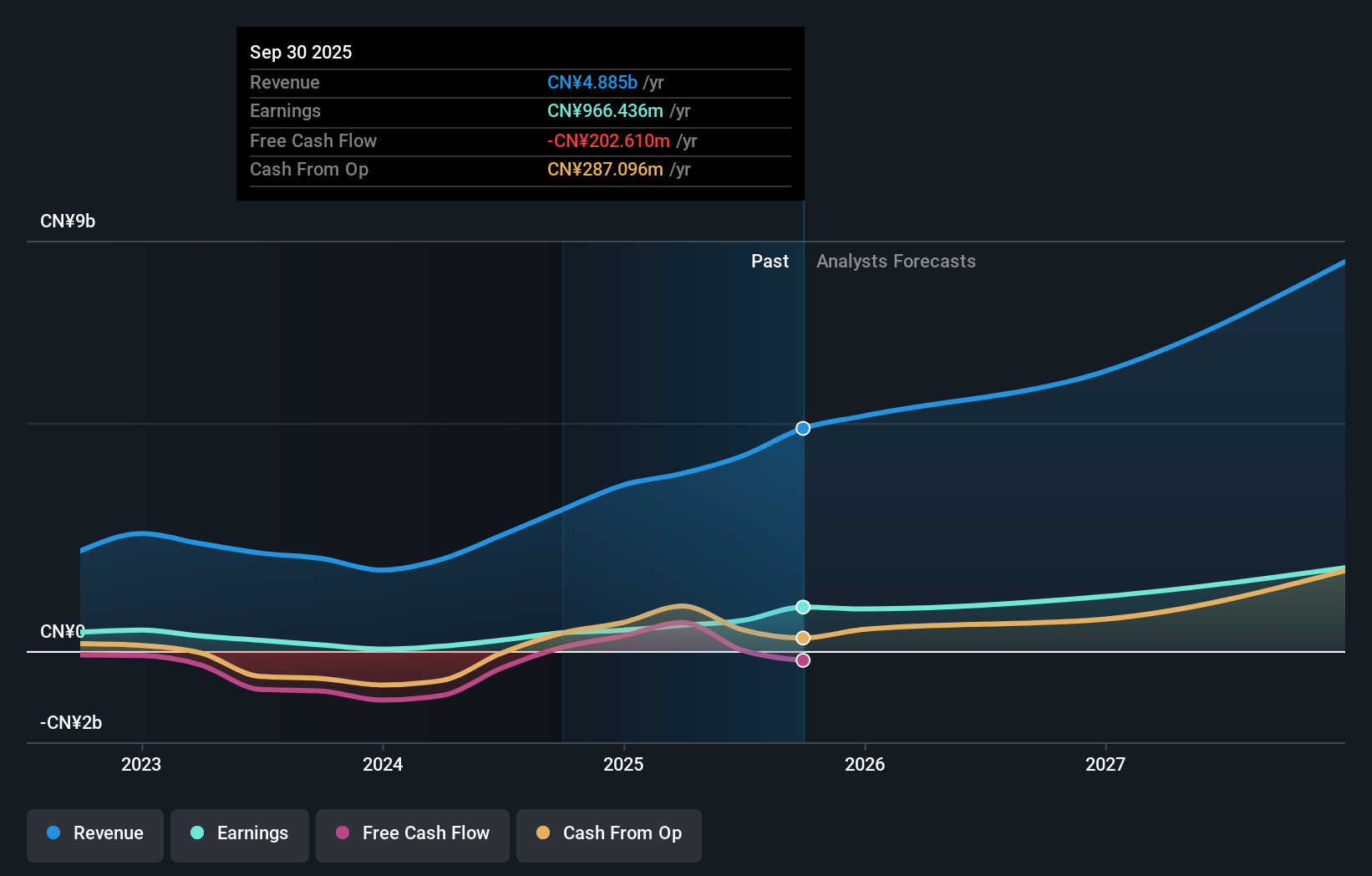

Hangzhou Changchuan TechnologyLtd (SZSE:300604)

Simply Wall St Growth Rating: ★★★★★★

Overview: Hangzhou Changchuan Technology Co., Ltd. engages in the research, development, production, and sale of integrated circuit equipment and high-frequency communication materials both domestically and internationally, with a market cap of CN¥50.38 billion.

Operations: The company generates revenue through its operations in integrated circuit equipment and high-frequency communication materials across domestic and international markets.

Insider Ownership: 31.9%

Hangzhou Changchuan Technology demonstrates robust growth potential, with earnings expected to rise significantly at 29.2% annually, outpacing the Chinese market. Its revenue is also forecasted to grow faster than 20% per year. Recent financials show a substantial increase in net income to CNY 865.4 million for the first nine months of 2025, compared to CNY 357.4 million a year ago, despite high share price volatility and no recent insider trading activity reported.

- Navigate through the intricacies of Hangzhou Changchuan TechnologyLtd with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Hangzhou Changchuan TechnologyLtd's share price might be on the expensive side.

Summing It All Up

- Unlock our comprehensive list of 637 Fast Growing Asian Companies With High Insider Ownership by clicking here.

- Seeking Other Investments? This technology could replace computers: discover the 28 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:001203

High growth potential with imperfect balance sheet.

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026